概述

懒熊动量挤压策略是一种结合布林带、Keltner通道和动量指标的量化交易策略。它利用布林带和Keltner通道判断当前市场是否处于挤压状态,然后结合动量指标进行交易信号的产生。

该策略的主要优势是可以自动识别趋势性行情的开始,并配合动量指标判断入场时机。但是也存在一定的风险,需要针对不同品种进行参数优化。

策略原理

懒熊动量挤压策略基于以下三个指标进行判定:

- 布林带(Bollinger Bands):包含中轨、上轨和下轨

- Keltner通道(Keltner Channels):包含中轨、上轨和下轨

- 动量指标(Momentum Indicator):当前价格与n天前价格的差值

当布林带上轨低于Keltner通道上轨,且布林带下轨高于Keltner通道下轨时,我们认为市场处于挤压状态。这通常意味着当前趋势性行情即将开始。

为了确定入场时机,我们利用动量指标判断价格变化的速度。当动量向上突破其平均值时生成买入信号;当动量向下跌破其平均值时生成卖出信号。

策略优势分析

懒熊动量挤压策略的主要优势有:

- 可以自动识别趋势开始的时机,及早入场

- 结合多种指标进行判断,避免假信号

- 兼顾趋势和反转两种交易方式

- 可自定义参数,针对不同品种进行优化

风险分析

懒熊动量挤压策略也存在一定的风险:

- 布林带和Keltner通道发出假信号的概率较大

- 动量指标表现不稳定,可能错过最佳入场点

- 需要对参数进行优化,否则效果不佳

- 效果与交易品种相关性较大

为了降低风险,建议优化布林带和Keltner通道的长度参数,调整止损点位,选择流动性较好的交易品种,同时结合其他指标进行验证。

策略优化方向

为进一步增强懒熊动量挤压策略的效果,主要的优化方向有:

- 测试不同品种和周期的参数组合

- 优化布林带和Keltner通道的长度

- 优化动量指标的长度

- 针对多头和空头制定不同的止损止盈策略

- 增加其他指标进行信号验证

通过多方位测试与优化,可以大幅提升该策略的胜率和盈利能力。

总结

懒熊动量挤压策略整合多种指标判断力强,可以有效识别趋势开始的时机。但也存在一定的风险,需要针对不同交易品种进行参数优化。通过不断测试与优化,该策略可以成为高效的算法交易系统。

策略源码

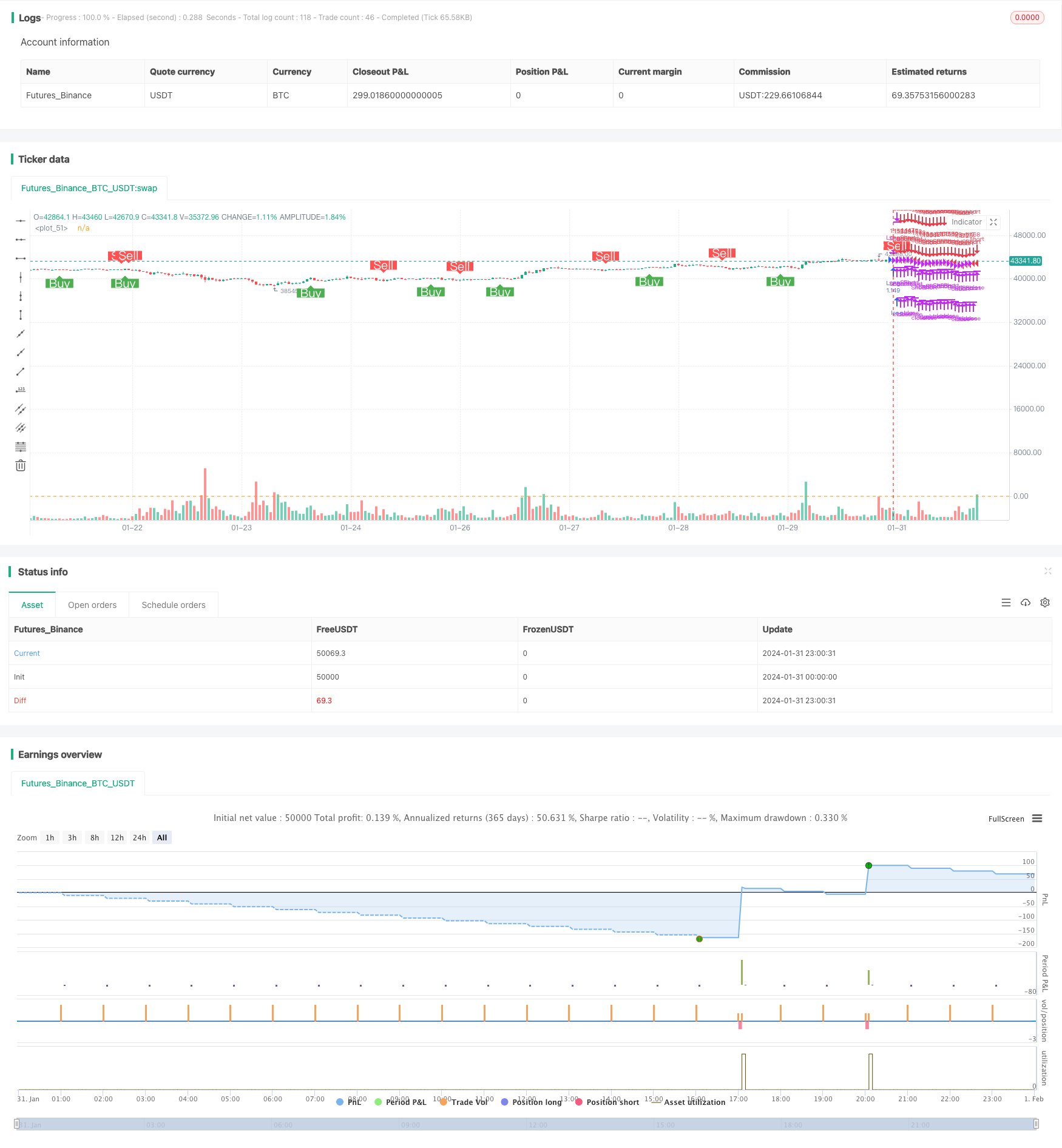

/*backtest

start: 2024-01-31 00:00:00

end: 2024-02-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mtahreemalam original strategy by LazyBear

strategy(title = 'SQM Strategy, TP & SL',

shorttitle = 'Squeeze.M Strat',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 1000,

commission_type=strategy.commission.percent,

commission_value=0.0,

process_orders_on_close=true,

use_bar_magnifier=true)

//Strategy logic

strategy_logic = input.string("Cross above 0", "Strategy Logic", options = ["LazyBear", "Cross above 0"])

// Date Range

testPeriodSwitch = input(false, "Custom Backtesting Date Range",group="Backtesting Date Range")

i_startTime = input(defval = timestamp("01 Jan 2022 00:01 +0000"), title = "Backtesting Start Time",group="Backtesting Date Range")

i_endTime = input(defval = timestamp("31 Dec 2022 23:59 +0000"), title = "Backtesting End Time",group="Backtesting Date Range")

timeCond = true

isPeriod = testPeriodSwitch == true ? timeCond : true

//// Stoploss and Take Profit Parameters

// Enable Long Strategy

enable_long_strategy = input.bool(true, title='Enable Long Strategy', group='SL/TP For Long Strategy', inline='1')

long_stoploss_value = input.float(defval=5, title='Stoploss %', minval=0.1, group='SL/TP For Long Strategy', inline='2')

long_stoploss_percentage = close * (long_stoploss_value / 100) / syminfo.mintick

long_takeprofit_value = input.float(defval=5, title='Take Profit %', minval=0.1, group='SL/TP For Long Strategy', inline='2')

long_takeprofit_percentage = close * (long_takeprofit_value / 100) / syminfo.mintick

// Enable Short Strategy

enable_short_strategy = input.bool(true, title='Enable Short Strategy', group='SL/TP For Short Strategy', inline='3')

short_stoploss_value = input.float(defval=5, title='Stoploss %', minval=0.1, group='SL/TP For Short Strategy', inline='4')

short_stoploss_percentage = close * (short_stoploss_value / 100) / syminfo.mintick

short_takeprofit_value = input.float(defval=5, title='Take Profit %', minval=0.1, group='SL/TP For Short Strategy', inline='4')

short_takeprofit_percentage = close * (short_takeprofit_value / 100) / syminfo.mintick

//// Inputs

//SQUEEZE MOMENTUM STRATEGY

length = input(20, title='BB Length', group = "Squeeze Momentum Settings")

mult = input(2.0, title='BB MultFactor', group = "Squeeze Momentum Settings")

source = close

lengthKC = input(20, title='KC Length', group = "Squeeze Momentum Settings")

multKC = input(1.5, title='KC MultFactor', group = "Squeeze Momentum Settings")

useTrueRange = input(true, title='Use TrueRange (KC)', group = "Squeeze Momentum Settings")

signalPeriod=input(5, title="Signal Length", group = "Squeeze Momentum Settings")

show_labels_sqm = input(title='Show Buy/Sell SQM Labels', defval=true, group = "Squeeze Momentum Settings")

h0 = hline(0)

// Defining MA

ma = ta.sma(source, length)

// Calculate BB

basis = ma

dev = mult * ta.stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.sma(range_1, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

// SqzON | SqzOFF | noSqz

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

// Momentum

val = ta.linreg(source - math.avg(math.avg(ta.highest(high, lengthKC), ta.lowest(low, lengthKC)), ta.sma(close, lengthKC)), lengthKC, 0)

red_line = ta.sma(val,signalPeriod)

blue_line = val

// lqm = if val > 0

// if val > nz(val[1])

// long_sqm_custom

// if val < nz(val[1])

// short_sqm_custom

// Plots

//plot(val, style = plot.style_line, title = "blue line", color= color.blue, linewidth=2)

//plot(ta.sma(val,SignalPeriod), style = plot.style_line, title = "red line",color = color.red, linewidth=2)

//plot(val, color=blue, linewidth=2)

//plot(0, color=color.gray, style=plot.style_cross, linewidth=2)

//plot(red_line, color=red, linewidth=2)

//LOGIC

//momentum filter

//filterMom = useMomAverage ? math.abs(val) > MomentumMin / 100000 ? true : false : true

//}

////SQM Long Short Conditions

//Lazy Bear Buy Sell Condition

// long_sqm_lazy = (blue_line>red_line)

// short_sqm_lazy = (blue_line<red_line)

long_sqm_lazy = ta.crossover(blue_line,red_line)

short_sqm_lazy = ta.crossunder(blue_line,red_line)

//Custom Buy Sell Condition

dir_sqm = val < 0 ? -1 : 1

long_sqm_custom = dir_sqm == 1 //and dir_sqm[1] == -1

short_sqm_custom = dir_sqm == -1 //and dir_sqm[1] == 1

long_sqm = strategy_logic == "LazyBear" ? long_sqm_lazy : long_sqm_custom

short_sqm = strategy_logic == "LazyBear" ? short_sqm_lazy : short_sqm_custom

// Plot Stoploss & Take Profit Levels

long_stoploss_price = strategy.position_avg_price * (1 - long_stoploss_value / 100)

long_takeprofit_price = strategy.position_avg_price * (1 + long_takeprofit_value / 100)

short_stoploss_price = strategy.position_avg_price * (1 + short_stoploss_value / 100)

short_takeprofit_price = strategy.position_avg_price * (1 - short_takeprofit_value / 100)

plot(enable_long_strategy and not enable_short_strategy ? long_stoploss_percentage : na, color=color.red, style=plot.style_linebr, linewidth=2, title='Long SL Level')

plot(enable_long_strategy and not enable_short_strategy ? long_takeprofit_percentage : na, color=color.green, style=plot.style_linebr, linewidth=2, title='Long TP Level')

plot(enable_short_strategy and not enable_long_strategy ? short_stoploss_price : na, color=color.red, style=plot.style_linebr, linewidth=2, title='Short SL Level')

plot(enable_short_strategy and not enable_long_strategy ? short_takeprofit_price : na, color=color.green, style=plot.style_linebr, linewidth=2, title='Short TP Level')

// Long Strategy

if long_sqm and enable_long_strategy == true

strategy.entry('Long', strategy.long)

strategy.exit('Long SL/TP', from_entry='Long', loss=long_stoploss_percentage, profit=long_takeprofit_percentage)

strategy.close('Long', comment = "L. CL")

// Short Strategy

if short_sqm and enable_short_strategy == true

strategy.entry('Short', strategy.short)

strategy.exit('Short SL/TP', from_entry='Short', loss=short_stoploss_percentage, profit=short_takeprofit_percentage)

strategy.close('Short', comment = "S.Cl")

plot_sqm_long = long_sqm and not long_sqm[1]

plot_sqm_short = short_sqm and not short_sqm[1]

plotshape(plot_sqm_long and show_labels_sqm, title='Buy', style=shape.labelup, location=location.belowbar, size=size.normal, text='Buy', textcolor=color.new(color.white, 0), color=color.new(color.green, 0))

plotshape(plot_sqm_short and show_labels_sqm, title='Sell', style=shape.labeldown, location=location.abovebar, size=size.normal, text='Sell', textcolor=color.new(color.white, 0), color=color.new(color.red, 0))

// Date Range EXIT

if (not isPeriod)

strategy.cancel_all()

strategy.close_all()