概述

本策略是一种短线震荡交易策略,它结合了EMA均线指标和CCI指标来识别市场的短线趋势和超买超卖状态,以捕捉短线价格波动的机会。

策略原理

该策略主要利用10日EMA,21日EMA和50日EMA三条均线以及CCI指标来判断入场和出场时机。

具体逻辑是: 当短期均线(10日EMA)上穿中期均线(21日EMA)并且短期均线高于长期均线(50日EMA),同时CCI指标大于0时视为多头信号,做多;当短期均线下穿中期均线并且短期均线低于长期均线,同时CCI指标小于0时视为空头信号,做空。

平仓逻辑是短期均线重新跨过中期均线时平仓。

策略优势

结合均线系统和CCI指标,可以有效识别短线价格波动的趋势方向和超买超卖状态。

利用均线金叉和死叉来判断entries和exists,简单实用。

CCI指标的参数和周期设置较为合理,可以滤除部分假信号。

采用多时间周期均线,可以在震荡市中获取较好的操作机会。

策略风险

短线操作波动大,连续止损可能会比较多。

CCI指标参数设置不当可能增多假信号。

震荡盘整理期间,该策略可能出现多次小亏损。

只适合短线频繁操作的交易者,不适合长线持有。

对应的风险应对措施包括:优化CCI参数,调整止损位置,增加 FILTER 条件等。

策略优化方向

可以测试不同长度的EMA均线组合,优化参数。

可以加入其他指标或Filter条件来过滤掉部分假信号。例如MACD,KDJ等。

可以通过动态追踪止损来控制单笔亏损。

可以结合更高时间周期的趋势指标,避免逆势操作。

总结

本策略整体来说是一个典型的短线震荡策略,利用均线指标的金叉死叉结合CCI指标的超买超卖状态来捕捉价格的短期反转机会。该策略适合短线频繁交易,但需要承受一定的止损压力。通过参数优化和增加filter条件可以进一步提高策略稳定性和盈利能力。

策略源码

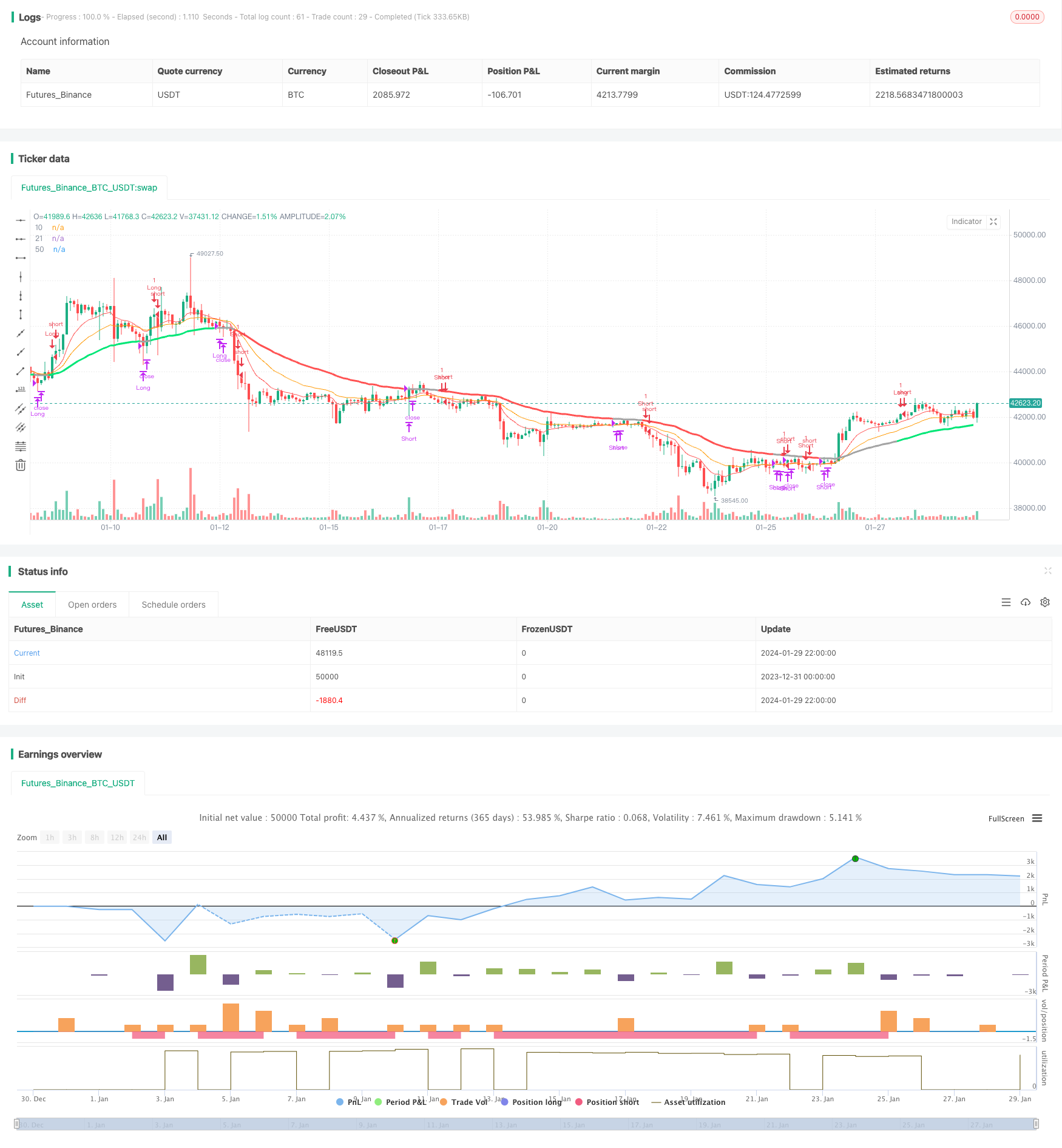

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-30 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//study(title="Strat CCI EMA scalping", shorttitle="EMA-CCI-strat", overlay=true)

strategy("Strat CCI EMA scalping", shorttitle="EMA-CCI-strat", overlay=true)

exponential = input(true, title="Exponential MA")

// the risk management inputs

inpTakeProfit = input(defval = 1000, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 200, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 200, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

src = close

ma10 = exponential ? ema(src, 10) : sma(src, 10)

ma21 = exponential ? ema(src, 21) : sma(src, 21)

ma50 = exponential ? ema(src, 50) : sma(src, 50)

xCCI = cci(close, 200)

//buy_cond = cross(ma21, ma50) and ma10 > ma21 and (xCCI > 0)

//sell_cond = cross(ma21, ma50) and ma10 < ma21 and (xCCI < 0)

buy_cond = ma10 > ma21 and ma10 > ma50 and xCCI > 0

sell_cond = ma10 < ma21 and ma10 < ma50 and xCCI < 0

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => buy_cond

exitLong() => ma10 < ma21

strategy.entry(id = "Long", long = true, when = enterLong()) // use function or simple condition to decide when to get in

strategy.close(id = "Long", when = exitLong()) // ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => sell_cond

exitShort() => ma10 > ma21

strategy.entry(id = "Short", long = false, when = enterShort())

strategy.close(id = "Short", when = exitShort())

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

//strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

//strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

//longCondition = buy_cond

//if(longCondition)

// strategy.entry("Long", strategy.long)

// strategy.exit("Close Long", "Long", when = exitLong())

//shortCondition = sell_cond

//if(shortCondition)

// strategy.entry("Short", strategy.short)

// strategy.exit("Close Short", "Short", when = exitShort())

//plotshape(buy_cond, style=shape.flag, color=green, size=size.normal)

//plotshape(sell_cond, style=shape.flag, color=red, size=size.normal)

c1 = buy_cond==1 ? lime : sell_cond==1 ? red : #a3a3a3 // color

plot( ma10, color=red, style=line, title="10", linewidth=1)

plot( ma21, color=orange, style=line, title="21", linewidth=1)

plot( ma50, color=c1, style=line, title="50", linewidth=3)

//alertcondition(buy_cond, title = "Buy Condition", message = "Buy Condition Alert")

//alertcondition(sell_cond, title = "Sell Condition", message = "Sell Condition Alert")