概述

双均线策略360°是一种融合双均线和趋势强弱判定的量化交易策略。该策略通过计算不同周期的均线,判断价格趋势;同时结合切线角累加判定趋势强弱,实现了更准确的买入卖出时机选择。

策略原理

双均线策略360°的核心逻辑是:

- 计算1分钟和经过卡尔曼滤波之后的均线;

- 通过两个均线的价差计算切线角;

- 累加切线角,得到趋势强弱信号;

- 根据累加切线角是否超过设定阈值发出交易信号。

具体而言,策略中定义了1分钟原始均线和经过卡尔曼滤波后的均线。卡尔曼滤波可以去除均线中的部分噪声,使其更加平滑。然后计算两个均线的切线角,该角度反映了价格的趋势变化。例如当切线角为正时,表示价格在上升;反之则表示下降。

策略选择30分钟作为计算周期,real summed该周期内所有正负切线角。当切线角和超过360度时,表示趋势十分强劲,发出做多信号;反之当切线角和小于-360度时,表示趋势反转,发出做空信号。

优势分析

双均线策略360°的主要优势有:

- 均线过滤了短期市场噪音,使交易决策更稳定可靠;

- 切线角量化了趋势强度,避免了仅凭均线形态判断的主观性;

- 选取多个切线角累加具有更好的去噪效果,发出的交易信号更加可靠;

- 相比单一均线策略,双均线结合趋势强度判断使策略更加全面和稳健。

风险分析

双均线策略360°也存在一些风险:

- 均线具有滞后性,可能错过短期趋势转折点;

- 仅依赖数量积累的趋势强度信号容易受到市场震荡的影响;

- 参数设置(如计算周期长度)不当可能导致错失交易机会或产生错误信号。

为降低上述风险,可以缩短均线周期、优化参数组合、增加止损机制等。

优化方向

双均线策略360°还有进一步优化的空间:

- 增加自适应均线,根据市场波动率调整均线参数;

- 增加多个均线周期参考,形成优化的参数组合;

- 增加基于波动率、交易量等的动态趋势判断模块;

- 结合机器学习模型辅助调整参数或做出交易决策。

总结

双均线策略360°综合运用均线过滤和切线角量化判断趋势,实现了较为稳健的量化交易策略。相比单一技术指标,该策略形成了更全面的考量,具有较强的实用性。但仍需注意参数调整与风险控制,未来可继续优化,使策略效果更佳。

策略源码

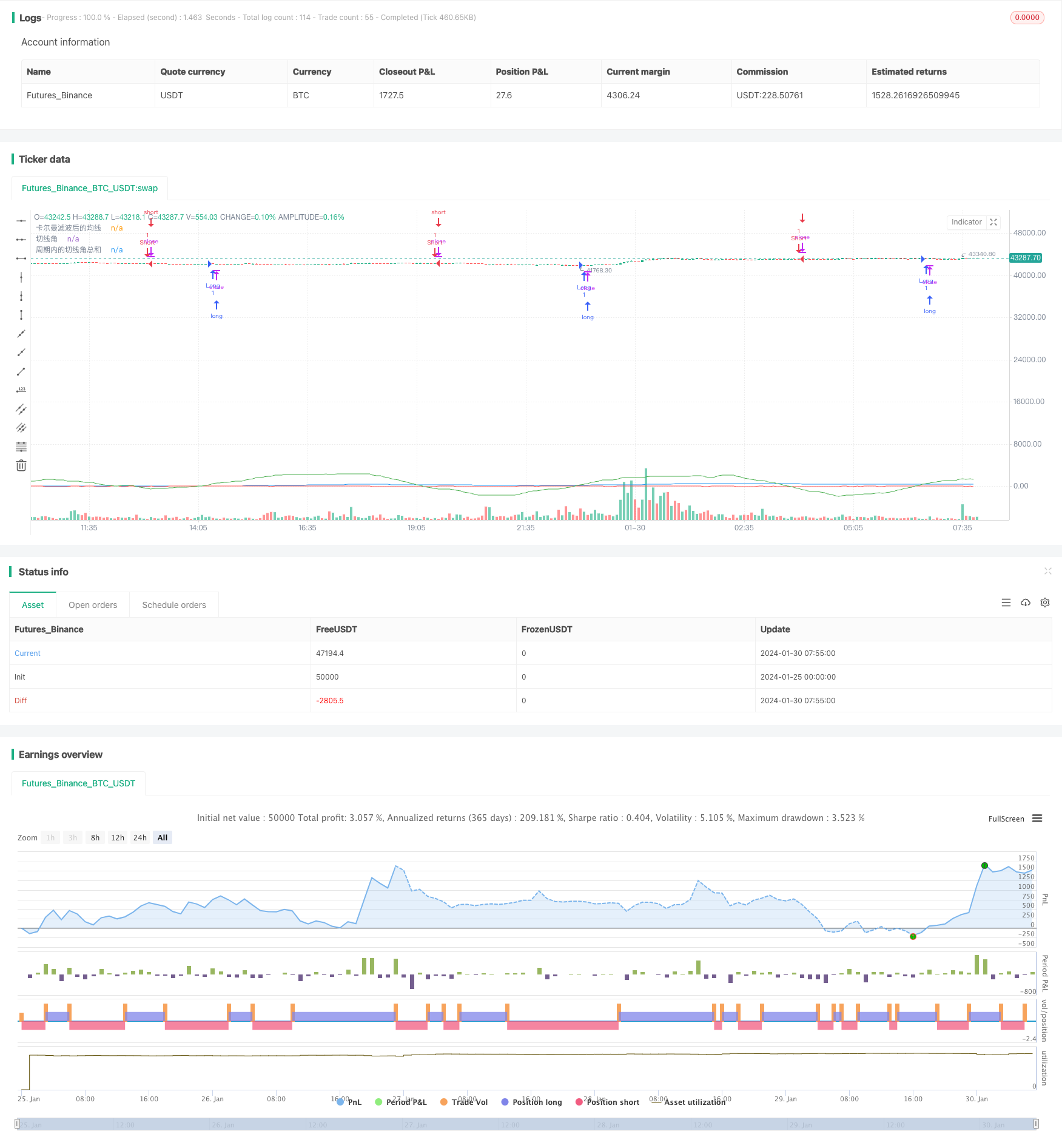

/*backtest

start: 2024-01-25 00:00:00

end: 2024-01-30 08:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@library=math

strategy("策略360°(测试)", overlay=true)

// 定义1分钟均线

ma1 = request.security(syminfo.tickerid, "1", ta.sma(close, 1)) // 在这里使用了 math.sma() 函数

//plot(ma1, color=color.yellow, title="原始均线")

// 定义卡尔曼滤波函数,参考了[1](https://www.tradingview.com/pine-script-docs/en/v5/language/Methods.html)和[2](https://www.tradingview.com/pine-script-docs/en/v5/language/Operators.html)的代码

kalman(x, g) =>

kf = 0.0

dk = x - nz(kf[1], x) // 在这里使用了 nz() 函数

smooth = nz(kf[1], x) + dk * math.sqrt(g * 2) // 在这里使用了 math.sqrt() 函数

velo = 0.0

velo := nz(velo[1], 0) + g * dk // 在这里使用了 nz() 函数

kf := smooth + velo

kf

// 定义卡尔曼滤波后的均线

ma2 = kalman(ma1, 0.01)

plot(ma2, color=color.blue, title="卡尔曼滤波后的均线")

// 定义切线角

angle = math.todegrees(math.atan(ma2 - ma2[1])) // 在这里使用了 math.degrees() 和 math.atan() 函数

// 定义累加的切线角

cum_angle = 0.0

cum_angle := nz(cum_angle[1], 0) + angle // 在这里使用了 nz() 函数

// 定义30分钟周期

period = 30 // 您可以根据您的需要修改这个参数

// 定义周期内的切线角总和

sum_angle = 0.0

sum_angle := math.sum(angle, period) // 在这里使用了 math.sum() 函数,把周期内的切线角总和改成简单地把 5 个切线角相加

// 定义买入和卖出条件

buy = sum_angle > 360// 在这里使用了 math.radians() 函数

sell = sum_angle < -360

// 执行买入和卖出操作

strategy.entry("Long", strategy.long, when=buy)

strategy.close("Short", when=buy)

strategy.entry("Short", strategy.short, when=sell)

strategy.close("Long", when=sell)

// 绘制曲线图

plot(sum_angle, color=color.green, title="周期内的切线角总和")

plot(angle, color=color.red, title="切线角") // 这是我为您添加的代码,用于显示实时计算的切线角