概述

高低点突破策略是一个基于高低点识别的长线期波动策略。该策略在策略方向参数方向上,在突破最近一个特定窗口期的最高价时做多,突破最近一个特定窗口期的最低价时做空。

策略原理

该策略通过输入参数设置查看最近N根K线的最高价和最低价,即波动的高低点,根据方向参数判断策略方向。在做多时,当价格突破最近N根K线内的最高点时按照止赢方式入市做多;当价格跌破最近N根K线内的最低点时按照止损方式入市做空。

此外,该策略还设定了止损位。在开仓做多后,止损线设置为最低价附近;做空后,止损线设置为最高价附近。这可以有效规避单边行情带来的巨大亏损。

优势分析

该策略最大优势是能抓住高低点附近的关键波动,顺势而为,实现盈利。另外设置止损线有效控制了风险。

具体优势有:

策略思路清晰,通过突破高低点来判断入场和出场。

利用swing高低点来寻找反转机会,这是技术分析的经典做法。

有止损设置来控制风险,可以避免单边行情带来的巨亏。

代码结构清晰,容易理解和修改。

可输入不同参数来优化策略,如调整最高最低点周期数等。

风险分析

该策略的主要风险在于高低点判断不准带来的错误交易。具体风险包括:

最高最低点可能出现错误突破带来错误入场。

突破点附近可能有巨大的止损被触发。

趋势品种容易形成花费巨大才能确定高低点。

参数设置不当也会影响策略表现。

对应解决方法包括:

优化参数,调整最高最低点判断的周期数。

加大止损幅度。

区分品种特性,避免在趋势品种使用。

采用机器学习方法动态优化参数。

策略优化方向

该策略可以从以下方向进行优化:

最高最低点周期数优化:当前固定周期数,可以改为动态优化以避免固定模式带来的过优化。

增加止损止盈优化:可以基于ATR、波动率等指标动态调整止损幅度。

结合多个时间周期:可以在更高时间周期确定趋势,低时间周期决定入场。

增加机器学习:使用神经网络等方法预测潜在高低点突破概率,提升效果。

优化止损算法:改进算法以在保证止损的前提下尽量减少无效止损被触发的情况。

总结

高低点突破策略整体是一个非常实用的长线量化策略。它通过捕捉高低点附近的反转机会获利,并设置止损来控制风险,从而在保证收益的同时也控制了回撤。该策略参数设置灵活,思路清晰,是值得推荐的一个策略思路。后续可通过引入动态优化、机器学习等方式以进一步完善该策略。

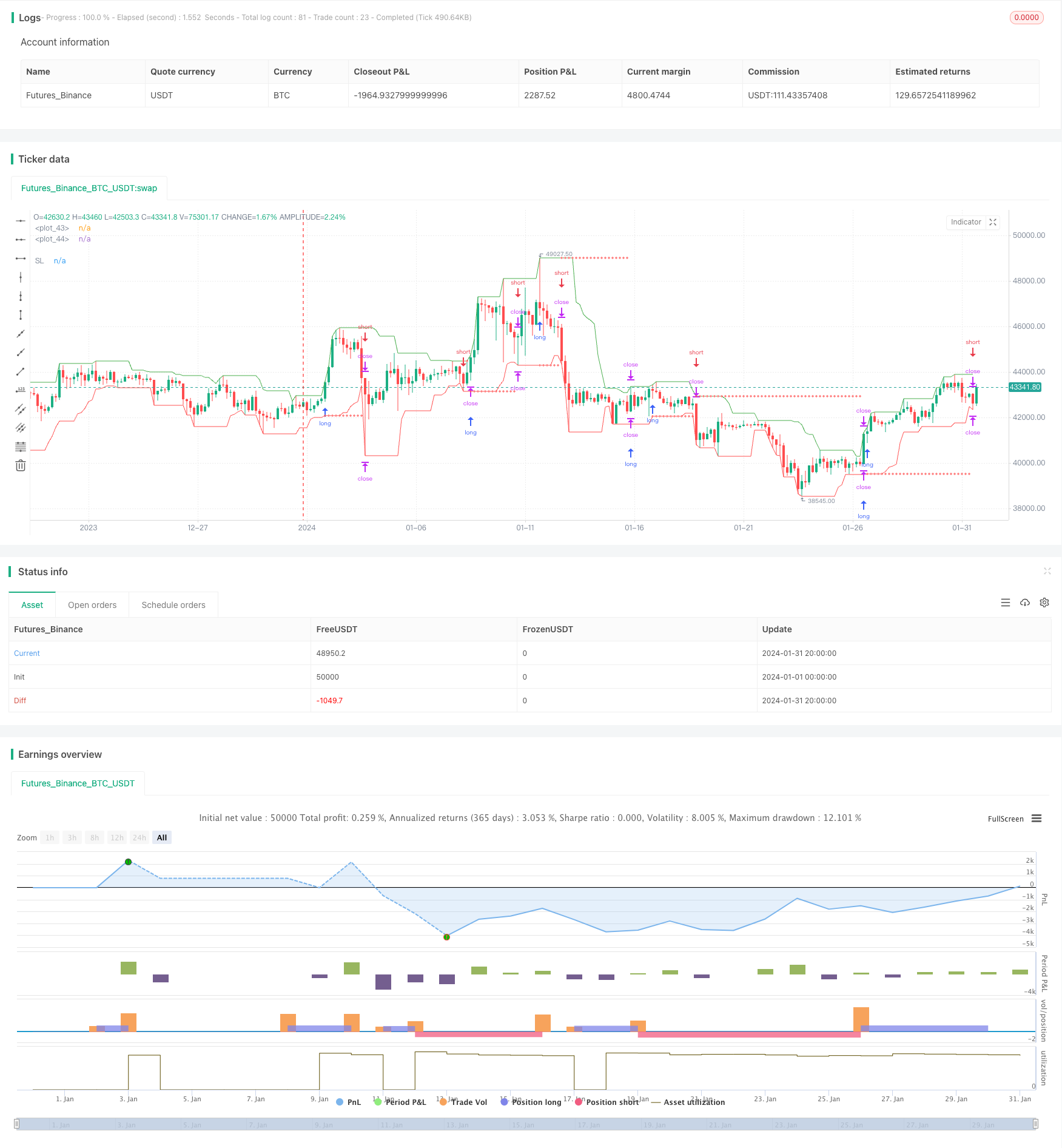

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tweakerID

// Long term strategy for managing a Crypto investment with Swing Trades of more than 1 day. The strategy buys with a

// stop order at the Swing High price (green line) and sells with a stop order at the Swing Low price (red line).

// The direction of the strategy can be adjusted in the Inputs panel.

//@version=4

strategy("Swing Points Breakouts", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=10000, commission_value=0.04)

direction = input(0, title = "Strategy Direction", type=input.integer, minval=-1, maxval=1)

strategy.risk.allow_entry_in(direction == 0 ? strategy.direction.all : (direction < 0 ? strategy.direction.short : strategy.direction.long))

//Inputss

i_SL=input(true, title="Use Swing Lo/Hi Stop Loss & Take Profit")

i_SwingLow=input(10, title="Swing Low Lookback")

i_SwingHigh=input(10, title="Swing High Lookback")

i_reverse=input(false, "Reverse Trades")

i_SLExpander=input(defval=0, step=1, title="SL Expander")

//Strategy Calculations

SwingLow=lowest(i_SwingLow)

SwingHigh=highest(i_SwingHigh)

//SL & TP Calculations

bought=strategy.position_size != strategy.position_size[1]

LSL=valuewhen(bought, SwingLow, 0)-((valuewhen(bought, atr(14), 0)/5)*i_SLExpander)

SSL=valuewhen(bought, SwingHigh, 0)+((valuewhen(bought, atr(14), 0)/5)*i_SLExpander)

islong=strategy.position_size > 0

isshort=strategy.position_size < 0

SL= islong ? LSL : isshort ? SSL : na

//Entries and Exits

strategy.entry("long", true, stop=i_reverse?na:SwingHigh, limit=i_reverse?SwingLow:na)

strategy.entry("short", false, stop=i_reverse?na:SwingLow, limit=i_reverse?SwingHigh:na)

if i_SL

strategy.exit("longexit", "long", stop=LSL)

strategy.exit("shortexit", "short", stop=SSL)

//Plots

plot(i_SL ? SL : na, color=color.red, style=plot.style_cross, title="SL")

plot(SwingLow, color=color.red)

plot(SwingHigh, color=color.green)