概述

本策略是一个具有特定日期触发的多头仓位建立和 trailing stop loss 风险管理机制的策略。该策略特别适用于希望根据特定日历日期自动化仓位进入,并通过动态风险控制方法如追踪止损来管理仓位的交易者。

策略原理

该策略首先通过input输入特定的入市日期,包括月日,然后根据这些日期计算出准确的入市时间戳。策略还输入了追踪止损的百分比参数。

在入市日期当天,策略会打开多头仓位。同时,记录最高价highestPrice和止损价stopLoss。其中最高价会在后续时间不断更新,而止损价是按最高价的一定百分比向下 trailing。

如果价格低于止损价,则平仓退出。否则仓位一直持有,止损价会根据最高价持续向下追踪,从而锁定利润,控制风险。

优势分析

该策略具有以下几个主要优势:

- 可根据特定日期自动化入市。适合围绕重大事件交易的策略。

- 应用追踪止损机制,可以动态锁定利润,有效控制风险。

- 止损按比例设置,操作简单直观。可自定义止损幅度。

- 可实现长期持仓,最大限度获取股价上涨收益。

风险分析

该策略也存在一些风险:

- 存在止损失效风险。如果股价短期大幅下跌超过止损线 then反弹,会被止损出场,无法参与后续反弹。

- 无法限制最大亏损。如果追踪止损比例设置过大,则最大亏损可能超过理想范围。

对应优化措施: 1. 可结合其他指标判断大盘面临调整时,暂时关闭追踪止损,避免止损失效。 2. 设置追踪止损比例时需谨慎,通常不超过10%。或设置最大允许亏损数值。

优化方向

该策略可以从以下几个方向进行优化:

- 增加止盈机制。当价格超过一定水平时,例如上涨50%,则部分或全部获利了结。

- 结合指数指标判断市场结构,优化追踪止损的幅度。例如大盘处于震荡调整时,可适当放宽幅度。

- 增加仓位管理模块。当价格重新突破新高时,可考虑加仓,进一步追加利润。

总结

本策略基于特定日期入市并采用追踪止损的思路,可以自动化入场并动态控制风险。策略简单直观,易于操作,适合长线持仓。通过进一步优化,可成为一个非常实用的量化交易策略。

策略源码

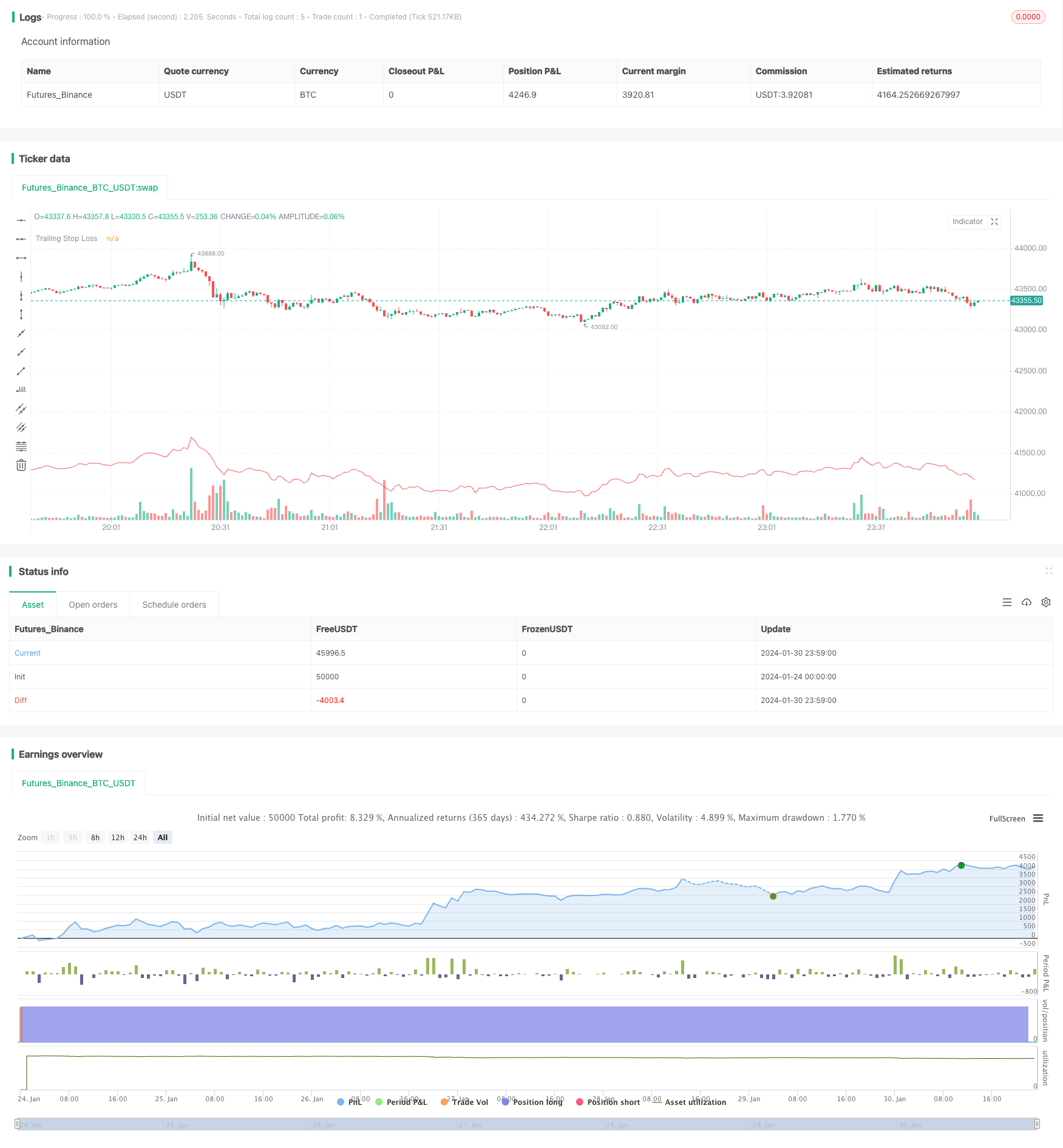

/*backtest

start: 2024-01-24 00:00:00

end: 2024-01-31 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Trailing Stop Loss Percent",

overlay=true, pyramiding=1)

// Input for the specific entry date

entryDay = input.int(defval = 1, title = "Entry Day", minval = 1, maxval = 31)

entryMonth = input.int(defval = 1, title = "Entry Month", minval = 1, maxval = 12)

entryYear = input.int(defval = 2023, title = "Entry Year", minval = 1970)

// Calculate the entry date timestamp

entryDate = timestamp(entryYear, entryMonth, entryDay, 00, 00)

// Trailing Stop Loss Percentage

trailStopPercent = input.float(defval = 5.0, title = "Trailing Stop Loss (%)", minval = 0.1)

// Entry Condition

enterTrade = true

// Variables to track the highest price and stop loss level since entry

var float highestPrice = na

var float stopLoss = na

// Update the highest price and stop loss level

if strategy.position_size > 0

highestPrice := math.max(highestPrice, high)

stopLoss := highestPrice * (1 - trailStopPercent / 100)

// Enter the strategy

if enterTrade

strategy.entry("Long Entry", strategy.long)

highestPrice := high

stopLoss := highestPrice * (1 - trailStopPercent / 100)

// Exit the strategy if the stop loss is hit

if strategy.position_size > 0 and low <= stopLoss

strategy.close("Long Entry")

// Plotting the stop loss level for reference

plot(strategy.position_size > 0 ? stopLoss : na, "Trailing Stop Loss", color=color.red)