概述

该策略是一个基于双移动平均线的交易策略。它会根据用户设定的长短两根移动平均线进行金叉和死叉操作,即快速移动平均线上穿或下穿慢速移动平均线时发出交易信号。当快速MA上穿慢速MA时,做多;当快速MA下穿慢速MA时,做空。

策略原理

该策略的核心逻辑基于双移动平均线的交叉原理。何为移动平均线,是将一定时间周期内的收盘价做算术平均而得到的平均价。移动平均线能够有效地滤除随机性噪音,反映更清晰的价格趋势。

该策略中短期MA代表价格的短期趋势,长期MA代表价格的长期趋势。短期MA比长期MA对价格变化更加敏感,能更快捕捉到价格反转。当短期MA上穿长期MA时,代表短期趋势转为上涨,做多;当短期MA下穿长期MA时,代表短期趋势转为空头,做空。

具体来说,策略通过ta.sma计算指定周期的简单移动平均线,以此作为交易信号。用户可自定义两个MA参数,即长线周期long_period和短线周期short_period。策略使用ta.crossover和ta.crossunder来判断MA的黄金交叉和死叉。当短MA上穿长MA,即金叉出现时,做多;当短MA下穿长MA,即死叉出现时,做空。

策略优势

该策略具有以下几点优势:

- 操作简单,容易掌握。

- 可自定义参数,适应多种市场环境。

- 采用双MA交叉原理,有效过滤噪音,捕捉趋势反转。

- 敏感度高,能及时捕捉价格转折点。

策略风险

该策略也存在一些风险:

- 双MA间距过小易产生错误信号。

- 截断MA周期不当,错过主要趋势。

- 反转不一定代表趋势转折,可能出现虚假信号。

- 需要适当调整参数以避免过优化。

针对上述风险,可通过调整MA参数、设置止损止盈、或结合其他指标进行优化。

优化空间

该策略可从以下几个方面进行优化:

- 优化MA周期参数,采用自适应MA周期。

- 增加成交量过滤,避免虚假突破。

- 结合其它技术指标,如MACD、KDJ等进行组合。

- 添加止损止盈逻辑,控制单笔损失。

- 代码结构优化,增加模块化后期扩展空间。

总结

该策略整体来说非常适合作为量化交易的入门策略。它只需要简单的双MA参数即可运行,操作简单,容易理解,能直观反映市场反转时机。同时策略留有较大的优化空间,可根据实际需要调整参数或添增其他逻辑来进行改进。

策略源码

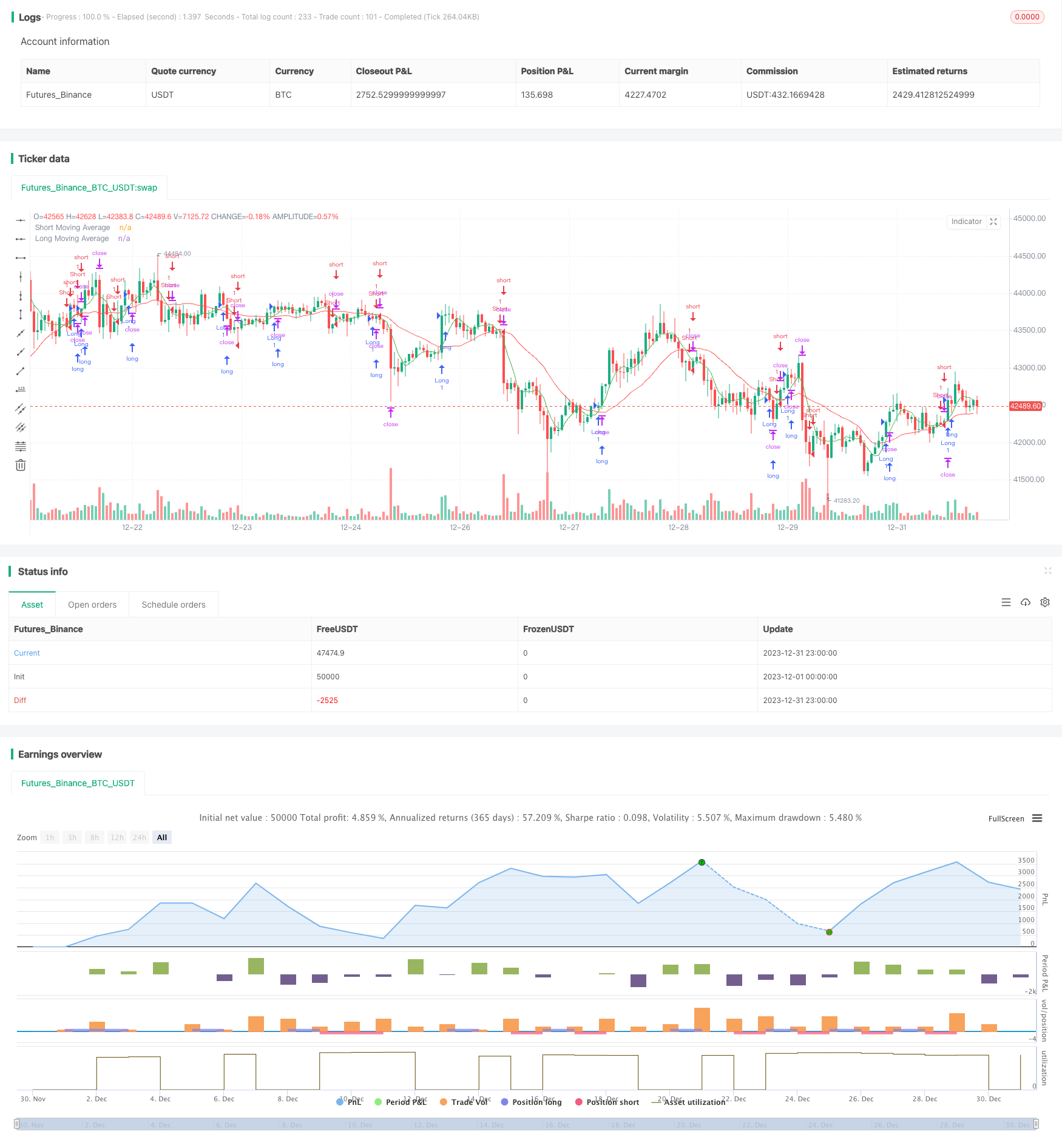

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Cross 2 Moving Average Strategy", shorttitle="2MA Cross", overlay=true)

// User-defined input for moving averages

long_period = input(20, title="Long Period")

short_period = input(5, title="Short Period")

type_ma = input.string("SMA", title = "MA type", options = ["SMA", "EMA"])

// Calculating moving averages

long_ma = ta.sma(close, long_period)

short_ma = ta.sma(close, short_period)

// Plot moving averages

plot(long_ma, title="Long Moving Average", color=color.red)

plot(short_ma, title="Short Moving Average", color=color.green)

// Strategy logic for crossing of moving averages

longCondition = ta.crossover(short_ma, long_ma)

shortCondition = ta.crossunder(short_ma, long_ma)

// Entry orders

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Optional: Add stop loss and take profit

stop_loss_perc = input(1, title="Stop Loss (%)") / 100

take_profit_perc = input(2, title="Take Profit (%)") / 100

strategy.exit("Exit Long", from_entry="Long", stop=close*(1-stop_loss_perc), limit=close*(1+take_profit_perc))

strategy.exit("Exit Short", from_entry="Short", stop=close*(1+stop_loss_perc), limit=close*(1-take_profit_perc))