概述

该策略是一个利用均线黄金交叉形成买入信号,死叉形成卖出信号的短线交易策略。它使用两条不同周期的指数移动平均线(EMA)作为交易信号。当短周期EMA线从下方向上突破长周期EMA线时,形成黄金交叉,产生买入信号;当短周期EMA线从上方向下跌破长周期EMA线时,形成死叉,产生卖出信号。

策略原理

该策略的核心逻辑是计算两条EMA线,一条长度为55周期的短期EMA线,另一条长度为34周期的长期EMA线。当短期EMA线上穿长期EMA线时,认为股价处于上升趋势,因此产生买入信号;当短期EMA下穿长期EMA时,认为股价下跌,因此产生卖出信号。

代码中首先输入了两个EMA参数,然后计算出两条EMA线。在产生买入和卖出信号时,分别画出了相关的图形标记。同时,将两条EMA线画在K线图上,便于直观判断趋势。

策略优势

- 操作简单,容易理解,适合新手学习;

- 响应灵敏,短线操作,获利快;

- 采用EMA能有效滤除价格异常波动的影响,发出较为可靠的信号;

- 可自定义EMA参数,优化策略;

- 可在多种品种中应用。

风险及解决

- 容易产生频繁交易,增加交易成本和滑点风险。可适当调整EMA周期参数,过滤掉过于频繁的信号。

- 存在一定的滞后,可能错过价格靠前的机会。可结合其他指标如BOLL加强判断。

- EMA参数设置不当可能导致交易信号错误。要多次反复测试优化参数。

优化思路

- 结合更多指标判断,如BOLL,MACD等,设定一定的门槛条件,避免错误信号。

- 增加仓位管理模块,使其能更好地控制风险。

- 根据不同品种和周期参数差异,设计自适应EMA参数优化机制。

- 增加止损策略,能够有效控制单笔损失。

总结

该策略整体来说是一个非常简单实用的短线交易策略,特别适合新手来学习和应用,容易上手,而且也具有不错的效果。如果能够不断优化参数,并辅以其他判断指标,会使策略更加强大、稳健。这是一个非常有价值的策略思路,值得后续不断深入研究。

策略源码

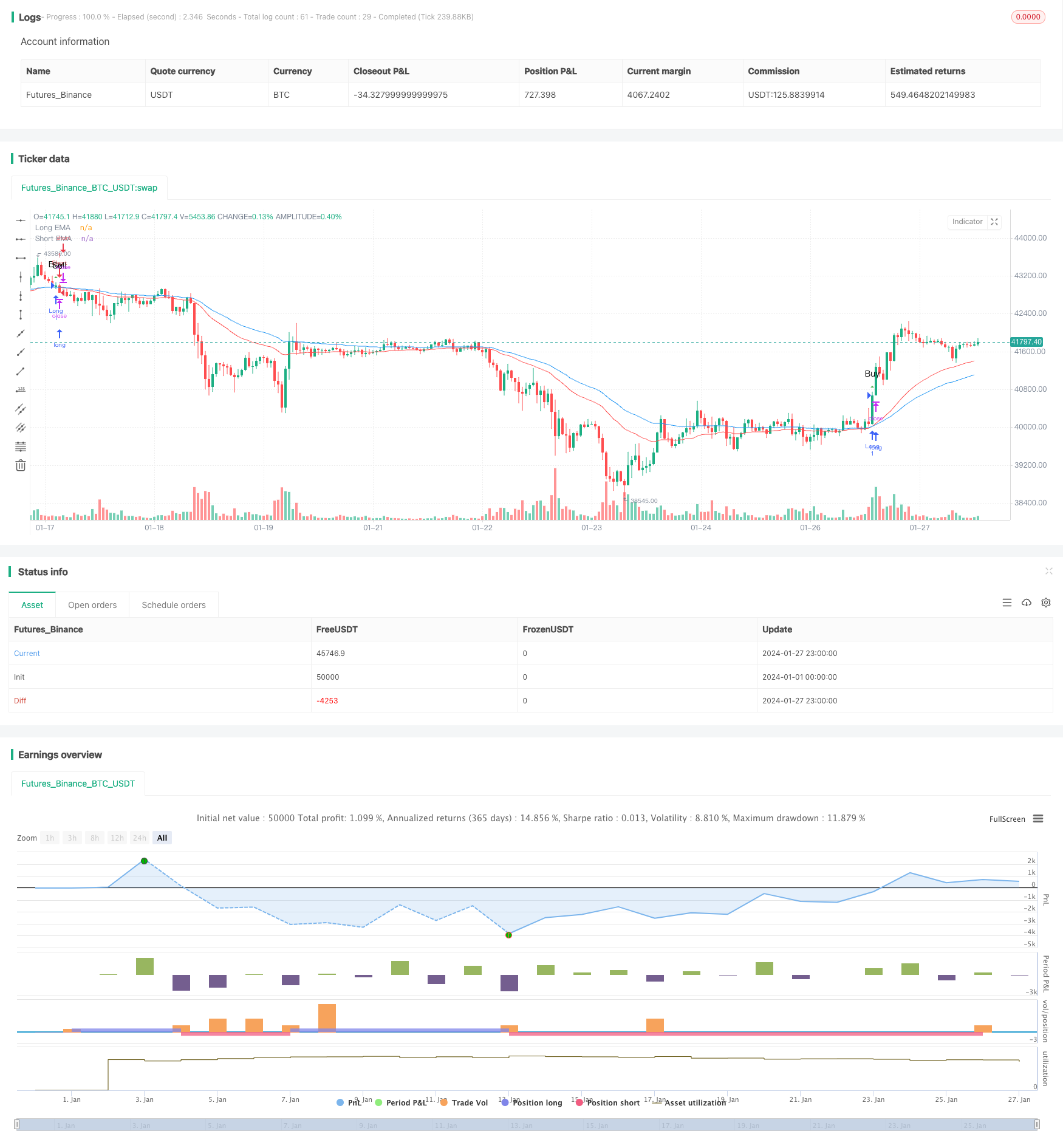

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("mohammad tork strategy", overlay=true)

// Input parameters

lengthShortEMA = input(55, title="Short EMA Length")

lengthLongEMA = input(34, title="Long EMA Length")

// Calculate EMAs

emaShort = ta.ema(close, lengthShortEMA)

emaLong = ta.ema(close, lengthLongEMA)

// Conditions for Long Signal

longCondition = ta.crossover(emaLong, emaShort)

// Conditions for Short Signal

shortCondition = ta.crossunder(emaLong, emaShort)

// Execute Long Signal

strategy.entry("Long", strategy.long, when = longCondition)

// Execute Short Signal

strategy.entry("Short", strategy.short, when = shortCondition)

// Plot EMAs on the chart

plot(emaShort, color=color.blue, title="Short EMA")

plot(emaLong, color=color.red, title="Long EMA")

// Plot Long Signal Icon with Buy Label

plotshape(series=longCondition, title="Long Signal", color=color.green, style=shape.triangleup, location=location.abovebar, size=size.small, text="Buy")

// Plot Short Signal Icon with Sell Label

plotshape(series=shortCondition, title="Short Signal", color=color.red, style=shape.triangledown, location=location.abovebar, size=size.small, text="Sell")