概述

该策略是一种典型的趋势跟随策略。它使用多组不同周期的移动平均线来判断市场趋势,在趋势确立时入场,在短期趋势反转时离场。

策略原理

该策略采用4组移动平均线:9日线、21日线、50日线和200日线。它们分别代表不同的时间维度。

当短期移动平均线由下向上突破长期移动平均线时,认为行情进入上涨趋势;当短期移动平均线由上向下跌破长期移动平均线时,认为行情进入下跌趋势。

策略以9日线为参考,判断其他几条移动平均线的排列关系,从而判断总体趋势方向。具体逻辑是:

多头入场条件:收盘价 > 9日线 且 9日线 > 21日线 且 21日线 > 50日线 且 50日线 > 200日线

空头入场条件:收盘价 < 9日线 且 9日线 < 21日线 且 21日线 < 50日线 且 50日线 < 200日线

其中,收盘价与9日线的关系判断最短期趋势,9日线与21日线的关系判断短期趋势,21日线与50日线的关系判断中期趋势,50日线与200日线的关系判断长期趋势。只有当四组移动平均线的关系都符合时,才判断行情趋势成立,发出交易信号。

离场条件:收盘价跌破21日移动平均线,平掉所有多单;收盘价涨破21日移动平均线,平掉所有空单。

策略优势

使用多组移动平均线判断趋势,可有效过滤非主流走势的市场噪音,捕捉中长线趋势。

入场条件严格,需要多种时间维度的趋势判断都有效,可避免被短期调整套住。

及时止损,有效控制风险。

风险及解决方法

长期横盘整理市场中,容易产生大量虚假信号,从而增加交易风险。可通过优化参数,调整移动平均线的周期数量,过滤部分噪音。

在剧烈行情中,移动平均线常常发生死叉或黄叉。这时需要结合其他因素判断真实趋势。可以加入像RSI,MACD等指标进行确认,避免错过大行情。

优化方向

参数优化。可以测试不同参数组合,寻找最优参数。如调整移动平均线的周期数,添加或调整止损条件等。

增加质量过滤。例如在入场时判断成交量是否放大,避免量能不足的跳空。或者判断波动是否放大,避免震荡整理。

增加其他技术指标确认,避免在剧烈行情中发出错误信号。可以考虑加入RSI、MACD等指标进行多因素判断。

总结

该策略整体来说是一种典型且实用的趋势跟随策略。它使用多组移动平均线判断趋势,入场条件严格,可以有效锁定中长线趋势。同时搭配及时止损,可以控制风险。通过参数优化、增加确认指标等手段,可以进一步提高策略的稳定性和盈利能力。它适合那些喜欢跟随趋势进行长线操作的投资者。

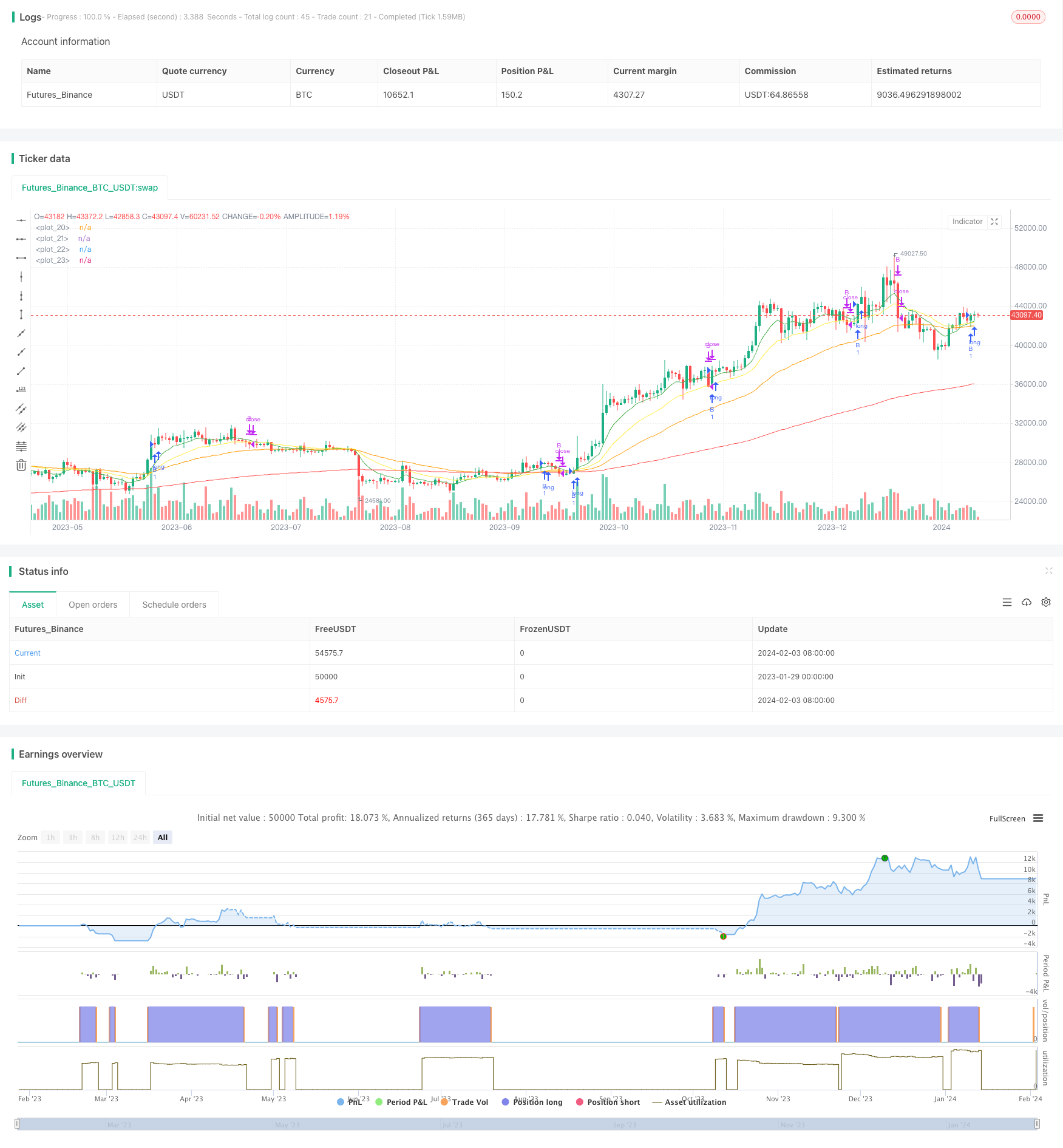

/*backtest

start: 2023-01-29 00:00:00

end: 2024-02-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shayak1

//@version=5

strategy('Super SR', overlay=true)

r = input.int(14,"rsi-length",1,100)

rsi = ta.rsi(close,r)

len1 = 9

len2 = 21

len3 = 50

len4 = 200

ema1 = ta.ema(close, len1)

ema2 = ta.ema(close, len2)

ema3 = ta.ema(close, len3)

ema4 = ta.ema(close, len4)

plot(ema1,color= color.green)

plot(ema2,color= color.yellow)

plot(ema3,color= color.orange)

plot(ema4,color= color.red)

// *** entries

Long1 = close > ema1

Long2 = ema1 > ema2

Long3 = ema2 > ema3

Long4 = ema3 > ema4

buy_condition = Long1 and Long2 and Long3 and Long4 and strategy.position_size == 0

if (buy_condition and strategy.position_size <= 1)

strategy.entry("B", strategy.long)

Short1 = close < ema1

Short2 = ema1< ema2

Short3 = ema2< ema3

Short4 = ema3< ema4

sell_condition = Short1 and Short2 and Short3 and Short4 and strategy.position_size == 0

//if (sell_condition)

// strategy.entry("S", strategy.short)

// trailing SL

//Long_sl = min(strategy.position_avg_price * 0.95, strategy.pos

//EXIT CONDITIONS

exit_long = ta.crossunder(close, ema2)

exit_short = ta.crossover(close, ema2)

if(exit_long)

strategy.close("B", "LE", qty_percent=100)

if(exit_short)

strategy.close("S", "SE", qty_percent=100)

//==============================================================================

//INSERT SECTION

//This section is where users will be required to insert the indicators they

//would like to use for their NNFX Strategy.

//==============================================================================

//INSERT - CONFIRMATION INDICATOR 1

//==============================================================================

//==============================================================================

//INSERT - CONFIRMATION INDICATOR 2

//==============================================================================

//==============================================================================

//INSERT - VOLUME INDICATOR

//==============================================================================

//==============================================================================

//INSERT - BASELINE INDICATOR

//==============================================================================

//==============================================================================

//INSERT - EXIT INDICATOR

//==============================================================================

//==============================================================================

//INSERT - CONTINUATION TRADES INDICATOR

//==============================================================================

//==============================================================================

//COMPLETED SECTION

//This section has been optimised to work with the above indicators the user

//has inserted above. The user does not require to change any code below and

//is completed and optimised for the full NNFX strategy. Users may wish to

//customise this section of code if they wish to alter the NNFX strategy.

//==============================================================================

//COMPLETE - BACKTEST DATE RANGE

//==============================================================================

// start_day = input.int(1,"start day",1,31)

// start_month = input.int(1,"start month",1,12)

// start_year = input.int(1,"start year",2010,2023)

//==============================================================================

//COMPLETE - CURRENCY CONVERSION

//==============================================================================

//==============================================================================

//COMPLETE - ATR MONEY MANAGEMENT

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - C1

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - C2

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - Vol

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - Bl

//==============================================================================

//==============================================================================

//COMPLETE - USER INPUT CONDITIONS - Exit

//==============================================================================

//==============================================================================

//COMPLETE - CONTINUATION TRADES

//==============================================================================

//==============================================================================

//COMPLETE - ONE CANDLE RULE

//==============================================================================

//==============================================================================

//COMPLETE - BRIDGE TOO FAR

//==============================================================================

//==============================================================================

//COMPLETE - BASELINE AND ATR RULE

//==============================================================================

//==============================================================================

//COMPLETE - ENTRY CONDITIONS

//==============================================================================

//==============================================================================

//COMPLETE - ENTRY ORDERS

//==============================================================================

//==============================================================================

//COMPLETE - TAKE PROFIT AND STOP LOSS CONDITIONS

//==============================================================================

//==============================================================================

//COMPLETE - EXIT ORDERS

//==============================================================================

//==============================================================================

//COMPLETE - CLOSE ORDERS

//==============================================================================

//==============================================================================