概述:该策略使用Bitfinex的BTC期货头寸数据来指导交易。当短仓数量上升时做空,当短仓数量下降时做多。适用于跟随“智囊团”交易行为。

策略原理: 1. 使用Bitfinex BTC期货短仓数量作为指标。Bitfinex被认为是机构和“智囊团”主导的交易所。 2. 当短仓数量上升时,做空BTC现货。此时机构正在 加仓做空BTC。 3. 当短仓数量下降时,做多BTC现货。此时机构正在减仓,表明看涨迹象。 4. 使用RSI指标来判断短仓数量的高点和低点。RSI高于75为高点信号,低于30为低点信号。 5. 在高低点发出信号时进入做多或做空仓位。

优势分析: 1. 使用Bitfinex专业交易员的仓位数据作为指示信号,可捕捉机构交易活动。 2. RSI指标有助判断短仓高低点,控制交易风险。 3. 实时监控机构交易动向,及时调整自己的仓位。 4. 无需自己分析技术指标,直接跟随“智囊团”的交易思路。 5. 回测数据表现不错,收益率较为可观。

风险分析:

1. 无法判断短仓数量增加是投机还是对冲。需谨慎跟随。

2. Bitfinex交易数据更新有延迟,可能错过最佳入场时机。

3. 机构交易不是百分之百正确的,有失败的可能。

4. RSI参数设置不当可能导致虚假信号或漏失信号。

5. 止损设置过于宽松,单笔损失可能较大。

优化方向:

1. 优化RSI参数,测试不同持仓周期的效果。

2. 尝试其他指标如KD、MACD等判断短仓高低点。

3. 缩紧止损幅度,降低单笔损失。

4. 增加离场条件,如趋势反转、breaker等信号。

5. 测试适用的币种范围,比如跟随BTC短仓交易ETH。

总结: 该策略通过跟随Bitfinex的BTC期货专业交易员,实现及时获知机构交易信号。有助投资者监测市场热度,把握高低点。同时也警示投资风险,当专业交易员大量做空时,要小心降低多头仓位。总体来说,该策略利用了期货头寸信息的优势,不失为一种有趣的交易思路。但参数优化和风险控制仍需进一步完善,才能在实盘中稳定获得收益。

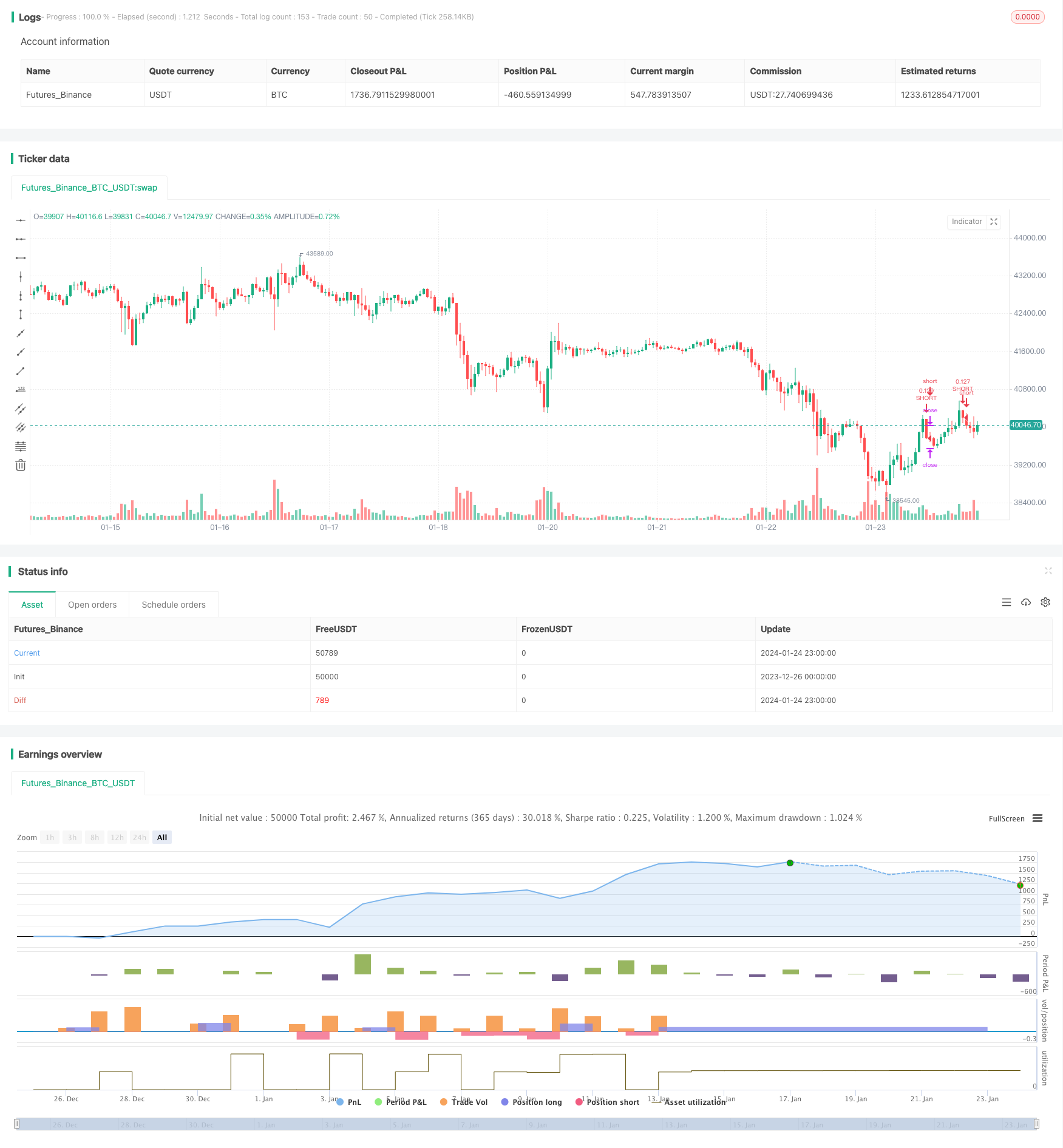

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bitfinex Shorts Strat",

overlay=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10, precision=2, initial_capital=1000,

pyramiding=2,

commission_value=0.05)

//Backtest date range

StartDate = input(timestamp("01 Jan 2021"), title="Start Date")

EndDate = input(timestamp("01 Jan 2024"), title="Start Date")

inDateRange = true

symbolInput = input(title="Bitfinex Short Symbol", defval="BTC_USDT:swap")

Shorts = request.security(symbolInput, "", open)

// RSI Input Settings

length = input(title="Length", defval=7, group="RSI Settings" )

overSold = input(title="High Shorts Threshold", defval=75, group="RSI Settings" )

overBought = input(title="Low Shorts Threshold", defval=30, group="RSI Settings" )

// Calculating RSI

vrsi = ta.rsi(Shorts, length)

RSIunder = ta.crossover(vrsi, overSold)

RSIover = ta.crossunder(vrsi, overBought)

// Stop Loss Input Settings

longLossPerc = input.float(title="Long Stop Loss (%)", defval=25, group="Stop Loss Settings") * 0.01

shortLossPerc = input.float(title="Short Stop Loss (%)", defval=25, group="Stop Loss Settings") * 0.01

// Calculating Stop Loss

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// Strategy Entry

if (not na(vrsi))

if (inDateRange and RSIover)

strategy.entry("LONG", strategy.long, comment="LONG")

if (inDateRange and RSIunder)

strategy.entry("SHORT", strategy.short, comment="SHORT")

// Submit exit orders based on calculated stop loss price

if (strategy.position_size > 0)

strategy.exit(id="LONG STOP", stop=longStopPrice)

if (strategy.position_size < 0)

strategy.exit(id="SHORT STOP", stop=shortStopPrice)