概述

动态均线交叉策略(Dynamic Moving Average Crossover Strategy)是一种典型的趋势跟踪策略。该策略通过计算快速移动平均线(Fast MA)和慢速移动平均线(Slow MA),并在它们交叉时产生买入和卖出信号,以捕捉市场趋势的转折点。

策略原理

该策略的核心逻辑是:当快速移动平均线从下方上穿越慢速移动平均线时,产生买入信号;当快速移动平均线从上方下穿慢速移动平均线时,产生卖出信号。

移动平均线能有效地滤波市场噪音,捕捉价格趋势。快速移动平均线更加灵敏,能及时捕捉趋势的变化;慢速移动平均线更加稳定,有效滤除短期波动的影响。当快慢均线发生金叉(由下向上穿越)时,表示市场步入多头行情;当发生死叉(由上向下穿越)时,表示步入空头行情。

该策略会在均线交叉时立即发出交易信号,采取趋势追踪策略,跟踪市场趋势赚取较大盈利。同时,策略会设置止损位和止盈位,严格控制风险。

优势分析

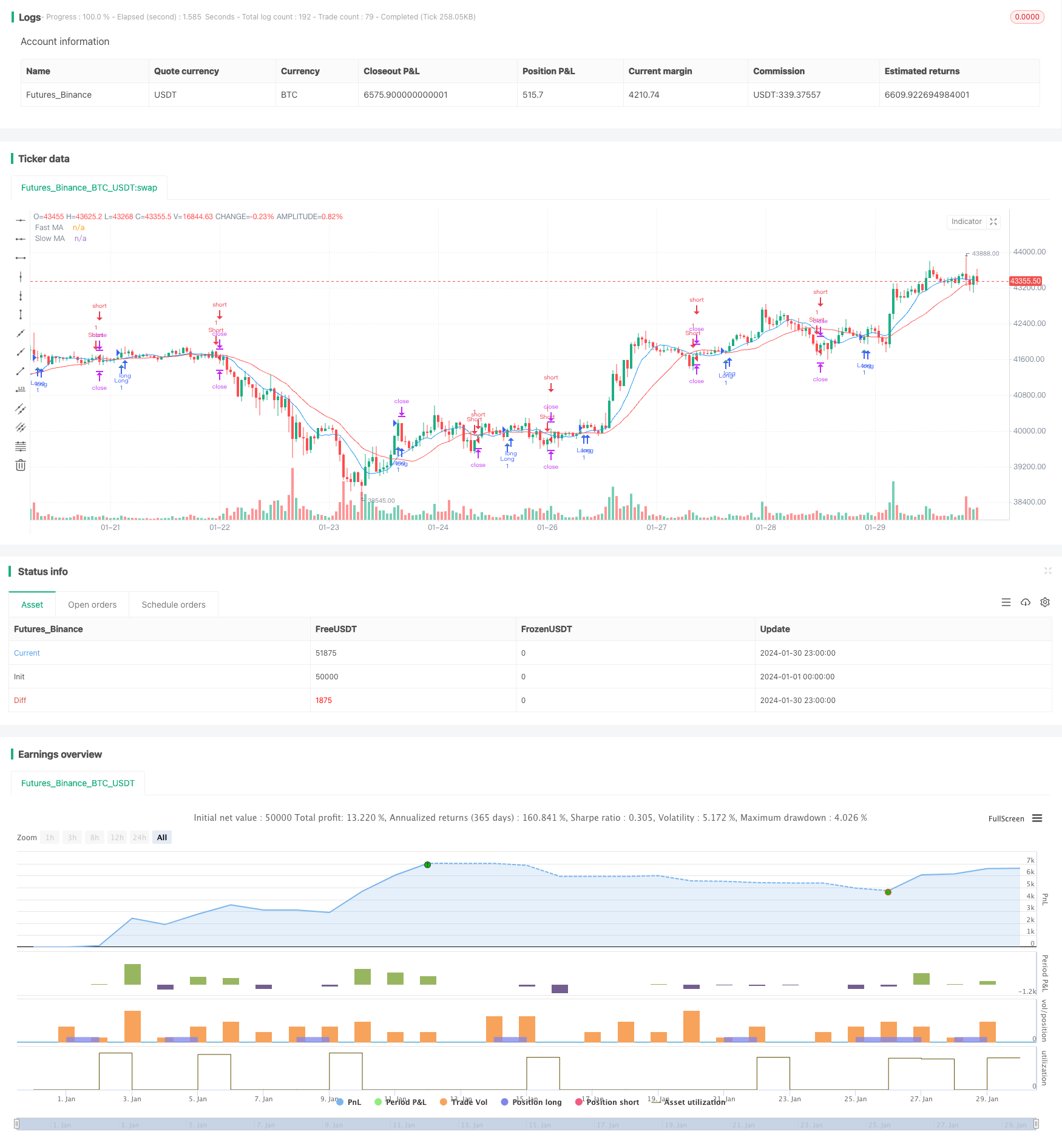

- 策略回测表现良好,跟踪趋势捕捉较大行情

- 均线交叉产生清晰信号,容易实施

- 设置止损止盈,严格控制风险

风险分析

- 容易产生损失严重的信号错误交易

- 交易频繁,持仓时间较短

- 需要合理设置参数

可以通过优化参数,调整均线周期长度,或加入过滤条件等方法来改善。

优化方向

- 调整均线参数,寻找最佳参数组合

- 加入量能指标等过滤条件,减少错误信号

- 优化止损止盈设定

- 结合其他指标判断趋势方向

总结

动态均线交叉策略整体效果较好,通过调整参数优化可以进一步改善策略表现。该策略容易实施,适合初学者实战练习。但也需要警惕产生错误信号的风险,需辅助其他指标判断效果才会更好。

策略源码

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple Moving Average Crossover", shorttitle="SMAC", overlay=true)

// Define input parameters

fast_length = input.int(9, title="Fast MA Length")

slow_length = input.int(21, title="Slow MA Length")

stop_loss = input.float(1, title="Stop Loss (%)", minval=0, maxval=100)

take_profit = input.float(2, title="Take Profit (%)", minval=0, maxval=100)

// Calculate moving averages

fast_ma = ta.sma(close, fast_length)

slow_ma = ta.sma(close, slow_length)

// Define conditions for long and short signals

long_condition = ta.crossover(fast_ma, slow_ma)

short_condition = ta.crossunder(fast_ma, slow_ma)

// Plot moving averages on the chart

plot(fast_ma, title="Fast MA", color=color.blue)

plot(slow_ma, title="Slow MA", color=color.red)

// Execute long and short trades

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

// Set stop loss and take profit levels

stop_loss_price = close * (1 - stop_loss / 100)

take_profit_price = close * (1 + take_profit / 100)

strategy.exit("Take Profit/Stop Loss", stop=stop_loss_price, limit=take_profit_price)

// Plot signals on the chart

plotshape(series=long_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=short_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)