策略概述:该策略综合运用了超级趋势指标、相对强弱指标(RSI)和指数移动平均线(EMA)来识别买入时机。只有当收盘价高于超级趋势线,RSI大于70并且价格高于9日EMA时,才产生买入信号。

策略原理:

超级趋势指标用于判断价格趋势和超买超卖区域。当价格高于超级趋势时为上涨趋势,当价格低于超级趋势时为下跌趋势。

RSI指标判断价格是否进入超买或超卖状态。RSI大于70代表进入超买状态,小于30代表进入超卖状态。

EMA指标判断价格在上涨趋势时能否突破其短期均线。只有价格高于9日EMA时才具有突破信号意义。

本策略在超级趋势、RSI和EMA三个指标发出同步信号时,即认为具有较强的买入时机。这可以有效过滤掉一些假突破带来的噪音交易。

优势分析:

综合多个指标判断,可以有效过滤假突破交易,提高策略胜率。

同时考量趋势、强弱指标和均线指标,识别高概率买点的可能性较大。

相对简单的策略逻辑,容易理解实现,适合量化交易的算法化。

可根据不同市场调整参数,适应性较强。

风险分析:

单一的买入规则,没有考虑降低风险的止损机制。

没有卖出退出机制,需要人工止损止盈,增加操作风险。

指标参数设置不当可能错过买入时机或者产生错误信号。

需要对参数组合进行大量回测实验,找到最优参数。

优化方向:

增加止损止盈机制,让策略退出亏损交易,自动止盈。

优化指标参数,找到最佳参数组合。可以考虑遗传算法、网格搜索等方法。

增加卖出信号判断,形成完整的决策系统。卖出信号可以结合Volatility Stop等方法。

可以考虑加入机器学习模型,利用LSTM、RNN等进行特征提取,提高决策的准确性。

将策略容器化,利用Kubernetes进行弹性扩展,提高策略的并行化程度。

总结:本策略综合运用超级趋势、RSI和EMA多种指标判断,在三者发出同步信号时产生买入,可以有效过滤假突破带来的噪音,提高决策准确率。但策略可以进一步优化,增加止损机制,找出最优参数,增加卖出机制等,从而构建一个更加完整和优化的量化交易系统。

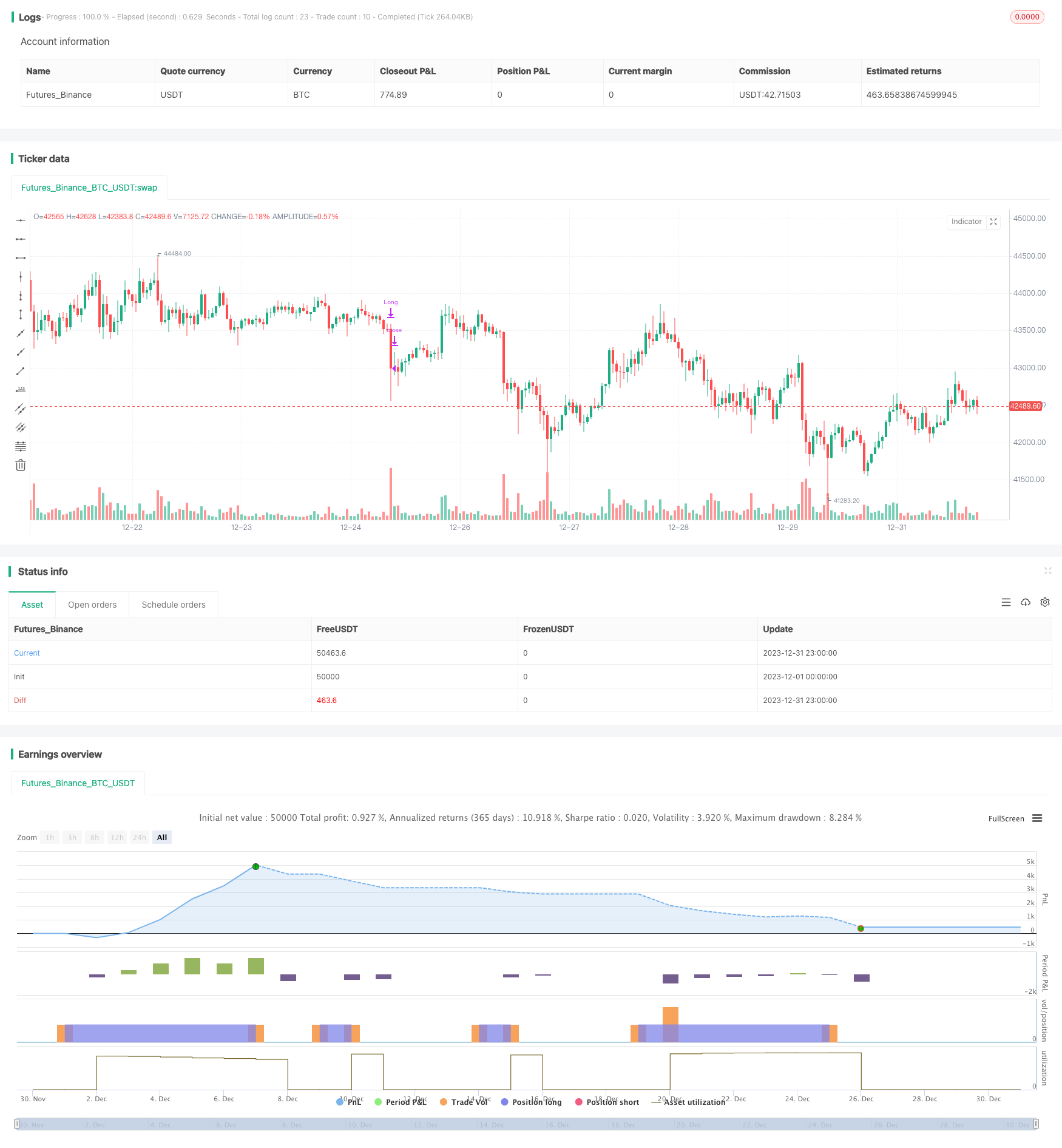

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Supertrend, RSI, and EMA Strategy", overlay=true)

// Supertrend Indicator

atrPeriod = input.int(10, "ATR Length", minval=1)

factor = input.float(3.0, "Factor", minval=0.01, step=0.01)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

// RSI Indicator

rsiLength = input.int(14, "RSI Length")

rsi = ta.rsi(close, rsiLength)

// EMA Indicator

emaLength = 9

ema = ta.ema(close, emaLength)

// Entry Conditions

longCondition1 = close > supertrend and rsi > 70

longCondition2 = close > ema

// Combined Entry Condition

longCondition = longCondition1 and longCondition2

if (longCondition)

strategy.entry("Long", strategy.long)

// Exit Condition

exitCondition = close < supertrend

if (exitCondition)

strategy.close("Long")