概述

本策略名称为“量化W形态高手之路”。该策略综合运用W形态与高量能量策略,通过量化指标识别价格W形态与高成交量配合形成的买入时机。

策略原理

该策略主要基于两个指标进行量化交易信号判断。第一个指标是W形态指标,它通过快速简单移动平均线(10周期)与慢速简单移动平均线(30周期)的多头交叉来识别价格W形态。当快速线从下方上穿慢速线时,判断为W形态底部形成。第二个指标是成交量指标,它将当前成交量与成交量简单移动平均线(20周期)的2倍进行比较。如果当前成交量大于移动平均量的2倍,则判断为高量能量配合。当价格W形态与高量能量同时出现时,产生买入信号。

具体来说,该策略使用以下几个步骤识别交易时机: 1) 计算10周期与30周期的简单移动平均线; 2) 判断快速线与慢速线的金叉配合一次金叉再次死叉构成W形态; 3) 计算20周期成交量的简单移动平均线,当前成交量大于移动平均量的2倍识别高量能量; 4) W形态与高量能量同时出现时,产生买入信号。

通过上述多个指标的量化判断,可有效识别价格反转机会,形成具有高胜率的交易策略。

优势分析

本策略最大的优势在于多指标量化判断,使交易信号更加准确可靠。具体优势如下:

- W形态指标可准确识别价格反转,具有较高的质量;

- 高量能量验证可避免虚假信号,提高信号的可靠性;

- 多指标组合使策略更加全面和立体,胜率更高;

- 参数可调整空间大,可根据不同市场环境进行优化。

总的来说,该策略成功结合技术形态与成交量指标,通过量化手段识别高质量交易机会,可靠性强,适应性广,是一种较为先进的量化交易策略。

风险分析

本策略也存在一定的风险,主要包含以下几个方面:

- W形态无法百分百预测价格反转,会存在一定的假信号风险;

- 高量验证也可能会漏掉部分机会,无法识别全部买入点位;

- 参数设置如移动平均周期等需要根据市场环境进行调整优化,否则会影响策略表现;

- 任何技术指标都无法完美预测市场,多指标组合也无法完全规避亏损风险。

针对上述风险,我们可以通过以下几点来进一步完善和优化策略: 1) 增加止损点位,严格控制单笔亏损; 2) 优化参数设置,调整移动平均周期等参数; 3) 增加模型Ensemble,结合更多技术指标判断; 4) 增加风控模块,根据大市环境调整仓位。

优化方向

本策略还有进一步优化的空间,主要包含以下几个方面:

1)优化参数设置:可以通过更多数据回测和参数扫描来找到最佳参数组合,如移动平均周期、成交量放大倍数等;

2)Ensemble模型:可以增加更多技术指标,构建Ensemble模型,集成判断交易信号,提高策略稳定性;

3)动态仓位管理:可以根据大盘指标、情绪指标等建立动态仓位管理模型,在高风险环境下降低仓位;

4)止损策略:设定合理的止损点位,严格控制单笔亏损;

5)回测验证:在更多市场环境下进行回测,验证策略在不同行情下的稳健性。

通过上述几个方面的持续优化,可望进一步提升策略的稳定性和盈利能力。

总结

“量化W形态高手之路”策略成功实现价格技术形态与成交量指标的有效结合,通过量化手段识别高质量买入点位。策略优势在于指标组合全面、可靠性高、适应性强。但也存在一定假信号风险,需要通过参数优化、模型Ensemble、动态仓位管理等手段进一步稳定。本策略为代表性的多指标量化交易策略,通过持续优化和改进,必将成为量化交易的一大杀手锏。

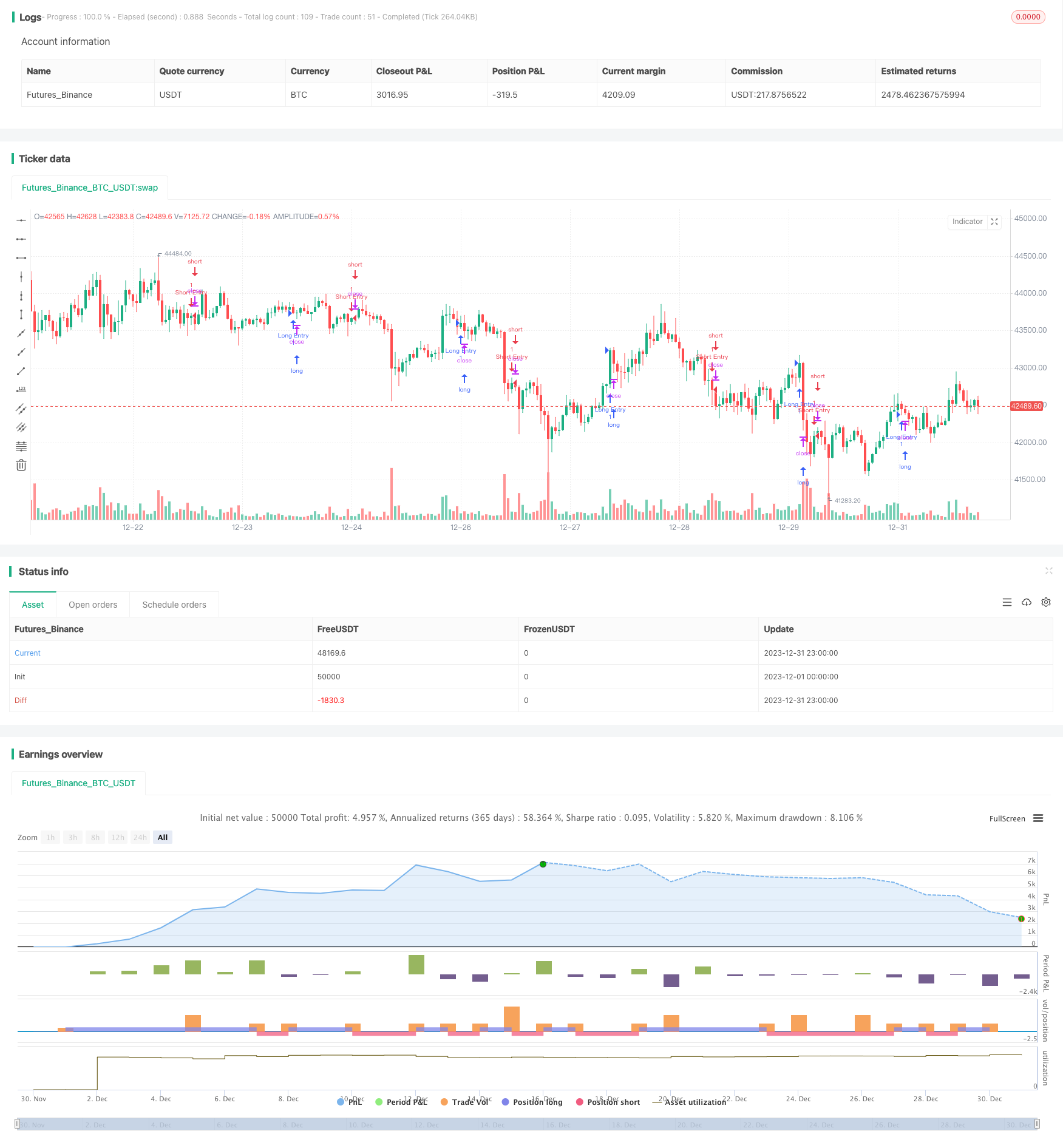

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Combined Strategy", overlay=true)

// Input parameters for the W pattern with high volume

wBottomDepth_W = input.int(3, title="W Bottom Depth", minval=1)

volumeMultiplier_W = input.int(2, title="Volume Multiplier", minval=1)

// Calculate moving averages for the W pattern

maShort = ta.sma(close, 10)

maLong = ta.sma(close, 30)

// Find W pattern

wBottom = ta.crossover(maShort, maLong) and ta.crossover(maShort[1], maLong[1])

// Check for high volume

isHighVolume = volume > volumeMultiplier_W * ta.sma(volume, 20)

// Strategy logic for the W pattern with high volume

if (wBottom and isHighVolume)

strategy.entry("W Pattern Buy", strategy.long)

// Plot shapes to highlight W pattern and high volume

plotshape(series=wBottom and isHighVolume, title="W Bottom with High Volume", color=color.new(color.green, 0), style=shape.triangleup, location=location.belowbar, size=size.small)

// Strategy logic for the second strategy

longCondition_My = ta.crossover(ta.sma(close, 14), ta.sma(close, 28))

if (longCondition_My)

strategy.entry("Long Entry", strategy.long)

shortCondition_My = ta.crossunder(ta.sma(close, 14), ta.sma(close, 28))

if (shortCondition_My)

strategy.entry("Short Entry", strategy.short)