概述

这个策略的主要思想是基于ATR指标计算出长线和短线的止损位,当价格突破这些止损线时生成交易信号。它同时具有趋势跟踪和震荡捕捉的功能。

策略原理

该策略使用ATR指标的N周期ATR乘以一个系数来计算长短两边的止损线。具体计算公式如下:

长线止损 = 最高价 - ATR * 系数

短线止损 = 最低价 + ATR * 系数

当价格上涨突破长线止损线时做多,当价格下跌突破短线止损线时做空。做多做空后会实时跟踪价格的波动来移动止损线。

这种以ATR波带作为止损位设置的方法,可以在保证止损风险的前提下充分捕捉价格趋势。当价格出现较大幅度的突破时产生信号,可以有效滤除假突破。

优势分析

这种策略最大的优势在于可以自动调整止损位,捕捉价格趋势的同时控制风险。具体优势如下:

基于ATR指标设置浮动止损,可以根据市场波动性调整止损幅度,有效控制单笔损失。

采用突破方式产生信号,可以滤除部分噪音,避免追顶和追底。

实时调整止损线追踪价格波动,防止止损过于宽松,锁定更多盈利。

风险分析

该策略也存在一些风险,主要集中在止损位设置和信号产生方式上。具体风险点如下:

ATR周期和系数不当可能导致止损过宽或过窄。

突破信号方式可能漏掉趋势初期机会。

趋势末期止损追踪可能有所滞后,无法完美退出。

对策主要是调整参数使止损更合理,或者辅助其他指标判断趋势和信号。

优化方向

该策略可以从以下几个方面继续优化:

设置第二层止损,进一步控制风险。

结合其他指标判断趋势,提高信号质量。

添加移动止盈策略,在趋势进一步延续时提高获利。

优化ATR周期和系数参数,使止损更贴近实际价格波动。

总结

这个策略整体来说非常实用,可以自动调整止损位有效控制风险,同时通过趋势跟踪可以获得不错的盈利。我们可以在原有基础上进一步结合其他分析方法来优化和改进策略,使其更稳定和智能。

策略源码

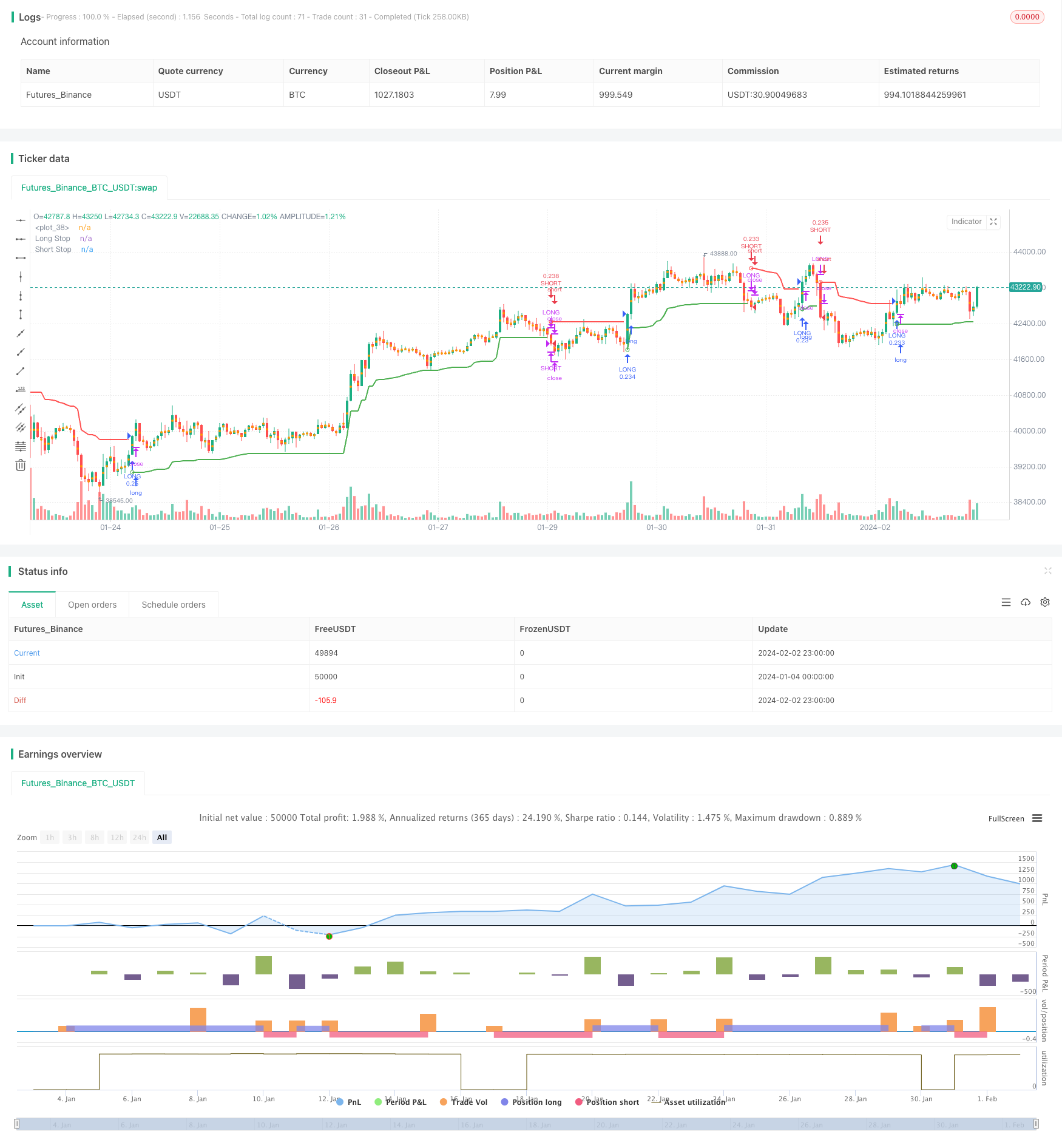

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © melihtuna

//@version=4

strategy("Chandelier Exit - Strategy",shorttitle="CE-STG" , overlay=true, default_qty_type=strategy.cash, default_qty_value=10000, initial_capital=10000, currency=currency.USD, commission_value=0.03, commission_type=strategy.commission.percent)

length = input(title="ATR Period", type=input.integer, defval=22)

mult = input(title="ATR Multiplier", type=input.float, step=0.1, defval=3.0)

showLabels = input(title="Show Buy/Sell Labels ?", type=input.bool, defval=false)

useClose = input(title="Use Close Price for Extremums ?", type=input.bool, defval=true)

highlightState = input(title="Highlight State ?", type=input.bool, defval=true)

atr = mult * atr(length)

longStop = (useClose ? highest(close, length) : highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = (useClose ? lowest(close, length) : lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var color longColor = color.green

var color shortColor = color.red

longStopPlot = plot(dir == 1 ? longStop : na, title="Long Stop", style=plot.style_linebr, linewidth=2, color=longColor)

buySignal = dir == 1 and dir[1] == -1

plotshape(buySignal ? longStop : na, title="Long Stop Start", location=location.absolute, style=shape.circle, size=size.tiny, color=longColor, transp=0)

plotshape(buySignal and showLabels ? longStop : na, title="Buy Label", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=longColor, textcolor=color.white, transp=0)

shortStopPlot = plot(dir == 1 ? na : shortStop, title="Short Stop", style=plot.style_linebr, linewidth=2, color=shortColor)

sellSignal = dir == -1 and dir[1] == 1

plotshape(sellSignal ? shortStop : na, title="Short Stop Start", location=location.absolute, style=shape.circle, size=size.tiny, color=shortColor, transp=0)

plotshape(sellSignal and showLabels ? shortStop : na, title="Sell Label", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=shortColor, textcolor=color.white, transp=0)

midPricePlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0, display=display.none, editable=false)

longFillColor = highlightState ? (dir == 1 ? longColor : na) : na

shortFillColor = highlightState ? (dir == -1 ? shortColor : na) : na

fill(midPricePlot, longStopPlot, title="Long State Filling", color=longFillColor)

fill(midPricePlot, shortStopPlot, title="Short State Filling", color=shortFillColor)

long_short = input(true, "Long-Short",type=input.bool, group="Strategy Settings")

start = input(timestamp("2019-01-01"), "Date", type=input.time, group="Strategy Settings")

finish = input(timestamp("2025-01-01"), "Date", type=input.time, group="Strategy Settings")

window() => true

slRatio=input(5, "Manuel Stop Loss Ratio", type=input.float, minval=0, group="Strategy Settings")

tpRatio=input(20, "Take Profit Ratio", type=input.float, minval=0, group="Strategy Settings")

tsStartRatio=input(10, "Trailing Stop Start Ratio", type=input.float, minval=0, group="Strategy Settings")

tsRatio=input(5, "Trailing Stop Ratio", type=input.float, minval=1, group="Strategy Settings")

lastBuyPrice = strategy.position_avg_price

diffHiPriceRatio = (high-lastBuyPrice)/lastBuyPrice*100

diffLoPriceRatio = (close-lastBuyPrice)/lastBuyPrice*100

posHiRatio=0.0

posHiRatio:= strategy.position_size > 0 ? diffHiPriceRatio > posHiRatio[1] ? diffHiPriceRatio : posHiRatio[1] : 0

s_diffHiPriceRatio = (low-lastBuyPrice)/lastBuyPrice*100

s_diffLoPriceRatio = (close-lastBuyPrice)/lastBuyPrice*100

s_posHiRatio=0.0

s_posHiRatio:= strategy.position_size < 0 ? s_diffLoPriceRatio < s_posHiRatio[1] ? s_diffLoPriceRatio : s_posHiRatio[1] : 0

strategy.entry("LONG", strategy.long, when = window() and buySignal)

strategy.close("LONG", when = window() and sellSignal)

strategy.close("LONG", when = diffLoPriceRatio<(slRatio*(-1)), comment="STOP-LONG")

strategy.close("LONG", when = diffHiPriceRatio>tpRatio, comment="TAKE-PROFIT-LONG")

strategy.close("LONG", when = ((posHiRatio[1]>tsStartRatio) and (posHiRatio[1]-diffHiPriceRatio)>tsRatio), comment="TRAILING-STOP-LONG")

if long_short

strategy.entry("SHORT", strategy.short, when = window() and sellSignal)

strategy.close("SHORT", when = window() and buySignal)

strategy.close("SHORT", when = s_diffLoPriceRatio>(slRatio), comment="STOP-SHORT")

strategy.close("SHORT", when = s_diffHiPriceRatio<(tpRatio*(-1)), comment="TAKE-PROFIT-SHORT")

strategy.close("SHORT", when = ((s_posHiRatio[1]*(-1)>tsStartRatio) and ((s_posHiRatio[1]-s_diffLoPriceRatio))*(-1)>tsRatio), comment="TRAILING-STOP-SHORT")