概述

该策略通过计算MACD指标及其MACD柱状线,检测MACD柱状线与价格走势之间的背离信号,进而产生交易信号。当检测到价格新高但MACD柱状线没有创出新高时,产生看跌背离信号;当检测到价格新低但MACD柱状线没有创出新低时,产生看涨背离信号。结合ATR指标,设置止损位和止盈位,进行趋势跟踪交易。

策略原理

该策略的核心原理是利用MACD指标及其MACD柱状线反映价格趋势变化的特性,检测MACD柱状线与价格之间的背离信号,作为交易信号的触发条件。

具体来说,策略首先计算MACD线、Signal线和MACD柱状线。然后通过定义 fractal 函数,检测 MACD柱状线 的 peak 和 valley,提取局部极大值和极小值点。再结合价格的最高价和最低价,判断 MACD柱状线 与价格之间是否存在背离。

当价格创出新高,但 MACD柱状线没有创出新高时,产生 regulark_bearish_div 看跌背离信号;当价格创出新低,但 MACD柱状线没有创出新低时,产生 regulark_bullish_div 看涨背离信号。

最后,策略在看跌背离和看涨背离信号产生时,分别发出做空和做多指令,并以 ATR 止损、止盈退出仓位。

优势分析

该策略具有以下几个优势:

利用 MACD柱状线与价格之间的背离特征,可提前捕捉到价格趋势的转变。

ATR止损止盈设置合理,可有效控制单笔交易的最大亏损。

采用趋势跟踪方法,可最大限度锁住利润。

参数设置合理,可过滤掉部分噪音交易信号。

策略逻辑清晰易懂,容易实盘验证。

风险分析

该策略也存在一些风险:

MACD背离不一定会带来价格的反转,存在一定的假信号风险。

止损止盈设置不合理可能导致亏损过大或利润太小。

背离信号周期偏短,可能是噪音造成,应适当过滤。

交易品种和参数设置不匹配,也会影响策略效果。

对应解决方法:

适当增大背离长度和背离幅度要求,过滤假信号。

用 ATR 作为止损止盈指标,并调整ATR 倍数,控制单笔交易风险。

针对不同交易品种选取不同参数。进行参数优化,找到最佳参数组合。

优化方向

该策略还可从以下几个方向进行优化:

更复杂的背离确认,如 Volume 背离确认。

优化 MACD 参数,寻找最佳参数组合。

优化 ATR 止损止盈的倍数。

增加机器学习算法,辅助判断背离信号的可靠性。

增加模型预测,判断价格反转概率。

根据市场环境变化,动态调整策略参数。

总结

总的来说,该毕达哥蜡烛图MACD指标背离趋势跟踪策略,利用 MACD柱状线与价格之间的背离特征,实现趋势的捕捉。ATR 止损止盈设置合理,可控制单笔交易风险。该策略逻辑清晰易懂,值得实盘检验。后续可从多方面进行策略优化,以获得更好的效果。

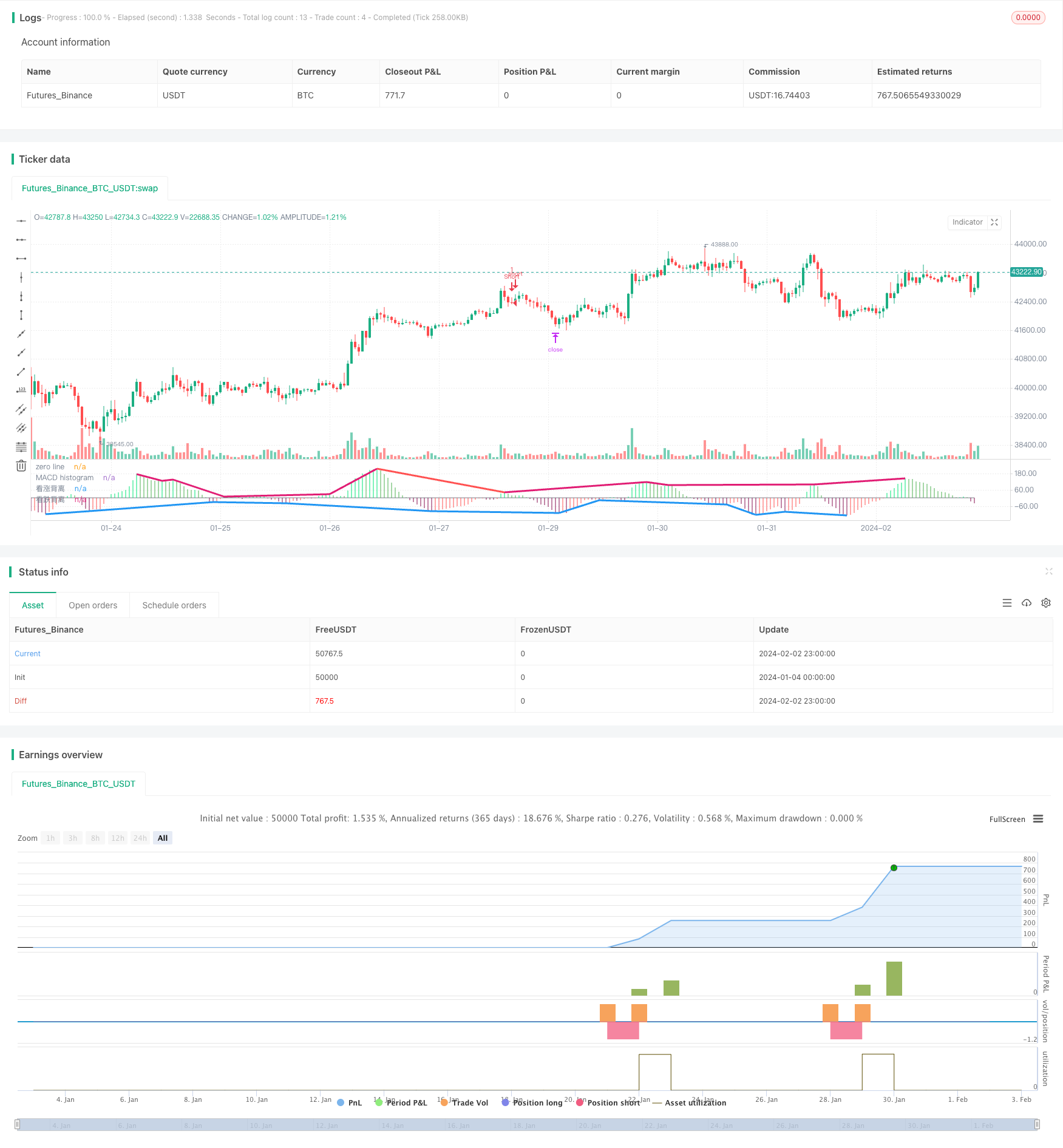

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © bigwin_sun

// copyright: Tradingvue Limited

//@version = 5

strategy(title = "Demigod : CDMA histogram Divergence strategy", shorttitle = "Demigod strategy", overlay = false, pyramiding = 100)

//macd input

fastMA = input.int(13, title = "fast Length", minval = 1, group = "CDMA")

slowMA = input.int(34, title = "slow Length", minval = 1, group = "CDMA")

src = input.source(title = "source", defval = close, group = "CDMA")

signalSmooth = input.int(9, title="ma Length", minval = 1, group = "CDMA")

//Divergenc

divLength = input.int(title = "Divergenc Length", defval = 5, minval = 1, maxval = 50, inline = "ATRLength", group = "Divergence")

divStren = input.float(title="Divergenc Strength", defval = 2, minval = 1.0, maxval = 5.0, inline = "ATRLength", group = "Divergence")

//atr input

atrLength = input.int(13, title = "ATR Length", minval = 1, inline = "ATRLength", group = "ATR")

m = input.float(1.0, "ATR multyple", minval = 0.5, inline = "ATRLength", group = "ATR", step = 0.5)

collong = input.color(color.teal, title = "upper color", inline = "ATR显示", group = "ATR")

colshort = input.color(color.red, title = "under color", inline = "ATR显示", group = "ATR")

// MACD---------------------------------------------------------------------------------------------------------------------------------

DivOffset = -2

macdLine = ta.ema(src, fastMA) - ta.ema(src, slowMA)

signalLine = ta.ema(macdLine, signalSmooth)

histogram = macdLine - signalLine

histogramColor = if histogram > 0

histogram > histogram[1] ? color.lime : color.green

else

histogram < histogram[1] ? color.maroon : color.red

// cdma histogram

plot(histogram, title = "MACD histogram", linewidth = 2, style = plot.style_histogram, color = histogramColor)

plot(0, title = "zero line", linewidth = 1, color = color.gray)

// Divergenc calculation-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

//peak / valley fundation

f_top_fractal(_src)=>_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and _src[2] > _src[0] and _src > 0

f_bot_fractal(_src)=>_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and _src[2] < _src[0] and _src < 0

f_fractalize(_src)=>f_top_fractal(_src) ? 1 : f_bot_fractal(_src) ? -1 : 0

//peak / valley value

fractal_top1 = f_fractalize(histogram) > 0 ? true : false //histogram[2] : na

fractal_bot1 = f_fractalize(histogram) < 0 ? true : false //histogram[2] : na

//previouse peak or valley

high_prev1 = ta.valuewhen(fractal_top1, histogram[2], 0)[2]

high_price1 = ta.valuewhen(fractal_top1, high[2], 0)[2]

low_prev1 = ta.valuewhen(fractal_bot1, histogram[2], 0)[2]

low_price1 = ta.valuewhen(fractal_bot1, low[2], 0)[2]

//Divergenc : cdma histogram against candle value

regular_bearish_div1 = high[2] > high_price1 + divStren and histogram[2] < high_prev1 / divStren and ta.barssince(fractal_top1[1]) > divLength

regular_bullish_div1 = low[2] < low_price1 - divStren and histogram[2] > low_prev1 / divStren and ta.barssince(fractal_bot1[1]) > divLength

//-------------------------cdma Divergenc range------------------------------------------------

//histogramColor

col1 = regular_bearish_div1 ? color.red : na

col2 = regular_bullish_div1 ? #00FF00EB : na

//plot

plot(title='看跌背离', series= fractal_top1 ? histogram[2] : na, color=col1, linewidth=3, offset=DivOffset)

plot(title='看涨背离', series= fractal_bot1 ? histogram[2] : na, color=col2, linewidth=3, offset=DivOffset)

// calculate ATR --------------------------------------------------------------------------------------------------------------------------------------------------

atr = ta.ema(ta.tr(true), atrLength) * m

up = atr + high

dw = low - atr

//stratety : enrty and exit---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

if regular_bearish_div1 and fractal_top1

//if regular_bullish_div1 and fractal_bot1

//label.new(bar_index, histogram[2], text = "Short", textcolor = color.white, color = color.gray, style = label.style_label_lower_left)

strategy.entry("Short", strategy.short, qty = 1)

strategy.exit("exitShort", "Short", stop = up, limit = dw - atr)

if regular_bullish_div1 and fractal_bot1

//if regular_bearish_div1 and fractal_top1

//label.new(bar_index, histogram[2], text = "Long", textcolor = color.white, color = color.fuchsia, style = label.style_label_upper_left)

strategy.entry("Long", strategy.long, qty = 1)

strategy.exit("exitLong", "Long", stop = dw, limit = up + atr)