概述

该策略基于3条不同周期的EMA平均线,通过判断价格是否处于EMA平均线之上,来判断目前的趋势方向。当短期EMA线上穿长期EMA线时生成买入信号;当短期EMA线下穿长期EMA线时生成卖出信号。该策略追踪趋势运行,在趋势转向时及时平仓。

策略原理

该策略使用3条EMA平均线,分别是10日线、20日线和50日线。其判断规则为:

当10日EMA线和20日EMA线同时位于50日EMA线之上时,定义为上升趋势;

当10日EMA线和20日EMA线同时位于50日EMA线之下时,定义为下降趋势;

当短期EMA线(10日线和20日线)上穿长期EMA线(50日线)时产生买入信号;

当短期EMA线(10日线和20日线)下穿长期EMA线(50日线)时产生卖出信号;

在上升趋势中持有多头仓位,下降趋势中持有空头仓位;

在趋势转向时(EMA短期线与长期线发生穿透)平掉当前信号方向的头寸。

该策略通过 capture profit,通过及时平仓锁定盈利的方式轮番进行多空操作。

优势分析

该策略具有以下优势:

- 规则简单清晰,容易理解和实现;

- 利用EMA平均线判断趋势方向,避免被市场短期波动干扰;

- 及时平仓,追踪趋势运行,避免亏损扩大;

- 无需预测行情方向,跟踪趋势运行,胜率较高。

风险分析

该策略也存在一些风险:

- 在盘整市的时候,EMA平均线之间容易出现多次穿透,可能频繁开仓平仓带来交易成本;

- 行情跳空后EMA判断趋势的效果会受到影响,可能错失良好的开仓机会。

针对以上风险,可以通过以下方法加以优化:

- 在EMA间距较小时,可以适当放宽开仓规则,避免过于频繁交易;

- 结合其他指标确定趋势,避免EMA判断失效的情况。

优化方向

该策略可以从以下几个方向进行优化:

参数优化。可以测试不同EMA周期的参数组合,找到最佳的参数;

交易成本优化。适当优化开仓规则,减少不必要的频繁交易;

止损策略优化。设定合理的止损水平,控制单笔损失;

结合其他指标。运用MACD,KDJ等其他指标辅助判断,优化入场时机。

总结

该策略整体来说较为简单实用。其利用EMA判断趋势运行方向,附带适当的止损策略,可以有效控制风险。同时也存在一些优化空间,若果结合参数优化、止损策略、其他指标等,该策略的效果还具有很大提升空间。

策略源码

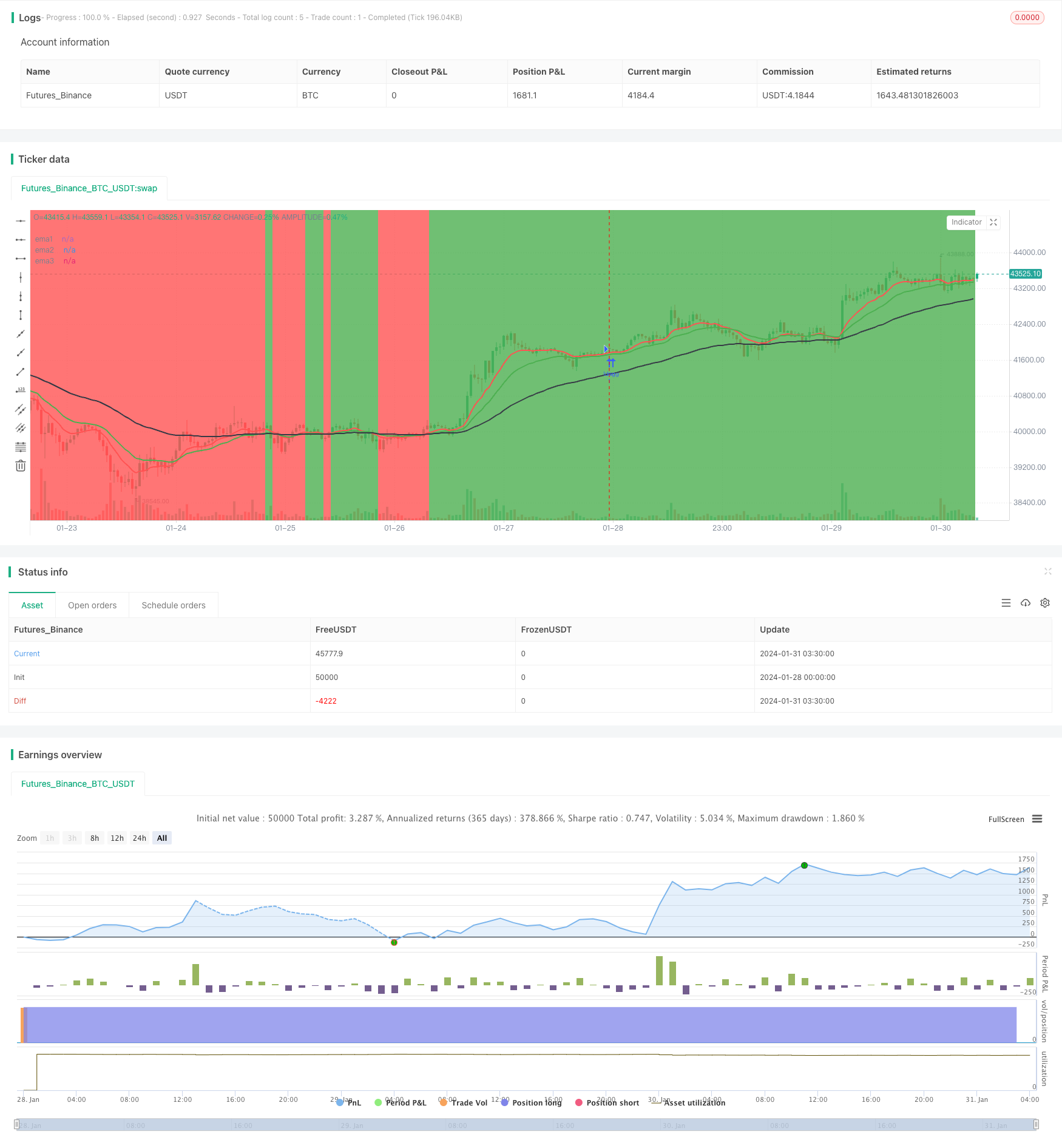

/*backtest

start: 2024-01-28 00:00:00

end: 2024-01-31 04:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mattehalen

//@version=4

//study("EMA 10,20 59",overlay=true)

strategy("EMA 10,20 59",overlay=true)

infoBox = input(true, title="infoBox", type=input.bool)

infoBox2 = input(false, title="infoBox2", type=input.bool)

BuySellSignal_Bool = input(false, title="Buy & SellSignal", type=input.bool)

infoBoxSize = input(title="infoBoxSize", defval=size.large, options=[size.auto, size.tiny, size.small, size.normal, size.large, size.huge])

ema1Value = input(10)

ema2Value = input(20)

ema3Value = input(59)

maxLoss = input(3000)

ema1 = ema(close,ema1Value)

ema2 = ema(close,ema2Value)

ema3 = ema(close,ema3Value)

objcnt = 0

buyTitle = tostring(close[1])

myProfit = float(0)

plot(ema1,title="ema1",color=color.red,linewidth=2)

plot(ema2,title="ema2",color=color.green,linewidth=2)

plot(ema3,title="ema3",color=color.black,linewidth=2)

Buytrend = (ema1 and ema2 > ema3) and (ema1[1] and ema2[1] > ema3[1])

BarssinceBuyTrend = barssince(Buytrend)

BarssinceSellTrend = barssince(not Buytrend)

closeAtBuyTrend = close[1]

bgcolor(Buytrend ? color.green : color.red,transp=70)

BuySignal = Buytrend and not Buytrend[1] and BuySellSignal_Bool

BuySignalOut = Buytrend and (crossunder(ema1,ema2)) and BuySellSignal_Bool

BarssinceBuy = barssince(BuySignal)

bgcolor(BuySignal ? color.green : na , transp=30)

bgcolor(BuySignalOut ? color.black : na , transp=30)

plot(BarssinceBuy,title="BarssinceBuy",display=display.none)

SellSignal = not Buytrend and Buytrend[1] and BuySellSignal_Bool

SellSignalOut = not Buytrend and (crossover(ema1,ema2)) and BuySellSignal_Bool

BarssinceSell = barssince(SellSignal)

bgcolor(SellSignal ? color.red : na , transp=30)

bgcolor(SellSignalOut ? color.black : na , transp=30)

plot(BarssinceSell,title="BarssinceSell",display=display.none)

buyProfit = float(0)

cntBuy =0

sellProfit = float(0)

cntSell =0

buyProfit := Buytrend and not Buytrend[1]? nz(buyProfit[1]) + (close[BarssinceBuyTrend[1]]-close) : nz(buyProfit[1])

cntBuy := Buytrend and not Buytrend[1]? nz(cntBuy[1]) + 1: nz(cntBuy[1])

sellProfit := not Buytrend and Buytrend[1]? nz(sellProfit[1]) + (close-close[BarssinceSellTrend[1]]) : nz(sellProfit[1])

cntSell := not Buytrend and Buytrend[1]? nz(cntSell[1]) + 1 : nz(cntSell[1])

totalProfit = buyProfit + sellProfit

// if (Buytrend and not Buytrend[1] and infoBox==true)

// l = label.new(bar_index - (BarssinceBuyTrend[1]/2), na,text="Close = " + tostring(close) + "\n" + "Start = "+tostring(close[BarssinceBuyTrend[1]]) + "\n" + "Profit = "+tostring(close[BarssinceBuyTrend[1]]-close) ,style=label.style_labelup, yloc=yloc.belowbar,color=color.red,size=infoBoxSize)

// if (not Buytrend and Buytrend[1] and infoBox==true)

// l = label.new(bar_index - (BarssinceSellTrend[1]/2), na,text="Close = " + tostring(close) + "\n" + "Start = "+tostring(close[BarssinceSellTrend[1]]) + "\n" + "Profit = "+tostring(close-close[BarssinceSellTrend[1]]) ,style=label.style_labeldown, yloc=yloc.abovebar,color=color.green,size=infoBoxSize)

// if (BuySignalOut and not BuySignalOut[1] and infoBox2==true)

// // l = label.new(bar_index - (BarssinceBuy[0]/2), na,text="Close = " + tostring(close) + "\n" + "Start = "+tostring(close[BarssinceBuy[0]]) + "\n" + "Profit = "+tostring(close-close[BarssinceBuy[0]]) ,style=label.style_labelup, yloc=yloc.belowbar,color=color.purple,size=infoBoxSize

// l = label.new(bar_index, na,text="Close = " + tostring(close) + "\n" + "Start = "+tostring(close[BarssinceBuy[0]]) + "\n" + "Profit = "+tostring(close-close[BarssinceBuy[0]]) ,style=label.style_labelup, yloc=yloc.belowbar,color=color.lime,size=infoBoxSize)

// if (SellSignalOut and not SellSignalOut[1] and infoBox2==true)

// // l = label.new(bar_index - (BarssinceSell[0]/2), na,text="Close = " + tostring(close) + "\n" + "Start = "+tostring(close[BarssinceSell[0]]) + "\n" + "Profit = "+tostring(close[BarssinceSell[0]]-close) ,style=label.style_labeldown, yloc=yloc.abovebar,color=color.purple,size=infoBoxSize)

// l = label.new(bar_index, na,text="Close = " + tostring(close) + "\n" + "Start = "+tostring(close[BarssinceSell[0]]) + "\n" + "Profit = "+tostring(close[BarssinceSell[0]]-close) ,style=label.style_labeldown, yloc=yloc.abovebar,color=color.fuchsia,size=infoBoxSize)

// l2 = label.new(bar_index, na, 'buyProfit in pip = '+tostring(buyProfit)+"\n"+ 'cntBuy = '+tostring(cntBuy) +"\n"+ 'sellProfit in pip = '+tostring(sellProfit)+"\n"+ 'cntSell = '+tostring(cntSell) +"\n"+ 'totalProfit in pip = '+tostring(totalProfit) ,

// color=totalProfit>0 ? color.green : color.red,

// textcolor=color.white,

// style=label.style_labeldown, yloc=yloc.abovebar,

// size=size.large)

// label.delete(l2[1])

//--------------------------------------------------

//--------------------------------------------------

if (Buytrend)

strategy.close("short", comment = "Exit short")

strategy.entry("long", true)

strategy.exit("Max Loss", "long", loss = maxLoss)

//if BuySignalOut

// strategy.close("long", comment = "Exit Long")

if (not Buytrend)

// Enter trade and issue exit order on max loss.

strategy.close("long", comment = "Exit Long")

strategy.entry("short", false)

strategy.exit("Max Loss", "short", loss = maxLoss)

//if SellSignalOut

// Force trade exit.

//strategy.close("short", comment = "Exit short")

//--------------------------------------------------

//--------------------------------------------------

//--------------------------------------------------