概述

动态移平均交叉组合策略(Dynamic Moving Average Crossover Combo Strategy)是一个集成了多个技术指标和市场阶段检测的复合交易策略。它动态计算市场的波动性,根据价格与长期移动平均线的距离和波动性判断市场的三个阶段:震荡、趋势和整理。在不同市场阶段,策略采用不同的入市出场规则,同时结合EMA/SMA交叉、MACD和Bollinger Bands等多个指标发出买入和卖出信号。

策略原理

计算市场波动性

使用ATR(平均真实波动幅度)指标计算最近14天的市场日内波动性。然后用100日简单移动平均线滤波,得到平均波动性。

判断市场阶段

计算价格相对200日简单移动平均线的距离。如果距离超过平均波动性的1.5倍,且方向明确,则判断为趋势行情。如果当前波动性超过平均波动性的1.5倍,则判断为震荡行情。

EMA/SMA交叉

快速EMA周期为10天,慢速SMA周期为30天。当快速EMA上穿慢速SMA时,产生买入信号。

MACD

计算12、26、9参数MACD。当MACD柱变为正值时产生买入信号。

Bollinger Bands

计算20日内的标准差Channel。如果Channel宽度小于自身的20日SMA,则判断为整理期。

入场规则

震荡期:快慢线交叉或MACD柱变正,且收盘价在Bollinger Bands内,则入场做多。

趋势期:快慢线交叉或MACD柱变正则入场做多。

整理期:快慢线交叉,且收盘价高于Lower Band则入场做多。

出场规则

满足以下条件则出场平仓:MACD连续两根K线为负,且收盘价连续两日下跌。

震荡期:另外当StockRSI进入超买区则出场。

整理期:另外当价格低于Upper Band则出场。

优势分析

这是一个结合市场环境判断的智能交易策略,具有以下优势:

系统化操作,减少主观干预。

结合市场环境调整策略参数,更具适应性。

多指标组合,增加信号确定性。

Bollinger Bands自动止损,降低风险。

全方位条件判断,过滤假信号。

动态止损止盈,追踪趋势获利。

风险分析

主要风险如下:

参数设置不当可能导致策略失效。建议优化参数组合。

突发事件造成模型失效。建议及时更新策略逻辑。

交易费用压缩获利空间。建议选择低手续费券商。

多指标组合提高策略复杂度。建议选择核心指标。

优化方向

可以从以下几个维度继续优化:

优化市场环境判断标准,提高准确率。

增加机器学习模块,实现参数自适应。

结合文本处理判断重大事件风险。

多市场回测,寻找最佳组合参数。

增加止盈的 trailing stop 策略。

总结

动态移平均交叉组合策略是一个多指标智能交易策略。它能够结合市场环境调整参数,实现条件判断式的系统化交易。具有较强的适应性和确定性。但参数设置和新增模块都需要谨慎,避免增加策略复杂性。整体而言,这是一个可行性较强的量化策略思路。

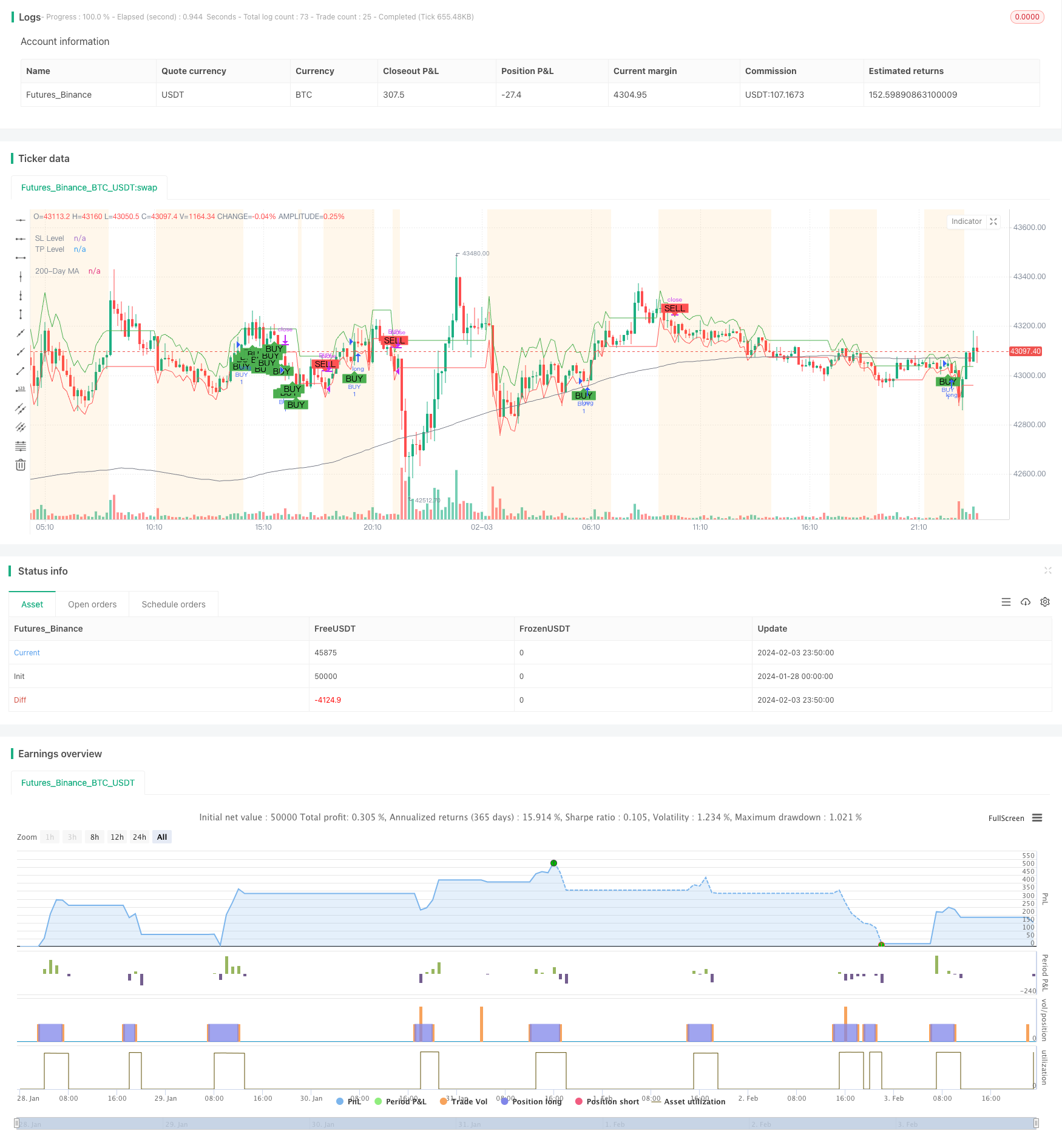

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Custom Strategy", shorttitle="ICS", overlay=true)

// Volatility

volatility = ta.atr(14)

avg_volatility_sma = ta.sma(volatility, 100)

avg_volatility = na(avg_volatility_sma) ? 0 : avg_volatility_sma

// Market Phase detection

long_term_ma = ta.sma(close, 200)

distance_from_long_term_ma = close - long_term_ma

var bool isTrending = math.abs(distance_from_long_term_ma) > 1.5 * avg_volatility and not na(distance_from_long_term_ma)

var bool isVolatile = volatility > 1.5 * avg_volatility

// EMA/MA Crossover

fast_length = 10

slow_length = 30

fast_ma = ta.ema(close, fast_length)

slow_ma = ta.sma(close, slow_length)

crossover_signal = ta.crossover(fast_ma, slow_ma)

// MACD

[macdLine, signalLine, macdHistogram] = ta.macd(close, 12, 26, 9)

macd_signal = crossover_signal or (macdHistogram > 0)

// Bollinger Bands

source = close

basis = ta.sma(source, 20)

upper = basis + 2 * ta.stdev(source, 20)

lower = basis - 2 * ta.stdev(source, 20)

isConsolidating = (upper - lower) < ta.sma(upper - lower, 20)

// StockRSI

length = 14

K = 100 * (close - ta.lowest(close, length)) / (ta.highest(close, length) - ta.lowest(close, length))

D = ta.sma(K, 3)

overbought = 75

oversold = 25

var float potential_SL = na

var float potential_TP = na

var bool buy_condition = na

var bool sell_condition = na

// Buy and Sell Control Variables

var bool hasBought = false

var bool hasSold = true

// Previous values tracking

prev_macdHistogram = macdHistogram[1]

prev_close = close[1]

// Modify sell_condition with the new criteria

if isVolatile

buy_condition := not hasBought and crossover_signal or macd_signal and (close > lower) and (close < upper)

sell_condition := hasBought and (macdHistogram < 0 and prev_macdHistogram < 0) and (close < prev_close and prev_close < close[2])

potential_SL := close - 0.5 * volatility

potential_TP := close + volatility

if isTrending

buy_condition := not hasBought and crossover_signal or macd_signal

sell_condition := hasBought and (macdHistogram < 0 and prev_macdHistogram < 0) and (close < prev_close and prev_close < close[2])

potential_SL := close - volatility

potential_TP := close + 2 * volatility

if isConsolidating

buy_condition := not hasBought and crossover_signal and (close > lower)

sell_condition := hasBought and (close < upper) and (macdHistogram < 0 and prev_macdHistogram < 0) and (close < prev_close and prev_close < close[2])

potential_SL := close - 0.5 * volatility

potential_TP := close + volatility

// Update the hasBought and hasSold flags

if buy_condition

hasBought := true

hasSold := false

if sell_condition

hasBought := false

hasSold := true

// Strategy Entry and Exit

if buy_condition

strategy.entry("BUY", strategy.long, stop=potential_SL, limit=potential_TP)

strategy.exit("SELL_TS", from_entry="BUY", trail_price=close, trail_offset=close * 0.05)

if sell_condition

strategy.close("BUY")

// Visualization

plotshape(series=buy_condition, style=shape.labelup, location=location.belowbar, color=color.green, text="BUY", size=size.small)

plotshape(series=sell_condition, style=shape.labeldown, location=location.abovebar, color=color.red, text="SELL", size=size.small)

plot(long_term_ma, color=color.gray, title="200-Day MA", linewidth=1)

plot(potential_SL, title="SL Level", color=color.red, linewidth=1, style=plot.style_linebr)

plot(potential_TP, title="TP Level", color=color.green, linewidth=1, style=plot.style_linebr)

bgcolor(isVolatile ? color.new(color.purple, 90) : isTrending ? color.new(color.blue, 90) : isConsolidating ? color.new(color.orange, 90) : na)