概述

本策略名为“炫彩闪电”,是一个基于三条移动平均线的趋势跟随策略。它通过计算快线、中线和慢线的交叉来判断价格趋势,并以ATR值设置目标价位和止损价位。

策略原理

该策略使用以下三条移动平均线:

- 13日加权移动平均线,用于判断短期趋势

- 55日指数移动平均线,用于判断中期趋势

- 110日简单移动平均线,用于判断长期趋势

当快线上穿中线,中线上穿慢线时,判断为看多趋势;当快线下穿中线,中线下穿慢线时,判断为空头趋势。

为过滤掉部分噪音交易,策略还设置了多个辅助条件:

- 前5根K线低点都在中线之上

- 前2根K线有低点跌破中线

- 前1根K线收盘价在中线之上

符合这些条件时,会发出做多或做空的信号。每次只持有一个头寸,平仓或止损后才可再次开仓。

目标价位和止损价位根据ATR值的一定倍数设置。

优势分析

该策略具有以下优势:

- 使用三条移动平均线组合判断趋势,避免了单一指标判断失误的概率。

- 设置多个辅助条件过滤噪音交易,可以提高信号质量。

- ATR动态止损,有利于控制单笔亏损。

风险分析

该策略也存在以下风险:

- 移动平均线组合可能发出错误信号,需要充分回测。

- ATR倍数设置不当可能导致止损过于宽松或严格。

- 无法有效过滤突发事件的价格震荡。

为控制风险,建议适当调整移动平均线参数,优化ATR倍数,并设置最大持仓时间,避免单笔损失过大。

优化方向

该策略可从以下方面进行优化:

- 测试不同长度或类型的移动平均线。

- 优化辅助条件的参数。

- 尝试其他指标预测趋势。如MACD,DMI等。

- 结合量能指标如成交量,价差等过滤信号。

总结

本策略“炫彩闪电”整体是一个稳定的趋势跟随策略。它主要依靠移动平均线判断趋势方向,并有一定的技术指标组合作为辅助,可以过滤部分噪音。虽然仍有进一步优化的空间,但整体风险可控,适合跟随中长线趋势进行投资。

策略源码

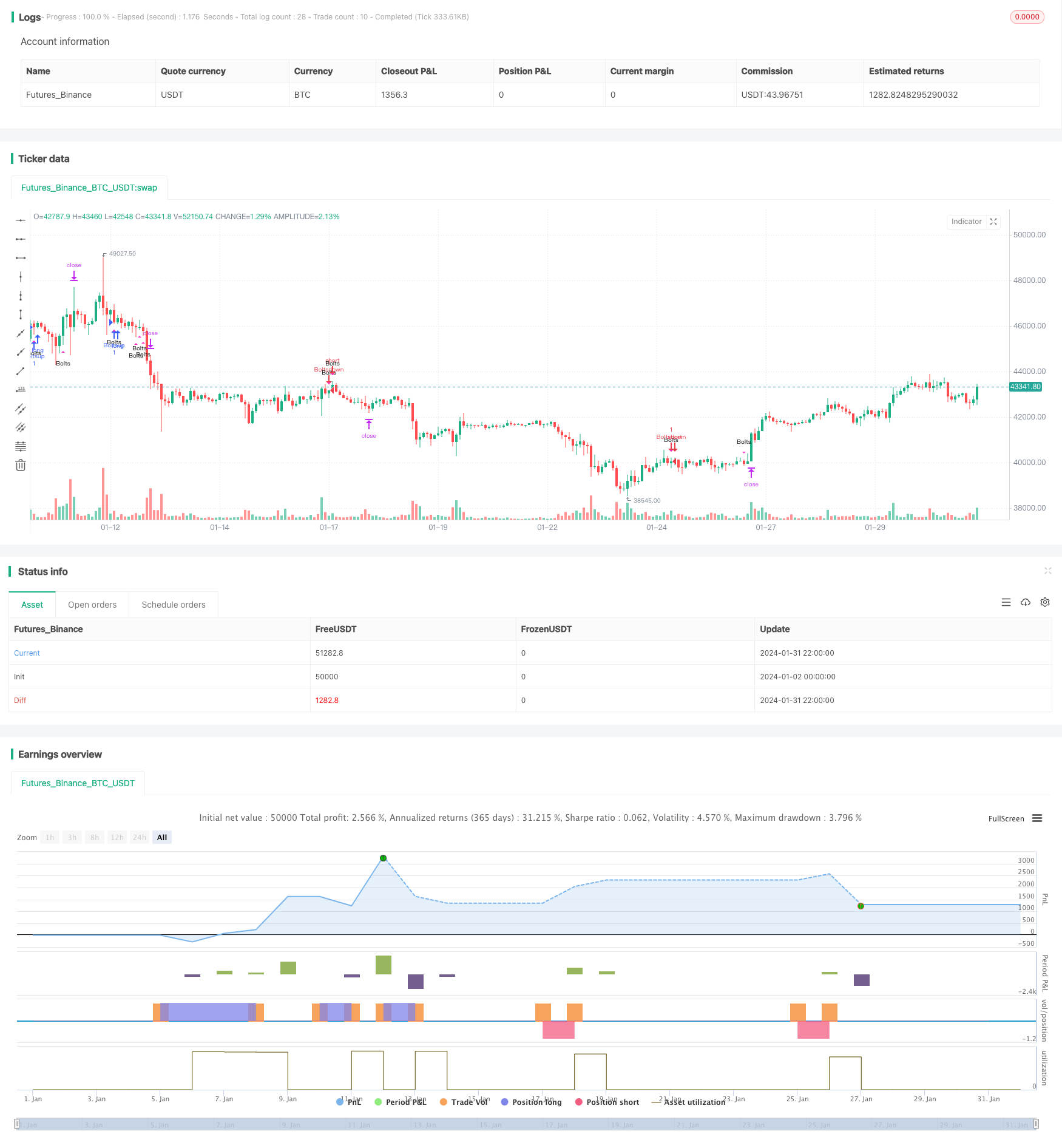

/*backtest

start: 2024-01-02 00:00:00

end: 2024-02-01 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © greenmask9

//@version=4

strategy("Dazzling Bolts", overlay=true)

//max_bars_back=3000

// 13 SMMA

len = input(10, minval=1, title="SMMA Period")

src = input(close, title="Source")

smma = 0.0

smma := na(smma[1]) ? sma(src, len) : (smma[1] * (len - 1) + src) / len

// 55 EMA

emalength = input(55, title="EMA Period")

ema = ema(close, emalength)

// 100 SMA

smalength = input(110, title="SMA Period")

sma = sma(close, smalength)

emaforce = input(title="Force trend with medium EMA", type=input.bool, defval=true)

offsetemavalue = input(defval = 6)

bullbounce = smma>ema and ema>sma and low[5]>ema and low[2]<ema and close[1]>ema and (ema[offsetemavalue]>sma or (not emaforce))

bearbounce = smma<ema and ema<sma and high[5]<ema and high[2]>ema and close[1]<ema and (ema[offsetemavalue]<sma or (not emaforce))

plotshape(bullbounce, title= "Purple", location=location.belowbar, color=#ff33cc, transp=0, style=shape.triangleup, size=size.tiny, text="Bolts")

plotshape(bearbounce, title= "Purple", location=location.abovebar, color=#ff33cc, transp=0, style=shape.triangledown, size=size.tiny, text="Bolts")

strategy.initial_capital = 50000

ordersize=floor(strategy.initial_capital/close)

longs = input(title="Test longs", type=input.bool, defval=true)

shorts = input(title="Test shorts", type=input.bool, defval=true)

atrlength = input(title="ATR length", defval=12)

atrm = input(title="ATR muliplier",type=input.float, defval=2)

atr = atr(atrlength)

target = close + atr*atrm

antitarget = close - (atr*atrm)

//limits and stop do not move, no need to count bars from since

bullbuy = bullbounce and longs and strategy.opentrades==0

bb = barssince(bullbuy)

bearsell = bearbounce and shorts and strategy.opentrades==0

bs = barssince(bearsell)

if (bullbuy)

strategy.entry("Boltsup", strategy.long, ordersize)

strategy.exit ("Bolts.close", from_entry="Boltsup", limit=target, stop=antitarget)

if (crossover(smma, sma))

strategy.close("Boltsup", qty_percent = 100, comment = "Bolts.crossover")

if (bearsell)

strategy.entry("Boltsdown", strategy.short, ordersize)

strategy.exit("Bolts.close", from_entry="Boltsdown", limit=antitarget, stop=target)

if (crossunder(smma, sma))

strategy.close("Boltsdown", qty_percent = 100, comment = "Bolts.crossover")

// if (bb<5)

// bulltarget = line.new(bar_index[bb], target[bb], bar_index[0], target[bb], color=color.blue, width=2)

// bullclose = line.new(bar_index[bb], close[bb], bar_index[0], close[bb], color=color.blue, width=2)

// bullstop = line.new(bar_index[bb], antitarget[bb], bar_index[0], antitarget[bb], color=color.blue, width=2)

// if (bs<5)

// bulltarget = line.new(bar_index[bs], antitarget[bs], bar_index[0], antitarget[bs], color=color.purple, width=2)

// bullclose = line.new(bar_index[bs], close[bs], bar_index[0], close[bs], color=color.purple, width=2)

// bullstop = line.new(bar_index[bs], target[bs], bar_index[0], target[bs], color=color.purple, width=2)