概述

移动平均线交叉策略是一种基于两个移动平均线(快速移动平均线和慢速移动平均线)交叉的交易策略。当快速移动平均线向上突破慢速移动平均线时,采取长仓(买入)的操作。反之,当快速移动平均线向下跌破慢速移动平均线时,平掉之前的多头仓位。

策略原理

该策略使用两个移动平均线。一个是短期的快速移动平均线,一个是长期的慢速移动平均线。快速移动平均线能更快地响应价格变化,慢速移动平均线过滤掉短期波动,更能反映长期趋势。当快速移动平均线上穿慢速移动平均线时,表示短期价格开始向上,属于金叉信号,做多;当快速移动平均线下穿慢速移动平均线时,表示短期价格开始向下,属于死叉信号,平仓。

策略优势

- 实现简单,容易理解,参数较少,不易过拟合;

- 移动平均线指标平滑价格,有一定的预测能力,避免被噪声误导;

- 策略回撤较小,最大回撤不会太大;

- 适用于大部分行情,特别是趋势性行情;

策略风险

- 在盘整行情中容易产生错误信号;

- 移动平均线指标具有滞后性,可能错过趋势的最佳入场和出场点;

- 无止损设置,可能造成较大亏损;

- 参数设置不当可能导致策略效果不佳;

可以设置止损来控制风险。选择合适的参数可以提高策略效果。

策略优化

- 测试不同长度的移动平均线组合,找到最优参数;

- 加入其他技术指标进行过滤,提高信号质量;

- 设置动态止损来控制风险;

- 结合波动率指标优化入场和出场;

- 优化资金管理,设置头寸规模;

总结

移动平均线交叉策略总的来说是一种简单实用的趋势跟踪策略。它利用移动平均线的指示作用识别价格趋势的变化。优点是实现简单,容易理解,回撤较小。缺点是可能产生错误信号,具有滞后性。通过参数优化、止损设置以及与其他指标组合使用,可以获得更好的策略效果。

策略源码

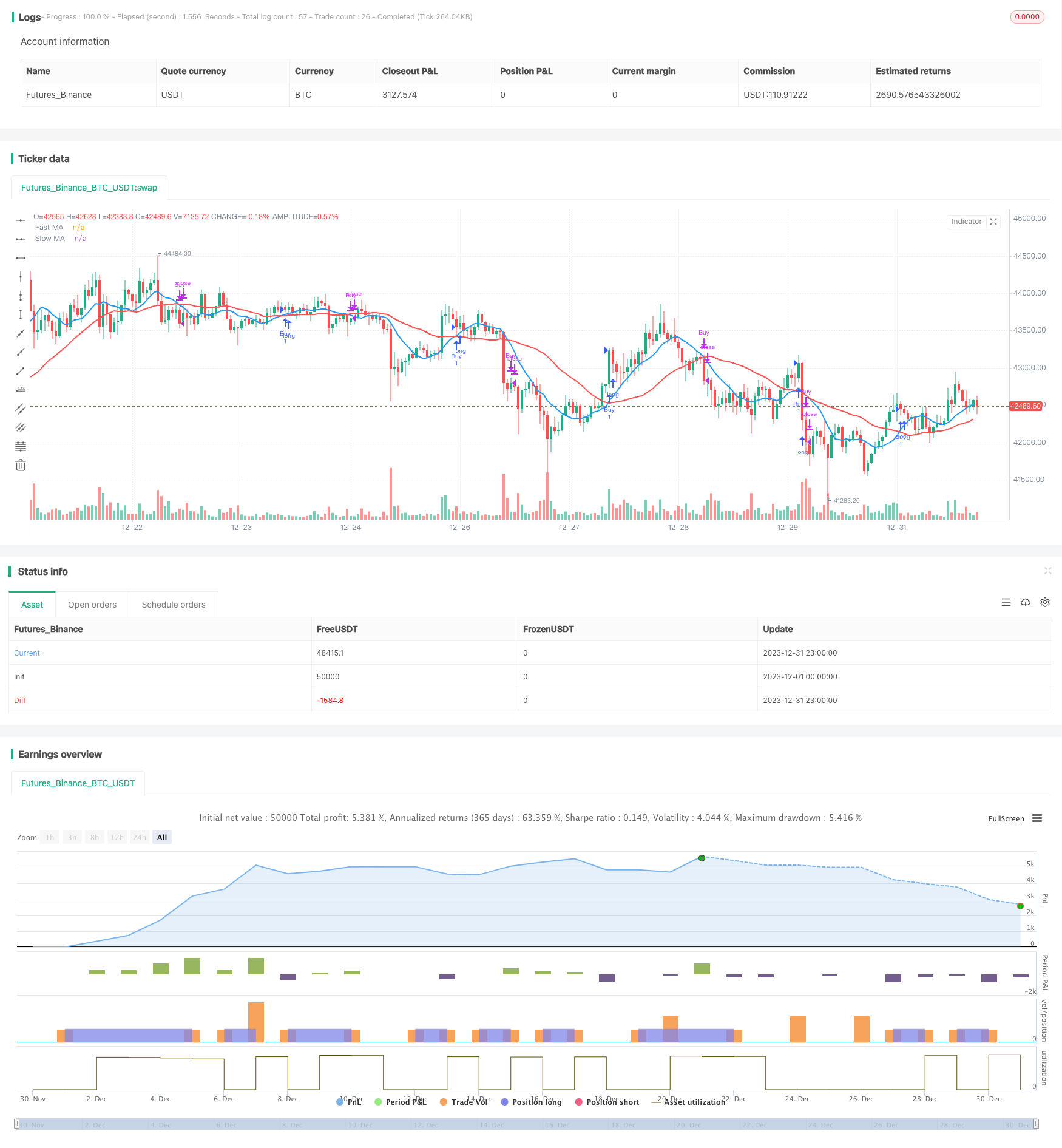

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple Moving Average Crossover", overlay=true)

// Input parameters

fastLength = input(10, title="Fast MA Length")

slowLength = input(30, title="Slow MA Length")

stopLossPercent = input(1, title="Stop Loss Percentage")

// Calculate moving averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Buy condition: Fast MA crosses above Slow MA

buyCondition = ta.crossover(fastMA, slowMA)

// Sell condition: Fast MA crosses below Slow MA

sellCondition = ta.crossunder(fastMA, slowMA)

// Plot moving averages as lines

plot(fastMA, color=color.blue, title="Fast MA", linewidth=2)

plot(slowMA, color=color.red, title="Slow MA", linewidth=2)

// Execute trades based on conditions

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.close("Buy")

// Set stop loss level

stopLossLevel = close * (1 - stopLossPercent / 100)

strategy.exit("Sell", from_entry="Buy", loss=stopLossLevel)