概述

自适应线性回归通道策略是一种基于线性回归分析的量化交易策略。该策略通过计算一定时间段内的证券价格线性回归方程,形成上下通道,并以通道上下轨作为交易信号,进行区间交易或趋势跟踪。

策略原理

自适应线性回归通道策略的核心是计算一定数量K根K线的收盘价线性回归方程,形成代表价格中位数的中线、代表价格上限的上轨和代表价格下限的下轨。具体计算过程如下:

收集输入参数length指定的K根K线的independent variable x和dependent variable y。这里x为1到length的整数,y为对应K线的收盘价。

计算回归系数:

- b = (∑y)/n - m(∑x)/n

- m = [(n∑xy) - (∑x)(∑y)]/[(n∑x2) - (∑x)2]

- b = (∑y)/n - m(∑x)/n

计算每个K线对应线性回归值y’,标准差STDDEV

中线为回归方程y’=mx+b,上下轨分别为中线上下浮动一个标准差倍数区间。

随着新K线到达,以上计算滚动更新,形成上中下自适应通道。根据通道上下轨交叉做多做空,中线附近止损。

优势分析

自适应线性回归通道策略相比传统均线策略,具有如下优势:

更科学合理,回归分析模型比均线有更高的统计学意义

更自适应灵活,通道范围会随价格变化自动调整

回测效果更佳,在某些品种上明显优于均线策略

实盘验证效果好,在实盘中表现令人满意

风险分析

该策略主要存在以下风险:

价格震荡过大导致巨大亏损。解决方法是设置止损,优化参数。

通道错落带来追踪效果不佳。解决方法是调整参数,结合其他技术指标。

回测效果看似很好,但实盘效果差强人意。解决方法是调整参数,充分验证。

优化方向

该策略可以从以下几个维度继续优化:

测试更多参数组合,寻找最优参数

结合其他技术指标避免走势剧烈的时候信号错乱

增加止损策略控制亏损风险,保护资金

增加仓位管理模块,根据市场情况调整仓位规模

总结

自适应线性回归通道策略整体来说是一种效果还不错的量化策略。它理论基础稳固,实践效果良好,值得进一步研究和优化,可以成为量化交易体系中的有效组成部分。但也需要认识到其局限性,防范风险,谨慎实践。

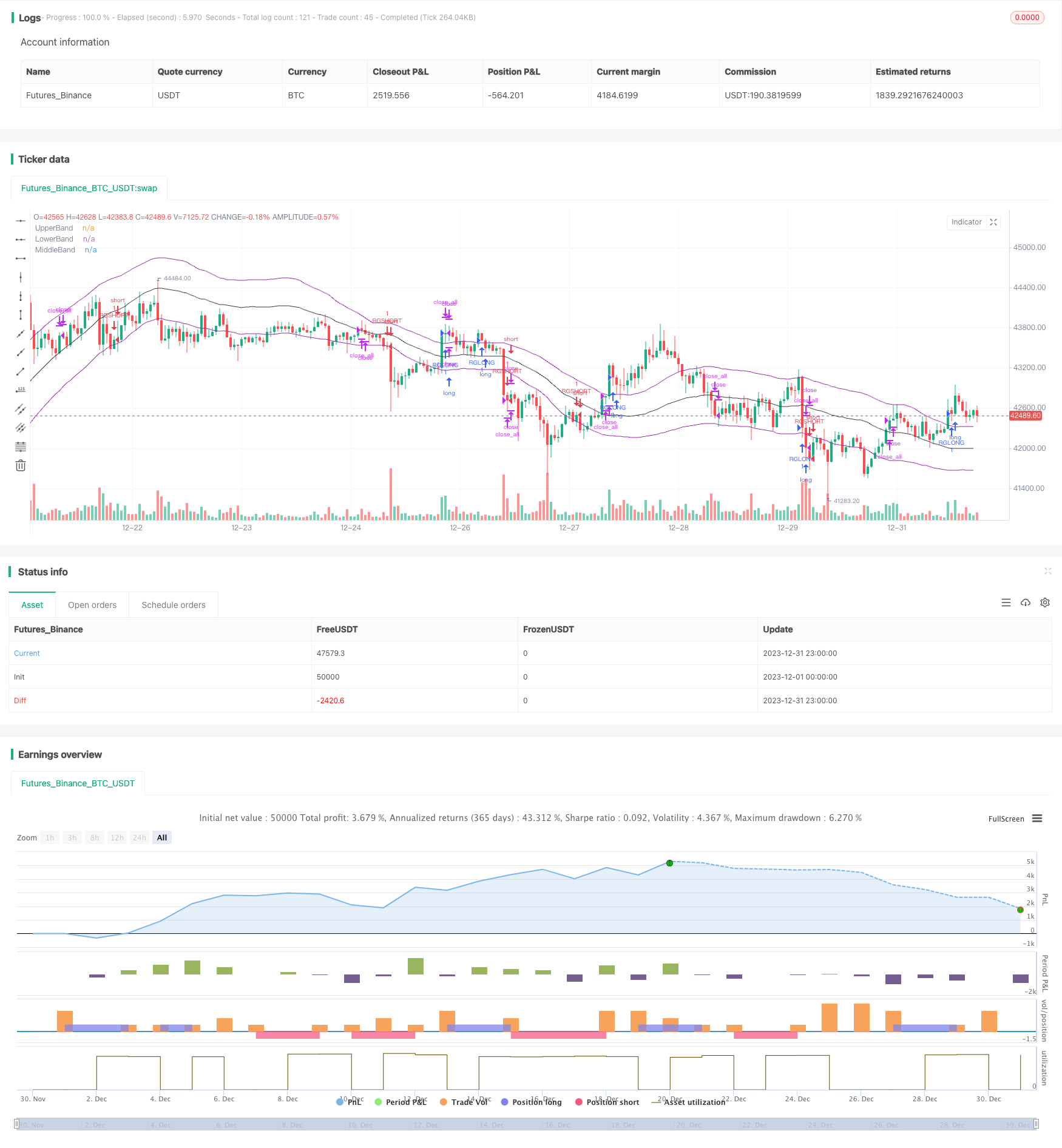

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Stealthy 7 Linear Regression Channel Strategy", overlay=true)

source = open

length = input(100, minval=1)

mult1 = input(1, minval=0.001, maxval=50)

mult2 = input(1, minval=0.001, maxval=50)

DayTrader = input(title="Range Mode", type=bool, defval=false)

//Making the first least squares line

sum_x = length * (length + 1) / 2

sum_y = 0

sum_xy = 0

xyproductsum = 0

sum_xx = 0

for i = 1 to length

sum_y := sum_y + close[i]

sum_xy := i * close[i] + sum_xy

sum_xx := i * i + sum_xx

m = (length*sum_xy - (sum_x * sum_y)) / (length * sum_xx - (sum_x * sum_x))

b = sum_y / length - (m * sum_x / length)

//Finding the first standard deviation from the line

difference = 0

for i = 1 to length

y = i * m + b

difference := pow(abs(close[i] - y),2) + difference

STDDEV = sqrt(difference / length)

//Creating trading zones

dev = mult1 * STDDEV

dev2 = mult2 * STDDEV

upper = b + dev

lower = b - dev2

middle = b

if DayTrader == false

if crossover(source, upper)

strategy.entry("RGLONG", strategy.long, oca_name="RegChannel", comment="RegLong")

else

strategy.cancel(id="RGLONG")

if crossunder(source, lower)

strategy.entry("RGSHORT", strategy.short, oca_name="RegChannel", comment="RegShort")

else

strategy.cancel(id="RGSHORT")

if crossover(source, middle) and strategy.position_size < 0

strategy.close_all()

if crossunder(source,middle) and strategy.position_size > 0

strategy.close_all()

if DayTrader == true

if crossover(source, lower)

strategy.entry("RGLONG", strategy.long, oca_name="RegChannel", comment="RegLong")

else

strategy.cancel(id="RGLONG")

if crossunder(source, upper)

strategy.entry("RGSHORT", strategy.short, oca_name="RegChannel", comment="RegShort")

else

strategy.cancel(id="RGSHORT")

plot(upper, title="UpperBand", color=purple, linewidth=1, style=line)

plot(lower, title="LowerBand", color=purple, linewidth=1, style=line)

plot(middle, title="MiddleBand", color=black, linewidth=1, style=line)