概述

该策略基于智能资金概念,使用日线均量指标识别机构资金的累积与分配,以捕捉市场趋势。当机构资金累积时,策略做多;当机构资金分配时,策略做空。

策略原理

- 均量指标(OBV)

OBV是一种动量指标,它将成交量与价格变化相关联。OBV在价格上涨日累加成交量,在价格下跌日减去成交量。

该策略使用日线OBV。

- 智能资金条件

策略基于OBV的斜率识别两种主要条件:

智能资金买入条件:当OBV斜率为正,表示可能出现机构资金累积。

智能资金卖出条件:当OBV斜率为负,表示可能出现机构资金分配。

- 信号绘图

使用绿色上箭头和红色下箭头代表买入和卖出信号。

- 策略逻辑

当识别到智能资金买入条件时,做多;当识别到智能资金卖出条件时,做空。

- 出场逻辑

当做多时,如果出现智能资金卖出信号,平仓做多单;当做空时,如果出现智能资金买入信号,平仓做空单。

优势分析

使用均量指标识别市场趋势,有效滤除市场噪音。

基于机构资金行为判断市场结构,精准捕捉趋势转折。

策略信号明确,规则简单,容易实施。

可在任何品种和任何时间框架使用。

风险分析

OBV指标可能产生错误信号,导致错过买入/卖出时机。可适当结合其他指标进行验证。

无法预测极端行情的突发事件。可设置止损来控制风险。

机构资金行为难以准确判断,可能导致信号偏差。可适当放宽买入/卖出条件。

优化方向

结合其他指标验证信号可靠性,如K线形态、stoch指标等。

设置动态止损或跟踪止损来控制单笔损失。

测试不同时间框架的参数设置,寻找最优参数组合。

添加机构资金力度指标,判断资金流入/流出的力度,提高信号质量。

总结

SMART专业量化交易策略利用均量指标识别机构资金行为,判断市场结构,精确捕捉趋势转折点。策略信号简单明确,容易实施,可广泛应用于任何品种和时间周期,是一种非常实用的趋势跟踪策略。结合其他指标信号验证和适当风险控制,可提高策略稳定性和profit因子。

策略源码

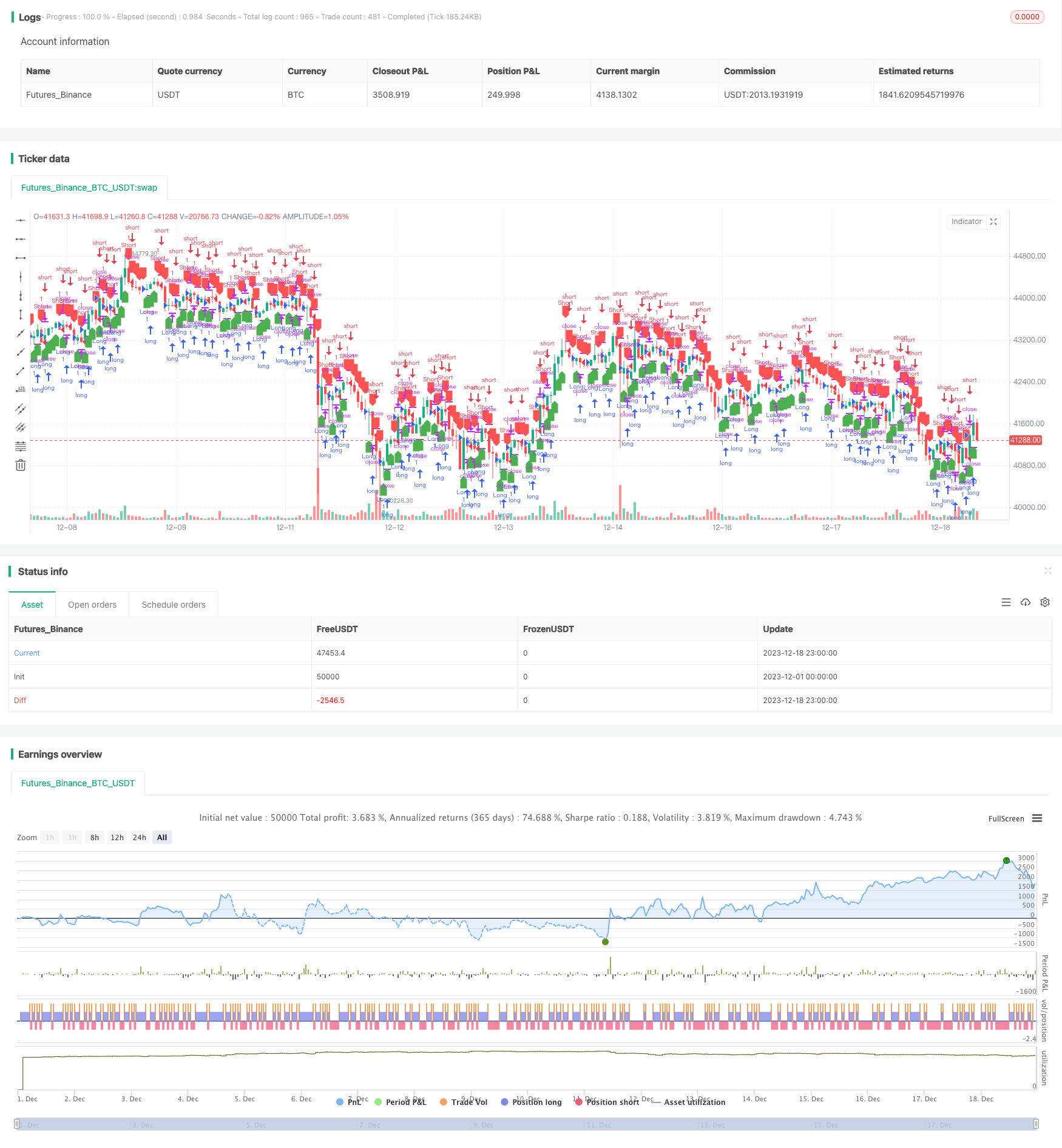

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-18 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Smart Money Concept Strategy", overlay=true)

// Smart Money Concept: On-Balance Volume (OBV)

obv_value = request.security(syminfo.tickerid, "D", close)

obv_slope = obv_value - obv_value[1]

// Define conditions for smart money accumulation/distribution

smart_money_buy_condition = obv_slope > 0

smart_money_sell_condition = obv_slope < 0

// Plot signals

plotshape(series=smart_money_buy_condition, title="Buy Signal", color=color.green, style=shape.labelup, location=location.belowbar)

plotshape(series=smart_money_sell_condition, title="Sell Signal", color=color.red, style=shape.labeldown, location=location.abovebar)

// Strategy Logic

if (smart_money_buy_condition)

strategy.entry("Long", strategy.long)

if (smart_money_sell_condition)

strategy.entry("Short", strategy.short)

// Strategy Exit Logic

strategy.close("ExitLong")

strategy.close("ExitShort")