概述

这是一个基于布林带的外汇跳空短线交易系统。它适用于主要货币对,要求交易手续费低于1点差,时间周期在1-15分钟之间。

策略原理

该系统使用布林带、RSI和ADX三个指标来识别交易机会。

布林带被用来识别价格的突破。当价格突破上边带时,看多;当价格突破下边带时,看空。RSI被用来避免假突破。只有在RSI反转时(从超买区下落或从超卖区上升),才认为突破是有效的。ADX被用来过滤掉趋势不明显的市场,只在ADX低于32时才入场。

具体的入场规则是:多单入场要求价格突破上边带,RSI从超卖区上升并交叉30线,同时ADX低于32;空单入场要求价格突破下边带,RSI从超买区下落并交叉70线,同时ADX低于32。

出场规则有止盈止损和中线回归。具体为:设定固定止盈止损点;当价格重新回到布林中线时平仓。

优势分析

该系统具有以下几个优势:

使用布林带能捕捉价格的跳空行情,这种行情利润潜力大。

结合RSI指标避免假突破,提高盈利概率。

使用ADX指标过滤掉无明显趋势的市场,避免无谓交易。

回归中线出场能锁定大部分利润,避免利润回吐。

适合高杠杆交易,能迅速放大盈利。

风险分析

该系统也存在一些风险:

依赖跳空突破,如果无法捕捉到价格跳空则无法盈利。

回测数据拟合风险。实盘可能无法复制回测结果。

趋势持续时间过短,出现震荡市也会亏损。

高杠杆放大了风险。单笔损失可能较大。

交易时间受限,可能错过部分交易机会。

优化方向

该系统可以从以下几个方面进行优化:

优化参数,改进指标效果。比如修改布林带周期,RSI参数等。

增加或改进过滤条件,提高获利交易比例。比如结合更多指标或者基本面元素。

优化止盈止损策略,最大化单笔盈利。比如跟踪止损,依据ATR止损等。

自动确定合适杠杆水平。使期望收益最大化。

使用机器学习技术自动寻找最优参数。避免人工遍历。

总结

黄金布林带跳空回归系统是一个典型的短线突破系统。它捕捉价格跳空带来的利润机会。同时使用多个指标进行过滤,在回测中展现出良好的盈利能力。但实盘测试仍有待验证,流动性和滑点也会对结果产生一定影响。总体来说,这是一个有潜力的短线交易策略,值得实盘验证和优化改进。

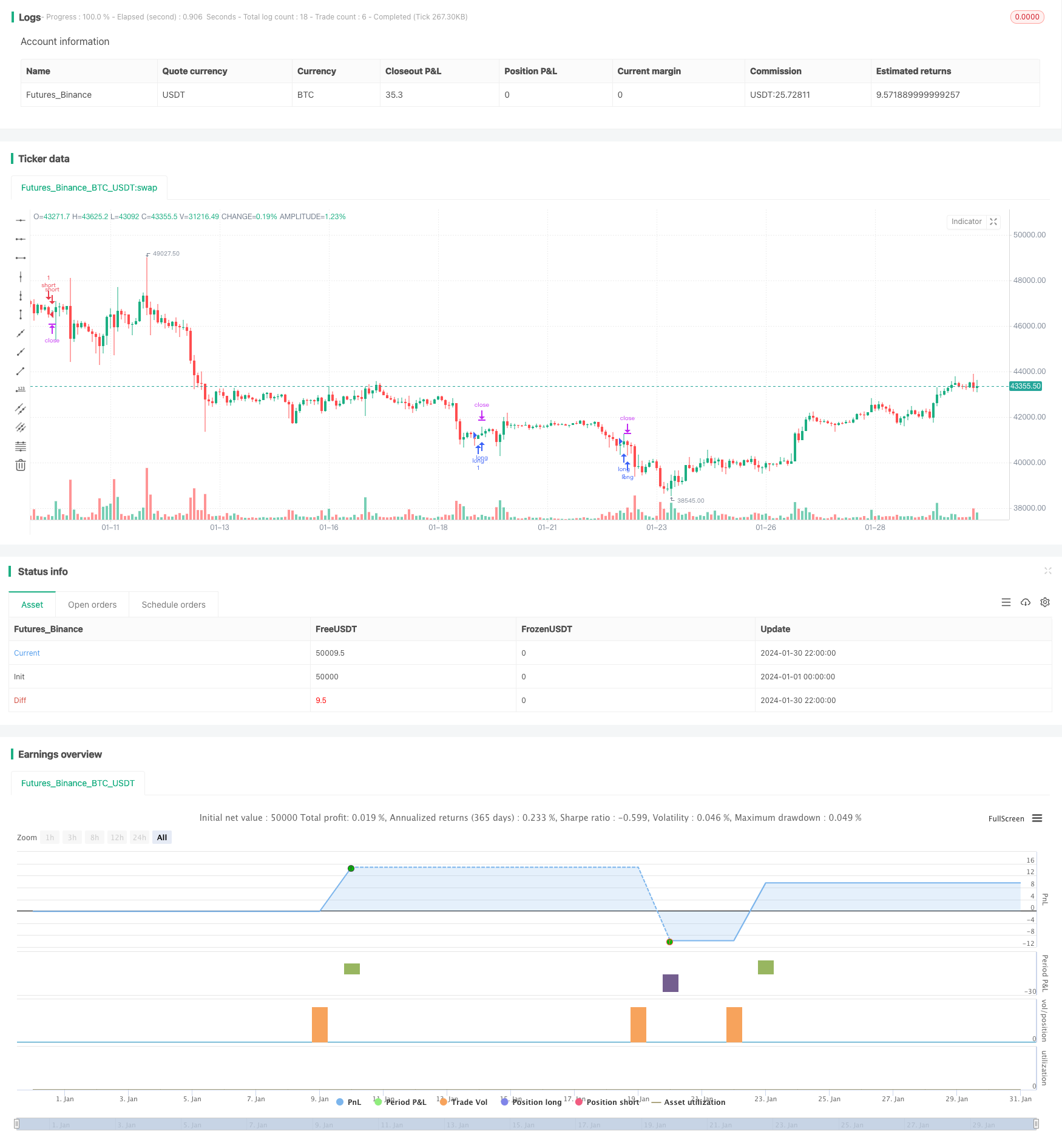

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy("Bollinger Bands, RSI and ADX Trading System", overlay=true)

timeinrange(res, sess) => time(res, sess) != 0

timer = color.red

//bgcolor(timeinrange(timeframe.period, "0300-0600") or timeinrange(timeframe.period, "0900-1300") or timeinrange(timeframe.period, "2030-2300") ? timer : na, transp=70)

//RSI

length = input( 20 )

overSold = input( 35 )

overBought = input( 65 )

price = close

vrsi = rsi(price, length)

co = crossover(vrsi, overSold)

cu = crossunder(vrsi, overBought)

//if (not na(vrsi))

//BB

lengthB = input(60, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(src, lengthB)

dev = mult * stdev(src, lengthB)

upper = basis + dev

lower = basis - dev

//adx

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

longEntry = close < upper and crossover(vrsi,overSold) and sig < 32 //and (timeinrange(timeframe.period, "0301-0600") or timeinrange(timeframe.period, "0901-1300") or timeinrange(timeframe.period, "2031-2300"))

shortEntry = close > upper and crossunder(vrsi,overBought) and sig < 32 //and (timeinrange(timeframe.period, "0301-0600") or timeinrange(timeframe.period, "0901-1300") or timeinrange(timeframe.period, "2031-2300"))

tp=input(90, step=10)

sl=input(90, step=10)

strategy.entry("long",1,when=longEntry)

strategy.exit("X_long", "long", profit=tp, loss=sl )

strategy.close("long",when=crossunder(close,basis))

strategy.entry('short',0,when=shortEntry)

strategy.exit("x_short", "short",profit=tp, loss=sl)

strategy.close("short",when=crossover(close,basis))