概述

双均线金叉死叉算法交易策略(Dual Moving Average Crossover Strategy)是一个利用均线金叉和死叉来判断入场和退出的量化交易策略。该策略同时结合不同周期的均线,形成多层过滤,可以有效降低假信号,提高交易信号的可靠性。

策略原理

该策略的核心逻辑是跟踪3个时间周期(180分钟,60分钟,120分钟)的2条移动平均线(10日线和200日线)。当快线从下方向上穿过慢线时,产生金叉信号,代表品种进入多头行情;当快线从上方向下穿过慢线时,产生死叉信号,代表品种进入空头行情。

策略首先在180分钟和60分钟周期分别计算10日线和200日线。当180分钟的10日线从下方向上穿过200日线时,产生金叉信号;当从上方向下穿过时,产生死叉信号。这相当于快速周期的交易信号。

然后,策略引入120分钟周期的200日线作为控制线。只有当金叉或死叉发生时,通过判断60分钟周期的200日线是否高于或低于120分钟周期的200日线,来决定是否启动交易,以滤除部分假信号。

举例来说,当180分钟产生金叉时,如果60分钟的200日线高于120分钟的200日线,则看多;只有在这个条件下,才会开多单。相反,如果60分钟的200日线低于120分钟的200日线,则不看多,也不会开仓。

总之,该策略通过比较不同时间周期均线的关系,形成多层过滤,从而提高信号的可靠性,属于常见的过滤型交易策略。

策略优势

多周期确认,提高信号准确率。相比单一周期判断,该策略采用180分钟、60分钟和120分钟三个周期的均线关系进行確認,可以大大减少假信号,提高交易信号质量。

操作频率适中。相比高频交易策略,该策略的交易频率较低,无需频繁操作,更加适合手动跟单。

实现简单,容易理解。该策略仅采用均线指标,没有复杂逻辑,非常容易理解实现,门槛低,适合初学者练手。

可根据不同周期和参数进行优化。该策略中的均线周期和类型都可以进行调整,可以研究出适合不同品种和市场环境的参数组合。

策略风险

均线系统滞后,无法及时捕捉快速反转。该策略主要依赖均线关系,对价格变化的响应有一定滞后性,容易错过快速的反转行情。

大幅震荡市场中容易止损。当市场出现大幅震荡时,均线关系可能频繁交叉,导致频繁开仓和止损。这会增加交易成本和亏损风险。

过于依赖参数优化,容易过拟合。该策略主要通过参数优化获得Alpha,这种依赖单一数据集的结果可能导致过度优化和过拟合问题。

对应风险的解决方案如下:

适当缩短均线参数,加快反应速度。

增加过滤条件,避免在震荡市场高频开仓。

测试不同品种和时间段的数据,评估参数稳健性。

策略优化方向

该策略仍然有进一步优化的空间:

尝试 unterschiedlich 周期组合和均线参数,寻找更优参数。可以通过穷举优化和机器学习方法寻找更佳的参数组合。

增加 Volume 和大级别趋势指标的确认。这可以进一步过滤假信号,例如在Volume放量不足时不开仓。

结合深度学习模型预测曲线形态。利用RNN等深度学习模型对未来价格进行预测,辅助决策。

采用自适应均线,改进过滤逻辑。当市场进入震荡状态时,动态调整均线长度,降低开仓频率。

总结

双均线金叉死叉算法交易策略通过比较不同时间周期的均线关系,建立多层过滤,可以有效提高交易信号质量,是一种较为常见的过滤型算法交易策略。该策略容易实现,适合初学者学习,也可以进行多维度扩展与优化,值得深入研究与应用。

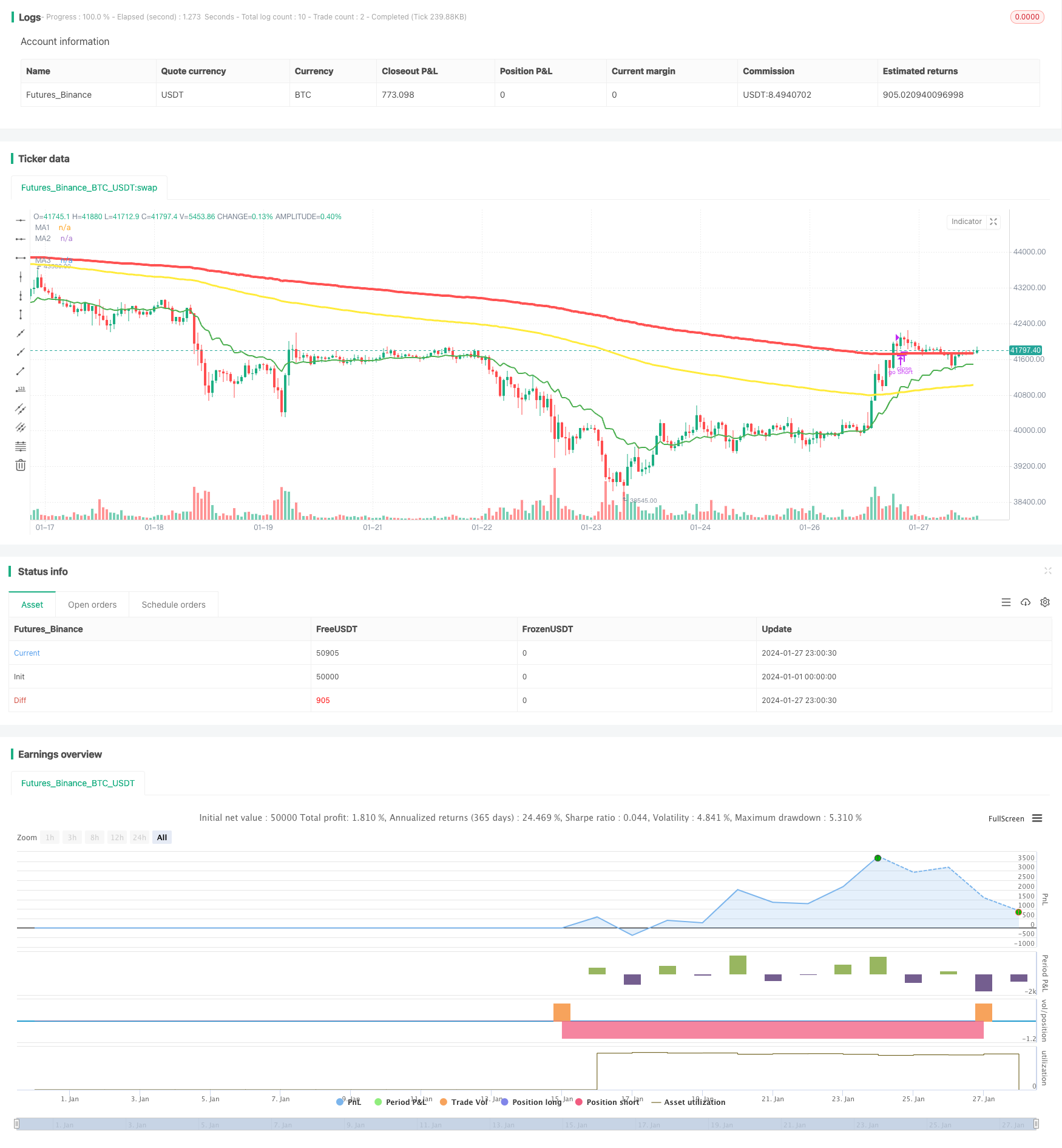

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(shorttitle = "ALGO 3-1-2", title="ALGO 3h, 1h, 2h", overlay=true)

bool startLONGBOTandDEAL = false

bool stopLONGBOTandDEAL = false

bool openLONG = false

bool closeLONG = false

bool startSHORTBOTandDEAL = false

bool stopSHORTBOTandDEAL = false

bool openSHORT = false

bool closeSHORT = false

MA1Period = ema(close, 10)

MA2Period = ema(close, 200)

MA3Period = ema(close, 200)

MA1 = security(syminfo.tickerid, "180", MA1Period)

MA2 = security(syminfo.tickerid, "60", MA2Period)

MA3 = security(syminfo.tickerid, "120", MA3Period)

MA12Crossover = crossover(MA1, MA2)

MA12Crossunder = crossunder(MA1, MA2)

MA23Crossover = crossover(MA2, MA3)

MA23Crossunder = crossunder(MA2, MA3)

if MA23Crossover

startLONGBOTandDEAL := true //stop shortBOT and DEAL code in the TV alert as well, probably stop first w/ a delay on startlong

lblBull = label.new(bar_index, na, ' BULL Time Open LONG', color=color.blue, textcolor=color.black, style=label.style_label_up, size=size.small)

label.set_y(lblBull, MA2)

strategy.close("go Short")

strategy.entry("go Long", strategy.long, comment="go Long")

if MA23Crossunder

//not sure if i should set alert for stop and start each bot, or just put start appropriate bot and stop its opposite in the same alert.

startSHORTBOTandDEAL := true

lblBull = label.new(bar_index, na, ' BEAR Time - Open SHORT', color=color.orange, textcolor=color.black, style=label.style_label_down, size=size.small)

label.set_y(lblBull, MA2)

strategy.close("go Long")

strategy.entry("go Short", strategy.short, comment="go Short")

if MA12Crossover

if MA2 >= MA3

openLONG := true

lup1 = label.new(bar_index, na, ' OPEN LONG ', color=color.green, textcolor=color.white, style=label.style_label_up, size=size.small, yloc=yloc.belowbar)

strategy.entry("go Long", strategy.long, comment="go Long")

if MA2 <= MA3

closeSHORT := true

lup1 = label.new(bar_index, na, ' CLOSE SHORT ', color=color.gray, textcolor=color.black, style=label.style_label_up, size=size.small, yloc=yloc.belowbar)

strategy.close("go Short")

if MA12Crossunder

if MA2 >= MA3

closeLONG := true

lun1 = label.new(bar_index, na, ' CLOSE LONG ', color=color.red, textcolor=color.white, style=label.style_label_down, size=size.small, yloc=yloc.abovebar)

strategy.close("go Long")

if MA2 <= MA3

openSHORT := true

lun1 = label.new(bar_index, na, ' OPEN SHORT ', color=color.red, textcolor=color.white, style=label.style_label_down, size=size.small, yloc=yloc.abovebar)

strategy.entry("go Short", strategy.short, comment="go Short")

plot(MA1, color=color.green, linewidth=2, title="MA1")

plot(MA2, color=color.yellow, linewidth=3, title="MA2")

plot(MA3, color=color.red, linewidth=4, title="MA3")

alertcondition(startLONGBOTandDEAL, title="Start LONG BOT and DEAL", message="Start Long Bot and Deal")

alertcondition(stopLONGBOTandDEAL, title="Stop LONG BOT and DEAL", message="Stop Long Bot and Deal")

alertcondition(openLONG, title="Open LONG DEAL", message="Open Long Deal")

alertcondition(closeLONG, title="Close LONG DEAL", message="Close Long Deal")

alertcondition(stopSHORTBOTandDEAL, title="Stop SHORT BOT and DEAL", message="Stop Short Bot and Deal")

alertcondition(openSHORT, title="Open SHORT DEAL", message="Open Short Deal")

alertcondition(closeSHORT, title="Close SHORT DEAL", message="Close Short Deal")