概述

该策略运用移动平均线差值法判断股价与均线偏离度,并结合零轴交叉系统发出交易信号。基本思路是,当价格从上方接近均线时看跌,当价格从下方接近均线时看涨。

策略原理

- 计算8日指数移动平均线ema和过去8日中的最低移动平均线lowestEMA

- 计算价格与当前移动平均线ema的差值diff

- 判断diff小于0为看跌信号,diff上穿0为底背离,看涨信号

- 结合diff的数值大小比较过去一周最大跌幅,发出交易信号

优势分析

- 利用双均线系统,能够有效过滤假突破

- 运用最小价格理论,发现底部信号

- 结合数值比较判断超跌超买,避免追高杀跌

风险分析

- 双均线策略容易产生 whipsaw effect

- 需关注交易频率过高的问题

- 合理设置移动平均线参数很关键

优化方向

- 调整移动平均线周期参数,适应不同周期

- 增加成交量指标过滤假突破信号

- 结合 stochastic 指标避免超跌超买

总结

本策略整合均线差值法和零轴交叉判断系统,旨在提高买卖点探测准确性。但仍需进一步优化参数设置,并配合其他指标过滤信号。总的来说,该策略利用简单指标判断效果尚可,可作为基础策略之一运用于实盘。

策略源码

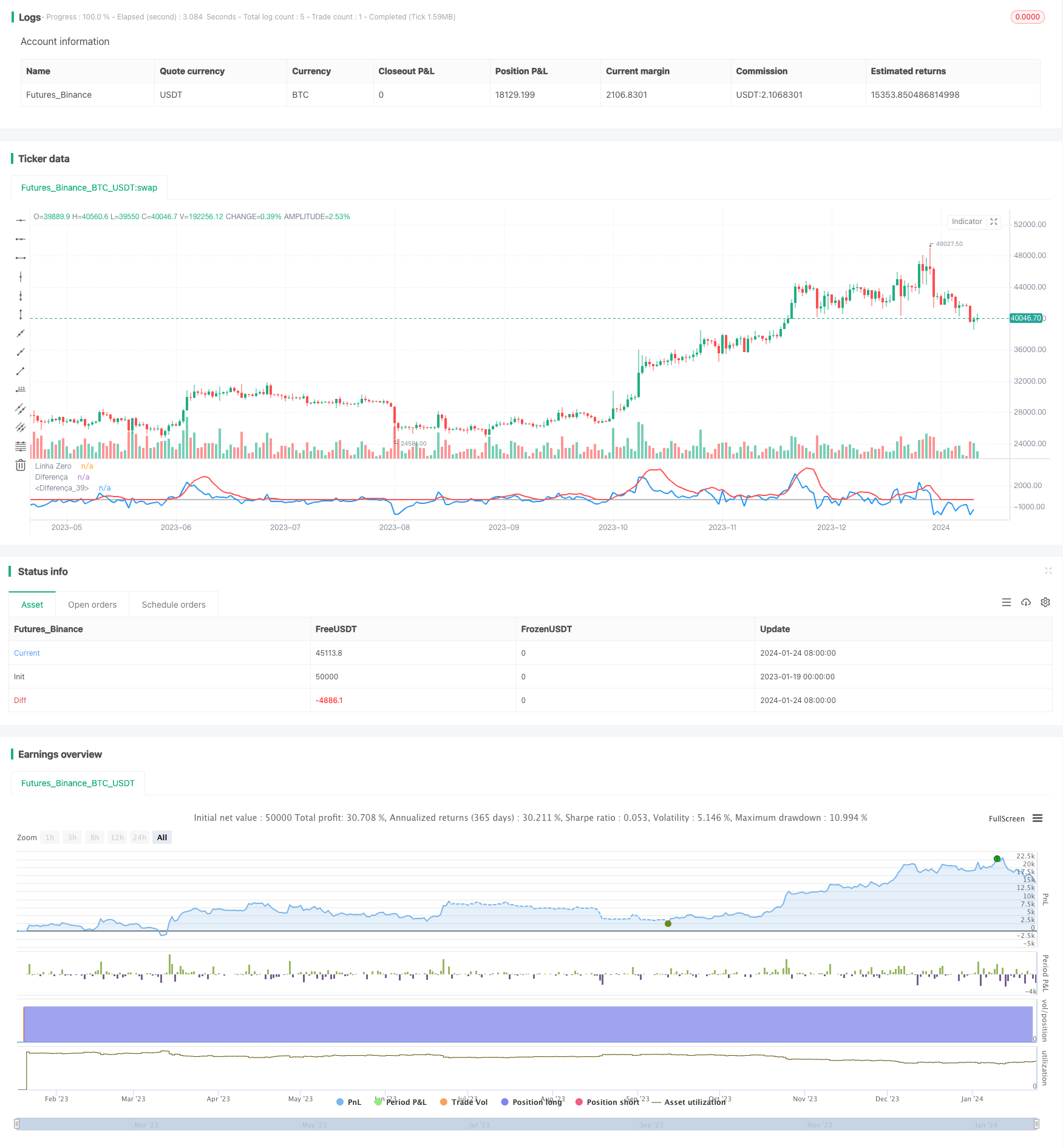

/*backtest

start: 2023-01-19 00:00:00

end: 2024-01-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = "Estratégia diferença menor preço de 8")

// Configuração da Média Móvel

emaPeriod = 8

ema= ema(close, emaPeriod)

ema1= ema(close[1], emaPeriod)

lowestEMA = lowest(ema, 8)

// Calcula a diferença entre o preço e a média móvel

diff = close - ema

diff1 = close[1] - ema1

diffLow = ema - lowestEMA

//Condições

diffZero = diff < 0

diffUnder = diff < diffLow

diffUm = diff > 0

Low0 = diffLow == 0

// Sinais de entrada

buy_signal = diffUnder and crossover(diff, diff1)

sell_signal = diffUm and diffUnder and crossunder(diff, diff1)

// Executa as operações de compra/venda

if buy_signal

strategy.entry("Buy", strategy.long)

if sell_signal

strategy.exit("Buy")

// Plota as linhas

plot(0, title="Linha Zero", color=color.gray)

plot(diff, title="Diferença", color=color.blue, linewidth=2)

plot(diffLow, title="Diferença", color=color.red, linewidth=2)