概述

该策略首先根据前一交易日的最高价、最低价以及收盘价计算出卡马奇拉枢轴点。然后结合布林带指标对价格进行过滤,在价格突破枢轴点时产生交易信号。

策略原理

- 计算前一交易日的最高价、最低价、收盘价

- 根据公式计算出卡马奇拉枢轴线,包含上轨H4、H3、H2、H1和下轨L1、L2、L3、L4

- 计算20日布林带上轨和下轨

- 当价格上穿下轨时做多,下穿上轨时做空

- 止损点设在布林带上轨或下轨附近

优势分析

- 卡马奇拉枢轴线包含多个关键支撑阻力位,增强交易信号的可靠性

- 与布林带指标结合,可有效过滤假突破

- 多组参数组合,交易灵活

风险分析

- 布林带指标参数设置不当可能导致交易信号错误

- 卡马奇拉枢轴线关键位计算依赖前一交易日价格,可能受隔夜跳空影响

- 多头空头操作都有亏损风险

优化方向

- 优化布林带参数,寻找最佳参数组合

- 结合其它指标过滤假突破信号

- 增加止损策略,降低单笔亏损

总结

该策略综合运用卡马奇拉枢轴线和布林带指标,在价格突破关键支撑阻力位时产生交易信号。可通过参数优化和信号过滤来提高策略收益率和稳定性。总体来说,该策略交易思路清晰,可操作性强,值得实盘验证。

策略源码

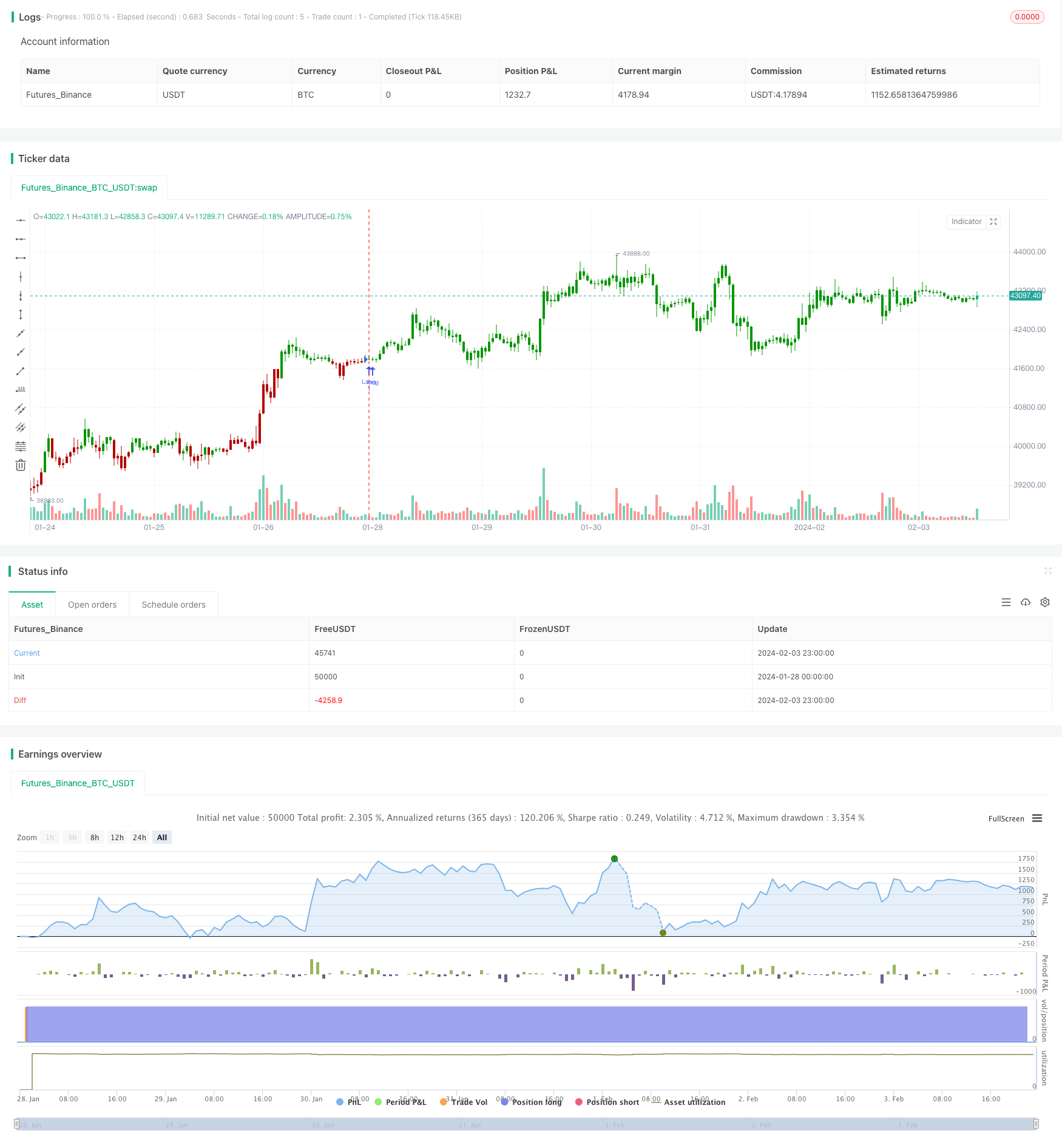

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/05/2020

// Camarilla pivot point formula is the refined form of existing classic pivot point formula.

// The Camarilla method was developed by Nick Stott who was a very successful bond trader.

// What makes it better is the use of Fibonacci numbers in calculation of levels.

//

// Camarilla equations are used to calculate intraday support and resistance levels using

// the previous days volatility spread. Camarilla equations take previous day’s high, low and

// close as input and generates 8 levels of intraday support and resistance based on pivot points.

// There are 4 levels above pivot point and 4 levels below pivot points. The most important levels

// are L3 L4 and H3 H4. H3 and L3 are the levels to go against the trend with stop loss around H4 or L4 .

// While L4 and H4 are considered as breakout levels when these levels are breached its time to

// trade with the trend.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Camarilla Pivot Points V2 Backtest", shorttitle="CPP V2", overlay = true)

res = input(title="Resolution", type=input.resolution, defval="D")

width = input(1, minval=1)

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3", "R4"])

BuyFrom = input(title="Buu from ", defval="S1", options=["S1", "S2", "S3", "S4"])

reverse = input(false, title="Trade reverse")

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

H4 = (0.55*(xHigh-xLow)) + xClose

H3 = (0.275*(xHigh-xLow)) + xClose

H2 = (0.183*(xHigh-xLow)) + xClose

H1 = (0.0916*(xHigh-xLow)) + xClose

L1 = xClose - (0.0916*(xHigh-xLow))

L2 = xClose - (0.183*(xHigh-xLow))

L3 = xClose - (0.275*(xHigh-xLow))

L4 = xClose - (0.55*(xHigh-xLow))

pos = 0

S = iff(BuyFrom == "S1", H1,

iff(BuyFrom == "S2", H2,

iff(BuyFrom == "S3", H3,

iff(BuyFrom == "S4", H4,0))))

B = iff(SellFrom == "R1", L1,

iff(SellFrom == "R2", L2,

iff(SellFrom == "R3", L3,

iff(SellFrom == "R4", L4,0))))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )