概述

该策略通过计算不同周期的EMA移动平均线,判断它们的交叉情况,结合RSI指标判断行情趋势,实现趋势跟踪交易。其核心思想是:当短期EMA线从下方上穿较长周期的EMA线时产生买入信号;当短期EMA从上方下穿较长周期EMA线时产生卖出信号,通过这样的EMA交叉形成的交易信号,跟踪市场趋势运行。

策略原理

该策略主要利用EMA的快慢特性,计算5条不同周期的EMA线,包括9日线、21日线、51日线、100日线和200日线。短周期EMA线能更快地响应价格变化,较长周期EMA线对噪声相对不敏感,能反映市场趋势。 当短周期EMA线从下方上穿较长周期EMA线时,表示价格开始上涨,属于买入信号;当短周期EMA从上方下穿较长周期EMA线时,表示价格开始下跌,属于卖出信号。因此,通过EMA线的交叉情况,可以判断行情的涨跌趋势。

此外,该策略还引入RSI指标辅助判断。只有当RSI大于65时,才会发出买入信号;只有当RSI小于40时,才会发出卖出信号。这可以过滤掉一些错误的信号,避免交易被巨大的价格震荡所误导。

策略优势

该策略最大的优势在于可以有效跟踪市场趋势。通过EMA的快慢特性设定多组EMA均线,判断它们的交叉情况,形成买入和卖出信号,可以捕捉中长线的行情走势。这种趋势跟踪策略胜率较高,适合长线持有。

此外,该策略还引入RSI指标进行辅助判断,可以有效地过滤噪声,避免被短期市场波动所误导,从而提高信号的可靠性。RSI参数设置为14,可以捕捉较为明确的超买超卖情况。

总的来说,该策略融合了移动平均线的趋势跟踪和RSI的超买超卖判断,既可以捕捉行情趋势,有可以有效滤除错误信号,是一种可靠性较高的趋势跟踪策略。

策略风险

该策略最大的风险在于会存在一定的滞后。EMA本身对价格变化有一定滞后性,特别是较长周期的EMA,这意味着买入和卖出信号的产生会有一定延迟。如遇到价格剧烈反转的情况,会产生较大的浮亏。

此外,当市场处于盘整震荡时,EMA均线交叉信号会频繁出现,这时RSI参数设置为14可能会过滤掉过多信号,导致错过交易机会的情况。

要降低这些风险,可以适当缩短较长EMA的周期参数,并适当放宽RSI的超买超卖阈值,使信号参数设置更加灵敏。当然也需要承担更高的误导风险。需要根据实际市场情况调整参数,寻找最佳平衡点。

策略优化方向

该策略可以从以下几个方面进行优化:

EMA周期参数优化。可以测试更多种EMA周期参数的组合,寻找最佳参数对,使信号更加灵敏和可靠。

RSI参数优化。可以适当扩大RSI超买超卖区区间,使信号触发更加频繁,或缩小区间来减少误导风险。

增加止损机制。可以设置移动止损或挂单止损来锁定利润,这可以有效抑制亏损风险。

结合其他指标。可以引入像KDJ、MACD等其他指标来使信号更加可靠,提高策略效果。

优化仓位管理。可以根据市场波动程度来动态调整仓位大小,在趋势更加明确时加大仓位。

总结

该策略通过计算多组EMA均线并判断其交叉情况,结合RSI指标进行辅助判断,实现了对市场趋势的有效捕捉和跟踪。它融合了趋势跟踪和超买超卖判断两大思路,可以捕捉中长线行情的同时有效过滤误导信号。通过参数优化和策略组合,可以形成一个稳定、高效的量化交易系统。它代表了移动平均线策略和指标融合策略的典型案例。

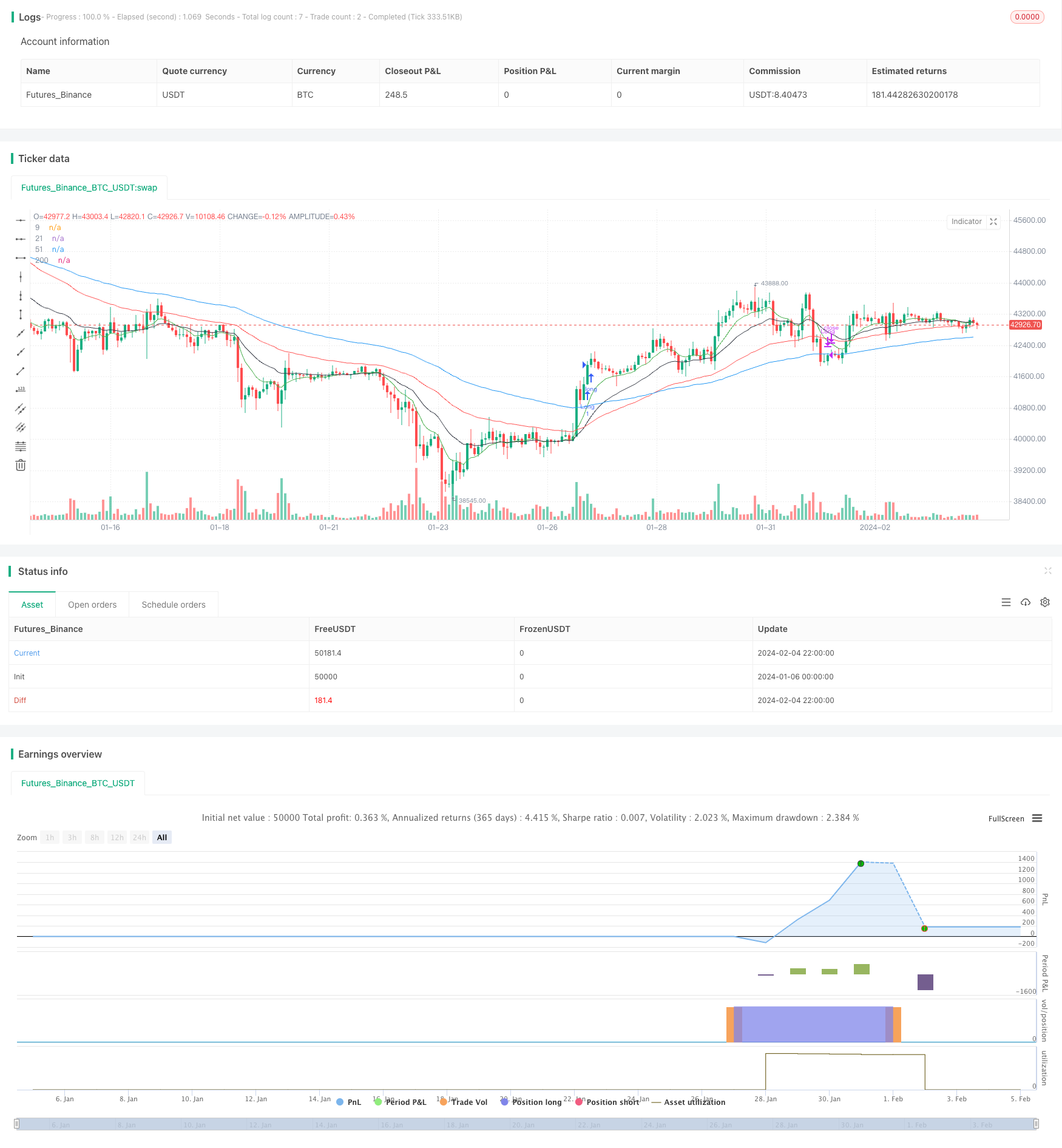

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Ravikant_sharma

//@version=5

strategy('new', overlay=true)

start = timestamp(1990, 1, 1, 0, 0)

end = timestamp(2023, 12, 12, 23, 59)

ema0 = ta.ema(close, 9)

ema1 = ta.ema(close, 21)

ema2 = ta.ema(close, 51)

ema3 = ta.ema(close, 100)

ema4 = ta.ema(close, 200)

rsi2=ta.rsi(ta.sma(close,14),14)

plot(ema0, '9', color.new(color.green, 0))

plot(ema1, '21', color.new(color.black, 0))

plot(ema2, '51', color.new(color.red, 0))

plot(ema3, '200', color.new(color.blue, 0))

//plot(ema4, '100', color.new(color.gray, 0))

//LongEntry = ( ta.crossover(ema0,ema3) or ta.crossover(ema0,ema2) or ta.crossunder(ema2,ema3) ) // ta.crossover(ema0,ema1) //

LongEntry=false

if ta.crossover(ema0,ema1)

if rsi2>65

LongEntry:=true

if ta.crossover(ema1,ema2)

if rsi2>65

LongEntry:=true

LongExit = ta.crossunder(ema0,ema2) or close >(strategy.position_avg_price*1.25) or rsi2 <40 or close < (strategy.position_avg_price*0.98)

if true

if(LongEntry and rsi2>60)

strategy.entry('Long', strategy.long, 1)

if(LongExit)

strategy.close('Long')