概述

该策略融合了动量指标和趋势跟踪,目的是识别股价中期的强势上涨或下跌趋势,并在趋势开始阶段就进入场内。策略首先计算价格的20日动量指标,然后进行标准化处理得到0到1区间的标准化动量值。同时计算20日简单移动均线作为中期趋势的代表。当标准化动量大于0.5并且股价高于中期趋势时,做多;当标准化动量小于0.5并且股价低于中期趋势时,做空。

策略原理

该策略的核心指标是价格的20日动量差值。动量差值定义为:(今日收盘价 - 20日前收盘价)/ 20日前收盘价。该指标反映了价格20天内的涨跌幅度。为了规避不同股票价差悬殊的问题,这里对动量差值进行了标准化处理,方法是:先找出最近100天中的最高和最低动量差值,再计算当前动量差值在这个极差内的比例,得到0到1的标准化动量值。标准化处理可以更好地反映出价格的涨跌力度。

此外,策略还引入20日简单移动均线来判断中期趋势的方向。移动平均线是视觉直观的趋势判断工具。当价格于移动平均线之上时,视为处于上涨趋势;价格低于移动平均线时,属于下跌趋势。

综合标准化动量指标和中期趋势判断,该策略拟捕捉股票中期明显的涨跌阶段。具体逻辑是:如果标准化动量大于0.5,说明股价近期正在加速上涨;同时价格高于20日移动平均线,代表中期依然是上涨趋势,这时做多;相反,如果标准化动量小于0.5,价格正在加速下跌;同时价格也低于20日均线,中期也处于下跌趋势,这时做空。

以上就是策略判断的基本逻辑。对于入场点,策略在动量和趋势同向时直接入场。对于止损,设置了一个固定的最小止损点,即买入最高价+最小价格变动单位,卖出最低价-最小价格变动单位,防止无效浮亏。

优势分析

该策略最大的优势在于同时利用两个指标进行判断,可以有效过滤掉一些误入场的情况。仅仅依靠动量指标容易产生假信号,而加入中期趋势指标则可以验证动量信号的有效性,避免在震荡行情中被套。同样,单纯跟踪趋势指标也会漏掉趋势中的部分机会,加入动量指标则可以识别趋势开始加速的时机。所以,两个指标的配合使用可以使策略更加稳健。

另一个优势是,策略选择20日周期进行计算。这种中期参数设定,可以减少高频交易的次数,有利于抓取中长线的价差机会。同时也可以过滤掉短期市场噪音的影响。

风险分析

该策略的主要风险在于动量和趋势可能会发生背离。当趋势和动量不一致时,会造成错误信号。例如,股价处于下跌趋势,但短期内发生反弹拉升,可能导致动量指标产生误导信号。这时如果直接做多就可能遭遇亏损。

此外,策略的止损设置也较为简单,无法完全规避风险。如果行情出现大幅跳空,固定点数的止损可能会被直接突破,应对不足。

优化方向

该策略有以下几个主要的优化方向:

加入更多指标进行综合判断。例如MACD,KD,布林带等。这可以检验动量信号的有效性,避免出现误导信号。

动态调整止损位置。可以根据ATR指标实时设置浮动止损,或者利用期权定价理论计算合理的止损线。这可以减少止损被套的概率。

优化参数周期。当前策略采用20日周期计算指标。可以测试更多的参数组合,找到最佳周期参数。

区分买入卖出动量差值的判断标准。当前是使用同一个0.5的标准。可以分别测试买入和卖出的最佳参数。

加入交易量过滤。例如只在成交量放大的情况下发出信号。这可以避免一些量能不足的假突破。

总结

本策略综合运用趋势分析和动量指标,在中长线捕捉价格动量变化带来的交易机会。相比单一指标,多指标组合可以提高判断的准确性和盈利空间。止损规则简单直接,可以快速止损控制风险。如果进一步优化指标参数设定、止损方式、和加入更多辅助判断条件,可以使策略更加灵活和适应不同市况。总的来说,这是一个非常有前景和拓展空间的量化策略思路。

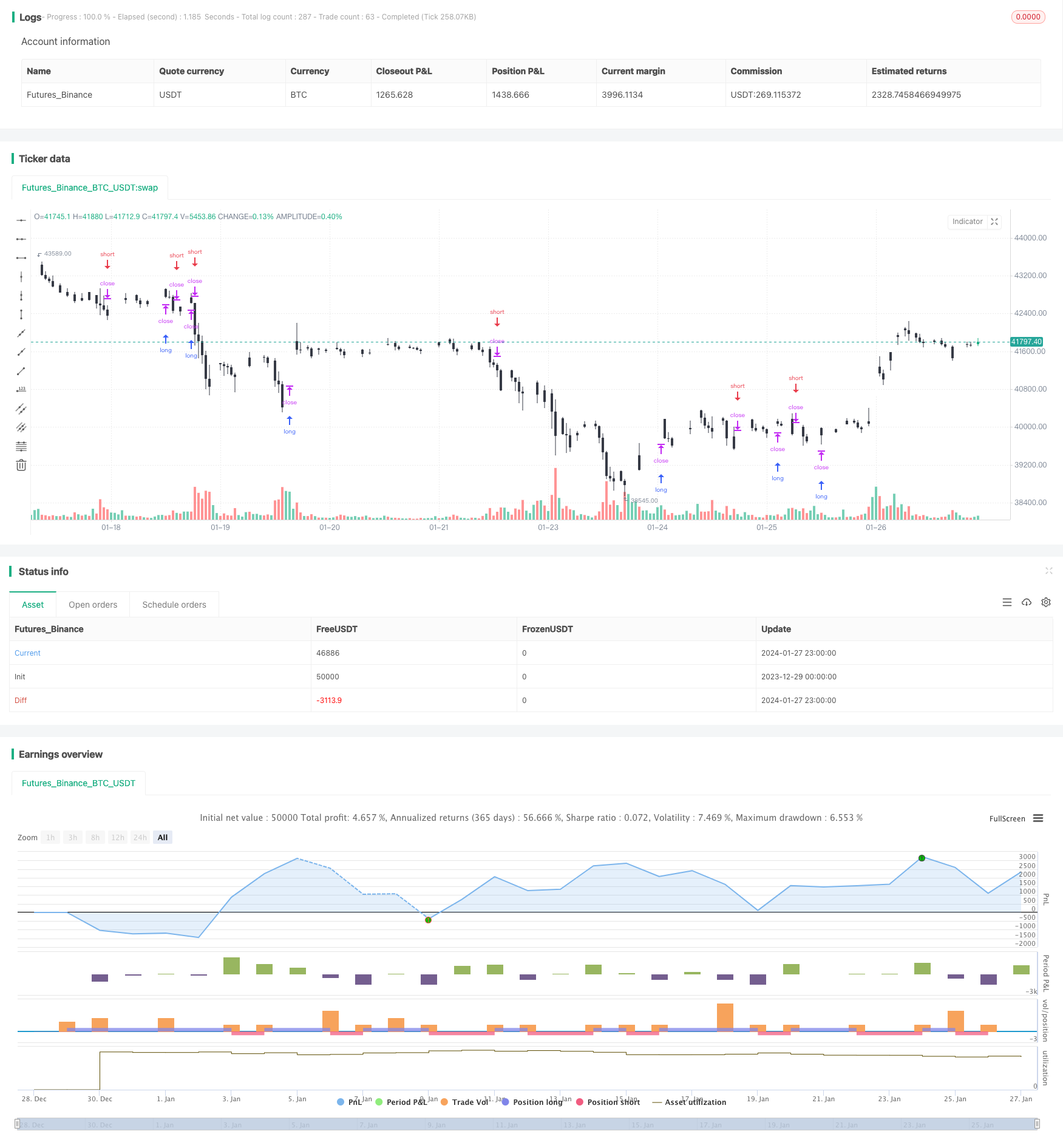

/*backtest

start: 2023-12-29 00:00:00

end: 2024-01-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Momentum Strategy, rev.2", overlay=true)

//

// Data

//

src = input(close)

lookback = input(20)

cscheme=input(1, title="Bar color scheme", options=[1,2])

//

// Functions

//

momentum(ts, p) => (ts - ts[p]) / ts[p]

normalize(src, len) =>

hi = highest(src, len)

lo = lowest(src, len)

res = (src - lo)/(hi - lo)

//

// Main

//

price = close

mid = sma(src, lookback)

mom = normalize(momentum(price, lookback),100)

//

// Bar Colors

//

clr1 = cscheme==1?black: red

clr2 = cscheme==1?white: green

barcolor(close < open ? clr1 : clr2)

//

// Strategy

//

if (mom > .5 and price > mid )

strategy.entry("MomLE", strategy.long, stop=high+syminfo.mintick, comment="MomLE")

else

strategy.cancel("MomLE")

if (mom < .5 and price < mid )

strategy.entry("MomSE", strategy.short, stop=low-syminfo.mintick, comment="MomSE")

else

strategy.cancel("MomSE")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)