概述

本策略基于K线的开高低数据设计 Entries,以寻找趋势的反转点。 Entries后会根据ATR指标设定止损线,并追踪止损。策略还会根据风险回报比例计算Target位,在达到Target或被止损后平仓。

策略原理

该策略的 Entries 信号来自开高低点。当某根K线的开盘价等于最低价时产生买入信号,当开盘价等于最高价时产生卖出信号,表示可能存在趋势反转机会。

Entries后会根据ATR指标计算动态追踪止损。买入后止损线为最近N根K线内的最低价减去1倍ATR;卖出后止损线为最近N根K线内的最高价加上1倍ATR。止损线会动态更新,追踪价格运行。

目标利润按照设置的风险回报比率计算。买入的目标价为Entry价格加上(Entry价格与止损价差额的风险回报比倍数);卖出目标价为Entry价格减去(止损价与Entry价差额的风险回报比倍数)。

当价格触及止损价或目标价时,发出平仓指令。

优势分析

该策略具有以下优势:

Entries信号简单清晰,容易判断,避免多次震荡。

动态ATR止损,最大程度锁定盈利,避免追高杀低。

风险回报率控制,避免利润遗留和超短线操作。

适用于不同品种,容易优化。

风险分析

该策略也存在一定的风险:

Entries信号可能存在一定程度的滞后,错过行情最佳点位。

止损价靠近或者过于宽松,可能被套或失去盈利。

无趋势判断模块,在震荡行情中容易被套。

无法处理隔夜建仓的情况。

对应优化方向: 1. 结合其他指标判断趋势,避免震荡行情的套利。

- 调整ATR参数或加入波动率控制,优化止损线位。

3.增加趋势判断或过滤模块,减少Entries信号的误差。

- 加入隔夜处理模块,处理特定品种的隔夜仓位。

总结

本策略总体来说较为简单直接,Entries信号清晰,止损思路合理,风险控制到位。但也存在一定Limitation,如趋势判断不足,信号滞后等问题。这些问题也为未来的优化提供了方向。通过结合更多指标判断和风控模块,该策略可以进一步增强效果,变得更加通用。

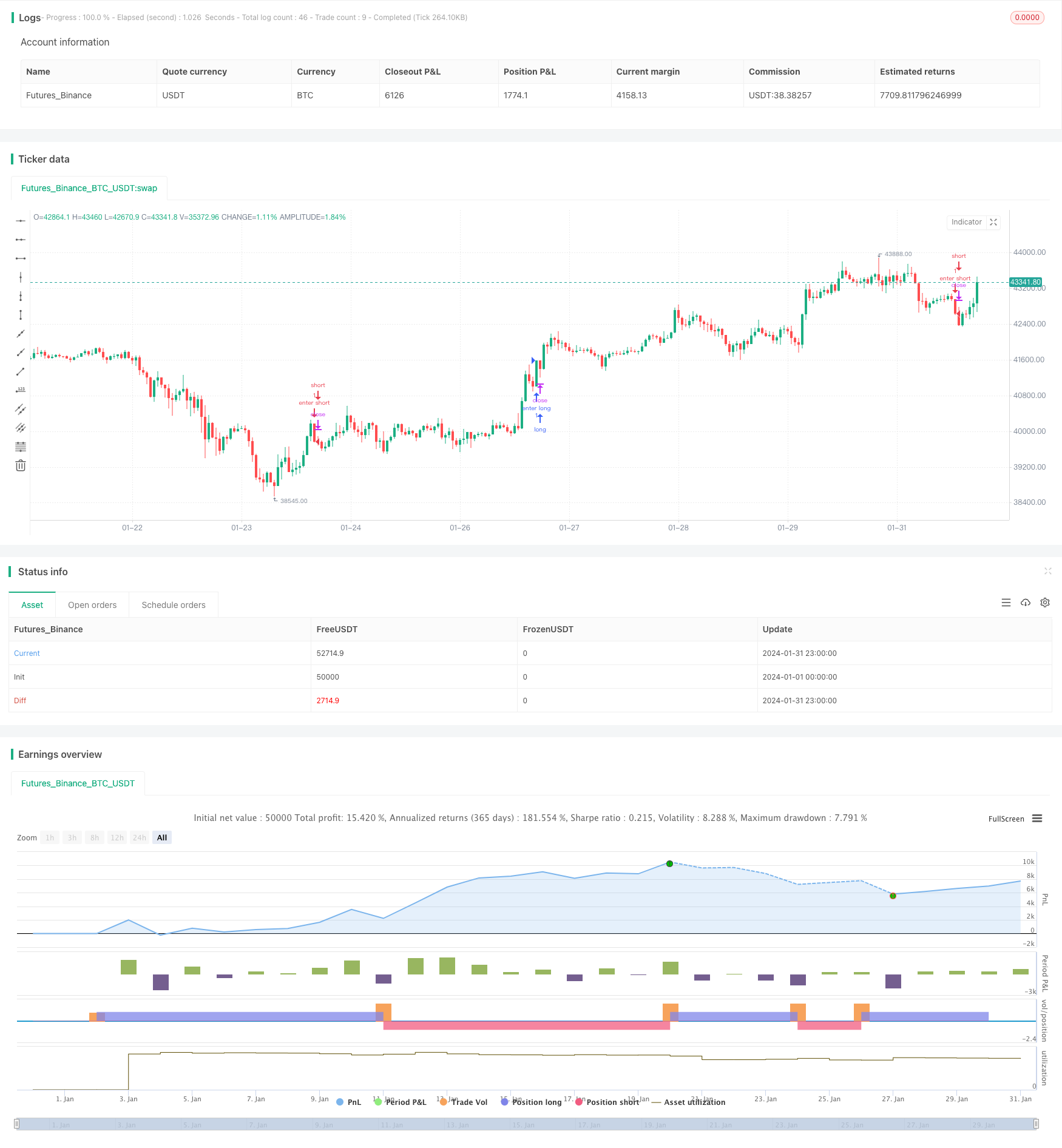

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Open-High-Low strategy

strategy('Strategy: OLH', shorttitle="OLH", overlay=true )

// Inputs

slAtrLen = input.int(defval=14, title="ATR Period for placing SL", group="StopLoss settings")

showSLLines = input.bool(defval=false, title="Show SL lines in chart", tooltip="Show SL lines also as dotted lines in chart. Note: chart may look untidy.", group="Stolploss settings")

// Trade related

rrRatio = input.float(title='Risk:Reward', step=0.1, defval=2.0, group="Trade settings")

endOfDay = input.int(defval=1500, title="Close all trades, default is 3:00 PM, 1500 hours (integer)", group="Trade settings")

mktAlwaysOn = input.bool(defval=true, title="Markets that never closed (Crypto, Forex, Commodity)", tooltip="Some markers never closes. For those cases, make this checked.", group="Trade settings")

lotSize = input.int(title='Lot Size', step=1, defval=1, group="Trade settings")

// Utils

green(open, close) => close > open ? true : false

red(open, close) => close < open ? true : false

body(open, close) => math.abs(open - close)

lowerwick = green(open, close) ? open - low : close - low

upperwick = green(open, close) ? high - close : high - open

crange = high - low

crangep = high[1] - low[1] // previous candle's candle-range

bullish = close > open ? true : false

bearish = close < open ? true : false

// Trade signals

longCond = barstate.isconfirmed and (open == low)

shortCond = barstate.isconfirmed and (open == high)

// For SL calculation

atr = ta.atr(slAtrLen)

highestHigh = ta.highest(high, 7)

lowestLow = ta.lowest(low, 7)

longStop = showSLLines ? lowestLow - (atr * 1) : na

shortStop = showSLLines ? highestHigh + (atr * 1) : na

plot(longStop, title="Buy SL", color=color.green, style=plot.style_cross)

plot(shortStop, title="Sell SL", color=color.red, style=plot.style_cross)

// Trade execute

h = hour(time('1'), syminfo.timezone)

m = minute(time('1'), syminfo.timezone)

hourVal = h * 100 + m

totalTrades = strategy.opentrades + strategy.closedtrades

if (mktAlwaysOn or (hourVal < endOfDay))

// Entry

var float sl = na

var float target = na

if (longCond)

strategy.entry("enter long", strategy.long, lotSize, limit=na, stop=na, comment="Enter Long")

sl := longStop

target := close + ((close - longStop) * rrRatio)

alert('Buy:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

if (shortCond)

strategy.entry("enter short", strategy.short, lotSize, limit=na, stop=na, comment="Enter Short")

sl := shortStop

target := close - ((shortStop - close) * rrRatio)

alert('Sell:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

// Exit: target or SL

if ((close >= target) or (close <= sl))

strategy.close("enter long", comment=close < sl ? "Long SL hit" : "Long target hit")

if ((close <= target) or (close >= sl))

strategy.close("enter short", comment=close > sl ? "Short SL hit" : "Short target hit")

else if (not mktAlwaysOn)

// Close all open position at the end if Day

strategy.close_all(comment = "Close all entries at end of day.")