概述

本策略的核心是利用卡尔曼滤波技术对价格均线进行平滑处理,通过计算平滑后的均线的切线角,当切线角在指定周期内超过一定阈值时产生交易信号。该策略致力于跟踪中长线趋势,通过卡尔曼滤波技术减少噪音的影响,从而获得更加清晰和可靠的趋势信号。

策略原理

本策略的核心逻辑主要包含以下几个步骤:

计算1分钟价格的简单移动平均线(SMA)作为原始均线;

对原始均线进行卡尔曼滤波,输出平滑后的均线;

计算平滑后的均线的切线角;

定义参数周期,统计周期内切线角的总和;

当周期内切线角总和大于360度时产生买入信号;当小于-360度时产生卖出信号。

通过这样的设计,当价格出现向上或向下的趋势时,均线的切线角会逐步积累,当积累到一定程度时产生交易信号,因而能够有效跟踪中长线趋势。

其中,卡尔曼滤波是本策略的关键所在。卡尔曼滤波是一种递归算法,它在预测当前状态的同时,也会预测过程噪声和测量噪声的值,并利用这些噪声的值来校正当前状态的预测,从而获得更加准确和可靠的状态估计。

在本策略中,价格的SMA可以看作是状态的测量,受到市场噪音的影响,卡尔曼滤波器会递归地估计价格的真实趋势,大幅减少噪声的影响,使得后续的均线运算更加可靠,从而产生更稳定和准确的交易信号。

策略优势

相比简单移动平均线等指标策略,本策略最大的优势在于利用卡尔曼滤波减少了噪声的影响,使得交易信号更加清晰可靠。具体优势主要体现在以下几个方面:

减少假信号。卡尔曼滤波通过自适应地估计和消除噪声,有效过滤掉了大量由随机波动引发的假信号,使得产生的交易信号更加可靠。

更佳跟踪效果。平滑后的均线形态更加流畅,能够更好地反映价格中长线趋势,从而实现更出色的趋势跟踪效果。

可调参数设置灵活。可调整的参数包括均线长度、卡尔曼滤波的参数和统计周期,能够灵活适应不同市场环境。

风险可控。本策略更多关注中长线趋势而不是短期波动,实现了较好的风险回报平衡。

实现简单,容易扩展。本策略的核心算法较为简洁,易于实现和测试,也提供了扩展的空间,如可引入机器学习算法自动优化参数等。

策略风险

本策略也存在以下主要风险:

趋势反转风险。本策略侧重趋势跟踪,一旦发生剧烈的趋势反转则会产生较大损失。可通过适当缩短统计周期以减少单笔损失。

参数优化风险。不当的参数设置可能导致交易频繁或信号滞后,需要充分测试优化。可结合机器学习算法自动优化。

过优化风险。在历史数据上过度优化也可能导致参数失效,需要控制在样本外有效。

实现复杂度增加风险。引入卡尔曼滤波和切线角算法会增加代码复杂度,需要确保正确实现。

策略优化方向

考虑到上述风险因素,本策略可优化的方向包括:

引入止损和仓位管理。适当的止损可以有效控制单笔损失风险;动态仓位管理也可以根据市场情况调整仓位覆盖风险。

自动参数优化。通过机器学习优化算法,可以实现参数的自动优化,避免过优化风险。

集成其他指标。可以在策略中集成一些其他指标,形成指标组合,以提升策略稳定性。

增加效率评估。引入更多风险调整指标,对策略效率和稳定性进行评估,从而得出更全面准确的结论。

扩展多个品种。如果效果良好,可以考虑扩展到更多品种,从中长期积累更丰富的样本,也方便跨品种参数优化。

总结

本策略总体来说是一个较为简单实用的趋势跟踪策略。相比传统移动平均线策略,引入卡尔曼滤波算法是其最大的创新点,也使得策略能够产生更加清晰和可靠的交易信号。下一步通过进一步优化,本策略可望取得更加优异的效果。总的来说,本策略为量化交易策略提供了一种新的思路,值得进一步研究和应用。

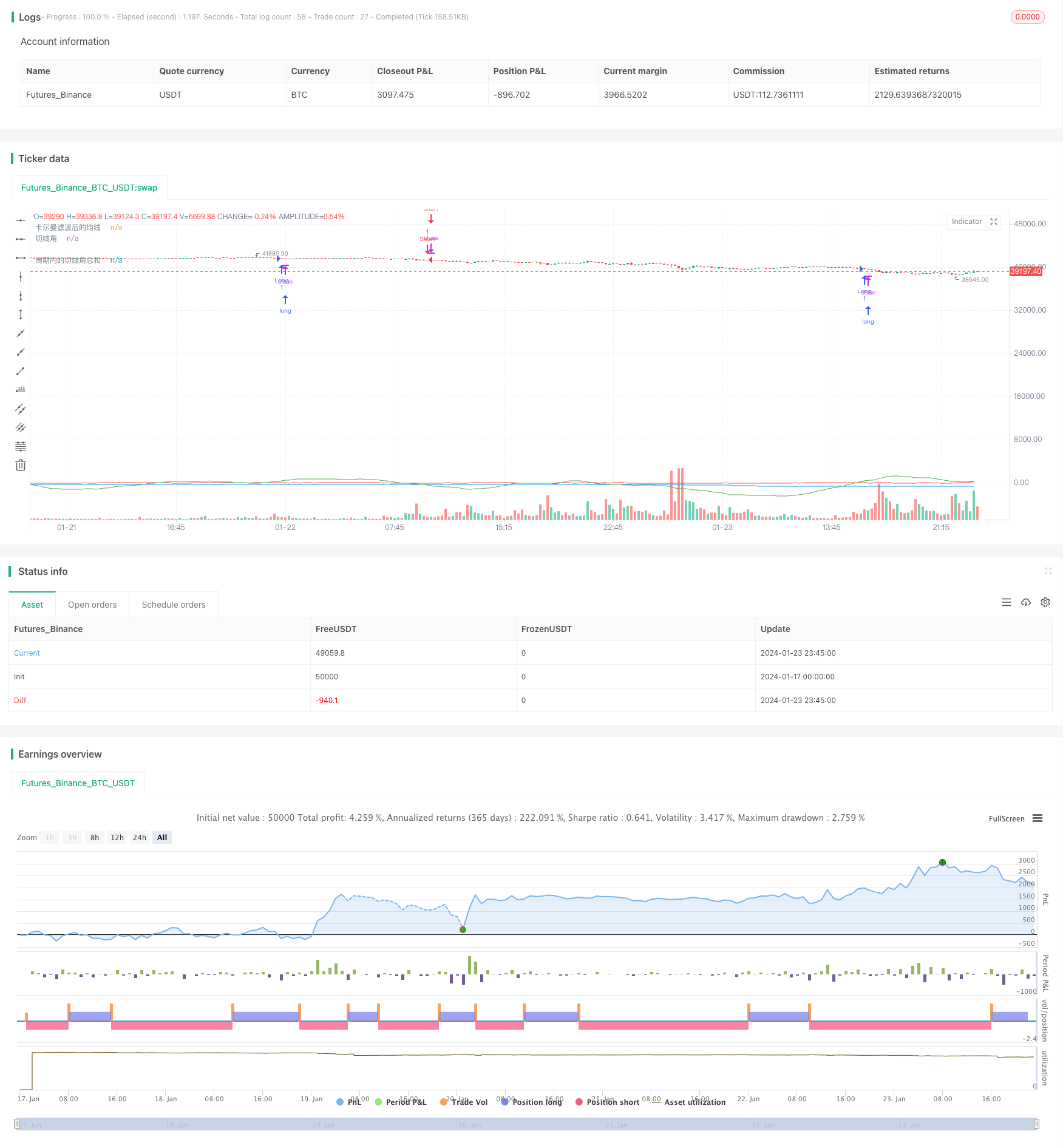

/*backtest

start: 2024-01-17 00:00:00

end: 2024-01-24 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@library=math

strategy("策略360°(测试)", overlay=true)

// 定义1分钟均线

ma1 = request.security(syminfo.tickerid, "1", ta.sma(close, 1)) // 在这里使用了 math.sma() 函数

//plot(ma1, color=color.yellow, title="原始均线")

// 定义卡尔曼滤波函数,参考了[1](https://www.tradingview.com/pine-script-docs/en/v5/language/Methods.html)和[2](https://www.tradingview.com/pine-script-docs/en/v5/language/Operators.html)的代码

kalman(x, g) =>

kf = 0.0

dk = x - nz(kf[1], x) // 在这里使用了 nz() 函数

smooth = nz(kf[1], x) + dk * math.sqrt(g * 2) // 在这里使用了 math.sqrt() 函数

velo = 0.0

velo := nz(velo[1], 0) + g * dk // 在这里使用了 nz() 函数

kf := smooth + velo

kf

// 定义卡尔曼滤波后的均线

ma2 = kalman(ma1, 0.01)

plot(ma2, color=color.blue, title="卡尔曼滤波后的均线")

// 定义切线角

angle = math.todegrees(math.atan(ma2 - ma2[1])) // 在这里使用了 math.degrees() 和 math.atan() 函数

// 定义累加的切线角

cum_angle = 0.0

cum_angle := nz(cum_angle[1], 0) + angle // 在这里使用了 nz() 函数

// 定义30分钟周期

period = 30 // 您可以根据您的需要修改这个参数

// 定义周期内的切线角总和

sum_angle = 0.0

sum_angle := math.sum(angle, period) // 在这里使用了 math.sum() 函数,把周期内的切线角总和改成简单地把 5 个切线角相加

// 定义买入和卖出条件

buy = sum_angle > 360// 在这里使用了 math.radians() 函数

sell = sum_angle < -360

// 执行买入和卖出操作

strategy.entry("Long", strategy.long, when=buy)

strategy.close("Short", when=buy)

strategy.entry("Short", strategy.short, when=sell)

strategy.close("Long", when=sell)

// 绘制曲线图

plot(sum_angle, color=color.green, title="周期内的切线角总和")

plot(angle, color=color.red, title="切线角") // 这是我为您添加的代码,用于显示实时计算的切线角