概述

该策略结合了简单移动平均线(SMA)和滚动线性回归趋势线,设定买入条件是收盘价高于SMA和趋势线时做多, Exit条件是收盘价低于SMA和趋势线时平仓。该策略主要利用了SMA的均线交易信号以及滚动趋势线的支持,在突破上行通道时入场,突破下行通道时出场。

策略原理

该策略主要基于以下几个组件:

SMA: 简单移动平均线,以一定周期(smaPeriod)计算收盘价的平均值作为信号线。

滚动趋势线: 基于线性回归计算一定周期内(window)的最佳拟合直线作为趋势信号。计算方法是最小二乘法。

入场条件: 当收盘价高于SMA均线和滚动趋势线时,做多入场。

出场条件: 当收盘价低于SMA均线和滚动趋势线时,平仓出场。

这样,该策略主要依赖均线交易信号突破入场,以及通道突破出场。利用了移动平均线的均值回归特性以及线性回归通道的均值支持,实现了趋势跟踪突破操作。

策略优势分析

该策略集成了均线和趋势线双重过滤,可以有效减少假突破操作。同时,滚动趋势线提供了更准确的通道支撑,使交易决策更加可靠。主要优势如下:

- 双重过滤机制,避免假突破,提高决策准确性。

- 滚动趋势线提供动态通道,支持更精确的通道交易。

- 简单直观的交易逻辑,容易理解和实现。

- 可自定义参数,适应不同市场环境。

风险分析

该策略也存在一些风险,主要集中在以下几点:

- SMA和趋势线参数设置不当,可能导致错失交易机会或假突破过多。

- 大幅震荡市场中,SMA和趋势线QIAN提供的通道支持会减弱。

- 突破失败可能造成亏损,需要严格止损。

针对这些风险,可以从以下几点着手优化:

- 优化参数,不同品种可以设置不同参数组合。

- 加大止损幅度,降低单笔损失。

- 在震荡行情中暂停交易,避免被套。

策略优化方向

该策略可以从以下几个维度进行优化:

增加动态调整SMA周期和滑点参数的功能。在不同市场环境中自动优化参数。

增加弹性止损机制。当价格突破趋势线一定比例时止损。

结合其它指标过滤信号。例如量能指标,强弱指标等。提高决策准确性。

开发反转版本。在价格接近底部,并突破下行通道时做多。

总结

该策略整合了移动平均线交易信号和滚动趋势线通道支持,实现了趋势跟踪操作。双重过滤机制降低了假突破概率,提高了决策质量。简单参数设定,逻辑清晰,易于实施和优化调整。整体而言,该策略形成了一套可靠、简单、直观的趋势突破交易体系。

策略源码

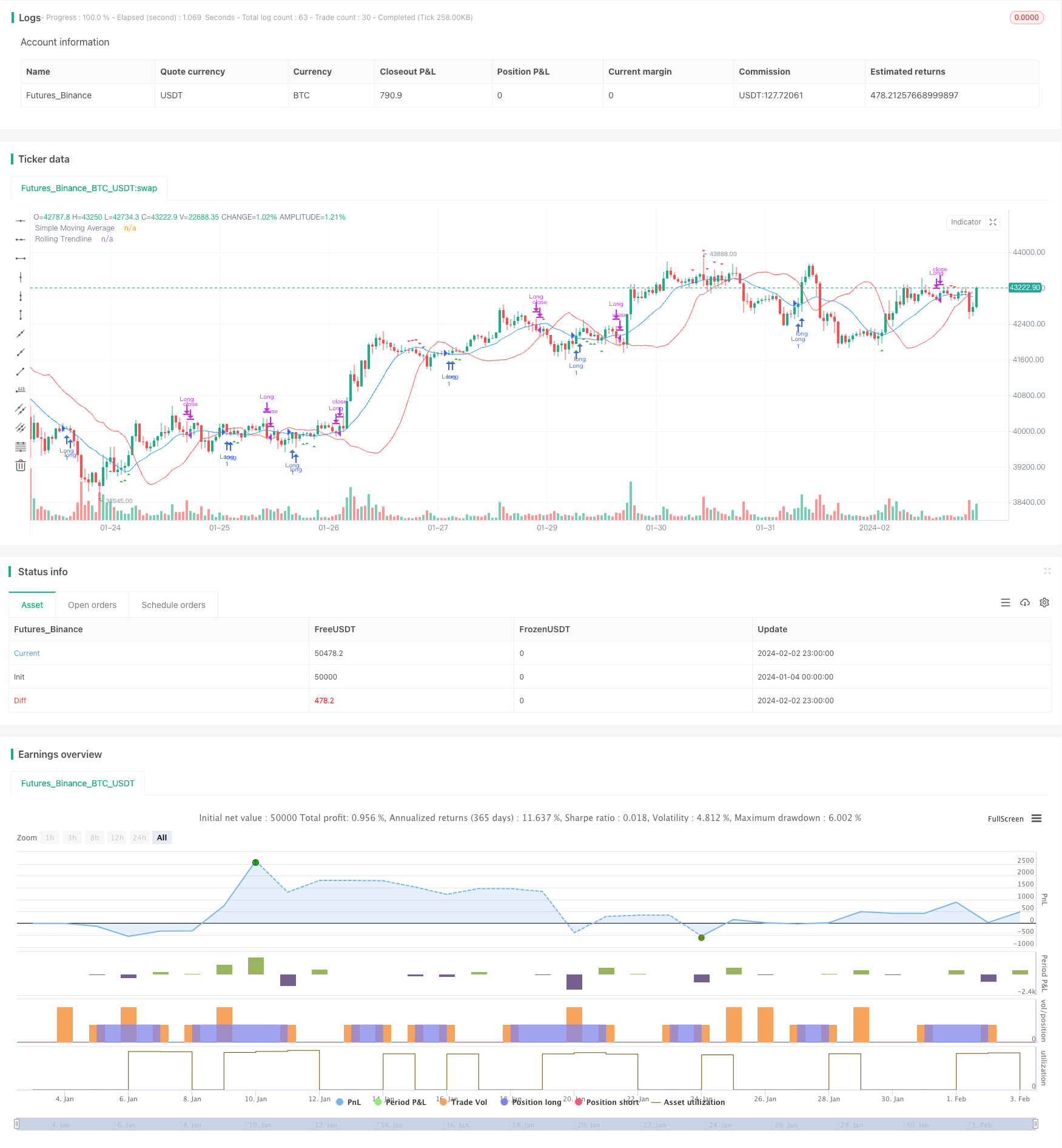

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SMA Strategy with Rolling Trendline", overlay=true)

// Input parameters

smaPeriod = input(14, title="SMA Period")

window = input(20, title="Trendline Window")

startDate = input(timestamp("2023-01-01"), title="Start Date")

endDate = input(timestamp("2023-12-31"), title="End Date")

// Calculating SMA

sma = sma(close, smaPeriod)

// Function to calculate linear regression trendline for a window

linreg_trendline(window) =>

sumX = 0.0

sumY = 0.0

sumXY = 0.0

sumX2 = 0.0

for i = 0 to window - 1

sumX := sumX + i

sumY := sumY + close[i]

sumXY := sumXY + i * close[i]

sumX2 := sumX2 + i * i

slope = (window * sumXY - sumX * sumY) / (window * sumX2 - sumX * sumX)

intercept = (sumY - slope * sumX) / window

slope * (window - 1) + intercept

// Calculating the trendline

trendline = linreg_trendline(window)

// Entry and Exit Conditions

longCondition = close > sma and close < trendline

exitLongCondition = close < sma and close > trendline

// Strategy logic

if (true)

if (longCondition)

strategy.entry("Long", strategy.long)

if (exitLongCondition)

strategy.close("Long")

// Plotting

plot(sma, title="Simple Moving Average", color=color.blue)

plot(trendline, title="Rolling Trendline", color=color.red)

plotshape(series=longCondition, title="Enter Trade", location=location.belowbar, color=color.green, style=shape.triangleup)

plotshape(series=exitLongCondition, title="Exit Trade", location=location.abovebar, color=color.red, style=shape.triangledown)