概述

震荡盈利波段Grid策略是一种趋势跟踪策略,它根据价格的波动自动建立网格,在价格波动的时候可以持续盈利。

策略原理

该策略的核心思想是建立一个价格波段网格,当价格进入不同的波段时,会产生新的交易信号。例如,如果网格间距设置为500美元,那么当价格上涨超过500美元时会产生新的做多信号。

具体来说,该策略通过追踪价格的新高价或新低价来不断移动建立新的网格。在代码中,我们定义了一个变量re_grid来存储当前的网格价位。价格只要突破这个网格价位超过设置的网格间距,就会重新计算下一个网格价位。

这样,当价格出现足够大的波动时,就会产生新的交易信号,我们可以通过做多或做空来获利。当价格开始向反方向移动超过网格间距时,原来的头寸会止损。

优势分析

该策略最大的优势在于可以自动跟踪价格趋势,持续获利。只要价格保持足够大的波动,我们的头寸规模会不断增大,利润也会越来越多。

另外,通过合理设置网格参数,可以有效控制风险。此外,结合Ichimoku 云图等技术指标过滤信号,可以提高策略稳定性。

风险分析

该策略主要的风险在于价格可能会突然反转,导致止损。这时之前积累的利润可能会减少或者亏损。

为了控制这种风险,我们可以设置止损线,合理调整网格参数,选择趋势性较强的交易品种,结合多个技术指标进行信号过滤等方法。

优化方向

我们可以从以下几个方面继续优化该策略:

优化网格参数,找到最佳的网格间距、仓位规模等参数组合

增加或调整止损机制,更好地控制风险

测试不同的交易品种,选择波动较大、趋势更明显的品种

增加更多技术指标判断,提高策略稳定性

总结

该震荡盈利波段Grid策略通过建立价格网格自动跟踪趋势,可以有效地持续获利。同时也存在一定的回撤风险。通过参数优化、止损设置、品种选择等手段可以有效控制风险,提高策略稳定性。

策略源码

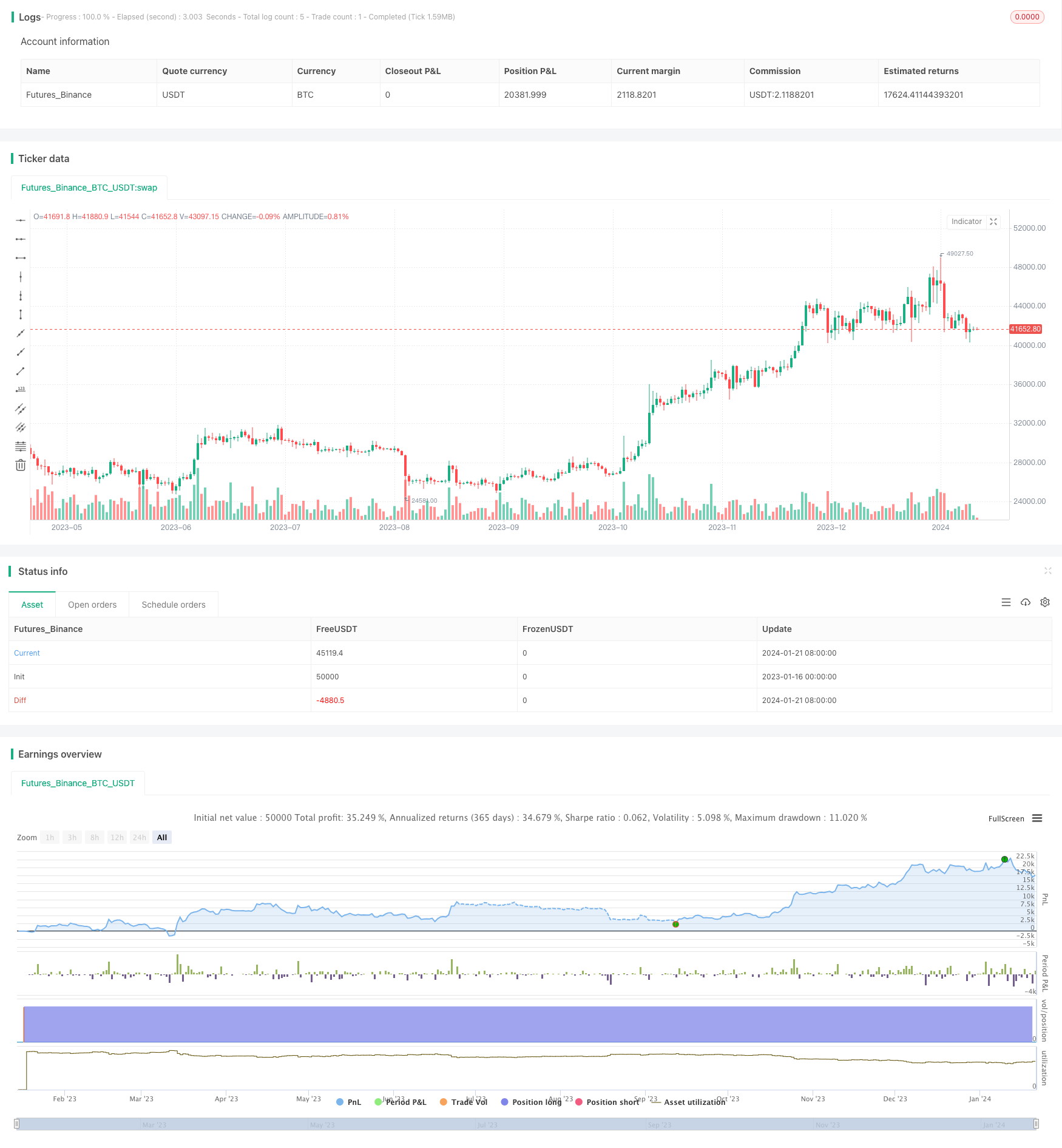

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ramsay09

//@version=4

strategy(title="Grid Tool",shorttitle= "Grid", overlay= true )

backtest = input(title= "Backtest (no comment-string, disable for API-trading)", type= input.bool, defval= true)

entry_type = input("Long", title= "Long/Short Entry", options= ["Long", "Short"])

X_opt = input("Grid - reentry", title="--- 1st ENTRY SIGNAL ---", options= ["---", "Grid - reentry", "Grid - counter trend", "Fractals", "Reverse fractal"])

X_opt_2 = input("---", title="--- 2nd ENTRY SIGNAL ---", options= ["---", "Grid - reentry", "Grid - counter trend", "Fractals", "Reverse fractal"])

entry_f_1 = input("---", title="Entry filter 1", options= ["---", "Bar breakout 1 filter", "Bar breakout 2 filter", "SMA filter", "MACD filter", "RSI50 filter", "Fractals filter",

"Segments filter", "Fractals 1-2-3 filter", "Reverse fractal filter", "EMA21/SMA20 filter", "TRIX filter",

"SuperTrend filter", "Parabolic SAR filter", "ADX filter", "Price X Kumo filter", "Price X Kijun filter", "Kumo flip filter",

"Price filtered Kumo flip filter", "Chikou X price filter", "Chikou X Kumo filter", "Price X Tenkan filter", "Tenkan X Kumo filter",

"Tenkan X Kijun filter"])

entry_f_2 = input("---", title="Entry filter 2", options= ["---", "Bar breakout 1 filter", "Bar breakout 2 filter", "SMA filter", "MACD filter", "RSI50 filter", "Fractals filter",

"Segments filter", "Fractals 1-2-3 filter", "Reverse fractal filter", "EMA21/SMA20 filter", "TRIX filter",

"SuperTrend filter", "Parabolic SAR filter", "ADX filter", "Price X Kumo filter", "Price X Kijun filter", "Kumo flip filter",

"Price filtered Kumo flip filter", "Chikou X price filter", "Chikou X Kumo filter", "Price X Tenkan filter", "Tenkan X Kumo filter",

"Tenkan X Kijun filter"])

exit_f_1 = input("---", title="Exit filter 1", options= ["---", "TRIX exit", "Reverse fractal exit", "SMA exit", "MACD exit",

"RSI50 exit", "Fractals exit", "SuperTrend exit", "Parabolic SAR exit", "ADX exit", "Cloud exit", "Kijun exit"])

exit_f_2 = input("---", title="Exit filter 2", options= ["---", "TRIX exit", "Reverse fractal exit", "SMA exit", "MACD exit",

"RSI50 exit", "Fractals exit", "SuperTrend exit", "Parabolic SAR exit", "ADX exit", "Cloud exit", "Kijun exit"])

//--------------------- Signal inputs -----------------------

grid_gap = input(500, type= input.float, title= "Grid gap - base currency", minval= 0, step= 10)

//--------------------- filter inputs --------------------

shared_param = input(false, title= " Shared filter and entry parameters :", type= input.bool)

sb = input(title="Segment max bars", defval= 10, minval= 0, step= 1)

fr_period = input(2, title= "Fractals period", minval= 1)

rsi_period = input(14, title= "RSI period", minval= 1)

ma_period = input(50, title= "MA period", minval= 1)

mult = input(3, type= input.float, title= "SuperTrend multiplier", minval= 1, step= 0.1)

len = input(6, type= input.integer, title= "SuperTrend length", minval= 1)

start = 0.02//input(0.02, title= "PSAR Start (Filter/Entry)", minval= 0)

inc = 0.02//input(0.02, title= "PSAR Increment (Filter/Entry)", minval= 0)

max = 0.2//input(.2, title= "PSAR Maximum (Filter/Entry)", minval= 0)

di_length_s = input(10, title= "DI length (signals)", minval= 1)

adx_smooth_s = input(10, title= "ADX smooth (signals)", minval= 1)

adx_thres_s = input(25, title= "ADX threshold (signals)", minval= 1)

trix_len_f = input(14, title= "TRIX Length", type=input.integer, minval=1)

smooth_length_f = input(6, title= "Signal Smoothing Length (TRIX)", type=input.integer, minval=1)

//--------------------- exit inputs --------------------

exit_param = input(false, title= " Exit Parameters :", type= input.bool)

trix_len_x = input(14, title= "TRIX Length", type=input.integer, minval=1)

smooth_length_x = input(6, title= "Signal Smoothing Length (TRIX)", type=input.integer, minval=1)

fr_period_x = input(2, title= "Exit fractals - period", minval= 1)

fr_past_x = input(0, title= "Exit fractals - past fractal", minval= 0)

rsi_period_x = input(14, title= "Exit RSI period", minval= 1)

ma_period_x = input(50, title= "Exit MA period", minval= 1)

mult_x = input(2, type= input.float, title= "Exit SuperTrend multiplier", minval= 1)

len_x = input(5, type= input.integer, title= "Exit SuperTrend length", minval= 1)

di_length_x = input(10, title= "Exit ADX period", minval= 1)

adx_smooth_x = input(10, title= "Exit ADX smooth", minval= 1)

adx_thres_x = input(25, title= "Exit ADX threshold", minval= 1)

//----------------------- Backtest periode --------------------------------

b_t_per_start = input(false, title= " Set backtest start or/and trend start :", type= input.bool)

start_year = input(2020, "Start year")

start_month = input(3, "Start month", minval= 1, maxval= 12)

start_day = input(13, "Start day", minval= 1, maxval= 31)

period_start = timestamp(start_year, start_month, start_day, 0, 0)

stop_year = input(2120, "Stop year")

stop_month = input(12, "Stop month", minval= 1, maxval= 12)

stop_day = input(31, "Stop day", minval= 1, maxval= 31)

period_stop = timestamp(stop_year, stop_month, stop_day, 0, 0)

backtest_period() => time >= period_start and time <= period_stop ? true : false

//-------------------- Ichimoku --------------------

TKlength = 9 //input(9, "Tenkan-sen length", minval= 1)

KJlength = 26 //input(26, "Kijun-sen length", minval= 1)

CSHSlength = 26 //input(26, "Chikouspan length/horizontal shift", minval= 1)

SBlength = 52 //input(52, "SenkouspanB length", minval= 1)

SAlength = 26 //input(26, "SenkouspanA length", minval= 1)

// calculation

TK = avg(lowest(TKlength), highest(TKlength))

KJ = avg(lowest(KJlength), highest(KJlength))

CS = close

SB = avg(lowest(SBlength), highest(SBlength))

SA = avg(TK,KJ)

kumo_high = max(SA[CSHSlength-1], SB[CSHSlength-1])

kumo_low = min(SA[CSHSlength-1], SB[CSHSlength-1])

//------------------------------------- Filters and entry signals --------------------------------------

//---------------------- Ichimoku filter ------------------------

// cross conditions for "Strong" filtered signals

var bool sasb_x = true

if crossover(SA, SB) and low > kumo_high

sasb_x := true

if crossunder(SA, SB) and high < kumo_low

sasb_x := false

var bool tkkj_x = true

if crossover(TK, KJ) and TK > kumo_high and KJ > kumo_high

tkkj_x := true

if crossunder(TK, KJ) and TK < kumo_low and KJ < kumo_low

tkkj_x := false

// Ichimoku filters

kijun_buy_f = close > KJ

kumo_buy_f = close > kumo_high

kumo_flip_buy_f = SA > SB

price_filtered_kumo_flip_buy_f = sasb_x and low > kumo_high

chikou_X_price_buy_f = CS > high[(26-1)]

chikou_X_kumo_buy_f = CS > kumo_high[26-1]

price_X_tenkan_buy_f = close > TK

tenkan_X_kumo_buy_f = TK > kumo_high

tenkan_X_kijun_buy_f = TK > KJ

kumo_filtered_tenkan_X_kijun_buy_f = tkkj_x and TK > kumo_high and KJ > kumo_high and TK > KJ

kijun_sell_f = close < KJ

kumo_sell_f = close < kumo_low

kumo_flip_sell_f = SA < SB

price_filtered_kumo_flip_sell_f = not sasb_x and high < kumo_low

chikou_X_price_sell_f = CS < low[(26-1)]

chikou_X_kumo_sell_f = CS < kumo_low[26-1]

price_X_tenkan_sell_f = close < TK

tenkan_X_kumo_sell_f = TK < kumo_low

tenkan_X_kijun_sell_f = TK < KJ

kumo_filtered_tenkan_X_kijun_sell_f = not tkkj_x and TK < kumo_low and KJ < kumo_low and TK < KJ

// Ichimoku exits

kijun_buy_x = close > KJ

kumo_buy_x = close > kumo_high

kijun_sell_x = close < KJ

kumo_sell_x = close < kumo_low

//------------------------ grid --------------------------

//up_grid = 0.

//up_grid := nz(high > up_grid[1] + grid_gap and backtest_period() ? close : up_grid[1]) // forward grid long

//dn_grid = 0.

//dn_grid := nz(low < dn_grid[1] - grid_gap and backtest_period() ? close : dn_grid[1]) // forward grid short

re_grid = 0.

re_grid := nz(high > re_grid[1] + grid_gap or low < re_grid[1] - grid_gap ? close : re_grid[1])

//grid_up_buy = up_grid > up_grid[1]

//grid_dn_sell = dn_grid < dn_grid[1]

grid_ct_buy = re_grid < re_grid[1]

grid_ct_sell = re_grid > re_grid[1]

grid_re_buy = re_grid > re_grid[1]

grid_re_sell = re_grid < re_grid[1]

//plot(re_grid,"Plot", color= color.yellow, linewidth= 2)

//---------------------- reverse fractal signal and filter --------------------------

up_bar = close[0] > open[0]

dn_bar = close[0] < open[0]

hl = low[0] > low[1]

lh = high[0] < high[1]

rev_up_fr_sell = pivothigh(high, 3, 0) and dn_bar and up_bar[1] or

pivothigh(high, 4, 1) and dn_bar and up_bar[1] or

pivothigh(high, 4, 1) and lh and up_bar and up_bar[1]

rev_dn_fr_buy = pivotlow(low, 3, 0) and up_bar and dn_bar[1] or

pivotlow(low, 4, 1) and up_bar and dn_bar[1] or

pivotlow(low, 4, 1) and hl and dn_bar and dn_bar[1]

ema_f(src, ema_len) => ema(src, ema_len) // ma function definition

sma_f(src, sma_len) => sma(src, sma_len)

ema_21 = ema_f(close, 21) // ema21/sma20 signal

sma_20 = sma_f(close, 20)

ma_cross_buy = close > ema_21 and close > sma_20 and ema_21 > sma_20

ma_cross_sell = close < ema_21 and close < sma_20 and ema_21 < sma_20

//--------------------- TRIX ------------------------

triple_ema_f = ema(ema(ema(close, trix_len_f), trix_len_f), trix_len_f)

trix_f = roc(triple_ema_f, 1)

signal_f = sma(trix_f, smooth_length_f)

triple_ema_x = ema(ema(ema(close, trix_len_x), trix_len_x), trix_len_x)

trix_x = roc(triple_ema_x, 1)

signal_x = sma(trix_x, smooth_length_x)

//filters

trix_buy_f = trix_f > signal_f

trix_sell_f = trix_f < signal_f

//exits

trix_buy_x = trix_x > signal_x

trix_sell_x = trix_x < signal_x

//----------------------- macd filter -----------------------

[macdLine_f, signalLine_f, histLine_f] = macd(close, 12, 26, 9)

//filters

macd_buy = macdLine_f > signalLine_f

macd_sell = macdLine_f < signalLine_f

//exit

macd_buy_x = macdLine_f > signalLine_f

macd_sell_x = macdLine_f < signalLine_f

//---------------------- rsi filter and entry signal------------------------

//entry

rsi_f = rsi(close, rsi_period)

rsi_f_buy = rsi_f > 50

rsi_f_sell = rsi_f < 50

//filters

rsi_f_buy_f = rsi_f > 50

rsi_f_sell_f = rsi_f < 50

//exit

rsi_f_x = rsi(close, rsi_period_x)

rsi_f_buy_x = rsi_f_x > 50

rsi_f_sell_x = rsi_f_x < 50

//---------------- Bill Williams Fractals (filter and entry signal) -----------------

up_fr = pivothigh(fr_period, fr_period)

dn_fr = pivotlow(fr_period, fr_period)

fractal_up_v = valuewhen(up_fr, high[fr_period],0)

fractal_dn_v = valuewhen(dn_fr, low[fr_period],0)

//entry signal

fr_upx = crossover(high, fractal_up_v)

fr_dnx = crossunder(low, fractal_dn_v)

//filters

fr_upx_f = high > fractal_up_v

fr_dnx_f = low < fractal_dn_v

//exit

up_fr_x = pivothigh(fr_period_x, fr_period_x)

dn_fr_x = pivotlow(fr_period_x, fr_period_x)

fractal_up_v_x = valuewhen(up_fr_x, high[fr_period_x], fr_past_x)

fractal_dn_v_x = valuewhen(dn_fr_x, low[fr_period_x], fr_past_x)

fr_upx_x = high > fractal_up_v_x

fr_dnx_x = low < fractal_dn_v_x

//higher low and higher high - lower high and lower low - entry

fractal_dn_v_1 = valuewhen(dn_fr, low[fr_period],1)

fractal_up_v_1 = valuewhen(up_fr, high[fr_period],1)

hl_hh_buy = fractal_dn_v > fractal_dn_v_1 and high > fractal_up_v // 123 signal and filter

lh_ll_sell = fractal_up_v < fractal_up_v_1 and low < fractal_dn_v

//-------------------- SuperTrend filter and entry signal ---------------------

//entry

[SuperTrend, Dir] = supertrend(mult, len)

sup_buy = close > SuperTrend

sup_sell = close < SuperTrend

//filters

sup_buy_f = close > SuperTrend

sup_sell_f = close < SuperTrend

//exit

[SuperTrend_x, Dir_x] = supertrend(mult_x, len_x)

sup_buy_x = close > SuperTrend_x

sup_sell_x = close < SuperTrend_x

//----------------- Parabolic SAR Signal (pb/ps) and filter -------------------

psar_buy = high > sar(start, inc, max)[0]

psar_sell = low < sar(start, inc, max)[0]

//filters

psar_buy_f = high > sar(start, inc, max)[0]

psar_sell_f = low < sar(start, inc, max)[0]

//-------------------------- ADX entry and filter ---------------------------

//exit

[diplus_f_x, diminus_f_X, adx_f_x] = dmi(di_length_x, adx_smooth_x)

adx_thres_f_x = adx_f_x < adx_thres_x

//adx signal 1/2 and filters

[diplus_s, diminus_s, adx_s] = dmi(di_length_s, adx_smooth_s)

adx_above_thres = adx_s > adx_thres_s

long_1 = diplus_s > diminus_s and adx_s < diplus_s and adx_s > diminus_s

short_1 = diplus_s < diminus_s and adx_s > diplus_s and adx_s < diminus_s

long_2 = diplus_s > diminus_s and adx_above_thres

short_2 = diplus_s < diminus_s and adx_above_thres

//-------------------------- SMA50 filter and entry---------------------------

//entry

sma_buy = close[2] > ema_f(close, ma_period)

sma_sell = close[2] < ema_f(close, ma_period)

//filters

sma_buy_f = close[2] > sma_f(close, ma_period)

sma_sell_f = close[2] < sma_f(close, ma_period)

//exit

sma_buy_x = close[1] > sma_f(close, ma_period_x)

sma_sell_x = close[1] < sma_f(close, ma_period_x)

//--------------------------- Segments signal ----------------------------

count1_l = 0

count2_l = 0

segment_1_stat_l = false

segment_2_stat_l = false

segment_3_stat_l = false

higher_low = low > low[1]

var line segment_low_1_l = na

var line segment_low_2_l = na

var line segment_low_3_l = na

// long segments

for i=0 to sb

count1_l := count1_l + 1

if low[1] > low[i+2] and higher_low

segment_1_stat_l := true

break

for i=count1_l to sb+count1_l

count2_l := count2_l + 1

if low[1+count1_l] > low[i+2] and segment_1_stat_l

segment_2_stat_l := true

break

for i=count2_l to sb+count2_l

if low[1+count1_l+count2_l] > low[i+2+count1_l] and segment_2_stat_l

segment_3_stat_l := true

break

// short segments

count1_s = 0

count2_s = 0

segment_1_stat_s = false

segment_2_stat_s = false

segment_3_stat_s = false

lower_high = high < high[1]

var line segment_high_1 = na

var line segment_high_2 = na

var line segment_high_3 = na

for i=0 to sb

count1_s := count1_s + 1

if high[1] < high[i+2] and lower_high

segment_1_stat_s := true

break

for i=count1_s to sb+count1_s

count2_s := count2_s + 1

if high[1+count1_s] < high[i+2] and segment_1_stat_s

segment_2_stat_s := true

break

for i=count2_s to sb+count2_s

if high[1+count1_s+count2_s] < high[i+2+count1_s] and segment_2_stat_s

segment_3_stat_s := true

break

// segments signals

seg_stat_l = segment_1_stat_l and segment_2_stat_l and segment_3_stat_l

seg_stat_s = segment_1_stat_s and segment_2_stat_s and segment_3_stat_s

//entry

segments_buy = high > high[1] and seg_stat_l[1]

segments_sell = low < low[1] and seg_stat_s[1]

//filters

segments_buy_f = high > high[1] and seg_stat_l[1]

segments_sell_f = low < low[1] and seg_stat_s[1]

//--------------------------- Entry Signal Options ---------------------------

// buy signal options 1

opt_sig_buy =

X_opt == "---" ? na :

// X_opt == "Grid - forward sig" ? grid_up_buy :

X_opt == "Grid - counter trend" ? grid_ct_buy :

X_opt == "Grid - reentry" ? grid_re_buy :

X_opt == "Fractals" ? fr_upx :

X_opt == "Reverse fractal" ? rev_dn_fr_buy : na

// sell signal options 1

opt_sig_sell =

X_opt == "---" ? na :

// X_opt == "Grid - forward sig" ? grid_dn_sell :

X_opt == "Grid - counter trend" ? grid_ct_sell :

X_opt == "Grid - reentry" ? grid_re_sell :

X_opt == "Fractals" ? fr_dnx :

X_opt == "Reverse fractal" ? rev_up_fr_sell : na

// buy signal options 2

opt_sig_buy_2 =

X_opt_2 == "---" ? na :

// X_opt_2 == "Grid - forward sig" ? grid_up_buy :

X_opt_2 == "Grid - counter trend" ? grid_ct_buy :

X_opt_2 == "Grid - reentry" ? grid_re_buy :

X_opt_2 == "Fractals" ? fr_upx :

X_opt_2 == "Reverse fractal" ? rev_dn_fr_buy : na

// sell signal options 2

opt_sig_sell_2 =

X_opt_2 == "---" ? na :

// X_opt_2 == "Grid - forward sig" ? grid_dn_sell :

X_opt_2 == "Grid - counter trend" ? grid_ct_sell :

X_opt_2 == "Grid - reentry" ? grid_re_sell :

X_opt_2 == "Fractals" ? fr_dnx :

X_opt_2 == "Reverse fractal" ? rev_up_fr_sell : na

//-------------------------- entry filter -------------------------------

//entry buy filter 1 options

entry_filter_buy_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_buy :

entry_f_1 == "RSI50 filter" ? rsi_f_buy_f :

entry_f_1 == "Fractals filter" ? fr_upx_f :

entry_f_1 == "SuperTrend filter" ? sup_buy_f :

entry_f_1 == "Parabolic SAR filter" ? psar_buy_f :

entry_f_1 == "SMA filter" ? sma_buy_f :

entry_f_1 == "ADX filter" ? adx_above_thres :

entry_f_1 == "Segments filter" ? segments_buy :

entry_f_1 == "Fractals 1-2-3 filter" ? hl_hh_buy :

entry_f_1 == "Reverse fractal filter" ? rev_dn_fr_buy :

entry_f_1 == "EMA21/SMA20 filter" ? ma_cross_buy :

entry_f_1 == "TRIX filter" ? trix_buy_f :

entry_f_1 == "Price X Kumo filter" ? kumo_buy_f :

entry_f_1 == "Price X Kijun filter" ? kijun_buy_f :

entry_f_1 == "Kumo flip filter" ? kumo_flip_buy_f :

entry_f_1 == "Price filtered Kumo flip filter" ? price_filtered_kumo_flip_buy_f :

entry_f_1 == "Chikou X price filter" ? chikou_X_price_buy_f :

entry_f_1 == "Chikou X Kumo filter" ? chikou_X_kumo_buy_f :

entry_f_1 == "Price X Tenkan filter" ? price_X_tenkan_buy_f :

entry_f_1 == "Tenkan X Kumo filter" ? tenkan_X_kumo_buy_f :

entry_f_1 == "Tenkan X Kijun filter" ? tenkan_X_kijun_buy_f : true

//entry sell filter 1 options

entry_filter_sell_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_sell :

entry_f_1 == "RSI50 filter" ? rsi_f_sell_f :

entry_f_1 == "Fractals filter" ? fr_dnx_f :

entry_f_1 == "SuperTrend filter" ? sup_sell_f :

entry_f_1 == "Parabolic SAR filter" ? psar_sell_f :

entry_f_1 == "SMA filter" ? sma_sell_f :

entry_f_1 == "ADX filter" ? adx_above_thres :

entry_f_1 == "Segments filter" ? segments_sell :

entry_f_1 == "Fractals 1-2-3 filter" ? lh_ll_sell :

entry_f_1 == "Reverse fractal filter" ? rev_up_fr_sell :

entry_f_1 == "EMA21/SMA20 filter" ? ma_cross_sell :

entry_f_1 == "TRIX filter" ? trix_sell_f :

entry_f_1 == "Price X Kumo filter" ? kumo_sell_f :

entry_f_1 == "Price X Kijun filter" ? kijun_sell_f :

entry_f_1 == "Kumo flip filter" ? kumo_flip_sell_f :

entry_f_1 == "Price filtered Kumo flip filter" ?price_filtered_kumo_flip_sell_f :

entry_f_1 == "Chikou X price filter" ? chikou_X_price_sell_f :

entry_f_1 == "Chikou X Kumo filter" ? chikou_X_kumo_sell_f :

entry_f_1 == "Price X Tenkan filter" ? price_X_tenkan_sell_f :

entry_f_1 == "Tenkan X Kumo filter" ? tenkan_X_kumo_sell_f :

entry_f_1 == "Tenkan X Kijun filter" ? tenkan_X_kijun_sell_f : true

//entry buy filter 2 options

entry_filter_buy_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_buy :

entry_f_2 == "RSI50 filter" ? rsi_f_buy_f :

entry_f_2 == "Fractals filter" ? fr_upx_f :

entry_f_2 == "SuperTrend filter" ? sup_buy_f :

entry_f_2 == "Parabolic SAR filter" ? psar_buy_f :

entry_f_2 == "SMA filter" ? sma_buy_f :

entry_f_2 == "ADX filter" ? adx_above_thres :

entry_f_2 == "Segments filter" ? segments_buy :

entry_f_2 == "Fractals 1-2-3 filter" ? hl_hh_buy :

entry_f_2 == "Reverse fractal filter" ? rev_dn_fr_buy :

entry_f_2 == "EMA21/SMA20 filter" ? ma_cross_buy :

entry_f_2 == "TRIX filter" ? trix_buy_f :

entry_f_2 == "Price X Kumo filter" ? kumo_buy_f :

entry_f_2 == "Price X Kijun filter" ? kijun_buy_f :

entry_f_2 == "Kumo flip filter" ? kumo_flip_buy_f :

entry_f_2 == "Price filtered Kumo flip filter" ? price_filtered_kumo_flip_buy_f :

entry_f_2 == "Chikou X price filter" ? chikou_X_price_buy_f :

entry_f_2 == "Chikou X Kumo filter" ? chikou_X_kumo_buy_f :

entry_f_2 == "Price X Tenkan filter" ? price_X_tenkan_buy_f :

entry_f_2 == "Tenkan X Kumo filter" ? tenkan_X_kumo_buy_f :

entry_f_2 == "Tenkan X Kijun filter" ? tenkan_X_kijun_buy_f : true

//entry sell filter 2 options

entry_filter_sell_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_sell :

entry_f_2 == "RSI50 filter" ? rsi_f_sell_f :

entry_f_2 == "Fractals filter" ? fr_dnx_f :

entry_f_2 == "SuperTrend filter" ? sup_sell_f :

entry_f_2 == "Parabolic SAR filter" ? psar_sell_f :

entry_f_2 == "SMA filter" ? sma_sell_f :

entry_f_2 == "ADX filter" ? adx_above_thres :

entry_f_2 == "Segments filter" ? segments_sell :

entry_f_2 == "Fractals 1-2-3 filter" ? lh_ll_sell :

entry_f_2 == "Reverse fractal filter" ? rev_up_fr_sell :

entry_f_2 == "EMA21/SMA20 filter" ? ma_cross_sell :

entry_f_2 == "TRIX filter" ? trix_sell_f :

entry_f_2 == "Price X Kumo filter" ? kumo_sell_f :

entry_f_2 == "Price X Kijun filter" ? kijun_sell_f :

entry_f_2 == "Kumo flip filter" ? kumo_flip_sell_f :

entry_f_2 == "Price filtered Kumo flip filter" ? price_filtered_kumo_flip_sell_f :

entry_f_2 == "Chikou X price filter" ? chikou_X_price_sell_f :

entry_f_2 == "Chikou X Kumo filter" ? chikou_X_kumo_sell_f :

entry_f_2 == "Price X Tenkan filter" ? price_X_tenkan_sell_f :

entry_f_2 == "Tenkan X Kumo filter" ? tenkan_X_kumo_sell_f :

entry_f_2 == "Tenkan X Kijun filter" ? tenkan_X_kijun_sell_f : true

//------------------------- exit filter -----------------------

//short exit buy filter 1 options

exit_filter_buy_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "TRIX exit" ? trix_buy_x :

exit_f_1 == "Reverse fractal exit" ? rev_dn_fr_buy :

exit_f_1 == "MACD exit" ? macd_buy_x :

exit_f_1 == "RSI50 exit" ? rsi_f_buy_x :

exit_f_1 == "Fractals exit" ? fr_upx_x :

exit_f_1 == "SuperTrend exit" ? sup_buy_x :

exit_f_1 == "Parabolic SAR exit" ? psar_buy :

exit_f_1 == "SMA exit" ? sma_buy_x :

exit_f_1 == "ADX exit" ? adx_thres_f_x :

exit_f_1 == "Cloud exit" ? kumo_buy_x :

exit_f_1 == "Kijun exit" ? kijun_buy_x : false

//long exit sell filter 1 options

exit_filter_sell_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "TRIX exit" ? trix_sell_x :

exit_f_1 == "Reverse fractal exit" ? rev_up_fr_sell :

exit_f_1 == "MACD exit" ? macd_sell_x :

exit_f_1 == "RSI50 exit" ? rsi_f_sell_x :

exit_f_1 == "Fractals exit" ? fr_dnx_x :

exit_f_1 == "SuperTrend exit" ? sup_sell_x :

exit_f_1 == "Parabolic SAR exit" ? psar_sell :

exit_f_1 == "SMA exit" ? sma_sell_x :

exit_f_1 == "ADX exit" ? adx_thres_f_x :

exit_f_1 == "Cloud exit" ? kumo_sell_x :

exit_f_1 == "Kijun exit" ? kijun_sell_x : false

//short exit buy filter 2 options

exit_filter_buy_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "TRIX exit" ? trix_buy_x :

exit_f_2 == "Reverse fractal exit" ? rev_dn_fr_buy :

exit_f_2 == "MACD exit" ? macd_buy_x :

exit_f_2 == "RSI50 exit" ? rsi_f_buy_x :

exit_f_2 == "Fractals exit" ? fr_upx_x :

exit_f_2 == "SuperTrend exit" ? sup_buy_x :

exit_f_2 == "Parabolic SAR exit" ? psar_buy :

exit_f_2 == "SMA exit" ? sma_buy_x :

exit_f_2 == "ADX exit" ? adx_thres_f_x :

exit_f_2 == "Cloud exit" ? kumo_buy_x :

exit_f_2 == "Kijun exit" ? kijun_buy_x : false

//long exit sell filter 2 options

exit_filter_sell_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "TRIX exit" ? trix_sell_x :

exit_f_2 == "Reverse fractal exit" ? rev_up_fr_sell :

exit_f_2 == "MACD exit" ? macd_sell_x :

exit_f_2 == "RSI50 exit" ? rsi_f_sell_x :

exit_f_2 == "Fractals exit" ? fr_dnx_x :

exit_f_2 == "SuperTrend exit" ? sup_sell_x :

exit_f_2 == "Parabolic SAR exit" ? psar_sell :

exit_f_2 == "SMA exit" ? sma_sell_x :

exit_f_2 == "ADX exit" ? adx_thres_f_x :

exit_f_2 == "Cloud exit" ? kumo_sell_x :

exit_f_2 == "Kijun exit" ? kijun_sell_x : false

//--------------------- strategy entry ---------------------

long = entry_type != "Short"

short = entry_type != "Long"

exit_long = exit_filter_sell_1 or exit_filter_sell_2

exit_short = exit_filter_buy_1 or exit_filter_buy_2

if backtest_period()

if long

strategy.entry("os_b", strategy.long, when = opt_sig_buy and entry_filter_buy_1 and entry_filter_buy_2 and not exit_long,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=buy, amount=100); }" : na)

strategy.entry("os_b", strategy.long, when = opt_sig_buy_2 and entry_filter_buy_1 and entry_filter_buy_2 and not exit_long,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=buy, amount=100); }" : na)

strategy.close("os_b", when = exit_long)

if short

strategy.entry("os_s",strategy.short, when = opt_sig_sell and entry_filter_sell_1 and entry_filter_sell_2 and not exit_short,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=sell, amount=100); }" : na)

strategy.entry("os_s",strategy.short, when = opt_sig_sell_2 and entry_filter_sell_1 and entry_filter_sell_2 and not exit_short,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=sell, amount=100); }" : na)

strategy.close("os_s", when = exit_short)

// {{strategy.order.comment}} #bot - altert message