概述

本策略基于K线的收盘价和开盘价的关系,判断当前趋势方向,从而产生长仓或者短仓的信号。具体来说,如果收盘价高于开盘价,则产生做多信号;如果收盘价低于开盘价,则产生做空信号。

策略原理

该策略主要基于以下两个判断条件来产生交易信号:

开仓信号判断:如果收盘价高于开盘价(close > open),并且已经到达开盘时间,则产生做多信号;如果收盘价低于开盘价(close < open),并且已经到达开盘时间,则产生做空信号。

平仓条件:和开仓信号相反,如果已做多,则亏损条件为收盘价低于开盘价加上ATR的值,止盈条件为收盘价高于开盘价加上ATR乘以止盈比例;如果已做空,则相反。

通过这样的设计,本策略充分利用了K线方向的信息,判断当前趋势方向,能够及时追踪趋势产生信号。同时,止损和止盈标准都基于ATR这个动态指标,避免了固定点数带来的问题。

策略优势

本策略最大的优势在于利用K线方向判断趋势追踪能力强。进场信号判断简单清晰,容易理解,同时结合开盘时间条件,避免了隔夜风险。止损止盈标准动态变化,可自动调整仓位规模。

整体来说,该策略反应灵敏,追踪能力强,适合中间周期如1小时、4小时进行趋势捕捉。

策略风险

本策略可能存在的主要风险有:

交易次数可能较多,容易被交易费用和滑点影响。可以适当调整止盈倍数进行优化。

K线若出现背驰等情况,则可能产生错误信号。可以结合其他指标进行滤除。

ATR参数设置会影响止损止盈的效果。ATR长度和止盈倍数需要根据市场调整。

开盘时间设置也会影响信号效果。不同市场需要设置不同的开盘时间。

策略优化

本策略还可进一步优化的方面包括:

结合移动平均线等指标进行信号过滤,处理因价格震荡产生的错误信号。

增加仓位管理机制,通过波动率等指标控制单次投入资金规模。

利用机器学习等方法动态优化止损止盈的参数,使之能根据实时市场调整。

结合情绪指标等方法判断市场热度,控制整体仓位。

总结

本策略整体曾反应灵敏,能够有效捕捉趋势。通过简单的K线收盘价和开盘价比较,判断方向并产生信号。同时,止盈止损标准采用动态ATR指标,可以根据波动率调整仓位。优化空间还很大,可进一步结合其他指标进行过滤以及参数调优。

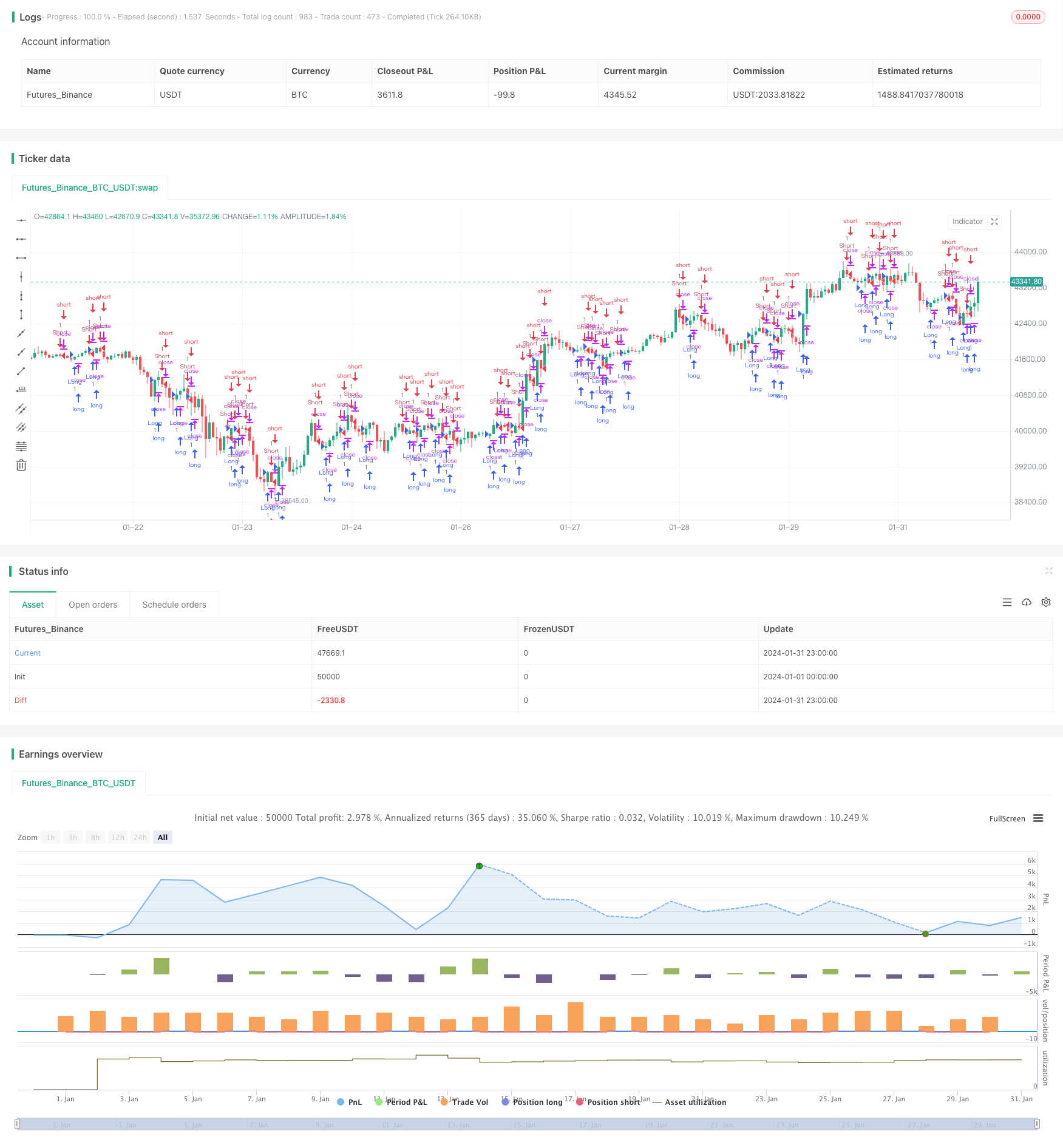

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Go with Trend Strategy", overlay=true)

// Input settings

startHour = input(9, title="Start Hour for Entries")

activateLong = input(true, title="Activate Long")

activateShort = input(true, title="Activate Short")

takeProfitRatio = input(1.5, title="Take Profit Ratio")

// Calculate ATR

atrLength = 14 // You can change this value as needed

atrValue = ta.atr(atrLength)

// Calculate entry conditions

enterLong = close > open and hour >= startHour

enterShort = close < open and hour >= startHour

// Strategy logic

if (activateLong and enterLong)

strategy.entry("Long", strategy.long)

if (activateShort and enterShort)

strategy.entry("Short", strategy.short)

// Stop loss and take profit conditions

strategy.exit("Exit Long", from_entry="Long", loss=close - atrValue, profit=close + takeProfitRatio * atrValue)

strategy.exit("Exit Short", from_entry="Short", loss=close + atrValue, profit=close - takeProfitRatio * atrValue)