概述

本策略是一个基于EMA指标的跨周期交易策略。它使用两个不同周期的EMA作为买卖信号,在短周期EMA上穿长周期EMA时做多,在短周期EMA下穿长周期EMA时做空,属于趋势跟踪策略。该策略同时设定了止损位和止盈位来控制风险。

策略原理

该策略使用EMA指标的金叉死叉作为交易信号。具体来说,分别计算短期EMA和长期EMA,当短期EMA上穿长期EMA时生成买入信号做多;当短期EMA下穿长期EMA时生成卖出信号做空。这样通过EMA的移动趋势决定买卖方向。

进入仓位后,策略同时设置了止损位和止盈位。止损位是入场价格的一定百分比作为止损线,如果价格触碰止损线则平仓止损;止盈位是入场价格的一定百分比作为止盈线,如果价格触碰止盈线则平仓止盈。

该策略还允许选择只做多或只做空,以及选择日内交易还是持仓交易。对于日内交易,在美股收盘前会强制平仓。

优势分析

该策略具有以下优势:

使用EMA指标过滤曲线,避免被高频波动误导,能顺势而为地捕捉中长线趋势。

采用短周期EMA和长周期EMA的交叉作为交易信号,避免频繁交易。

设置止损止盈来控制每个订单的风险收益比,有利于资金管理。

可以选择只做多或只做空,以及日内交易或持仓交易,适应不同类型交易者。

兼容多种交易品种,包括股票、外汇、数字货币等。

风险分析

该策略也存在一些潜在风险:

EMA指标有滞后性,可能错过短期趋势转折点。

长短周期EMA选择不当可能导致交易信号错乱。

持仓时间过长可能承受更大的行情震荡。

机械地止损止盈可能过早离场或减少盈利。

对应风险管理措施有:

优化EMA参数,找到最佳周期组合。

加入其他指标作为辅助判断。

动态调整止损止盈位。

人工干预异常行情。

优化方向

该策略可从以下几个方向进行优化:

最佳化EMA参数,找到不同品种合适的长短周期组合。

增加其他指标判断,如MACD、KD等,实现多指标共振。

增加机器学习模型训练,产生动态止损止盈。

接入更先进的RISK指标进行特征工程。

增加自适应交易元件,实现参数自优化。

总结

本策略整体是一个优秀的趋势跟踪策略模板,核心优势在于使用EMA指标过滤噪声实现稳定盈利,同时具备完善的风险收益管理。通过不断优化,该策略可以成为跨市场通用的量化策略,值得交易者学习和实践。

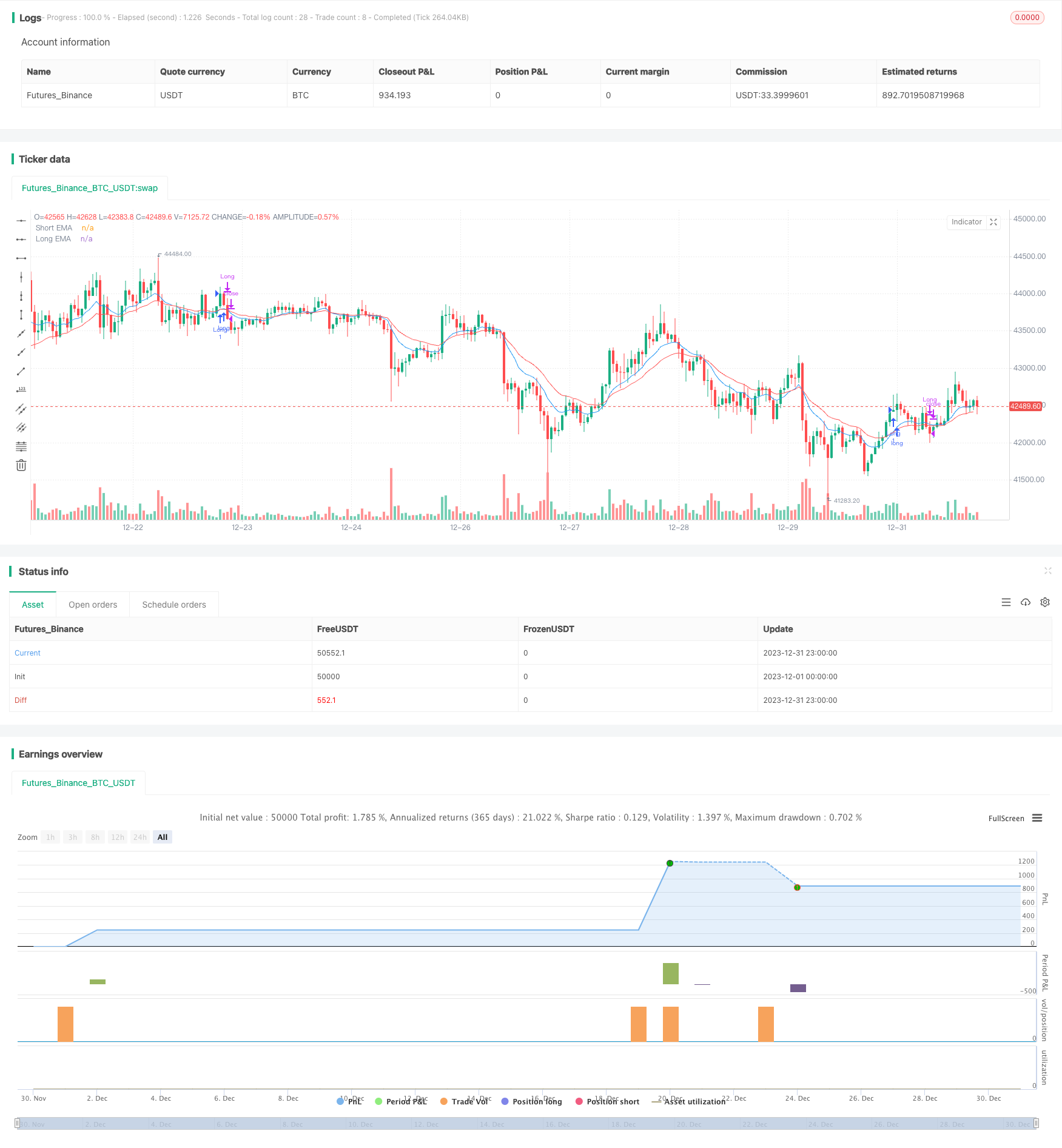

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover Strategy by Vikrant Singh", overlay=true)

// Input for EMA Lengths

var bool runningPOS = false

var float stopLossLevel = na

var float targetLevel = na

shortLength = input(11, title="Short EMA Length")

longLength = input(21, title="Long EMA Length")

// Input for Stop-Loss and Target

stopLossPct = input(1, title="Stop-Loss (%)")

targetPct = input(3, title="Target (%)")

longOnly = input(true, title="Long Only")

intraDay = input(true, title="intraday?")

// Calculate EMAs

emaShort = ta.ema(close, shortLength)

emaLong = ta.ema(close, longLength)

// Calculate crossover conditions

crossoverCondition = ta.crossover(emaShort, emaLong)

crossunderCondition = ta.crossunder(emaShort, emaLong)

// Entry condition (long position just before crossover)

if crossoverCondition and not runningPOS and longOnly and (hour <= 15)

strategy.entry("Long", strategy.long)

runningPOS := true

stopLossLevel := close * (1 - stopLossPct / 100)

targetLevel := close * (1 + targetPct / 100)

//Entry condition (short position just before crossover)

if crossunderCondition and not runningPOS and not longOnly and (hour <= 15)

strategy.entry("Short", strategy.short)

runningPOS := true

stopLossLevel := close * (1 + stopLossPct / 100)

targetLevel := close * (1 - targetPct / 100)

// Exit conditions (square off on reverse crossover)

//Exit long

if (crossunderCondition or (low < stopLossLevel) or (high > targetLevel) ) and longOnly and runningPOS

strategy.close("Long",comment = "Exit long")// ("Long", from_entry="Long",stop=stopLossLevel, limit=targetLevel)

runningPOS := false

//Exit short

if (crossoverCondition or (high > stopLossLevel) or (low < targetLevel) ) and not longOnly and runningPOS

strategy.close("Short", comment = "Exit Short")

runningPOS := false

if intraDay and runningPOS

if (hour >= 15)

strategy.close_all(comment = "Intraday square off")

//strategy.close("Long",comment = "intraday square off")

runningPOS := false

// Plot EMAs

plot(emaShort, color=color.blue, title="Short EMA")

plot(emaLong, color=color.red, title="Long EMA")