概述

该策略基于线性回归RSI指标设计。策略通过计算线性回归RSI和EMA的交叉来产生买入和卖出信号。该策略同时提供两种买入逻辑选择,可以根据需要选用。

策略原理

策略首先计算长度为200周期的线性回归,然后基于线性回归结果计算21周期的RSI。之后计算长度为50周期的EMA。当RSI上穿EMA时产生买入信号,当RSI下穿EMA时产生卖出信号,实现获利了结。

该策略提供两种买入逻辑:

- RSI上穿EMA时买入

- RSI高于EMA并且高于超买线时买入

可以根据市场情况选择使用哪种买入逻辑。

优势分析

该策略结合了线性回归RSI和EMA的优点,可以有效滤除价格的部分噪音,产生更可靠的交易信号。

线性回归RSI能够更好地体现趋势,EMA有助于发现转折点。两者的组合可以在趋势中寻找反转机会,形成mean reversion策略。

该策略提供两种买入逻辑可选,可以根据市场阶段更灵活地调整。例如趋势明显时可以选择第一种逻辑,震荡时可以选择第二种。

风险分析

该策略主要依赖于RSI和EMA的关系,如果两者之间关系发生改变,会导致交易信号产生错误。这是主要的风险点。

此外,RSI和EMA作为指标本身也会存在一定的滞后,可能导致买入和卖出出现一定程度的延迟,无法完美地捕捉转折点。这也会带来一定程度的实际风险。

为降低风险,可以适当调整RSI和EMA的长度参数,优化两者之间的配合。此外交易单元也要适量把控,避免单笔损失过大。

优化方向

该策略可以从以下几个方向进行优化:

- 优化线性回归RSI和EMA的长度参数,找到最佳参数组合

- 添加其他指标过滤,如MACD、布林带等,提高信号质量

- 结合波动率指标,调整仓位管理

- 利用机器学习方法自动优化参数

总结

本策略基于线性回归RSI和EMA设计了一个mean reversion策略,通过RSI和EMA的交叉来寻找盘整范围内的反转机会。该策略同时提供两种买入逻辑可供选择,可以灵活应对不同市场情况。总体来说,该策略结合了多个指标的优势,可以有效发现反转机会。通过参数优化和其他指标的辅助过滤,该策略可以获得更好的绩效表现。

策略源码

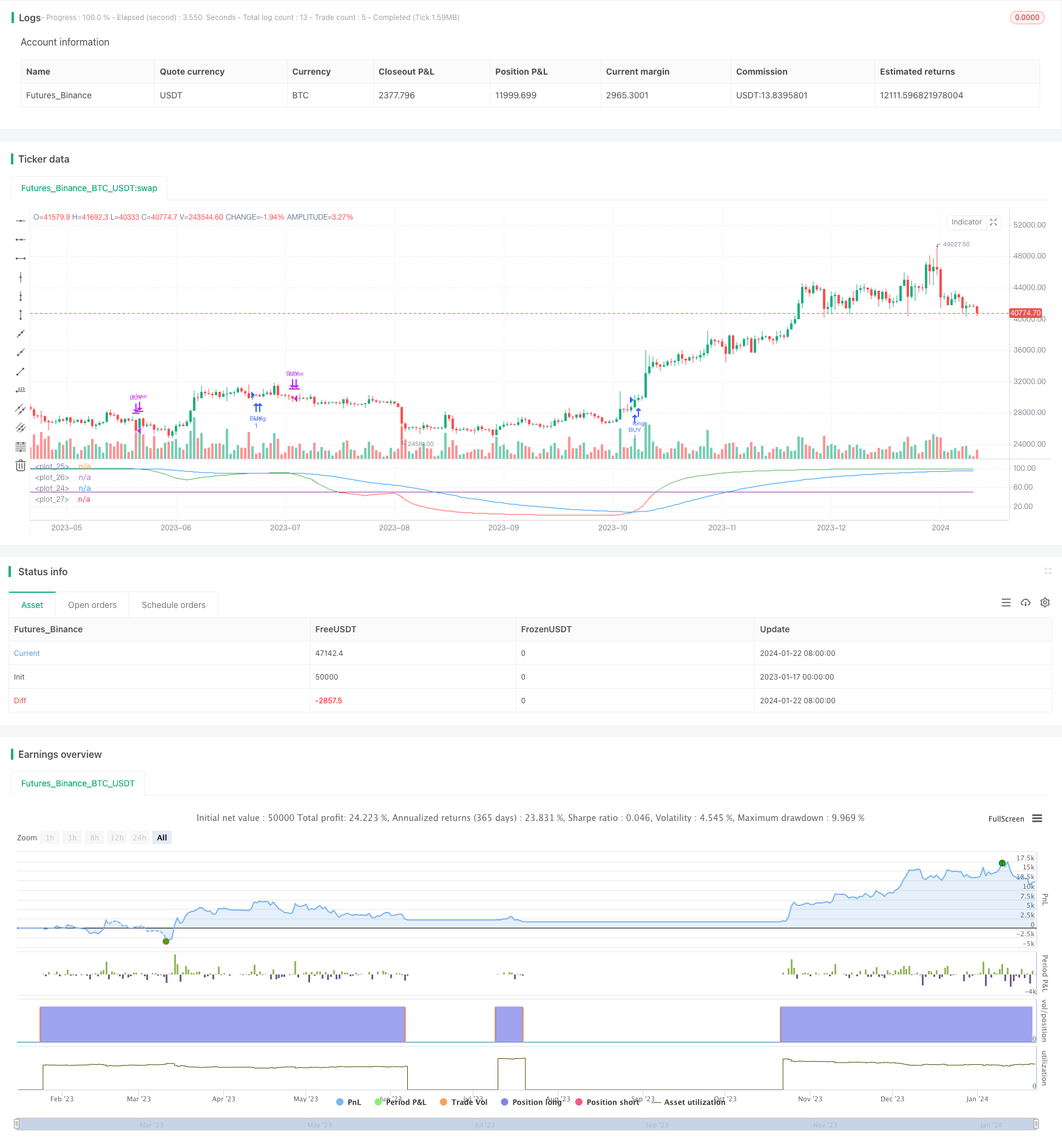

/*backtest

start: 2023-01-17 00:00:00

end: 2024-01-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Linear RSI")

startP = timestamp(input(2017, "Start Year"), input(12, "Month"), input(17, "Day"), 0, 0)

end = timestamp(input(9999, "End Year"), input(1, "Month"), input(1, "Day"), 0, 0)

_testPeriod() => true

//inputs

length = input(defval=200, minval=1, title="LR length")

length2 = input(defval=21, minval=1, title="RSI length")

ema_fast = input(defval=50, minval=1, title="EMA")

lag = 0

overBought = input(50)

overSold = input(50)

//rsi

src = close

Lr = linreg(src, length, lag)

rsi = rsi(Lr, length2)

ema = ema(rsi, ema_fast)

plot(rsi, color = rsi > overBought ? color.green : rsi < overSold ? color.red : color.silver)

plot(overBought, color=color.purple)

plot(overSold, color=color.purple)

plot(ema, color=color.blue)

first_type = input(true, title="Use first logic?")

second_type = input(false, title="Use second logic?")

long_condition = (first_type ? crossover(rsi, ema) and _testPeriod() : false) or (second_type ? rsi > ema and rsi > overBought and _testPeriod() : false)

strategy.entry('BUY', strategy.long, when=long_condition)

short_condition = crossunder(rsi, ema)

strategy.close('BUY', when=short_condition)