策略概述

该策略通过组合MACD和RSI两个指标来识别趋势反转点,实现低买高卖。当MACD指标出现金叉时并且RSI指标处于超卖状态,进行买入操作。当MACD指标出现死叉时并且RSI指标达到超买状态,进行卖出操作,完成一次交易循环。

策略原理

MACD指标

MACD指标由快线,慢线和柱状线组成。快线是短期平均线,慢线是长期平均线。当快线从下向上突破慢线时产生买入信号,这表示市场进入多头趋势;当快线从上向下跌破慢线时产生卖出信号,这表示市场进入空头趋势。

RSI指标

RSI指标反映市场的超买超卖情况。RSI高于70时表示市场超买,RSI低于30时表示市场超卖。

策略规则

买入条件:MACD快线上穿慢线(金叉)并且RSI低于40(超卖)时,进行买入操作。

卖出条件:MACD快线下穿慢线(死叉)并且RSI高于60(超买)时,进行卖出操作。

该策略通过MACD指标判断市场趋势方向,同时利用RSI指标识别超买超卖区域,从而捕捉市场反转买卖点。

策略优势

结合多个指标,提高策略的稳定性和胜率。MACD指标判断趋势方向,RSI指标识别反转时间点,二者相互验证提高信号的可靠性。

有效识别低吸引地和高离地,通过RSI指标的超买超卖水平配合MACD指标的金叉死叉信号,能够准确抓住市场的关键反转点。

简单明了的交易信号和规则。策略信号来自两个经典且广为人知的指标,明确判定的交易规则有利于实盘的执行。

灵活度高,易于优化。可以通过调整指标参数以及组合其他技术指标来丰富策略规则,优化策略以适应不同品种和交易风格。

策略风险分析

可能产生多次亏损交易的风险。当行情出现假突破时,会产生不必要的交易亏损。

无法建立止损机制的风险。策略本身没有设置止损点,长期亏损可能扩大。

MACD和RSI失效的风险。如果行情进入震荡期或特殊行情,MACD和RSI指标将会产生大量无效信号。

盲目优化的风险。如果没有对市场和品种特性有足够了解,盲目调整参数和优化策略可能导致超优化。

可以通过设定止损点、评估市场态势、谨慎优化参数、组合其他指标等方法来降低上述风险,提高策略的稳定性。

策略优化思路

设置止损机制。添加移动止损或者百分比止损来控制单笔亏损。

评估多重时间周期。评估不同时间周期下MACD和RSI指标的效果,选择最优时间周期。

结合其他指标过滤。可考虑加入如MA,KDJ等其它指标来验证信号,过滤假信号。

参数优化测试。通过多次回测和参数优化来选择指标参数的最优组合,提高策略效果。

适当调整仓位管理。根据品种特性和交易风格适当调整每次交易的头寸数量。

总结

该策略整合MACD和RSI两个广泛使用的指标,通过二者的优势互补获得反转交易信号。策略优点是简单实用、容易理解,可根据市场和交易风格进行灵活调整。下一步可通过止损、参数优化、指标过滤等方式进一步增强策略的稳定性和盈利能力。

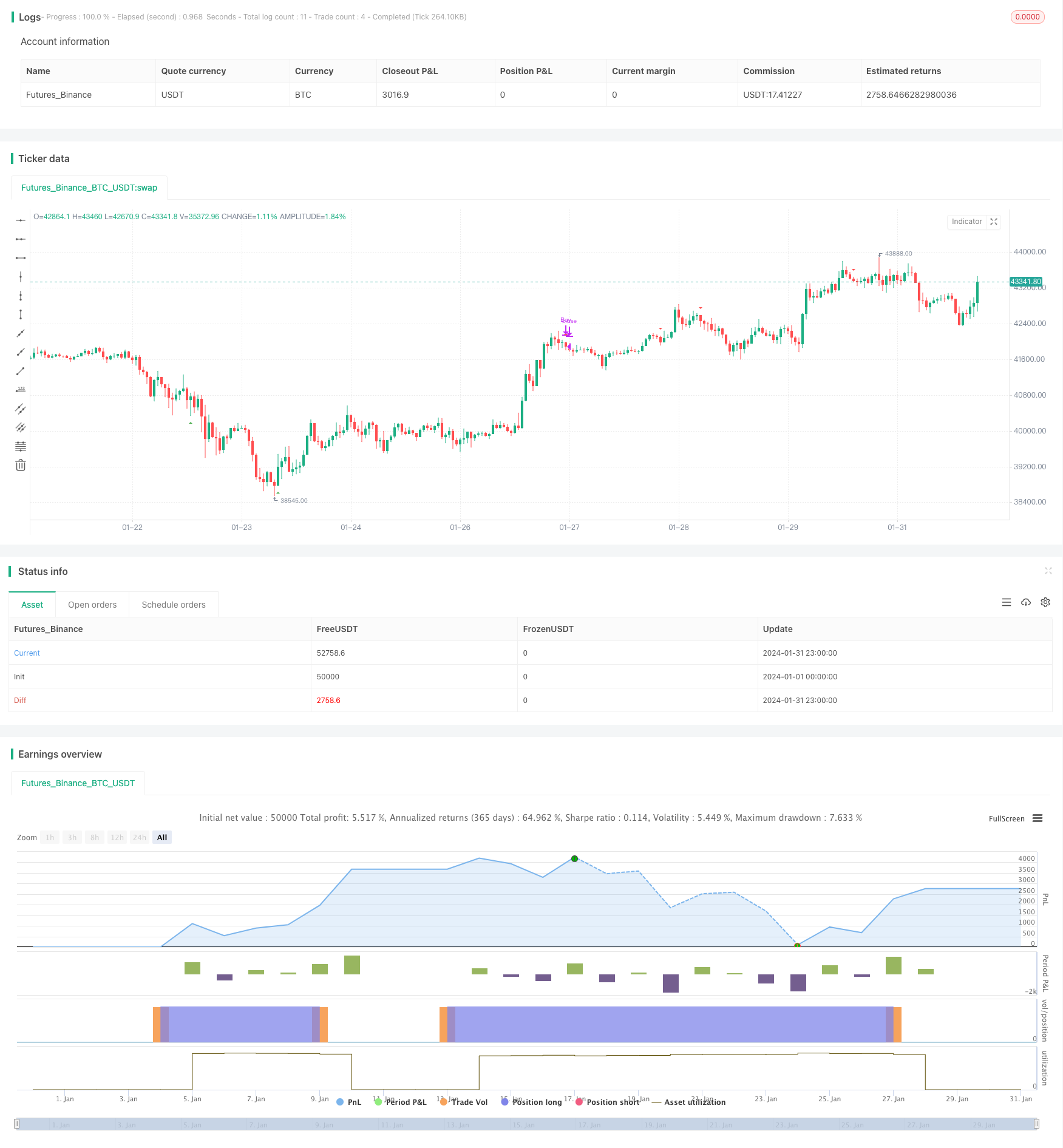

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MACD and RSI Strategy", shorttitle="MRS long", overlay=true)

// Define input parameters

fast_length = input.int(5, title="MACD Fast Length")

slow_length = input.int(35, title="MACD Slow Length")

signal_smoothing = input.int(5, title="MACD Signal Smoothing")

rsi_length = input.int(14, title="RSI Length")

// Calculate MACD with custom signal smoothing

[macdLine, signalLine, _] = ta.macd(close, fast_length, slow_length, signal_smoothing)

// Calculate RSI

rsi = ta.rsi(close, rsi_length)

// Define buy and close conditions

buy_condition = ta.crossover(macdLine, signalLine) and rsi < 40

sell_condition = ta.crossunder(macdLine, signalLine) and rsi > 60

// Define Sell and close conditions

b_condition = ta.crossunder(macdLine, signalLine) and rsi < 40

s_condition = ta.crossover(macdLine, signalLine) and rsi > 75

// Plot buy and sell signals on the chart

plotshape(buy_condition ? 1 : na, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(sell_condition ? 1 : na, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// Strategy entry and exit conditions

if (buy_condition)

strategy.entry("Buy", strategy.long)

if (sell_condition)

strategy.close("Buy")

// if (s_condition)

// strategy.entry("Sell", strategy.short)

// if (b_condition)

// strategy.close("Sell")