概述

该策略结合了相对强弱指数(RSI)和马丁格尔加仓原理。当RSI低于超卖线时,进行首次买入开仓;之后如果价格继续下跌,将以2的指数进行加仓,以获利止盈。这种策略适用于高市值币种的现货交易,可以获得长期稳定收益。

策略原理

- 使用RSI指标判断市场超卖,RSI期间设置为14,超卖阈值设置为30。

- 当RSI < 30时,以账户权益的5%进行首次开仓做多。

- 如果价格较首次入场价下跌0.5%,则以2倍仓位加仓做多;如果价格继续下跌,以4倍仓位再次加仓。

- 每上涨0.5%,以收益止盈方式平仓。

- 重复上述步骤,进行循环交易。

优势分析

- 利用RSI判断市场超卖点位,可以在相对低点开仓做多。

- 马丁格尔加仓可以使得平均开仓价格越来越低。

- 小幅止盈可以获得持续稳定的收益。

- 适用于高市值币种的现货交易,风险可控。

风险分析

- 如果行情长期低迷,持仓亏损可能进一步扩大。

- 没有设置止损,无法限制最大损失。

- 加仓次数过多也会使得损失加剧。

- 做多方向交易,行情继续下跌仍存在较大风险。

策略优化

- 可以设置止损点,限制最大亏损。

- 优化RSI参数,寻找最佳超卖超买信号。

- 可以根据特定币种波动率设定合理止盈范围。

- 可以根据总资产或单项持仓比例设定加仓幅度。

总结

该策略结合RSI指标和马丁格尔加仓原理,在判断超卖点位时适当加仓做多,以小幅止盈获利。它可以获取持续稳定收益,但也存在一定风险。通过设定止损、调整参数等方式可以进一步优化。

策略源码

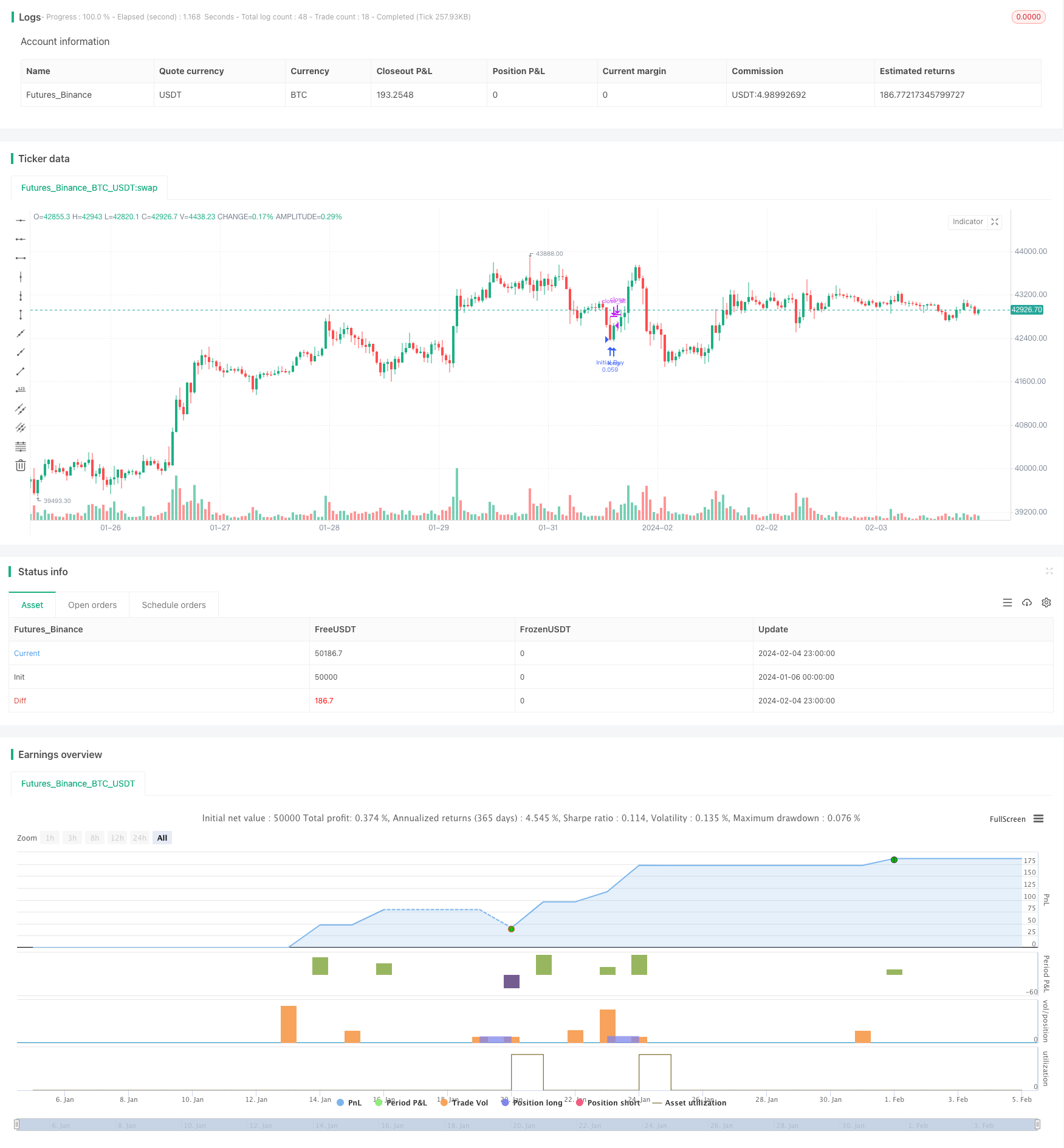

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Stavolt

//@version=5

strategy("RSI Martingale Strategy", overlay=true, default_qty_type=strategy.cash, currency=currency.USD)

// Inputs

rsiLength = input(14, title="RSI Length")

oversoldThreshold = input(30, title="Oversold Threshold") // Keeping RSI threshold

profitTargetPercent = input(0.5, title="Profit Target (%)") / 100

initialInvestmentPercent = input(5, title="Initial Investment % of Equity")

// Calculating RSI

rsiValue = ta.rsi(close, rsiLength)

// State variables for tracking the initial entry

var float initialEntryPrice = na

var int multiplier = 1

// Entry condition based on RSI

if (rsiValue < oversoldThreshold and na(initialEntryPrice))

initialEntryPrice := close

strategy.entry("Initial Buy", strategy.long, qty=(strategy.equity * initialInvestmentPercent / 100) / close)

multiplier := 1

// Adjusting for errors and simplifying the Martingale logic

// Note: This section simplifies the aggressive position size adjustments without loops

if (not na(initialEntryPrice))

if (close < initialEntryPrice * 0.995) // 0.5% drop from initial entry

strategy.entry("Martingale Buy 1", strategy.long, qty=((strategy.equity * initialInvestmentPercent / 100) / close) * 2)

multiplier := 2 // Adjusting multiplier for the next potential entry

if (close < initialEntryPrice * 0.990) // Further drop

strategy.entry("Martingale Buy 2", strategy.long, qty=((strategy.equity * initialInvestmentPercent / 100) / close) * 4)

multiplier := 4

// Additional conditional entries could follow the same pattern

// Checking for profit target to close positions

if (strategy.position_size > 0 and (close - strategy.position_avg_price) / strategy.position_avg_price >= profitTargetPercent)

strategy.close_all(comment="Take Profit")

initialEntryPrice := na // Reset for next cycle