概述

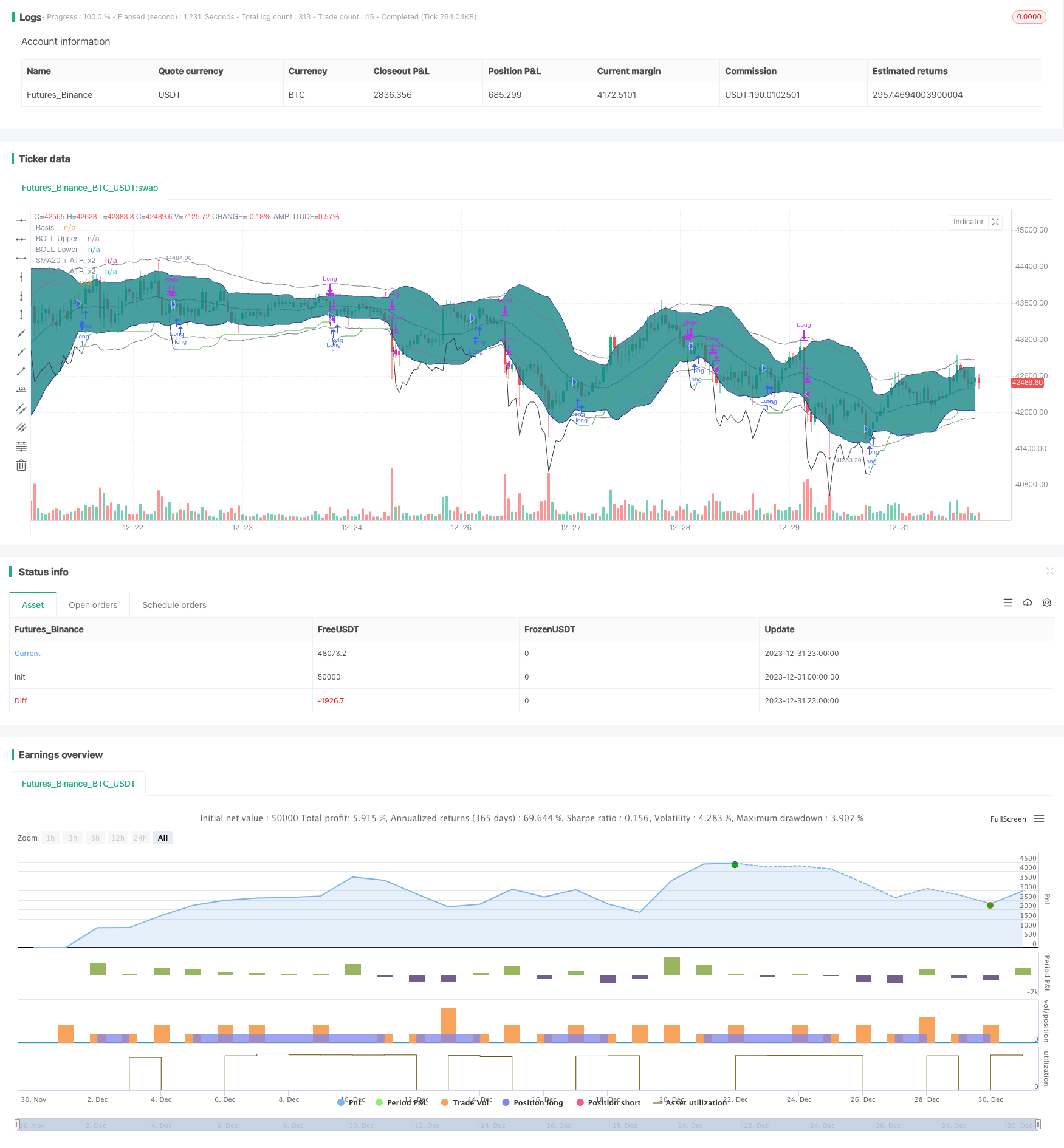

该策略将布林带和相对强弱指标(RSI)组合使用,识别出布林带收缩期配合RSI上升的机会,采取趋势跟踪止损以控制风险。

策略原理

本策略的交易逻辑核心在于识别布林带的收缩,并在RSI呈上升态势时判断趋势处于上涨初期。具体来说,当20日布林带中轨上的标准差小于ATR*2时,我们判定布林带发生收缩;同时,若10日和14日的RSI都呈上升趋势,那么我们预测价格即将突破布林带上轨,采取做多策略。

进入场内后,我们采用ATR安全距离+随价格上涨的止损方式来锁定利润并控制风险。当价格超过止损线或RSI过热(14日RSI超过70,10日RSI超过14日RSI)时平仓。

优势分析

本策略最大优势在于利用布林带收缩来判断行情整理期,结合RSI指标预测价格的突破方向。此外,采用适应性止损而不是固定止损,可以根据市场波动程度来灵活调整,从而在保证风险可控的前提下获得更大收益。

风险分析

本策略的主要风险在于识别布林带收缩和RSI上升时,行情可能是假突破。此外,在止损方面,波动过大时适应性止损可能无法及时止损。可以通过改进止损方式(例如曲线止损)来降低此风险。

优化方向

本策略可以从以下几个方面进行优化:

改进布林带参数设置,优化判断收缩效果

尝试不同的RSI周期参数

测试其他止损方式(曲线止损、回看止损等)的效果

根据不同品种特性调整参数

总结

本策略综合利用布林带和RSI的互补性,在控制风险的前提下获得较好回撤收益比。后续可从止损方式、参数选择等方面进行优化,使策略更适用于不同交易品种。

策略源码

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DojiEmoji

//

//@version=4

strategy("[KL] BOLL + RSI Strategy",overlay=true,pyramiding=1)

// Timeframe {

backtest_timeframe_start = input(defval = timestamp("01 Apr 2016 13:30 +0000"), title = "Backtest Start Time", type = input.time)

USE_ENDTIME = input(false,title="Define backtest end-time (If false, will test up to most recent candle)")

backtest_timeframe_end = input(defval = timestamp("01 May 2021 19:30 +0000"), title = "Backtest End Time (if checked above)", type = input.time)

within_timeframe = true

// }

// Bollinger bands (sdv=2, len=20) {

BOLL_length = 20, BOLL_src = close, SMA20 = sma(BOLL_src, BOLL_length), BOLL_sDEV_x2 = 2 * stdev(BOLL_src, BOLL_length)

BOLL_upper = SMA20 + BOLL_sDEV_x2, BOLL_lower = SMA20 - BOLL_sDEV_x2

plot(SMA20, "Basis", color=#872323, offset = 0)

BOLL_p1 = plot(BOLL_upper, "BOLL Upper", color=color.navy, offset = 0, transp=50)

BOLL_p2 = plot(BOLL_lower, "BOLL Lower", color=color.navy, offset = 0, transp=50)

fill(BOLL_p1, BOLL_p2, title = "Background", color=#198787, transp=85)

// }

// Volatility Indicators {

ATR_x2 = atr(BOLL_length) * 2 // multiplier aligns with BOLL

avg_atr = sma(ATR_x2, input(1,title="No. of candles to lookback when determining ATR is decreasing"))

plot(SMA20+ATR_x2, "SMA20 + ATR_x2", color=color.gray, offset = 0, transp=50)

plot(SMA20-ATR_x2, "SMA20 - ATR_x2", color=color.gray, offset = 0, transp=50)

plotchar(ATR_x2, "ATR_x2", "", location = location.bottom)

//}

// Trailing stop loss {

TSL_source = low

var entry_price = float(0), var stop_loss_price = float(0)

trail_profit_line_color = color.green

if strategy.position_size == 0 or not within_timeframe

trail_profit_line_color := color.black

stop_loss_price := TSL_source - ATR_x2

else if strategy.position_size > 0

stop_loss_price := max(stop_loss_price, TSL_source - ATR_x2)

plot(stop_loss_price, color=trail_profit_line_color)

if strategy.position_size > 0 and stop_loss_price > stop_loss_price[1]

alert("Stop loss limit raised", alert.freq_once_per_bar)

// } end of Trailing stop loss

//Buy setup - Long positions {

is_squeezing = ATR_x2 > BOLL_sDEV_x2

if is_squeezing and within_timeframe and not is_squeezing[1]

alert("BOLL bands are squeezing", alert.freq_once_per_bar)

else if not is_squeezing and within_timeframe and is_squeezing[1]

alert("BOLL bands stopped squeezing", alert.freq_once_per_bar)

ema_trend = ema(close, 20)

concat(a, b) =>

concat = a

if a != ""

concat := concat + ", "

concat := concat + b

concat

// }

// Sell setup - Long position {

rsi_10 = rsi(close, 10), rsi_14 = rsi(close, 14)

overbought = rsi_14 > input(70,title="[Exit] RSI(14) value considered as overbought") and rsi_10 > rsi_14

// } end of Sell setup - Long position

// MAIN: {

if within_timeframe

entry_msg = ""

exit_msg = ""

// ENTRY {

conf_count = 0

volat_decr = avg_atr <= avg_atr[1]

rsi_upslope = rsi_10 > rsi_10[1] and rsi_14 > rsi_14[1]

if volat_decr and rsi_upslope and is_squeezing and strategy.position_size == 0

strategy.entry("Long",strategy.long, comment=entry_msg)

entry_price := close

stop_loss_price := TSL_source - ATR_x2

// }

// EXIT {

if strategy.position_size > 0

bExit = false

if close <= entry_price and TSL_source <= stop_loss_price

exit_msg := concat(exit_msg, "stop loss [TSL]")

bExit := true

else if close > entry_price and TSL_source <= stop_loss_price

exit_msg := concat(exit_msg, "take profit [TSL]")

bExit := true

else if overbought

exit_msg := concat(exit_msg, "overbought")

bExit := true

strategy.close("Long", when=bExit, comment=exit_msg)

// }

// }

// CLEAN UP:

if strategy.position_size == 0 and not is_squeezing

entry_price := 0

stop_loss_price := float(0)