概述

华金斯蛇吻风云量化策略主要结合一云图指标和随机指标RSI,通过对二者指标信号判断的加权,构建量化交易策略信号,实现对证券品种的自动化交易。该策略综合考虑了不同强度一云图指标信号和StochRSI指标信号,通过设定权重,使交易决策更加平滑和稳定。

策略原理

该策略使用一云图中的转换线、基准线、先行1和先行2等指标与StochRSI中的K线和D线进行组合。一云图部分,如果转換线高于基准线且先行1高于先行2为强势做多信号,如果转換线低于基准线且先行1低于先行2为强势做空信号。此外,转換线高于或低于基准线也可产生做多或做空的弱势信号。StochRSI部分,如果K线高于D线且K线低于超买线且D线低于超买线为StochRSI做多信号,如果K线低于D线且K线高于超卖线且D线高于超卖线为StochRSI做空信号。通过给不同强度的一云图信号和StochRSI信号设定不同的权重,并与一个决策权重值进行比较,当超过决策权重值时形成最终的做多或做空信号。

优势分析

该策略结合使用一云图和StochRSI两个指标,能够同时判断趋势方向和超买超卖情况,信号更加全面和可靠。相较于单一使用某一个指标,能够减少错误信号的产生。一云图指标对中长线趋势判断比较准确,StochRSI指标可以测量短期的超买超卖现象,二者相结合使策略适用于不同周期。加入决策权重的设计也使策略信号更加平稳可靠。总体来说,该策略可以自动判断市场趋势转变点,并产生交易信号,具有操作简单,适用面广,信号稳定等优点。

风险分析

该策略最大的风险在于一云图和StochRSI指标都可能产生错误信号,特别是在震荡行情中,会增加不必要的交易次数。此外,权重和参数值的设定也会对策略的效果产生很大影响。如果权重设定不当,可能会错过重要信号或者产生过多错误信号。一些关键参数如RSI长度、Stoch长度等也需要针对不同品种和市场环境进行测试和优化,否则会影响策略效果。最后,数据问题也可能成为策略风险,如果数据质量不佳,也会使指标和信号产生偏差。

优化方向

该策略还具有很大的优化空间。第一,可以考虑加入更多指标,如布林线,KD指标等,使信号判断更加全面。第二,可以使用机器学习或遗传算法等方法自动优化参数,而不是使用固定参数,使策略更加智能化和适应性强。第三,可以研究如何改进指标算法,以减少错误信号的产生。第四,权重设定机制也可以进一步优化,如加大强势信号的权重。第五,可以针对更多品种或子市场进行参数和规则优化,以适应不断变化的市场环境。

总结

华金斯蛇吻风云量化策略结合使用了一云图和StochRSI两个指标,通过加权和参数设计形成交易信号,能够自动捕捉市场的趋势转变,对不同品种和周期都具有很好的适应性,是一套值得深入研究和应用的量化策略。该策略也具有进一步扩展和优化的潜力,如引入更多指标和技术手段等,有望获得更好的交易效果。

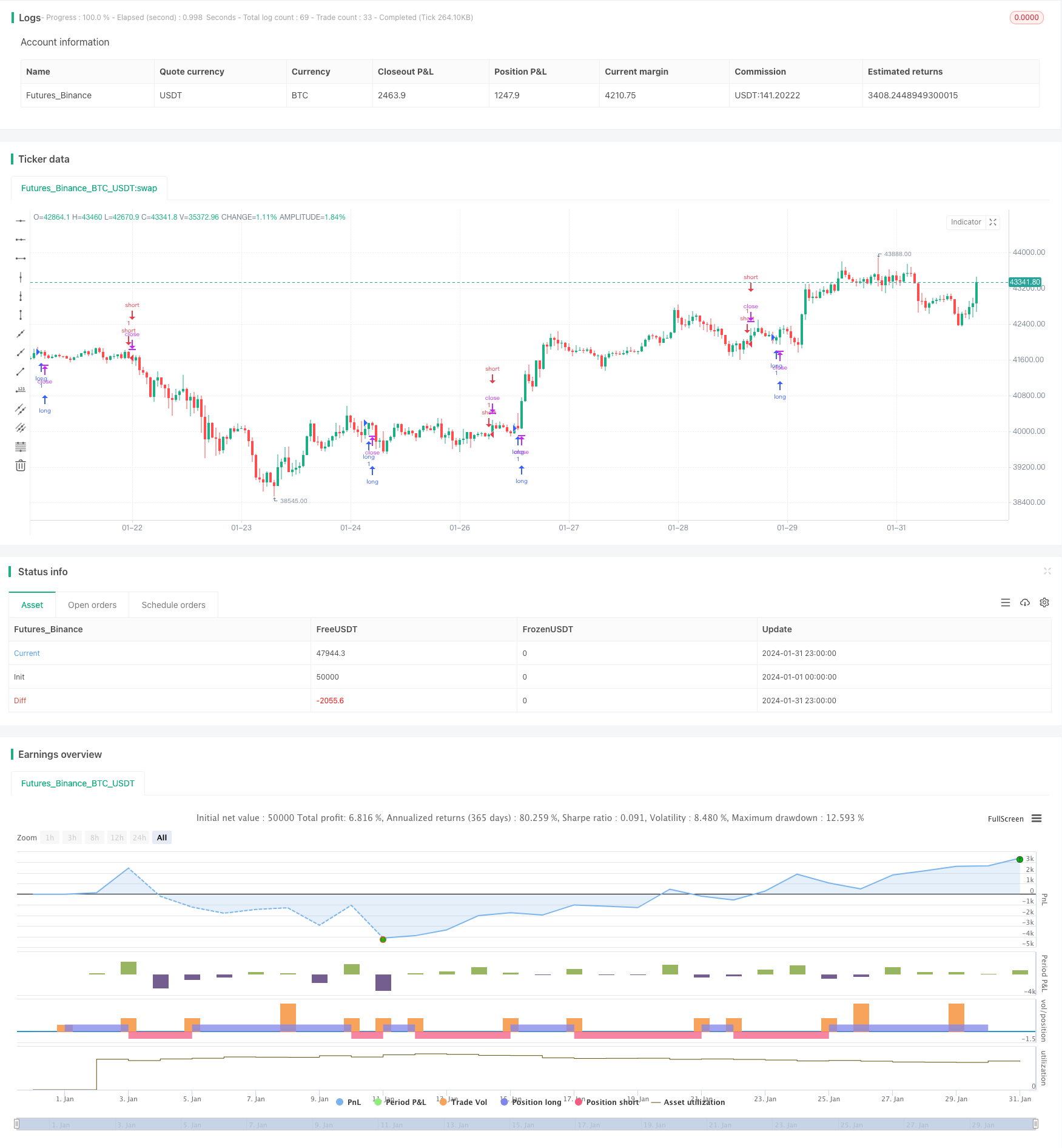

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Baracuda Ichimoku/StochRSI Strategy", overlay=true)

DecisionWeight = input(50, minval = 0, title="BUY/SELL decision weight")

ichimokuStrong = input(35, minval = 0, title="Ichimoku strong weight")

ichimokuStandard = input(20, minval = 0, title="Ichimoku standard weight")

ichimokuWeak = input(20, minval = 0, title="Ichimoku weak weight")

stochRSIWweak = input(30, minval = 0, title="Stoch RSI weight")

conversionPeriods = input(9, minval=1, title="Conversion Line Periods")

basePeriods = input(26, minval=1, title="Base Line Periods")

laggingSpan2Periods = input(52, minval=1, title="Lagging Span 2 Periods")

displacement = input(5, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(laggingSpan2Periods)

lengthRSI = input(8, minval=8) //14

lengthStoch = input(5, minval=5)//14

smoothK = input(3,minval=3)

smoothD = input(3,minval=3)

OverSold = input(20)

OverBought = input(80)

rsi1 = rsi(close, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

stronglong = conversionLine > baseLine and leadLine1 > leadLine2

strongshort = conversionLine < baseLine and leadLine1 < leadLine2

weaklong = conversionLine > baseLine

weakshort = conversionLine < baseLine

RSIlong = k > d and k < OverSold and d < OverSold

RSIshort = k < d and k > OverBought and d > OverBought

long=(((stronglong ? 1:0)*ichimokuStrong) + ((weaklong? 1:0)*ichimokuWeak) + ((RSIlong? 1:0)*stochRSIWweak)) > DecisionWeight

short=(((strongshort? 1:0)*ichimokuStrong) + ((weakshort? 1:0)*ichimokuWeak) + ((RSIshort? 1:0)*stochRSIWweak)) > DecisionWeight

strategy.entry("long", strategy.long, when=long)

strategy.entry("short", strategy.short, when=short)