概述:这是一个应用波浪指标识别趋势的跟踪策略。它通过计算平均价格的指数移动平均线和绝对价格差的移动平均线,得到一波浪线。策略通过监控波浪线与超买超卖区域的交叉,产生交易信号。同时结合均线过滤和交易量过滤来避免错误信号。

策略原理:

计算平均价格ap=(最高价+最低价+收盘价)/3

计算n1周期的ap的EMA,得到esa

计算ap与esa的绝对差值的n1周期EMA,得到d

计算波浪线:ci=(ap-esa)/(0.015*d)

计算n2周期ci的EMA,得到终极波浪线tci,即wt1

计算wt1的4周期SMA,得到wt2

绘制超买区和超卖区的水平线obLevel1/2和osLevel1/2

当wt1上穿obLevel2线时产生买入信号;当wt1下穿osLevel2线时产生卖出信号

添加均线emaFilter和交易量volumeFilter作为过滤条件,避免错误信号

入场后设置止盈止损比例,退出持仓

优势分析:

波浪线比较好地处理了多空转换,可以有效捕捉趋势

结合均线和交易量双重过滤,可靠性较高

采用多组参数计算,避免了单一指标的局限性

设置止盈止损,可以锁定部分利润,有效控制风险

风险与缺陷:

参数的选择在某些情况下可能导致性能不佳或过度拟合

没有关于最优参数选择的明确指导,需要试错

未将更广泛的市场条件纳入信号中

如果在范围受限或波动市场中使用,存在鞭炮效应的风险

除了获利/止损之外,缺乏退出规则

优化方向:

在各种时间框架和资产上测试参数集,以找到最优值

结合波动性指标,避免在低波动性时期出现信号

添加补充指标如RSI以提高信号准确度

构建一个机器学习模型,寻找针对特定资产的最优参数

通过添加跟踪止损或基于突然的波动性扩张事件的退出来增强退出

总结:

这是一个结合波浪线和辅助指标设计的策略。它利用波浪线有效识别趋势转换的特点,辅以均线和交易量过滤来避免错误信号,能够获取大部分中长线趋势。同时采用止盈止损来控制风险。优化空间还很大,通过调整参数组合,结合更多指标,以及机器学习等方式不断改进,可以使策略在更多品种和时间周期上表现更好。

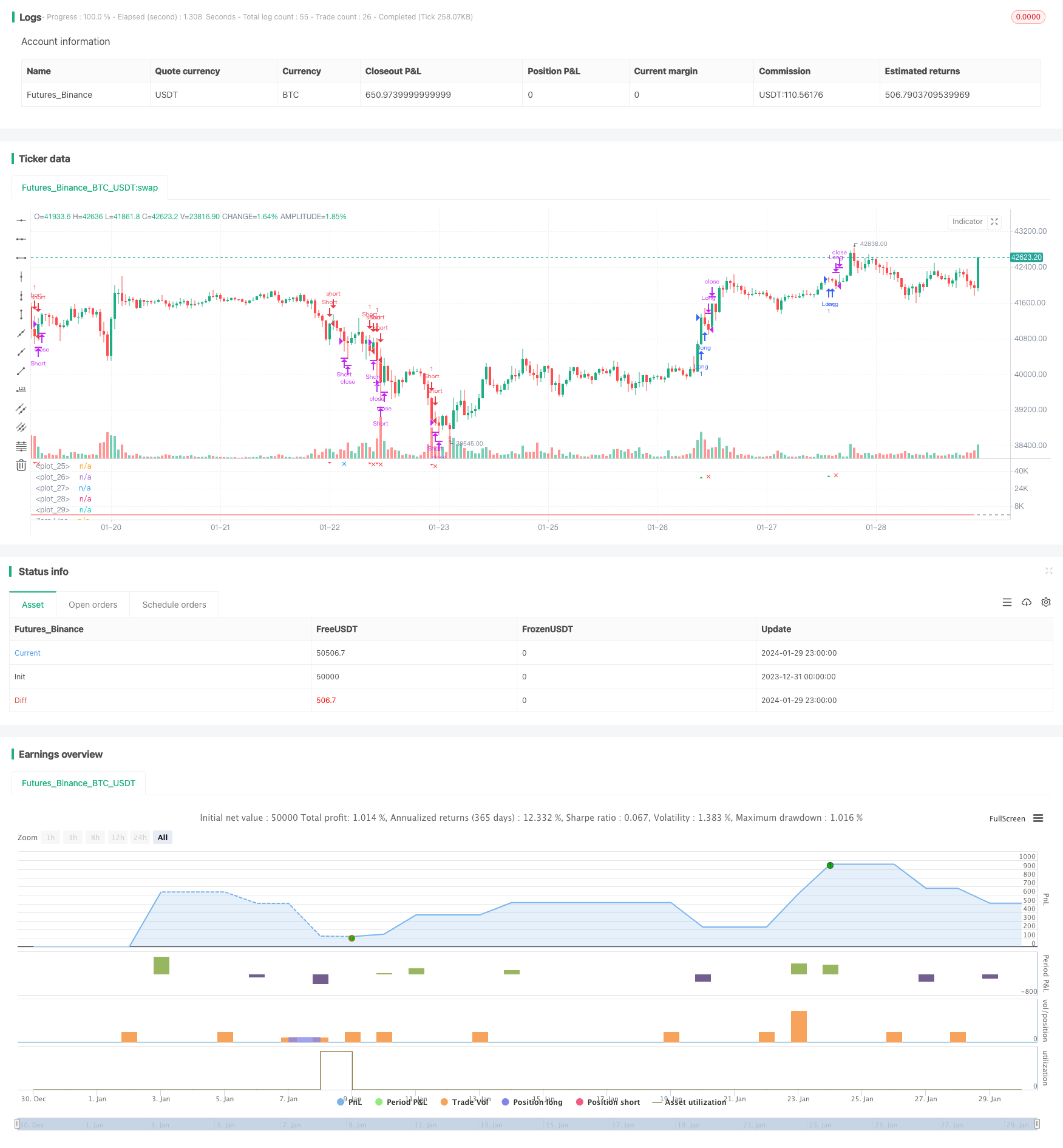

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bush Strategy test", shorttitle="Nique Audi", overlay=false)

// Paramètres

n1 = input(10, title="Channel Length")

n2 = input(21, title="Average Length")

obLevel1 = input(60, title="Over Bought Level 1")

obLevel2 = input(53, title="Over Bought Level 2")

osLevel1 = input(-65, title="Over Sold Level 1")

osLevel2 = input(-60, title="Over Sold Level 2")

takeProfitPercentage = input(1, title="Take Profit (%)")

stopLossPercentage = input(0.50, title="Stop Loss (%)")

// Calculs

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

wt1 = tci

wt2 = ta.sma(wt1, 4)

// Tracé des lignes

plot(0, color=color.gray)

plot(obLevel1, color=color.red)

plot(osLevel1, color=color.green)

plot(obLevel2, color=color.red, style=plot.style_line)

plot(osLevel2, color=color.green, style=plot.style_line)

plot(wt1, color=color.green)

plot(wt2, color=color.red, style=plot.style_line)

// Tracé de la différence entre wt1 et wt2 en bleu

hline(0, "Zero Line", color=color.gray)

// Conditions d'entrée long et court

longCondition = ta.crossover(wt1, obLevel2)

shortCondition = ta.crossunder(wt1, osLevel2)

// Tracé des signaux d'achat et de vente

plotshape(series=longCondition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(series=shortCondition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// Conditions d'entrée et de sortie

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Niveaux de prise de profit pour les positions longues et courtes

longTakeProfitLevel = strategy.position_avg_price * (1 + takeProfitPercentage / 100)

shortTakeProfitLevel = strategy.position_avg_price * (1 - takeProfitPercentage / 100)

// Vérification si les niveaux de prise de profit sont atteints

longTakeProfitReached = strategy.position_size > 0 and high >= longTakeProfitLevel

shortTakeProfitReached = strategy.position_size < 0 and low <= shortTakeProfitLevel

// Tracé des formes de prise de profit

plotshape(series=longTakeProfitReached, style=shape.xcross, location=location.belowbar, color=color.blue, size=size.small, title="Take Profit Long")

plotshape(series=shortTakeProfitReached, style=shape.xcross, location=location.abovebar, color=color.blue, size=size.small, title="Take Profit Short")

// Niveaux de stop loss pour les positions longues et courtes

longStopLossLevel = strategy.position_avg_price * (1 - stopLossPercentage / 100)

shortStopLossLevel = strategy.position_avg_price * (1 + stopLossPercentage / 100)

// Vérification si les niveaux de stop loss sont atteints

longStopLossReached = strategy.position_size > 0 and low <= longStopLossLevel

shortStopLossReached = strategy.position_size < 0 and high >= shortStopLossLevel

// Tracé des formes de stop loss

plotshape(series=longStopLossReached, style=shape.xcross, location=location.belowbar, color=color.red, size=size.small, title="Stop Loss Long")

plotshape(series=shortStopLossReached, style=shape.xcross, location=location.abovebar, color=color.red, size=size.small, title="Stop Loss Short")

// Fermeture des positions en cas de prise de profit ou de stop loss

strategy.close("Long", when=longTakeProfitReached or longStopLossReached)

strategy.close("Short", when=shortTakeProfitReached or shortStopLossReached)