本策略是一款创新的综合多空自动期货交易策略,整合SuperTrend、QQE和Trend Indicator A-V2多个指标,实现自动发现交易讯号并进行多空交易。本策略旨在发掘市场主要趋势,在控制好风险的前提下获得稳定收益。

策略原理

本策略主要基于三个部分:

SuperTrend指标负责判断市场主要趋势方向。当价格超过上转向线时为看涨,下破下转向线时为看跌。

QQE指标结合RSI判断超买超卖状态。根据RSI的平均值、标准差计算出动态上下限,RSI高于上限时为超买讯号,低于下限时为超卖讯号。

Trend Indicator A-V2指标通过计算EMA快慢线位置判断趋势,快线高于慢线为看涨讯号。

在判断市场方向时,当SuperTrend为看涨,且QQE判断非超卖,且A-V2为看涨时,发出做多讯号进场;当SuperTrend为看跌,且QQE判断非超买,且A-V2为看跌时,发出做空讯号进场。

策略优势

综合使用多个指标,使交易决策更加可靠,减少假讯号。

可实现自动发现交易讯号,无需人工干预判断,降低人为错误。

利用指标有机结合,在发现讯号的同时控制好风险,达到稳定盈利。

参数可调,用户可根据自己偏好个性化策略。

支持单边多单或双边交易,交易灵活。

风险及解决

市场特殊情况下,指标可能发出错误讯号,可通过优化指标参数减少。

交易成本和滑点可能影响策略盈利空间,可通过实现止损止盈机制优化。

指标参数设定不当可能导致策略表现不佳,可尝试不同参数寻找最佳配置。

优化方向

增加机器学习算法,根据历史数据自动优化指标参数,使策略更加智能化。

结合更多市场微结构因素,如交易量、外盘等数据发掘更有效的交易讯号。

应用高频交易技术,通过算法模型自动提交订单进行交易执行。

总结

本策略整合多个指标判断市场结构,在控制风险的前提下实现稳定盈利,既考虑趋势方向又兼顾超买超卖状态,交易决策更加细緻。优化空间还很大,可从参数优化、结构优化、执行优化等方面进一步提升策略表现。

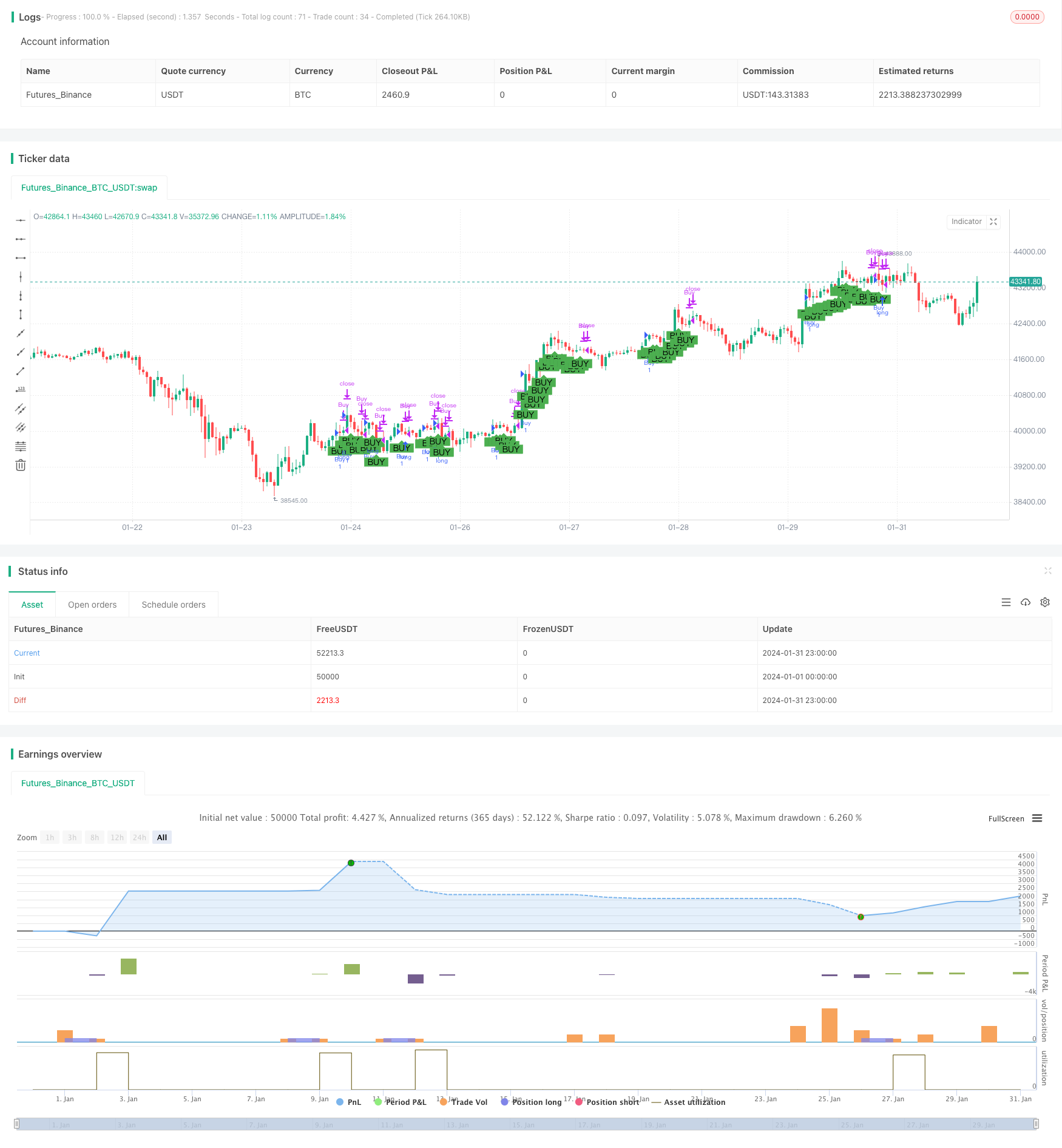

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//author:盧振興 芙蓉中華中學畢業 育達科技大學畢業碩士

//參考資料 : QQE MOD By:Mihkel00 ,SuperTrend By:KivancOzbilgic , TrendIndicator A-V2 By:Dziwne

strategy("綜合交易策略", shorttitle="Comprehensive Strategy", overlay=true)

// 添加單邊或多空參數

OnlyLong = input(true, title="單邊")

// SuperTrend 参数

PeriodsST = input(9, title="ST ATR Period")

MultiplierST = input(3.9, title="ST ATR Multiplier")

srcST = input(hl2, title="ST Source")

atrST = atr(PeriodsST)

upST = srcST - (MultiplierST * atrST)

upST := close[2] > upST[1] ? max(upST, upST[1]) : upST

dnST = srcST + (MultiplierST * atrST)

dnST := close[2] < dnST[1] ? min(dnST, dnST[1]) : dnST

trendST = 1

trendST := nz(trendST[1], trendST)

trendST := trendST == -1 and close[2] > dnST[1] ? 1 : trendST == 1 and close[2] < upST[1] ? -1 : trendST

// QQE 参数

RSI_PeriodQQE = input(6, title='QQE RSI Length')

SFQQE = input(5, title='QQE RSI Smoothing')

QQE = input(3, title='QQE Fast Factor')

ThreshHoldQQE = input(3, title="QQE Thresh-hold")

srcQQE = input(close, title="QQE RSI Source")

Wilders_PeriodQQE = RSI_PeriodQQE * 2 - 1

RsiQQE = rsi(srcQQE, RSI_PeriodQQE)

RsiMaQQE = ema(RsiQQE, SFQQE)

AtrRsiQQE = abs(RsiMaQQE[1] - RsiMaQQE)

MaAtrRsiQQE = ema(AtrRsiQQE, Wilders_PeriodQQE)

darQQE = ema(MaAtrRsiQQE, Wilders_PeriodQQE) * QQE

basisQQE = sma(RsiMaQQE - 50, 50)

devQQE = 0.35 * stdev(RsiMaQQE - 50, 50)

upperQQE = basisQQE + devQQE

lowerQQE = basisQQE - devQQE

qqeCondition = RsiMaQQE[1] - 50 > upperQQE[1] ? true : RsiMaQQE[1] - 50 < lowerQQE[1] ? false : na

// Trend Indicator A-V2 参数

ma_periodA_V2 = input(52, title="TIA-V2 EMA Period")

oA_V2 = ema(open, ma_periodA_V2)

cA_V2 = ema(close, ma_periodA_V2)

trendIndicatorAV2Condition = cA_V2[1] >= oA_V2[1] ? true : false

// 综合交易逻辑

longCondition = trendST == 1 and qqeCondition and trendIndicatorAV2Condition

shortCondition = trendST == -1 and not qqeCondition and not trendIndicatorAV2Condition

// 针对多单的开平仓逻辑

if (OnlyLong)

if (longCondition)

strategy.entry("Buy", strategy.long)

else

strategy.close("Buy")

// 多空都做时的逻辑

if (not OnlyLong)

if (longCondition)

strategy.entry("Buy", strategy.long)

else if (shortCondition)

strategy.entry("Sell",strategy.short)

// 添加多空平仓逻辑

if (not longCondition)

strategy.close("Buy")

if (not shortCondition)

strategy.close("Sell")

// 可视化信号

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition and not OnlyLong, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")