概述

该策略是一种双重策略,结合了反转趋势捕捉策略和动态止损策略,目的是在捕捉反转趋势的同时设置动态止损来控制风险。

策略原理

反转趋势捕捉策略

该策略基于随机指标K值和D值。当价格连续两天下跌,同时K值上升超过D值时生成买入信号;当价格连续两天上涨,同时K值下降低于D值时生成卖出信号。这样可以捕捉价格反转的趋势。

动态止损策略

该策略基于价格波动性和偏度设置动态止损位。它计算最近一段时间内价格高点和低点的波动情况,再结合偏度判断目前是在上行通道还是下行通道,从而动态设置止损价格。这样可以根据市场环境调整止损位置。

两种策略结合使用,在捕捉反转信号的同时设置动态止损来控制风险。

优势分析

- 能够捕捉价格反转点,适合反转交易

- 设置动态止损,能根据市场环境调整止损位置

- 双重信号确认,避免假信号

- 控制风险,保证盈利

风险分析

- 反转失败风险。价格反转信号可能失败

- 参数设置风险。参数设置不当可能影响策略效果

- 流动性风险。某些交易品种流动性差,无法止损

可以通过优化参数、严格止损、选择流动性好的品种来控制风险。

优化方向

- 优化随机指标参数,寻找最佳参数组合

- 优化止损参数,找到最佳的止损位置

- 增加过滤条件,避免在震荡市场开仓

- 增加仓位管理模块,控制最大损失

通过综合优化,使策略在控制风险的前提下尽可能捕捉反转趋势。

总结

该策略结合反转趋势捕捉和动态止损双重策略,既能捕捉价格反转点,又能设置动态止损控制风险,是一种相对稳定的短线交易策略。通过持续优化监控,该策略有望获取稳定收益。

策略源码

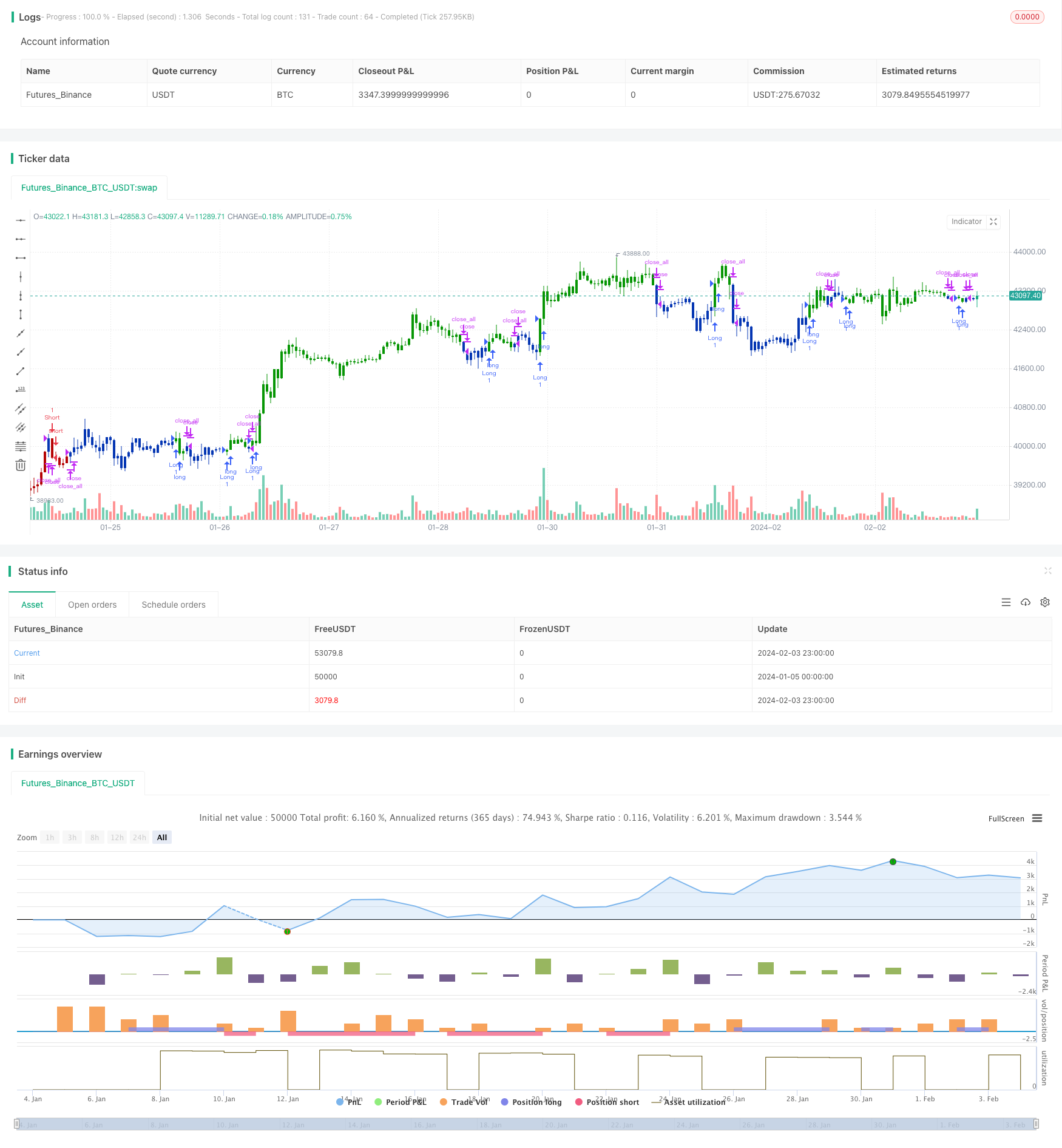

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 07/12/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Kase Dev Stops system finds the optimal statistical balance between letting profits run,

// while cutting losses. Kase DevStop seeks an ideal stop level by accounting for volatility (risk),

// the variance in volatility (the change in volatility from bar to bar), and volatility skew

// (the propensity for volatility to occasionally spike incorrectly).

// Kase Dev Stops are set at points at which there is an increasing probability of reversal against

// the trend being statistically significant based on the log normal shape of the range curve.

// Setting stops will help you take as much risk as necessary to stay in a good position, but not more.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

KaseDevStops(Length, Level) =>

pos = 0.0

RWH = (high - low[Length]) / (atr(Length) * sqrt(Length))

RWL = (high[Length] - low) / (atr(Length) * sqrt(Length))

Pk = wma((RWH-RWL),3)

AVTR = sma(highest(high,2) - lowest(low,2), 20)

SD = stdev(highest(high,2) - lowest(low,2),20)

Val4 = iff(Pk>0, highest(high-AVTR-3*SD,20), lowest(low+AVTR+3*SD,20))

Val3 = iff(Pk>0, highest(high-AVTR-2*SD,20), lowest(low+AVTR+2*SD,20))

Val2 = iff(Pk>0, highest(high-AVTR-SD,20), lowest(low+AVTR+SD,20))

Val1 = iff(Pk>0, highest(high-AVTR,20), lowest(low+AVTR,20))

ResPrice = iff(Level == 4, Val4,

iff(Level == 3, Val3,

iff(Level == 2, Val2,

iff(Level == 1, Val1, Val4))))

pos := iff(close < ResPrice , -1, 1)

pos

strategy(title="Combo Backtest 123 Reversal & Kase Dev Stops", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthKDS = input(30, minval=2, maxval = 100)

LevelKDS = input(title="Trade From Level", defval=4, options=[1, 2, 3, 4])

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posKaseDevStops = KaseDevStops(LengthKDS, LevelKDS)

pos = iff(posReversal123 == 1 and posKaseDevStops == 1 , 1,

iff(posReversal123 == -1 and posKaseDevStops == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )