概述

该策略采用动态 trailing stop 的思路,根据ATR和价格极值来计算长短仓止损线。结合Chandelier Exit的思想,根据止损线朝向判断长短仓方向。当止损线向上突破时判断为看涨,做多;当止损线向下突破时判断为看跌,做空。

该策略同时具有止损和入场信号判断的双重功能。

策略原理

该策略主要由以下几部分组成:

基于ATR计算长短仓止损线

基于用户设定的ATR周期length和倍数mult,实时计算ATR。然后根据ATR与价格极值计算长短仓止损线:

longStop = 最高价 - ATR shortStop = 最低价 + ATR利用突破判断交易方向

比较前一根K线的止损线和当前K线的止损线。如果当前K线的止损线发生突破,则发出交易信号:

长仓止损线上方突破,做多 短仓止损线下方突破,做空根据风险回报比设置止损和止盈

根据用户设定的风险回报比riskRewardRatio,从ATR计算出止损距离和止盈距离。 并在开仓时设置止损单和止盈单。

优势分析

该策略具有以下优势:

动态追踪止损,及时止损

该策略采用动态追踪止损线,能够及时止损和控制下跌风险。

同时具备止损和入场判断功能

该策略止损线同时作为入场判断条件,简化了策略逻辑。

可设定风险回报比

根据设定的风险回报比,适当追求更大利润。

容易理解、扩展

该策略结构简单,容易理解和优化扩展。

风险分析

该策略也存在一些风险:

双边风险

该策略是双边交易策略,同时承担做多和做空的风险。

ATR参数依赖

ATR参数设置会直接影响止损线和交易频率,设置不当可能导致止损过于宽松或交易频率过高。

趋势市场适应性

该策略更适合盘整均线后突破的情况,不适合趋势性太强的场景。

针对以上风险,可以从以下方面进行优化:

结合趋势指标

结合MA等趋势指标,判断市场趋势,避免逆势交易。

优化参数组合

优化ATR参数以及风险回报比参数,使止损和止盈更合理。

增加过滤条件

增加交易量或波动性指标的过滤条件,确保交易质量。

优化方向

该策略还有进一步优化的空间:

结合机器学习

利用机器学习模型预测价格趋势判断,提高入场准确性。

利用 Options构建无风险组合

利用期权对冲品种的价格波动率,构建无风险套利组合。

多品种跨市场套利

在不同市场、不同品种之间进行统计套利,获得稳定的Alpha。

算法交易

通过算法交易引擎进行高效的策略回测和实盘交易。

总结

本文深入分析了一种基于动态追踪止损的量化交易策略。该策略同时具有止损管理和交易信号判断功能,能够有效控制风险。我们还分析了策略的优势、可能存在的风险以及后续的优化思路。该策略是一个非常实用的交易策略,值得进一步研究与应用。

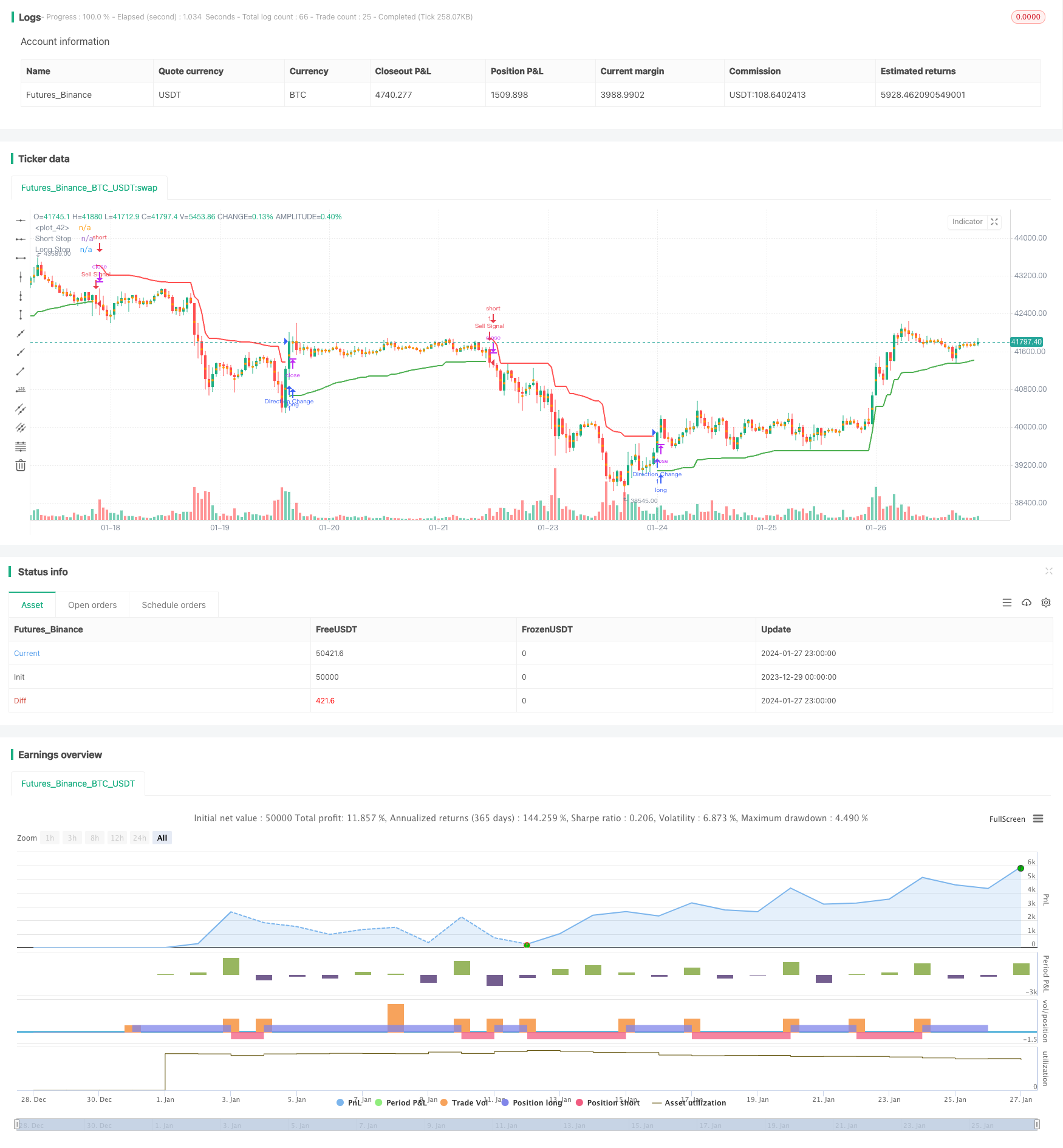

/*backtest

start: 2023-12-29 00:00:00

end: 2024-01-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Chandelier Exit with 1-to-1 Risk-Reward", shorttitle='CE', overlay=true)

// Chandelier Exit Logic

length = input.int(title='ATR Period', defval=22)

mult = input.float(title='ATR Multiplier', step=0.1, defval=3.0)

useClose = input.bool(title='Use Close Price for Extremums', defval=true)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

// Risk-Reward Ratio

riskRewardRatio = input.int(1, title="Risk-Reward Ratio", minval=1, maxval=10, step=1)

// Calculate Take Profit and Stop Loss Levels

takeProfitLevel = atr * riskRewardRatio

stopLossLevel = atr

// Entry Conditions

longCondition = dir == 1 and dir[1] == -1

shortCondition = dir == -1 and dir[1] == 1

// Entry Signals

if (longCondition)

strategy.entry("Long", strategy.long, stop=close - stopLossLevel, limit=close + takeProfitLevel)

if (shortCondition)

strategy.entry("Short", strategy.short, stop=close + stopLossLevel, limit=close - takeProfitLevel)

longStopPlot = plot(dir == 1 ? longStop : na, title='Long Stop', style=plot.style_linebr, linewidth=2, color=color.green)

shortStopPlot = plot(dir == 1 ? na : shortStop, title='Short Stop', style=plot.style_linebr, linewidth=2, color=color.red)

midPricePlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none, editable=false)

fill(midPricePlot, longStopPlot, color=color.new(color.green, 90), title='Long State Filling')

fill(midPricePlot, shortStopPlot, color=color.new(color.red, 90), title='Short State Filling')

// Alerts

if (dir != dir[1])

strategy.entry("Direction Change", strategy.long, comment="Chandelier Exit has changed direction!")

if (longCondition)

strategy.entry("Buy Signal", strategy.long, comment="Chandelier Exit Buy!")

if (shortCondition)

strategy.entry("Sell Signal", strategy.short, comment="Chandelier Exit Sell!")