概述

该策略主要利用renko股票日内低点回撤特征判断新的趋势方向,进而建立stock日内交易策略。当股票renko日内低点有明显回撤时,判断为新的看涨信号,采取买入操作;当股票renko收盘价有明显下跌时,判断为看跌信号,采取平仓操作。

策略原理

该策略主要判断标准是:股票renko日内低点回撤幅度超过上轨和下轨。其中,上轨计算方法是renko日内低点回撤20日均值+2倍标准差;下轨计算方法是renko日内低点50日最高点的85%。当renko日内低点回撤超过上轨或下轨时,判断为买入信号,否则为空仓。具体流程如下:

- 计算最近22根renko的最高价与最低价差额在最近20日内的标准差DesviaccionTipica

- 计算最近22根renko的最高价与最低价差额在最近20日内的均值Media

- 上轨Rango11 = Media + DesviaccionTipica * 2

- 下轨Rango22 = renko最近50根内最高点 * 0.85

- 当日renko满足low/highest(low,22)>Rango11或Rango22时,做多;当日renko满足close

以上就是该策略的主要判断规则和交易逻辑。

优势分析

- 利用renko具有的滤波假信号的优势,采用renko辅助判断,可以有效过滤震荡市的假信号

- 基于renko日内低点回撤特征判断趋势,避免使用单一均线判断产生的误判率

- 采用双轨判断法则,可以更准确判断趋势方向

- 策略判断规则简洁明了,容易理解实施

- 策略容易Parameter Tunning和优化,可以显著改进策略效果

风险分析

- renko具有的repaint特性可能对实盘交易产生一定影响

- 双轨距离设置不当可能遗漏或误判信号

- 策略使用了单一指标判断,可能会漏掉其他指标提供的重要信号

- 没有止损设置,可能带来更大的亏损

风险解决方法: 1. 适当放宽双轨参数,确保更多信号被捕获 2. 结合更多指标判断,例如均线、能量指标等确保准确判断 3. 加上移动止损来控制风险

优化方向

- Parameter Tunning, 优化双轨参数设置

- 加入更多辅助技术指标判断

- 加入止损机制

- 对交易品种进行扩展,增加更多交易机会

总结

该策略整体思路清晰、易于实现,利用renko股票日内低点回撤判断新的趋势方向。策略优势在于利用renko特性进行滤波,避免误判;采用双轨判断以提高准确率。同时,策略也存在一定改进空间,关键在于参数优化、止损设置以及多指标融合判断。总体而言,该策略为一个易于理解、简单有效的stock日内交易策略。

策略源码

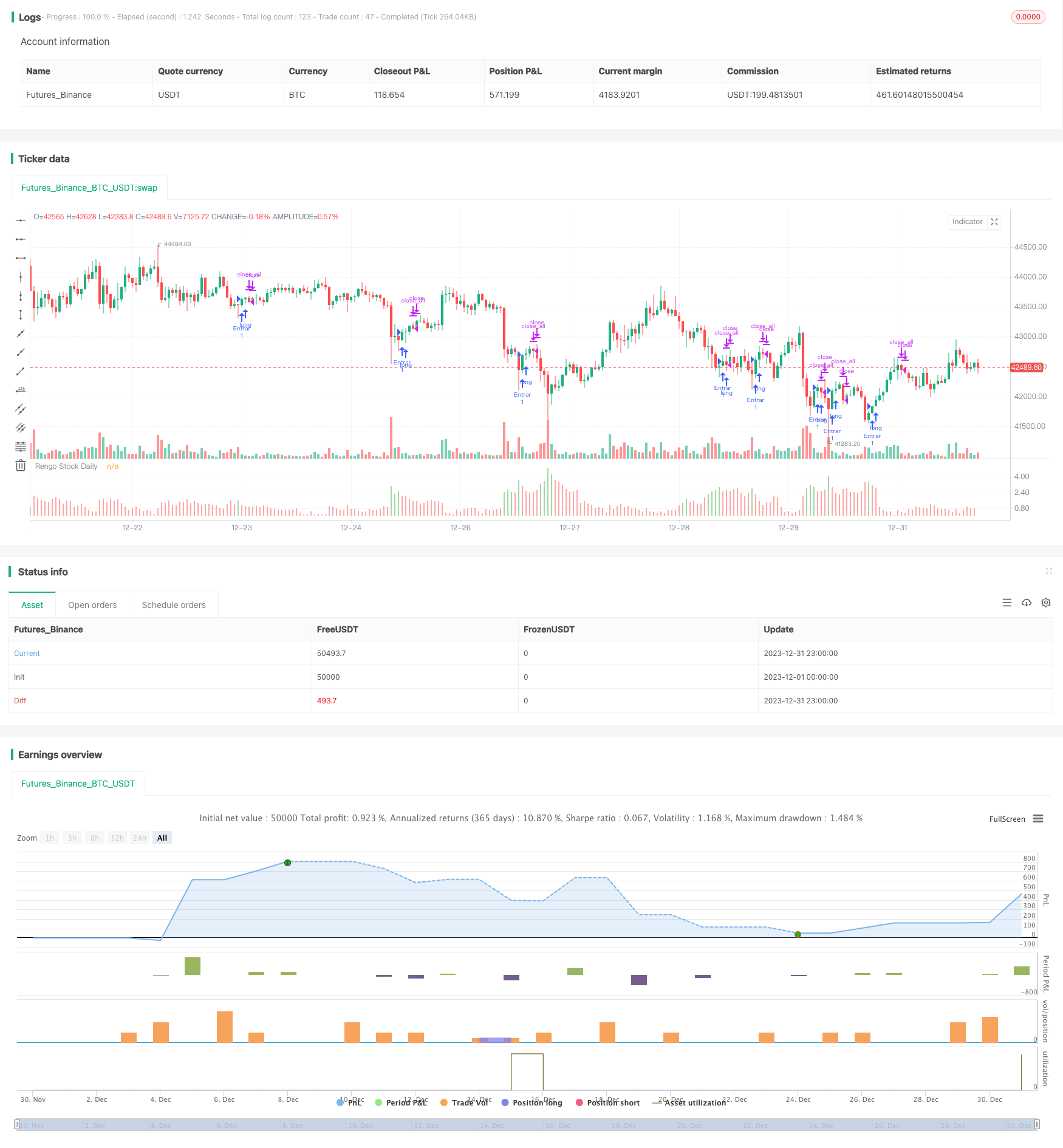

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=2

strategy("Renko Stock Daily")

Rango1 = input(false, title="Rango 1")

Rango2 = input(false, title="Rango 2")

Situacion = ((highest(close, 22)-low)/(highest(close, 22)))*100

DesviaccionTipica = 2 * stdev(Situacion, 20)

Media = sma(Situacion, 20)

Rango11 = Media + DesviaccionTipica

Rango22 = (highest(Situacion, 50)) * 0.85

advertir = Situacion >= Rango11 or Situacion >= Rango22 ? green : red

if (Situacion[1] >= Rango11[1] or Situacion[1] >= Rango22[1]) and (Situacion[0] < Rango11[0] and Situacion[0] < Rango22[0])and (close>open)

strategy.entry("Entrar", strategy.long,comment= "Entrar",when=strategy.position_size <= 0)

strategy.close_all(when=close<open)

plot(Rango1 and Rango22 ? Rango22 : na, title="Rango22", style=line, linewidth=4, color=orange)

plot(Situacion, title="Rengo Stock Daily", style=histogram, linewidth = 4, color=advertir)

plot(Rango2 and Rango11 ? Rango11 : na, title="Upper Band", style=line, linewidth = 3, color=aqua)