概述

金森一分钟震荡策略(Gem Forest One Minute Scalping Strategy)是一个短线量化交易策略。该策略综合运用多个指标,识别市场在1分钟时间框架下的震荡特征,据此进行长短仓位切换,实现超短线套利。

策略原理

- ATR指标构建上下轨,判断价格震荡范围

- 快慢EMA指标构建金叉死叉交易信号

- 双RSI指标确认金叉死叉信号

- 结合指标信号和价格位置,确定具体的入场点和出场点

当价格低于下轨时,快慢EMA形成金叉,快线RSI上穿慢线RSI,产生买入信号;当价格高于上轨时,快慢EMA形成死叉,快线RSI下穿慢线RSI,产生卖出信号。入场后设置止损和止盈退出。

优势分析

- 多指标组合,综合判断,可靠性较高

- 策略操作频率高,具有较强的盈利空间

- 策略回撤 pequeño 稳定性好

- 可在1分钟或更短周期内进行超短线套利

风险分析

- 超短线操作,对网络和硬件要求较高

- 超短线容易造成过度交易和资金分散

- 指标设置不当可能造成虚假信号

- 依赖特定市场环境,行情剧烈波动时容易止损

针对这些风险,可以优化指标参数,调整止损止盈方式,适当限制单日最大交易次数,选择流动性好、波动率适中的交易品种等。

策略优化方向

- 测试不同ATR周期参数对结果的影响

- 尝试不同类型的EMA,或将其中一个EMA改为其他指标

- 调整RSI周期参数,或尝试其他震荡指标如KDJ、Stochastics等

- 优化入场点选择方法,如结合更多因素判定趋势性等

- 调整止损止盈点以优化收益风险比

总结

金森一分钟震荡策略充分考量了超短线量化交易的特点,指标参数设置合理,采用多指标确认和组合使用,可靠性较高,在严格控制风险的前提下,具有较强的盈利潜力,非常适合有足够运算能力和心理素质的投资者实盘验证。

策略源码

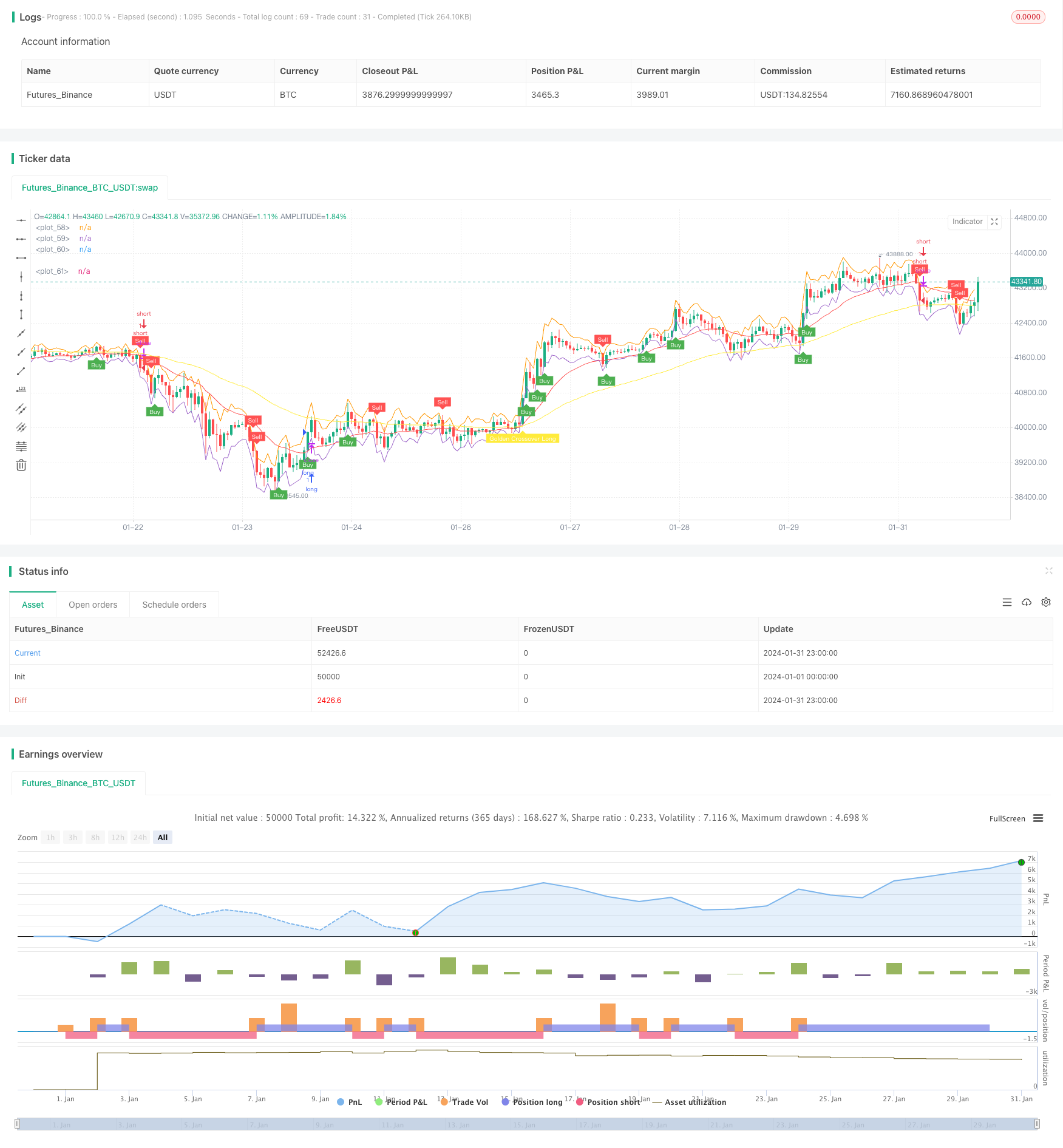

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Gem Forest 1 Dakika Scalp", overlay=true)

source = close

atrlen = input.int(14, "ATR Period")

mult = input.float(1, "ATR Multi", step=0.1)

smoothing = input.string(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, atrlen) =>

if smoothing == "RMA"

ta.rma(source, atrlen)

else

if smoothing == "SMA"

ta.sma(source, atrlen)

else

if smoothing == "EMA"

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

ShortEMAlen = input.int(21, "Fast EMA")

LongEMAlen = input.int(65, "Slow EMA")

shortSMA = ta.ema(close, ShortEMAlen)

longSMA = ta.ema(close, LongEMAlen)

RSILen1 = input.int(25, "Fast RSI Length")

RSILen2 = input.int(100, "Slow RSI Length")

rsi1 = ta.rsi(close, RSILen1)

rsi2 = ta.rsi(close, RSILen2)

atr = ta.atr(atrlen)

RSILong = rsi1 > rsi2

RSIShort = rsi1 < rsi2

longCondition = open < lower_band

shortCondition = open > upper_band

GoldenLong = ta.crossover(shortSMA,longSMA)

Goldenshort = ta.crossover(longSMA,shortSMA)

plotshape(shortCondition, title="Sell Label", text="Sell", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

plotshape(longCondition, title="Buy Label", text="Buy", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(Goldenshort, title="Golden Sell Label", text="Golden Crossover Short", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.blue, textcolor=color.white, transp=0)

plotshape(GoldenLong, title="Golden Buy Label", text="Golden Crossover Long", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.yellow, textcolor=color.white, transp=0)

if (longCondition)

stopLoss = low - atr * 2

takeProfit = high + atr * 5

strategy.entry("long", strategy.long, when = RSILong)

if (shortCondition)

stopLoss = high + atr * 2

takeProfit = low - atr * 5

strategy.entry("short", strategy.short, when = RSIShort)

plot(upper_band)

plot(lower_band)

plot(shortSMA, color = color.red)

plot(longSMA, color = color.yellow)