概述

该策略融合了超趋动指标和艾略特波浪理论,构建了一个稳健的技术交易工具。它采用多层次的趋势分析来提供更全面的市场视角,可以 Early Capture 市场的潜在趋势反转和重要的价格变动。

策略原理

核心思想在于其多层次的方法:

- 采用 4 个超趋动指标,每个指标使用不同的 ATR 长度和乘数,从短期到长期对趋势进行判断

- 通过指标的融合,可以找出稳健的做多做空信号

- 参考艾略特波浪的模式识别方法,识别类似的市场行为模式,确认交易信号

这样,既利用了多个指标,又增加了模式识别,使策略更稳健。

优势分析

- 多指标设计,提供全方位判断

- 波浪理论启发,模式识别增加稳定性

- 实时调整方向,适应市场变化

- 参数可配置,适用于不同品种和时间周期

风险分析

- 参数设置依赖经验,需要调整确定最佳参数组合

- 多指标设计较复杂,增加计算负载

- 无法完全回避错误信号的产生

可以通过参数优化,逐步确定最优参数;采用云计算提高计算性能;设置止损以控制风险。

优化方向

可以从以下几个方面进行优化:

- 增加自适应参数调整模块,根据市场情况动态调整参数

- 增加机器学习模型,辅助判断交易信号可靠性

- 结合情绪指标、新闻事件等外部因素判断市场模式

- 支持多品种参数模板,减少测试工作量

这将使策略参数更加智能化,判断更加准确,实际应用更加方便。

总结

该策略综合考虑了趋势、模式两个维度,既保证判断的稳健性,又增加策略的灵活性。多指标和参数设置保证了全市场适用性。如果进一步引入智能化、自动化的方法,将大大增强策略的实战水平。它为技术交易的发展提供了有益的启发和借鉴。

策略源码

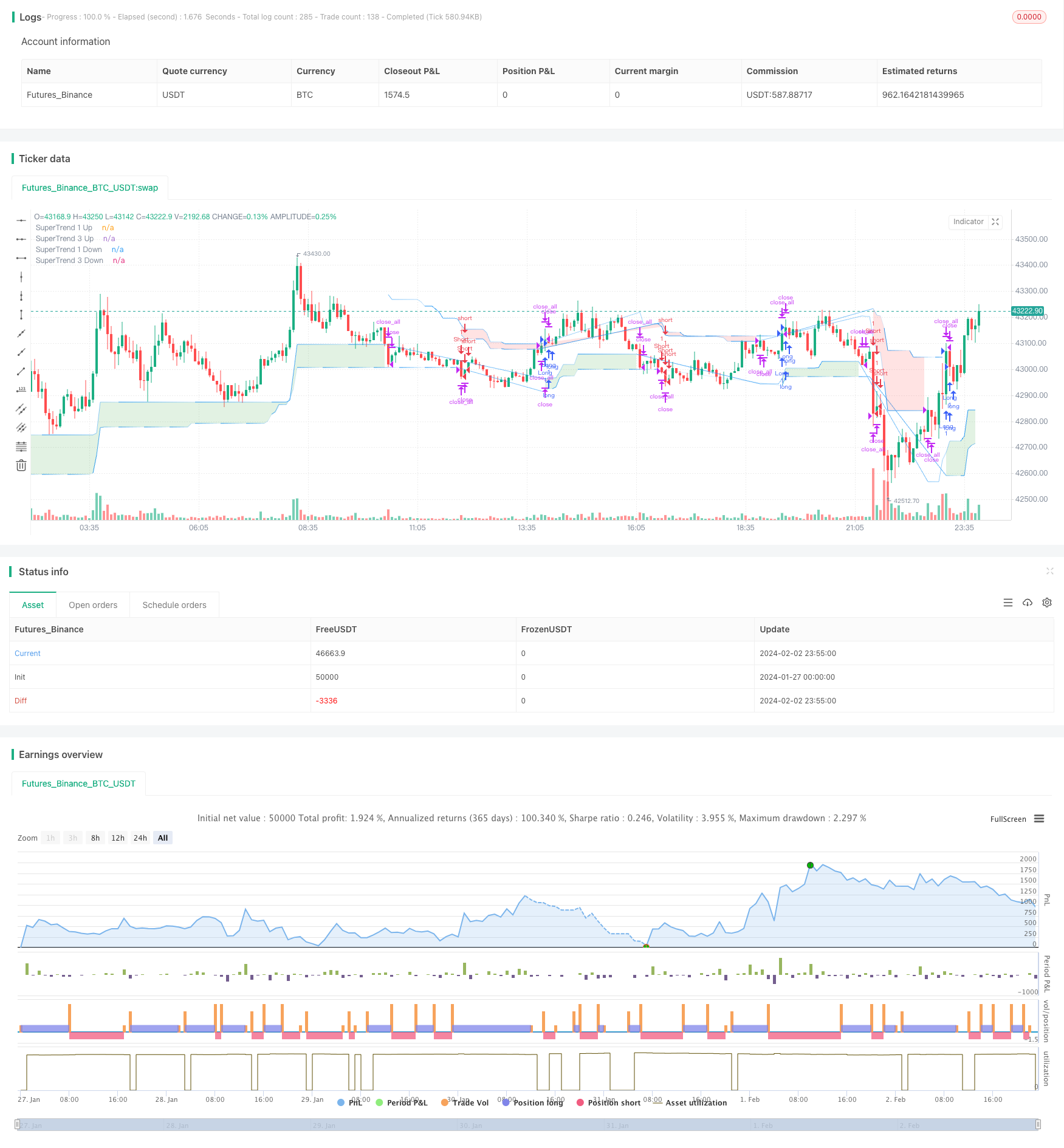

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-03 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Elliott's Quadratic Momentum - Strategy [presentTrading]",shorttitle = "EQM Strategy [presentTrading]", overlay=true )

// Inputs for selecting trading direction

tradingDirection = input.string("Both", "Select Trading Direction", options=["Long", "Short", "Both"])

// SuperTrend Function

supertrend(src, atrLength, multiplier) =>

atr = ta.atr(atrLength)

up = hl2 - (multiplier * atr)

dn = hl2 + (multiplier * atr)

trend = 1

trend := nz(trend[1], 1)

up := src > nz(up[1], 0) and src[1] > nz(up[1], 0) ? math.max(up, nz(up[1], 0)) : up

dn := src < nz(dn[1], 0) and src[1] < nz(dn[1], 0) ? math.min(dn, nz(dn[1], 0)) : dn

trend := src > nz(dn[1], 0) ? 1 : src < nz(up[1], 0)? -1 : nz(trend[1], 1)

[up, dn, trend]

// Inputs for SuperTrend settings

atrLength1 = input(7, title="ATR Length for SuperTrend 1")

multiplier1 = input(4.0, title="Multiplier for SuperTrend 1")

atrLength2 = input(14, title="ATR Length for SuperTrend 2")

multiplier2 = input(3.618, title="Multiplier for SuperTrend 2")

atrLength3 = input(21, title="ATR Length for SuperTrend 3")

multiplier3 = input(3.5, title="Multiplier for SuperTrend 3")

atrLength4 = input(28, title="ATR Length for SuperTrend 3")

multiplier4 = input(3.382, title="Multiplier for SuperTrend 3")

// Calculate SuperTrend

[up1, dn1, trend1] = supertrend(close, atrLength1, multiplier1)

[up2, dn2, trend2] = supertrend(close, atrLength2, multiplier2)

[up3, dn3, trend3] = supertrend(close, atrLength3, multiplier3)

[up4, dn4, trend4] = supertrend(close, atrLength4, multiplier4)

// Entry Conditions based on SuperTrend and Elliott Wave-like patterns

longCondition = trend1 == 1 and trend2 == 1 and trend3 == 1 and trend4 == 1

shortCondition = trend1 == -1 and trend2 == -1 and trend3 == -1 and trend4 == - 1

// Strategy Entry logic based on selected trading direction

if tradingDirection == "Long" or tradingDirection == "Both"

if longCondition

strategy.entry("Long", strategy.long)

// [Any additional logic for long entry]

if tradingDirection == "Short" or tradingDirection == "Both"

if shortCondition

strategy.entry("Short", strategy.short)

// [Any additional logic for short entry]

// Exit conditions - Define your own exit strategy

// Example: Exit when any SuperTrend flips

if trend1 != trend1[1] or trend2 != trend2[1] or trend3 != trend3[1] or trend4 != trend4[1]

strategy.close_all()

// Function to apply gradient effect

gradientColor(baseColor, length, currentBar) =>

var color res = color.new(baseColor, 100)

if currentBar <= length

res := color.new(baseColor, int(100 * currentBar / length))

res

// Apply gradient effect

color1 = gradientColor(color.blue, atrLength1, bar_index % atrLength1)

color4 = gradientColor(color.blue, atrLength4, bar_index % atrLength3)

// Plot SuperTrend with gradient for upward trend

plot1Up = plot(trend1 == 1 ? up1 : na, color=color1, linewidth=1, title="SuperTrend 1 Up")

plot4Up = plot(trend4 == 1 ? up4 : na, color=color4, linewidth=1, title="SuperTrend 3 Up")

// Plot SuperTrend with gradient for downward trend

plot1Down = plot(trend1 == -1 ? dn1 : na, color=color1, linewidth=1, title="SuperTrend 1 Down")

plot4Down = plot(trend4 == -1 ? dn4 : na, color=color4, linewidth=1, title="SuperTrend 3 Down")

// Filling the area between the first and third SuperTrend lines for upward trend

fill(plot1Up, plot4Up, color=color.new(color.green, 80), title="SuperTrend Upward Band")

// Filling the area between the first and third SuperTrend lines for downward trend

fill(plot1Down, plot4Down, color=color.new(color.red, 80), title="SuperTrend Downward Band")