概述

本策略是基于动向指数(DMI)的多空指标进行买卖信号生成的策略。其利用DMI的两个指标DMI+和DMI-的交叉以及和ADX的交叉来判断行情的多空和趋势,从而产生买入和卖出的信号。

策略原理

该策略主要使用了DMI中的三个指标:DMI+、DMI-和ADX。其中,DMI+反映多头行情的力量,DMI-反映空头行情的力量,ADX则反映市场趋势的力度。

策略的买入信号是:当DMI+上穿DMI-并且上穿ADX时,则产生买入信号,即认为行情由空头转为多头,且趋势开始形成。

策略的卖出信号是:当DMI+下穿DMI-或ADX时,则产生卖出信号,即认为多头力量减弱,应当止损了结。

因此,该策略通过DMI多空指标的交叉情况判断市场的多空和趋势变化,动态调整仓位。

优势分析

该策略主要有以下几个优势:

使用DMI指标判断多空和趋势,可靠性较高,避免错过主要趋势的机会。

结合ADX判断趋势力度,可以更准确判断行情的转折点。

采用DMI指标的交叉形态作为交易信号,简单明确,容易实现。

按照趋势运行,较好控制风险,适合中长线持有。

风险分析

该策略也存在一些风险:

DMI指标存在滞后性,可能导致买点偏后、卖点偏早。

ADX指标在判断趋势和盘整的效果一般,可能错过短线机会。

存在一定的空仓风险,行情可能出现一直持续上涨或下跌的情况。

参数设置可能存在过优化风险,实际运行效果会有折扣。

优化方向

该策略还可以从以下几个方面进行优化:

结合其他指标判断背离,提高买卖点选择的准确性。

加入止损机制,避免亏损扩大的风险。

调整参数或引入自适应参数设置,减少过优化风险。

增加仓位管理,根据趋势阶段动态调整仓位。

总结

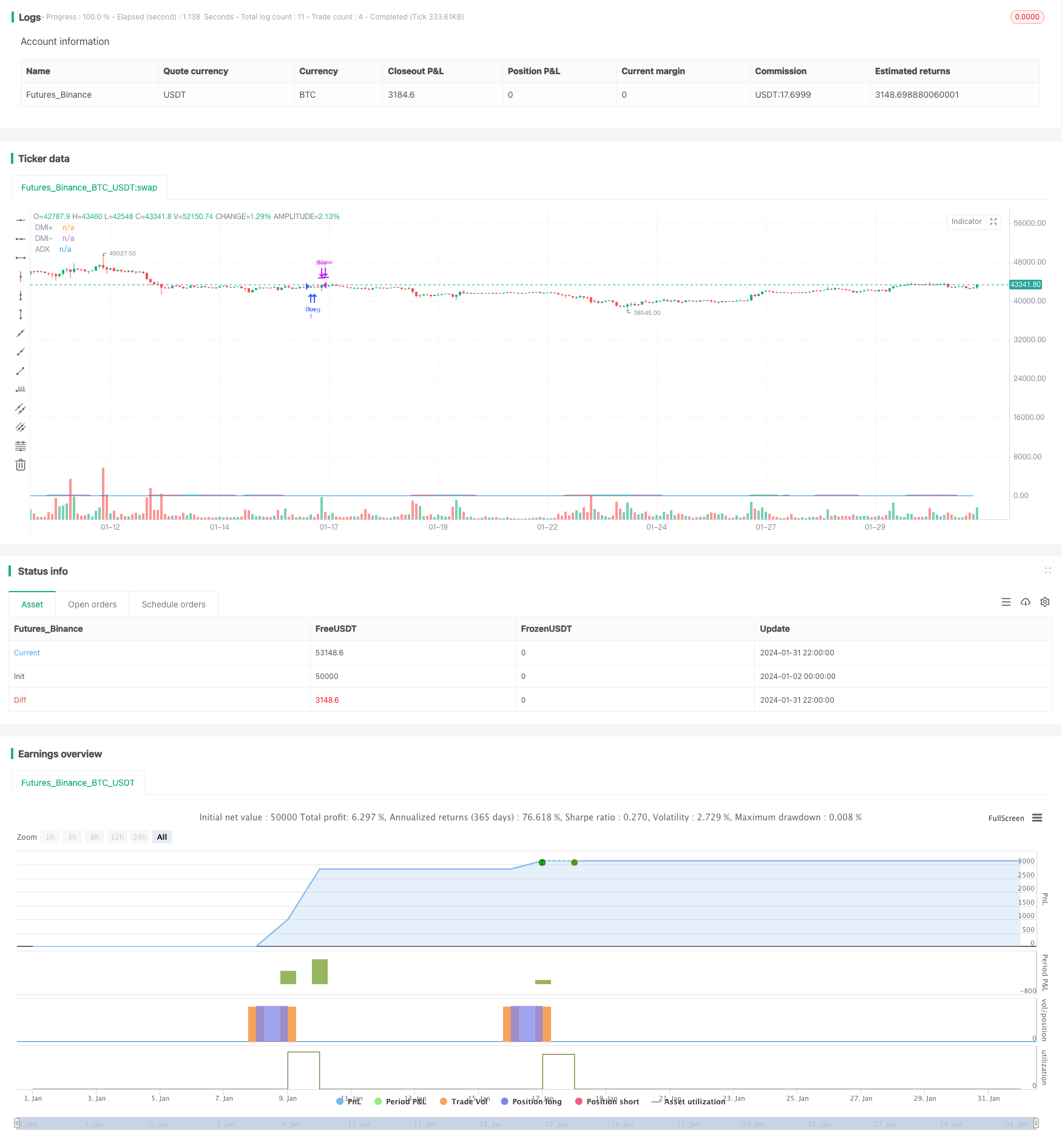

本策略基于DMI指标判断多空和趋势,简单实用,在中长线上捕捉主要趋势上具有较好的效果。但也存在一定的滞后性、空仓及参数优化风险。可通过多指标组合、止损机制、自适应参数等手段进行优化,从而获得更好的实盘效果。

//@version=5

strategy("DMI Buy/Sell Strategy", overlay=true)

// Input for DMI

length = input(14, title="DMI Length")

adxsmoothing =14

// Calculate DMI

[diPlus, diMinus, adx] = ta.dmi(length,adxsmoothing)

// Condition for Buy Entry

buyCondition = ta.crossover(diPlus, diMinus) and ta.crossover(diPlus, adx)

// Condition for Sell Exit

sellCondition = ta.crossunder(diPlus,diMinus) or ta.crossunder(diPlus,adx)

// Execute Buy Entry on the next day's open

if buyCondition

strategy.entry("Buy", strategy.long)

// Execute Sell Exit on the next day's open

if sellCondition

strategy.close("Buy")

// Plotting DMI components

plot(diPlus, title="DMI+", color=color.green)

plot(diMinus, title="DMI-", color=color.red)

// Plotting ADX

plot(adx, title="ADX", color=color.blue)