概述

该策略通过计算MACD和RSI这两个指标的交叉,产生交易信号。当RSI超买超卖时,在MACD金叉死叉发生时,产生买入和卖出信号。该策略结合了两种不同类型指标的优点,既考虑了价格的趋势性,也结合了超买超卖情况,从而提高策略的效果。

策略原理

该策略主要利用MACD和RSI这两个指标的组合来产生交易信号。其中,MACD一般用来判断价格趋势和动量变化,RSI一般用来判断超买超卖情况。

该策略首先计算出MACD的快慢均线和信号线。快线大于慢线产生金叉信号,快线小于慢线产生死叉信号。这表示价格的趋势和动量正在发生变化。

同时,该策略计算RSI指标,并设定超买线和超卖线。当RSI低于超卖线时表示超卖,当RSI高于超买线时表示超买。

在RSI超买超卖的情况下,策略在MACD金叉时产生买入信号,在MACD死叉时产生卖出信号。也就是在价格趋势发生转折的时候,利用MACD指标的灵敏度来捕捉转折点。而RSI指标的作用是避免在没有超买超卖的情况下发生错误交易。

优势分析

该策略结合MACD和RSI两个指标的优势,可以提高策略的效果。

MACD指标能敏感捕捉价格变化,RSI指标考虑超买超卖情况,两者互补。

结合两个指标,可以过滤掉一些噪音交易信号,减少不必要的交易。

MACD统计价格平均数差值,RSI统计价格变化比例,两种方法可以互相验证。

MACD反应价格变化迅速,RSI反应价格背离比较明显,组合使用效果好。

风险及解决

该策略也存在一定的风险需要注意:

MACD和RSI都易受突发事件影响,可能产生错误信号。可以适当调整参数,过滤信号。

单一股票效果可能不佳,可以考虑指数或组合使用。

需要同时满足MACD交叉和RSI超买超卖条件才发出信号,可能错过部分机会。可以适当降低RSI参数要求。

优化方向

该策略还可以从以下几个方面进行优化:

优化MACD和RSI的参数,使其更符合不同品种的特点。

增加止损策略,在亏损达到一定比例时及时止损。

结合其他指标,例如布林带、KDJ等,设定更严格的交易信号条件。

在高频数据上运行策略,利用MACD的快慢特性,提高策略效果。

根据回测结果,调整RSI的超买超卖线,寻找最佳参数组合。

总结

该MACD与RSI交叉策略,结合了趋势跟踪和超买超卖判断,可以有效获取价格转折点,增强策略效果。但也存在一定局限,仍需根据市场行情不断测试与优化,方能充分发挥策略效果。

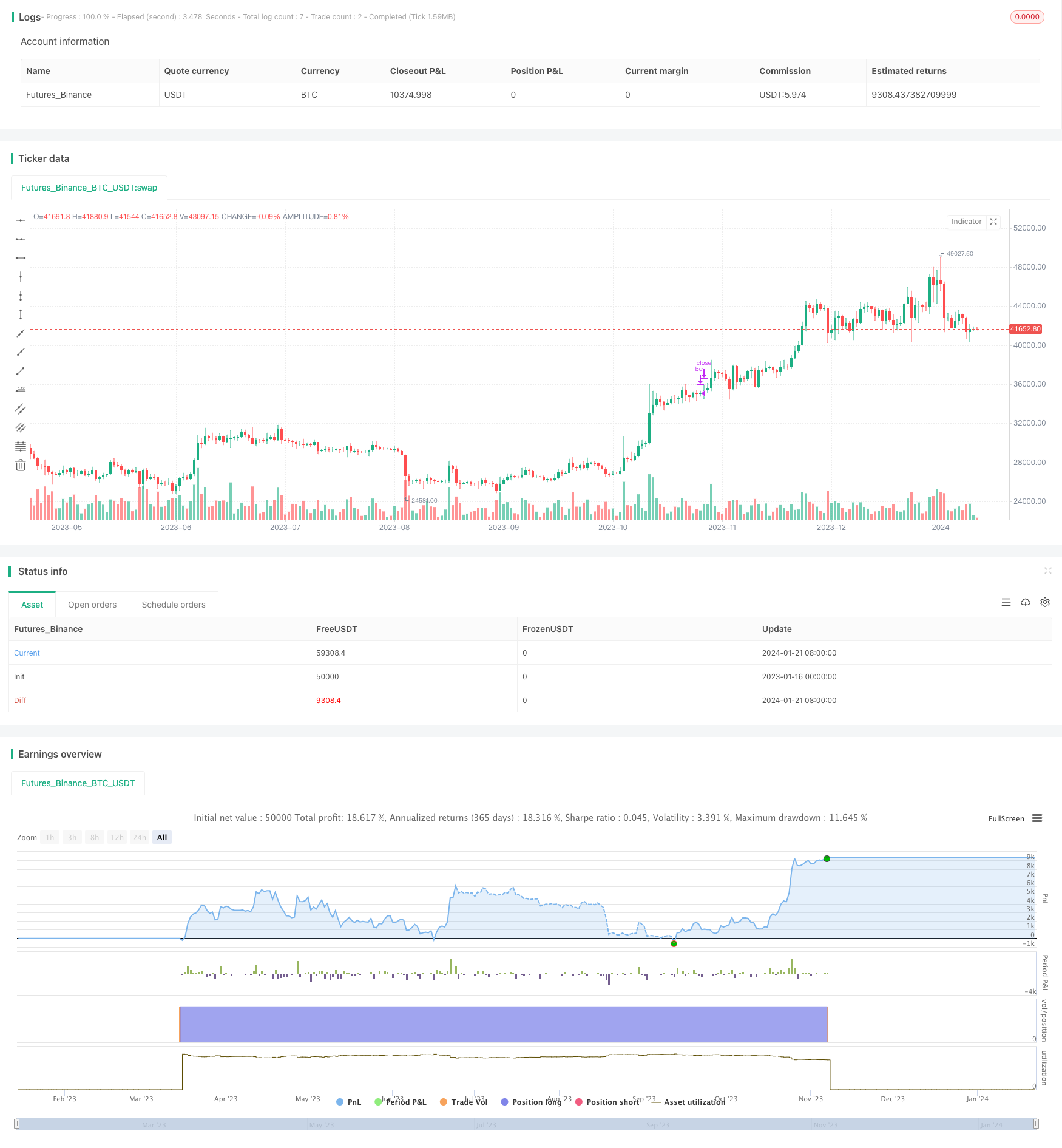

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// © sabirt

strategy(title='MACD and RSI', overlay=true, shorttitle='MACD&RSI')

//MACD Settings

fastMA = input.int(title='Fast moving average', defval=12, minval=1)

slowMA = input.int(title='Slow moving average', defval=26, minval=1)

signalLength = input.int(9, minval=1)

//RSI settings

RSIOverSold = input.int(35, minval=1)

RSIOverBought = input.int(80, minval=1)

src = close

len = input.int(14, minval=1, title='Length')

up = ta.rma(math.max(ta.change(src), 0), len)

down = ta.rma(-math.min(ta.change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

wasOversold = rsi[0] <= RSIOverSold or rsi[1] <= RSIOverSold or rsi[2] <= RSIOverSold or rsi[3] <= RSIOverSold or rsi[4] <= RSIOverSold or rsi[5] <= RSIOverSold

wasOverbought = rsi[0] >= RSIOverBought or rsi[1] >= RSIOverBought or rsi[2] >= RSIOverBought or rsi[3] >= RSIOverBought or rsi[4] >= RSIOverBought or rsi[5] >= RSIOverBought

[currMacd, _, _] = ta.macd(close[0], fastMA, slowMA, signalLength)

[prevMacd, _, _] = ta.macd(close[1], fastMA, slowMA, signalLength)

signal = ta.ema(currMacd, signalLength)

avg_1 = math.avg(currMacd, signal)

crossoverBear = ta.cross(currMacd, signal) and currMacd < signal ? avg_1 : na

avg_2 = math.avg(currMacd, signal)

crossoverBull = ta.cross(currMacd, signal) and currMacd > signal ? avg_2 : na

strategy.entry('buy', strategy.long, when=crossoverBull and wasOversold)

strategy.close('buy', when=crossoverBear and wasOverbought)