概述

该策略融合了Renko图和相对活力指数(RVI)两个指标,目标是捕捉市场主要趋势的大部分行情。适用于比特币、恒指等主流品种。

策略原理

策略使用9期ATR构建Renko砖,当收盘价格超过上一Renko砖高点时构建新砖,颜色为绿色;当收盘价格低于上一Renko砖低点时构建新砖,颜色为红色。结合RVI指标判定趋势方向。

RVI指标用于判断多头力量和空头力量的相对强度。RVI数值在0-1之间波动,高于0.5代表多头力量强于空头;低于0.5代表空头力量强于多头。当RVI上穿其平滑移动平均线时,代表空头力量减弱,多头力量增强,给出做多信号;当RVI下穿其平滑移动平均线时,代表多头力量减弱,空头力量增强,给出做空信号。

综合Renko砖方向和RVI指标的做多做空信号,进入相应的多头或空头仓位。

策略优势

- Renko砖隔离正常的市场波动,只关注更大幅度的价格变动,避免被套。

- RVI指标判断趋势发生反转的时机,进一步锁定交易信号。

- 结合两种指标进行过滤,可有效抓住市场主要趋势,过滤掉部分噪音。

风险分析

- Renko砖的大小直接影响交易频率,砖太大会错过机会,砖太小则会增加交易频率和手续费。

- RVI指标参数设置不当也会导致错过信号或增大假信号。

- 双重指标过滤会错过一定信号,无法抓住全部行情。

优化方向

- 动态优化Renko砖大小,让其自适应市场波动率。

- 优化RVI指标参数,寻找最佳平衡点。

- 尝试不同品种和周期参数组合,评估稳定性。

总结

该策略综合了两种不同类型指标的优点,目标是抓住市场主流趋势。通过对Renko和RVI参数的优化,可以获得更高的稳定性。但任何模型都无法完美,错过一定信号在所难免,关键是要把握主要方向。使用者需要清楚评估自身的风险偏好,选择适合自己的品种和参数。

策略源码

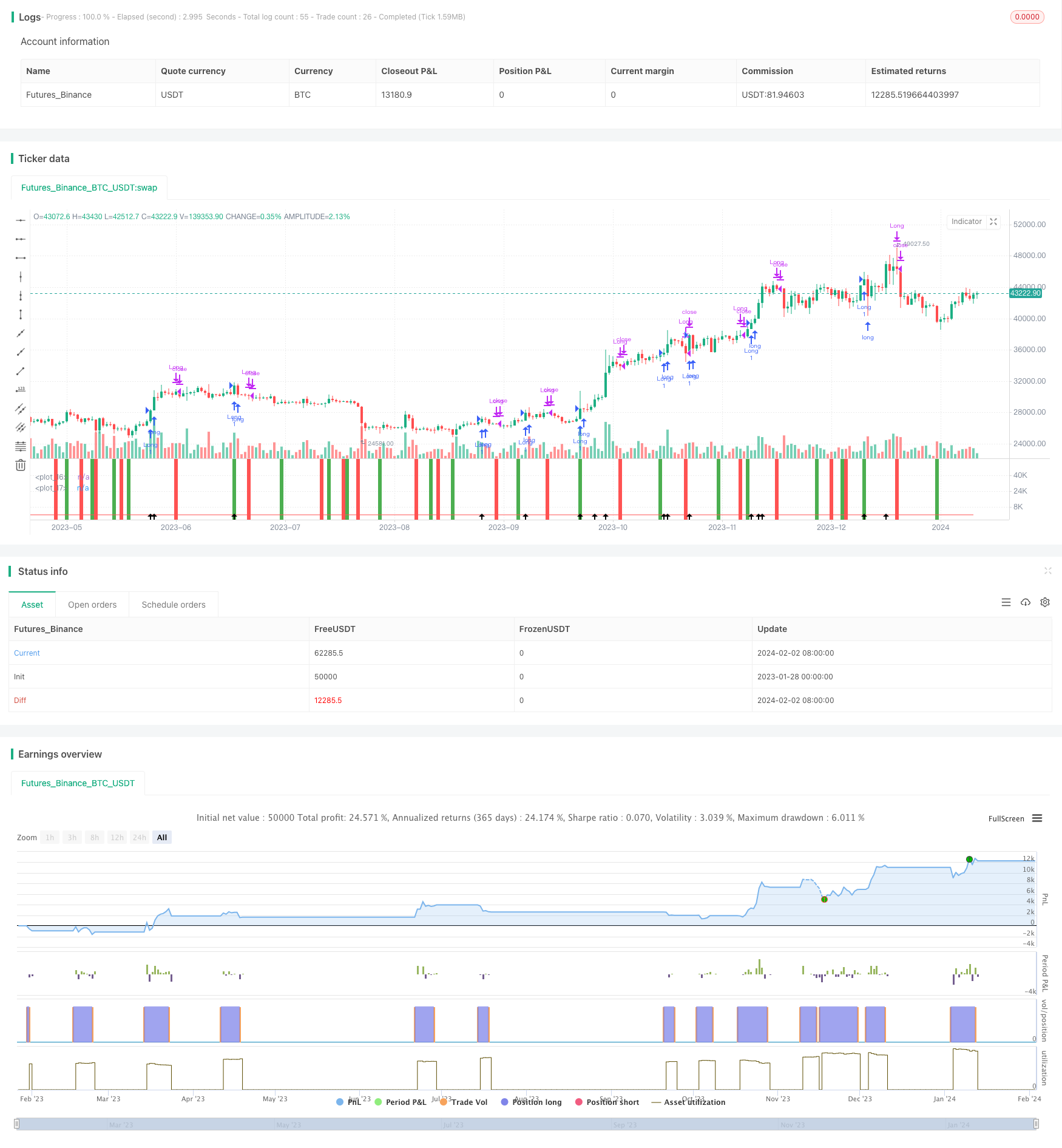

/*backtest

start: 2023-01-28 00:00:00

end: 2024-02-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Lancelot RR Strategy", overlay=false)

p=9

CO=close-open

HL=high-low

value1 = (CO + 2*CO[1] + 2*CO[2] + CO[3])/6

value2 = (HL + 2*HL[1] + 2*HL[2] + HL[3])/6

num=sum(value1,p)

denom=sum(value2,p)

RVI=denom!=0?num/denom:0

RVIsig=(RVI+ 2*RVI[1] + 2*RVI[2] + RVI[3])/6

rvicloselongcondition = crossunder(RVI, RVIsig)

rvicloseshortcondition = crossover(RVI, RVIsig)

plot(RVI,color=green,style=line,linewidth=1)

plot(RVIsig,color=red,style=line,linewidth=1)

bgcolor(rvicloseshortcondition ? green : na, transp = 75)

bgcolor(rvicloselongcondition ? red : na, transp = 75)

///Renko///

TF = input(title='TimeFrame', defval="D")

ATRlength = input(title="ATR length", defval=9, minval=2, maxval=100)

SMAlength = input(title="SMA length", defval=5, minval=2, maxval=100)

SMACurTFlength = input(title="SMA CurTF length", defval=20, minval=2, maxval=100)

HIGH = request.security(syminfo.tickerid, TF, high)

LOW = request.security(syminfo.tickerid, TF, low)

CLOSE = request.security(syminfo.tickerid, TF, close)

ATR = request.security(syminfo.tickerid, TF, atr(ATRlength))

SMA = request.security(syminfo.tickerid, TF, sma(close, SMAlength))

SMACurTF = sma(close, SMACurTFlength)

RENKOUP = na

RENKODN = na

H = na

COLOR = na

BUY = na

SELL = na

UP = na

DN = na

CHANGE = na

RENKOUP := na(RENKOUP[1]) ? ((HIGH+LOW)/2)+(ATR/2) : RENKOUP[1]

RENKODN := na(RENKOUP[1]) ? ((HIGH+LOW)/2)-(ATR/2) : RENKODN[1]

H := na(RENKOUP[1]) or na(RENKODN[1]) ? RENKOUP-RENKODN : RENKOUP[1]-RENKODN[1]

COLOR := na(COLOR[1]) ? white : COLOR[1]

BUY := na(BUY[1]) ? 0 : BUY[1]

SELL := na(SELL[1]) ? 0 : SELL[1]

UP := false

DN := false

CHANGE := false

if(not CHANGE and close >= RENKOUP[1]+H*3)

CHANGE := true

UP := true

RENKOUP := RENKOUP[1]+ATR*3

RENKODN := RENKOUP[1]+ATR*2

COLOR := lime

SELL := 0

BUY := BUY+3

if(not CHANGE and close >= RENKOUP[1]+H*2)

CHANGE := true

UP := true

RENKOUP := RENKOUP[1]+ATR*2

RENKODN := RENKOUP[1]+ATR

COLOR := lime

SELL := 0

BUY := BUY+2

if(not CHANGE and close >= RENKOUP[1]+H)

CHANGE := true

UP := true

RENKOUP := RENKOUP[1]+ATR

RENKODN := RENKOUP[1]

COLOR := lime

SELL := 0

BUY := BUY+1

if(not CHANGE and close <= RENKODN[1]-H*3)

CHANGE := true

DN := true

RENKODN := RENKODN[1]-ATR*3

RENKOUP := RENKODN[1]-ATR*2

COLOR := red

BUY := 0

SELL := SELL+3

if(not CHANGE and close <= RENKODN[1]-H*2)

CHANGE := true

DN := true

RENKODN := RENKODN[1]-ATR*2

RENKOUP := RENKODN[1]-ATR

COLOR := red

BUY := 0

SELL := SELL+2

if(not CHANGE and close <= RENKODN[1]-H)

CHANGE := true

DN := true

RENKODN := RENKODN[1]-ATR

RENKOUP := RENKODN[1]

COLOR := red

BUY := 0

SELL := SELL+1

plotshape(UP, style=shape.arrowup, location=location.bottom, size=size.normal)

renkolongcondition = UP

renkoshortcondition = DN

///Long Entry///

longcondition = UP

if (longcondition)

strategy.entry("Long", strategy.long)

///Long exit///

closeconditionlong = rvicloselongcondition

if (closeconditionlong)

strategy.close("Long")