概述

本策略通过计算两条不同参数的移动平均线,当快线上穿慢线时生成买入信号。同时利用平均真实波动范围计算追踪止损价位,当价格跌破该止损价位时产生卖出信号。该策略能够有效跟踪市场趋势,在盈利后及时止损。

策略原理

- 快速移动平均线(EMA):参数为12日指数移动平均线,能够快速响应价格变化。

- 慢速移动平均线(SMA):参数为45日简单移动平均线,表征中长期趋势。

- 当快速移动平均线上穿慢速移动平均线时,产生买入信号。

- 计算15日平均真实波动幅度(ATR)作为止损基准。

- 根据ATR数值设定追踪止损幅度(如6倍ATR),并实时更新止损价位。

- 当价格低于止损价位时,产生卖出信号。

该策略融合趋势跟踪和止损管理的优点,既可以跟踪中长线方向,又可以通过止损来控制单笔损失。

优势分析

- 移动平均线组合可以有效识别趋势,增加信号的可靠性。

- 动态追踪止损可以及时止损,避免打击资金实力。

- 结合ATR止损使止损价位合理,防止过于敏感。

- 策略思路清晰易懂,参数调整灵活。

风险分析

- 移动平均线存在滞后,可能错过短线机会。

- 止损过于宽松会使盈利能力变差。

- 止损过于敏感会增加交易频率和手续费负担。

- 股票波动率变化可能影响ATR参数的稳定性。

可以适当优化移动平均线参数,或调整ATR倍数来平衡止损幅度。也可以结合其他指标作为过滤条件来改善入场时机。

优化方向

- 测试更多参数组合选择最佳的移动平均线。

- 根据不同股票的特点调整ATR止损的倍数参数。

- 增加量价指标等过滤条件,避免不必要的交易。

- 积累更多历史数据测试,验证参数稳定性。

总结

本策略成功融合移动平均线的趋势跟踪和ATR动态止损,通过参数优化可以适应不同股票特性。该策略形成了清晰的买入定界和止损定界,使交易逻辑简单清楚。总体来说,该双移动均线追踪止损策略稳定、简单、易于优化,适合作为股票交易的基础策略。

策略源码

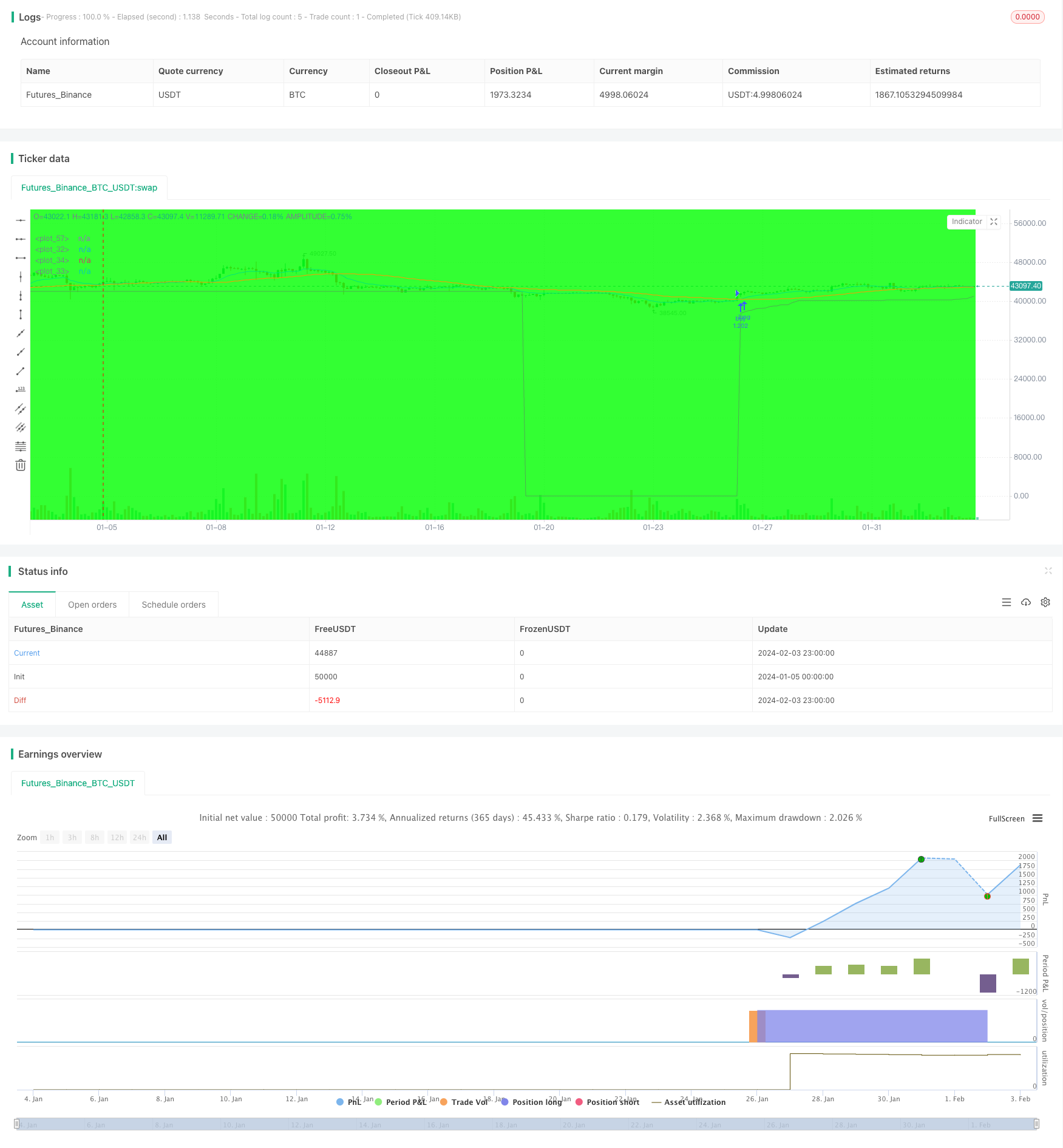

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//created by XPloRR 24-02-2018

strategy("XPloRR MA-Buy ATR-MA-Trailing-Stop Strategy",overlay=true, initial_capital=1000,default_qty_type=strategy.percent_of_equity,default_qty_value=100)

testStartYear = input(2005, "Start Year")

testStartMonth = input(1, "Start Month")

testStartDay = input(1, "Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2050, "Stop Year")

testStopMonth = input(12, "Stop Month")

testStopDay = input(31, "Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriodBackground = input(title="Background", type=bool, defval=true)

testPeriodBackgroundColor = testPeriodBackground and (time >= testPeriodStart) and (time <= testPeriodStop) ? #00FF00 : na

bgcolor(testPeriodBackgroundColor, transp=97)

emaPeriod = input(12, "Exponential MA")

smaPeriod = input(45, "Simple MA")

stopPeriod = input(12, "Stop EMA")

delta = input(6, "Trailing Stop #ATR")

testPeriod() => true

emaval=ema(close,emaPeriod)

smaval=sma(close,smaPeriod)

stopval=ema(close,stopPeriod)

atr=sma((high-low),15)

plot(emaval, color=blue,linewidth=1)

plot(smaval, color=orange,linewidth=1)

plot(stopval, color=lime,linewidth=1)

long=crossover(emaval,smaval)

short=crossunder(emaval,smaval)

//buy-sell signal

stop=0

inlong=0

if testPeriod()

if (long and (not inlong[1]))

strategy.entry("buy",strategy.long)

inlong:=1

stop:=emaval-delta*atr

else

stop:=iff((nz(emaval)>(nz(stop[1])+delta*atr))and(inlong[1]),emaval-delta*atr,nz(stop[1]))

inlong:=nz(inlong[1])

if ((stopval<stop) and (inlong[1]))

strategy.close("buy")

inlong:=0

stop:=0

else

inlong:=0

stop:=0

plot(stop,color=green,linewidth=1)