概述

动量平均倒数救济拉回策略(Momentum Average Inverse Relief Pullback Strategy)是一种简单的在移动平均线附近进行反转操作的策略。该策略采用 50 期指数移动平均线作为主要的趋势判断指标,并结合形态学的吞没规则来寻找反转机会。在突破移动平均线后,等待第二根或第三根反向K线的形成,如果符合反转形态,则在下一根K线收盘时进行反向开仓,并设置一分钟的止损计时器。

原理

该策略主要基于两个假设:

50期EMA可以有效判断市场趋势方向。当价格上穿时,视为多头行情;下穿时,视为空头行情。

在趋势突破EMA后,常出现短期的调整反弹,利用反转K线吞没的形态特征,可以捕捉到反弹结束的时机,从而进行反向操作。

具体来说,策略首先计算50期EMA,然后判断价格是否突破该EMA。如果突破多头,则等待2-3根向下的阴线K线,如果下一根K线为多头吞没,则在该K线收盘时做多;如果突破空头,则等待2-3根向上的阳线,如果下一根K线为空头吞没,则在该K线收盘时做空。做多做空后,设置1分钟计时器,超时后平仓。

优势分析

该策略具有以下优势:

操作逻辑简单清晰,容易理解实现,适合初学者。

充分利用了移动平均线的趋势判断和K线形态的特征,使交易信号更有效。

设置了止损时间,可以控制单次交易的损失。

程序化规则明确,避免了主观判断的影响,使策略更可靠。

风险分析

该策略也存在一定的风险:

50日EMA无法完全准确判断趋势,可能出现误断。

K线形态判断同样有一定的误判概率。

止损时间设置不当,可能增加损失或减少盈利。

机器交易中可能存在滑点、串单等问题,从而影响获利。

对策:

优化移动平均线的周期参数,找到更合适的数值。

结合其他指标进行组合判断,提高信号的可靠性。

测试和优化止损时间参数,找到最优参数。

在策略中设置滑点控制,避免严重的滑点损失。

优化方向

该策略可以从以下几个方面进行优化:

优化移动平均线周期参数,找到最佳参数。

更换其他类型的移动平均线,如加权移动平均线等。

增加volume和波幅等过滤器,避免在盘整中出现错误信号。

结合 Stochastics, MACD等其他指标进行组合策略,提高信号质量。

根据不同品种特点和交易时段设定最佳的止损时间。

添加止盈策略,在利润达到一定标准后主动止盈。

总结

动量平均倒数救济拉回策略是一个简单实用的短线交易策略,它主要使用移动平均线来判断趋势,并使用K线吞没来发现反转机会,从而进行短线操作。该策略具有操作清晰、实现简易的优点,但也存在一些参数优化空间。通过一定的测试和调整,该策略可以成为初学者量化交易的良好起点。

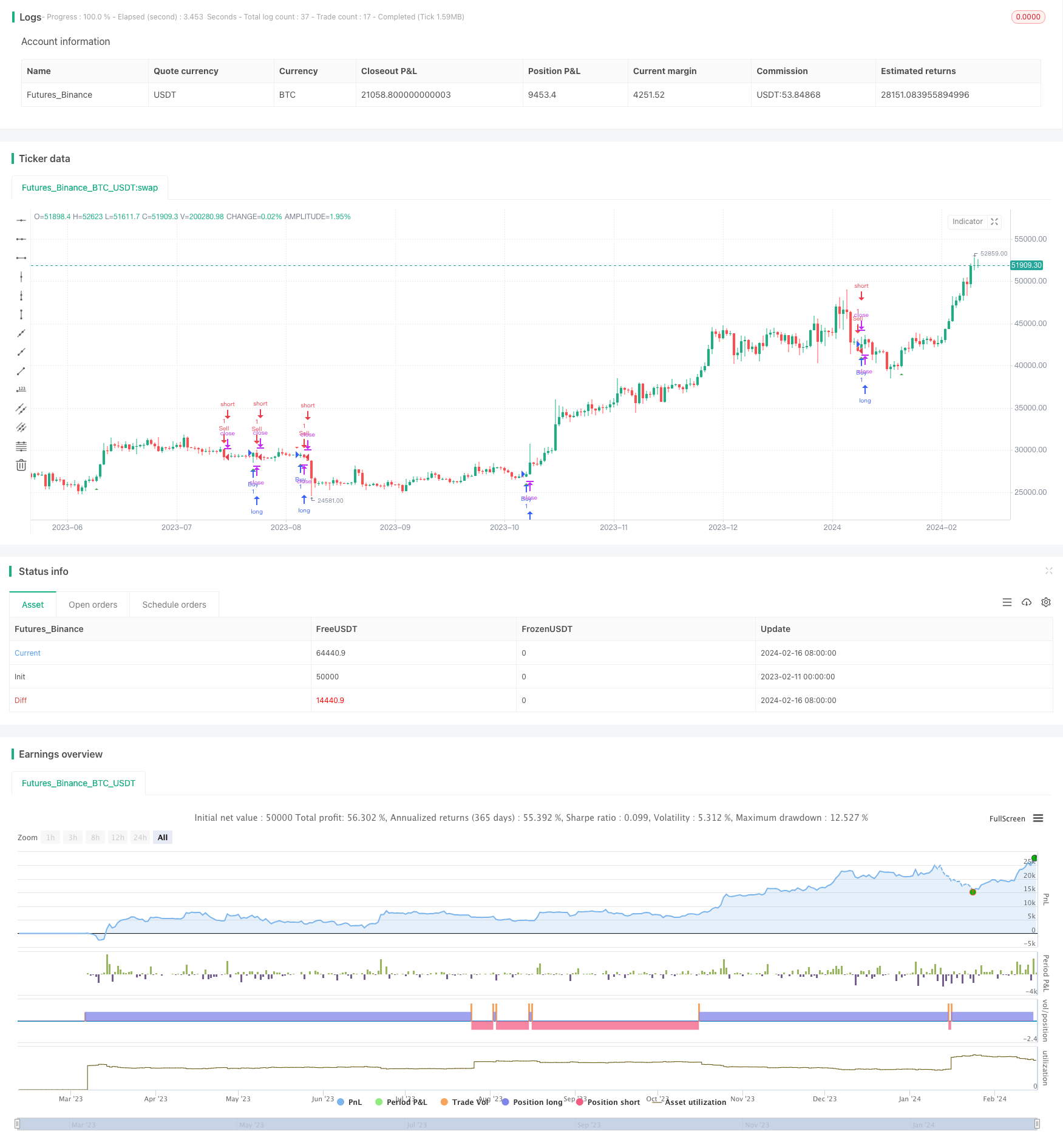

/*backtest

start: 2023-02-11 00:00:00

end: 2024-02-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("LinoR EMA Pullback Strategy", shorttitle="EPS", overlay=true)

// Define EMA period

emaPeriod = input(50, title="EMA Period")

// Calculate 50 EMA

ema50 = ta.ema(close, emaPeriod)

// Calculate engulfing conditions

engulfingBullish = close[1] < open[1] and close > open and close > close[1] and open < open[1]

engulfingBearish = close[1] > open[1] and open > close and open > open[1] and close < close[1]

// Define a 1-minute timer

var timer = 0

if bar_index > 0

timer := timer[1] + 1

// Long condition

longCondition = ta.crossover(close, ema50) and engulfingBullish

if longCondition

strategy.entry("Buy", strategy.long)

// Short condition

shortCondition = ta.crossunder(close, ema50) and engulfingBearish

if shortCondition

strategy.entry("Sell", strategy.short)

// Exit after 1 minute

if timer >= 1

strategy.close("Exit")

plotshape(series=longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)