概述

RSI鳄鱼趋势策略是基于RSI指标的鳄鱼指标组合,用于判断趋势的进入和退出。它使用三条平均线 - 鳄鱼的上颚线、牙齿线和唇线,采用不同周期的RSI构建。当牙齿线上穿唇线且RSI上颚线高于牙齿线时做多;当牙齿线下穿唇线且RSI上颚线低于牙齿线时做空。该策略同时设定了止损和止盈条件。

策略原理

RSI鳄鱼趋势策略使用RSI指标构建鳄鱼指标的三条移动平均线。具体设置如下:

- 上颚线:5周期的RSI线

- 牙齿线:13周期的RSI线

- 唇线:34周期的RSI线

进入信号的判断逻辑是:

多头信号:当牙齿线上穿唇线,同时上颚线高于牙齿线时,做多。

空头信号:当牙齿线下穿唇线,同时上颚线低于牙齿线时,做空。

该策略同时设定了止损和止盈条件:

- 止损设置为进入价格的10%

- 止盈设置为进入价格的90%

优势分析

RSI鳄鱼趋势策略具有以下优势:

- 使用鳄鱼线指标判断趋势,能够有效滤除市场噪音,锁定主要趋势

- 结合多周期RSI,避免假突破,提高信号的可靠性

- 设定合理的止损止盈条件,有助于策略的稳定运行

- 策略思路清晰易懂,参数设置简单,容易实盘操作

- 可同时做多做空,兼顾趋势的两个方向,灵活性强

风险分析

RSI鳄鱼趋势策略也存在以下风险:

牙齿线与唇线的交叉可能出现假突破,导致不必要的亏损。可以适当调整周期参数降低假突破概率。

止损设置可能过于激进,无谓止损的概率较大。可以适当放宽止损范围,或添加其他条件作为止损激活的前提条件。

若行情剧烈,止损或无法起到应有的保证金效果。这时则需要人工干预,及时止损。

多空切换频繁时,交易费用压力较大。可以适当放宽进入条件,减少不必要的反复。

优化方向

RSI鳄鱼趋势策略可以从以下几个方面进行优化:

优化鳄鱼线的参数设置,调整周期参数,找到最佳参数组合

优化进入的条件逻辑,比如新增交易量指标等过滤信号

优化止盈止损策略,使其更加顺应行情与保证金水平

增加对突发事件的处理机制,避免异常行情的暴露

增加开仓算法,控制单笔投入资金占比,规避风险

总结

RSI鳄鱼趋势策略整体来说是一种可靠、易操作的趋势跟踪策略。它使用鳄鱼指标判断趋势方向,配合RSI指标设定参考阈值,能有效锁定趋势并设定合理的出场点。同时,策略本身也具备较强的灵活性与扩展性,值得实盘应用与后续优化。

策略源码

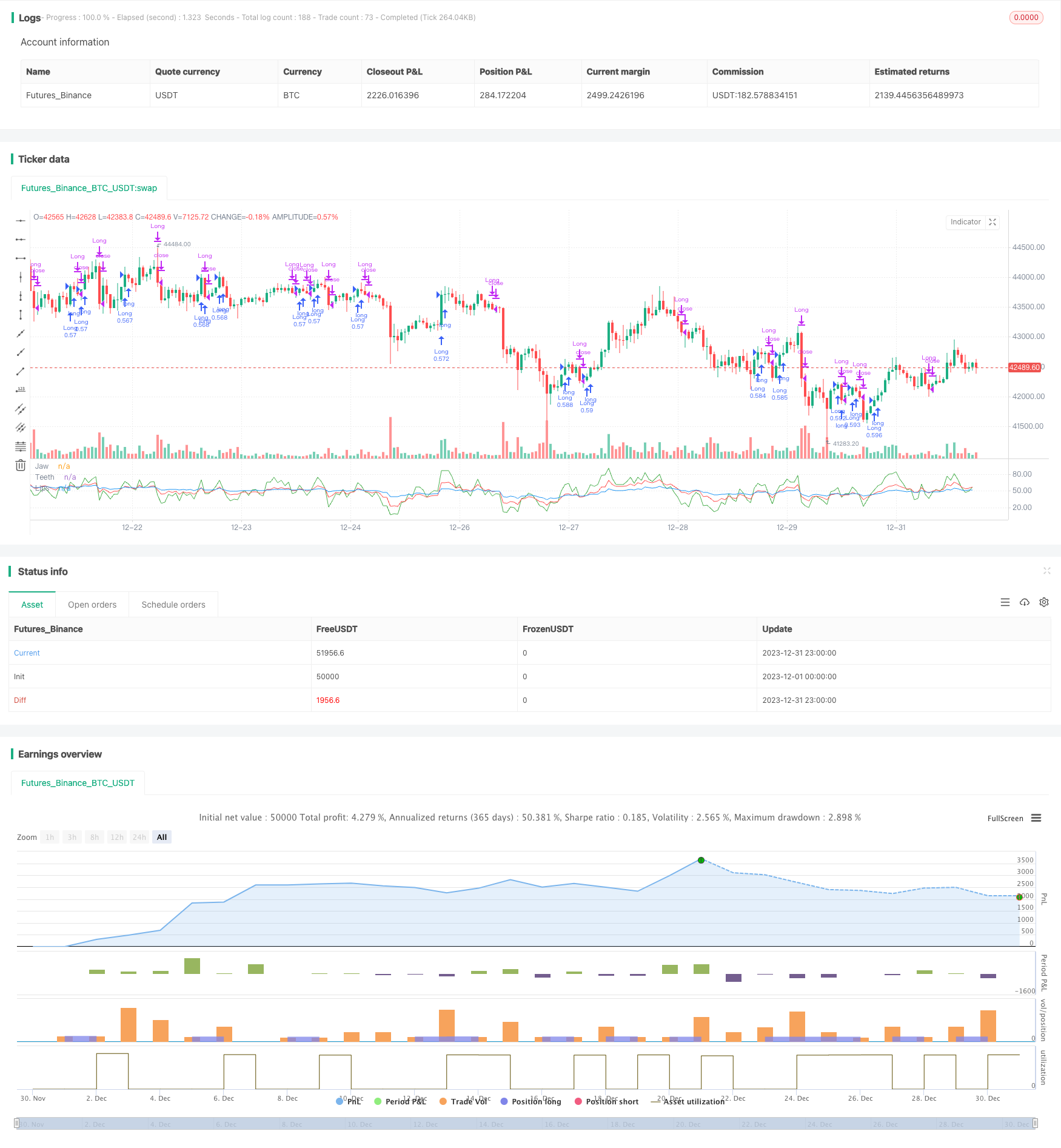

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=3

// RSI Alligator

// Forked from Author: Reza Akhavan

// Updated by Khalid Salomão

strategy("RSI Alligator Strategy", overlay=false, pyramiding=0, default_qty_type=strategy.cash, default_qty_value=25000, initial_capital=25000, commission_type=strategy.commission.percent, commission_value=0.15, slippage=3)

// === TA LOGIC ===

overBought = input(70, minval=0, maxval=100, title="Over bought")

overSold = input(30, minval=0, maxval=100, title="Over sold")

jawPeriods = input(5, minval=1, title="Jaw Periods")

jawOffset = input(0, minval=0, title="Jaw Offset")

teethPeriods = input(13, minval=1, title="Teeth Periods")

teethOffset = input(0, minval=0, title="Teeth Offset")

lipsPeriods = input(34, minval=1, title="Lips Periods")

lipsOffset = input(0, minval=0, title="Lips Offset")

jaws = rsi(close, jawPeriods)

teeth = rsi(close, teethPeriods)

lips = rsi(close, lipsPeriods)

plot(jaws, color=green, offset=jawOffset, title="Jaw")

plot(teeth, color=red, offset=teethOffset, title="Teeth")

plot(lips, color=blue, offset=lipsOffset, title="Lips")

//

// === Signal logic ===

//

LONG_SIGNAL_BOOLEAN = crossover(teeth, lips) and jaws > teeth

SHORT_SIGNAL_BOOLEAN = crossunder(teeth, lips) and jaws < teeth

// === INPUT BACKTEST DATE RANGE ===

strategyType = input(defval="Long Only", options=["Long & Short", "Long Only", "Short Only"])

FromMonth = input(defval = 7, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2020, title = "To Year", minval = 2017)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => true

// === STRATEGY BUY / SELL ENTRIES ===

// TODO: update the placeholder LONG_SIGNAL_BOOLEAN and SHORT_SIGNAL_BOOLEAN to signal

// long and short entries

buy() => window() and LONG_SIGNAL_BOOLEAN

sell() => window() and SHORT_SIGNAL_BOOLEAN

if buy()

if (strategyType == "Short Only")

strategy.close("Short")

else

strategy.entry("Long", strategy.long, comment="Long")

if sell()

if (strategyType == "Long Only")

strategy.close("Long")

else

strategy.entry("Short", strategy.short, comment="Short")

// === BACKTESTING: EXIT strategy ===

sl_inp = input(10, title='Stop Loss %', type=float)/100

tp_inp = input(90, title='Take Profit %', type=float)/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

strategy.exit("Stop Loss/Profit", "Long", stop=stop_level, limit=take_level)